ALPINE +116% (Directional Strategy Resonance)

A breakdown of the ALPINE/USDT trade demonstrates how the combination of a cluster chart and Dashboard tools helps identify strong entry points. Despite active selling, the price held and did not break new lows, and a rare deviation in the Z-Score reinforced the hypothesis of an upside move. Ultimately, the decisive factor was the emergence of selling pressure and signs of profit-taking by participants. This analysis demonstrates the value of a comprehensive approach—monitoring the balance of power and taking action promptly.

Table of content

Pair: ALPINE/USDT

Risk: Medium

Skill Level: Beginner

Entry Reasons

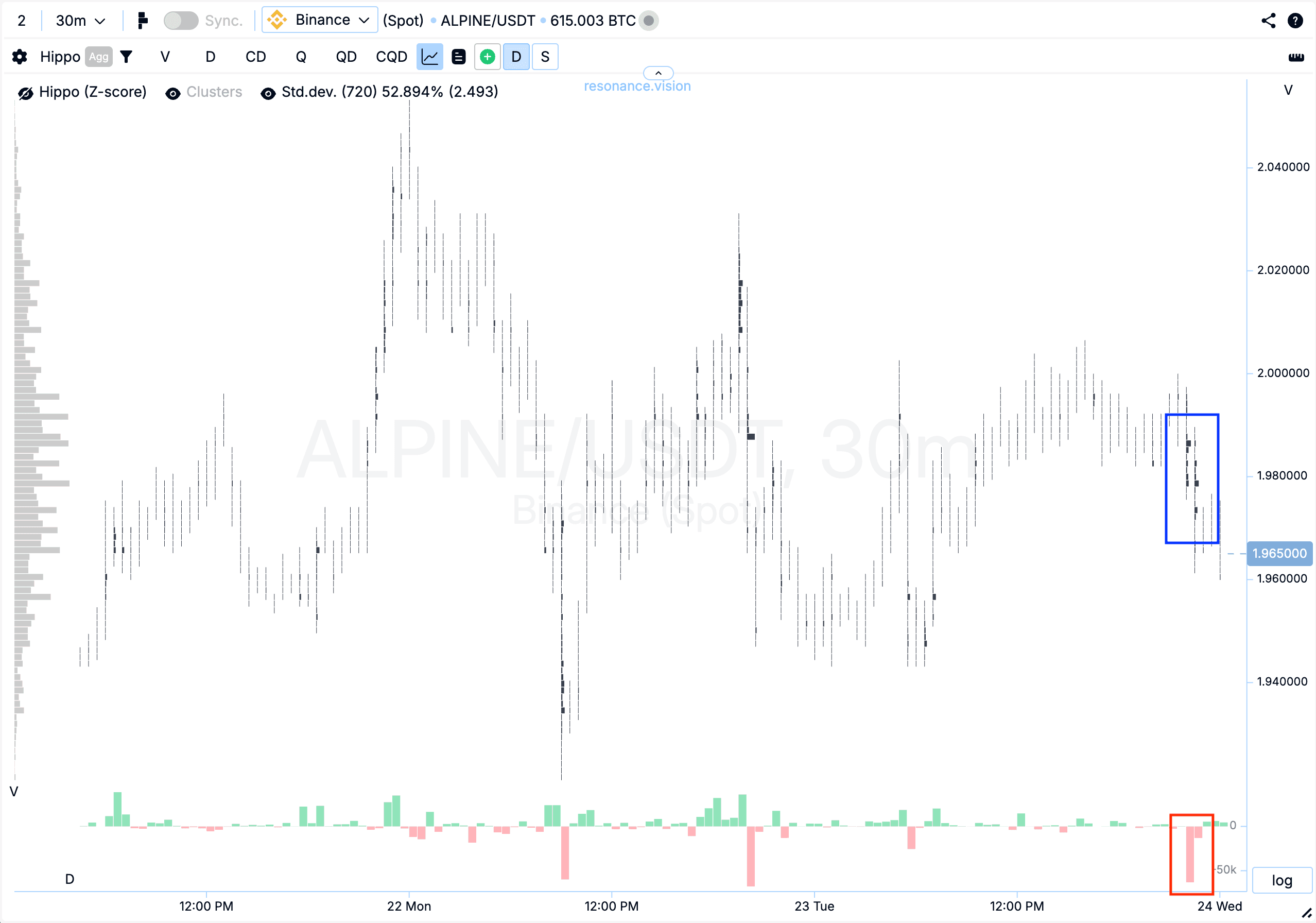

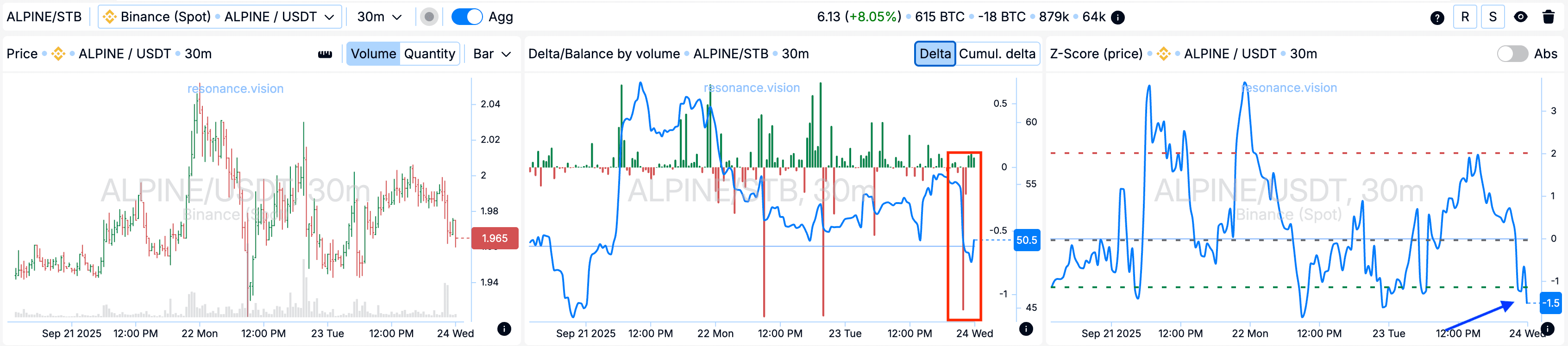

Cluster Chart: Volume clusters started to form (blue rectangle). Inside them, market selling dominated (red rectangle), but despite this pressure, the price did not update the local low. Such dynamics may indicate local deficit formation and buyer interest.

In the Dashboard

Delta/Volume Balance: Aggregated data shows a strong spike in market selling — clearly visible in the delta histogram (red rectangle). However, despite the pressure, the price barely declined, signaling weakening seller influence.

Z-Score (Price): Additionally, the price deviated below the lower percentile, which is a rare occurrence for this asset (blue arrow). Such an anomaly may indicate a potential reversal and further growth.

Exit Reasons

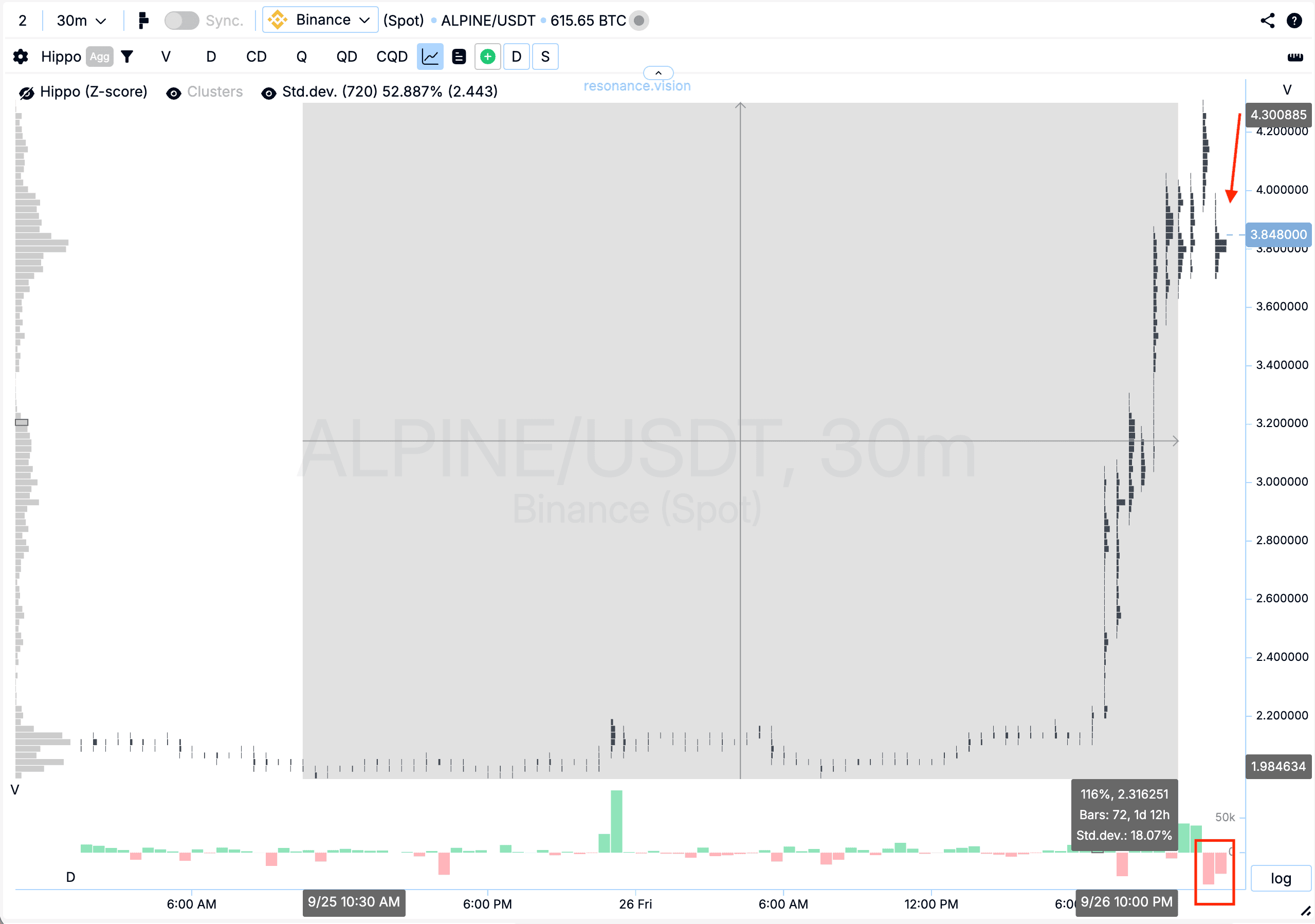

Cluster Chart: After entry, the price showed confident growth without significant pullbacks, adding an extra +116% move. Then, a decline began: market sell volumes started to exert notable pressure on the price (red rectangle and arrow). This dynamic signals the need to lock in profits, as market participants likely started offloading previously accumulated positions.

Conclusion

This trade demonstrates how combining cluster charts with Dashboard data helps identify strong entry points. Despite significant selling pressure, the lack of a new low and the abnormal price deviation pointed to a local deficit and buyer interest. This served as the basis for the long hypothesis.

On exit, the key signal was the increase in market selling and the emergence of tangible downward pressure, indicating participants were fixing profits and suggesting the need to close the trade.

Such an approach allows timely recognition of shifts in market balance and supports decisions that preserve results and manage risk.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.