AWE +132.57% (Resonance Directional Strategy)

AWE/USDT: a deal on signs of deficit on volumes

Analysis of the cluster chart and aggregated data revealed a classic picture of a local deficit: sellers were pressing with volume, but the price did not go down. This provided the basis for a confident entry into a long. Completion of the deal on an abnormal movement of +12% provided a result of +132.57%. The analysis shows how with minimal risk and competent analysis you can get an excellent result.

Table of content

Pair: AWE/USDT

Risk: Low

Skill Level: Beginner

Entry Reasons

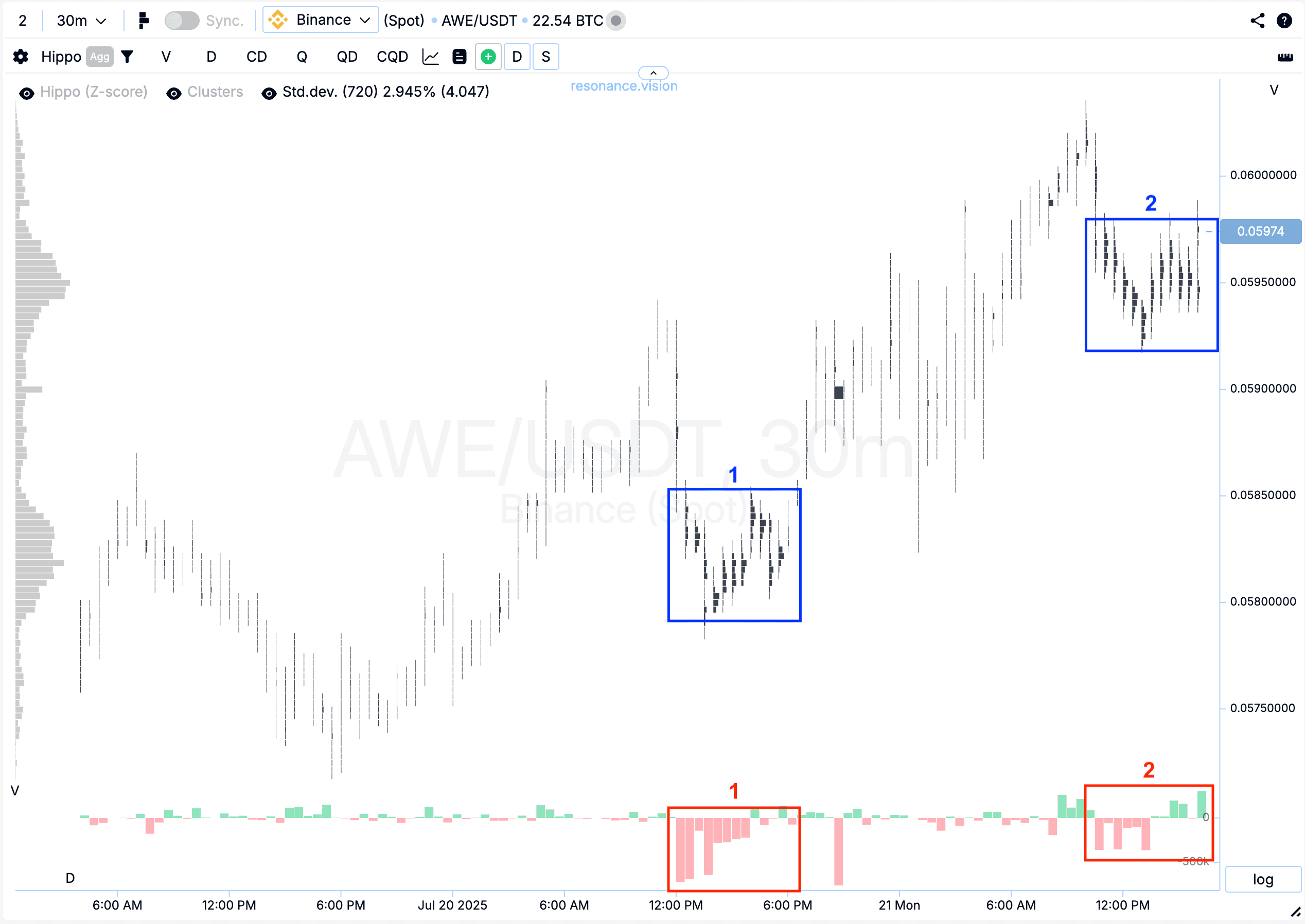

Cluster Chart: Volume clusters began to form within a relatively narrow price range (blue rectangle #1). During a local pullback, volumes shifted significantly toward selling (red rectangle #1), but the price barely reacted — the decline stopped.

Later, another round of volume cluster formation was recorded (blue rectangle #2), again showing selling dominance, which gradually started shifting toward buying (red rectangle #2). All of this may indicate signs of a local supply shortage — suggesting that initiative likely remains with the buyers.

In the Dashboard

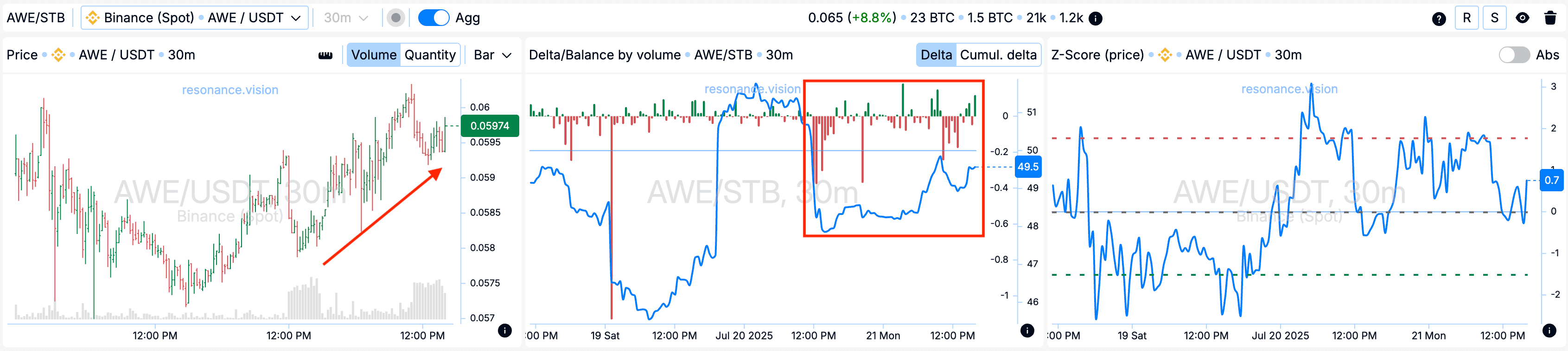

Delta/Volume Balance: Aggregated data across all pairs also shows a dominance of market sells — clearly visible on the histogram (red rectangle). However, despite seller pressure, the price continues to rise (indicated by the arrow).

All of this confirms that local supply shortage signs are still present — buyers are effectively holding the price despite aggressive selling. This provides a strong argument for opening a long position.

Exit Reasons

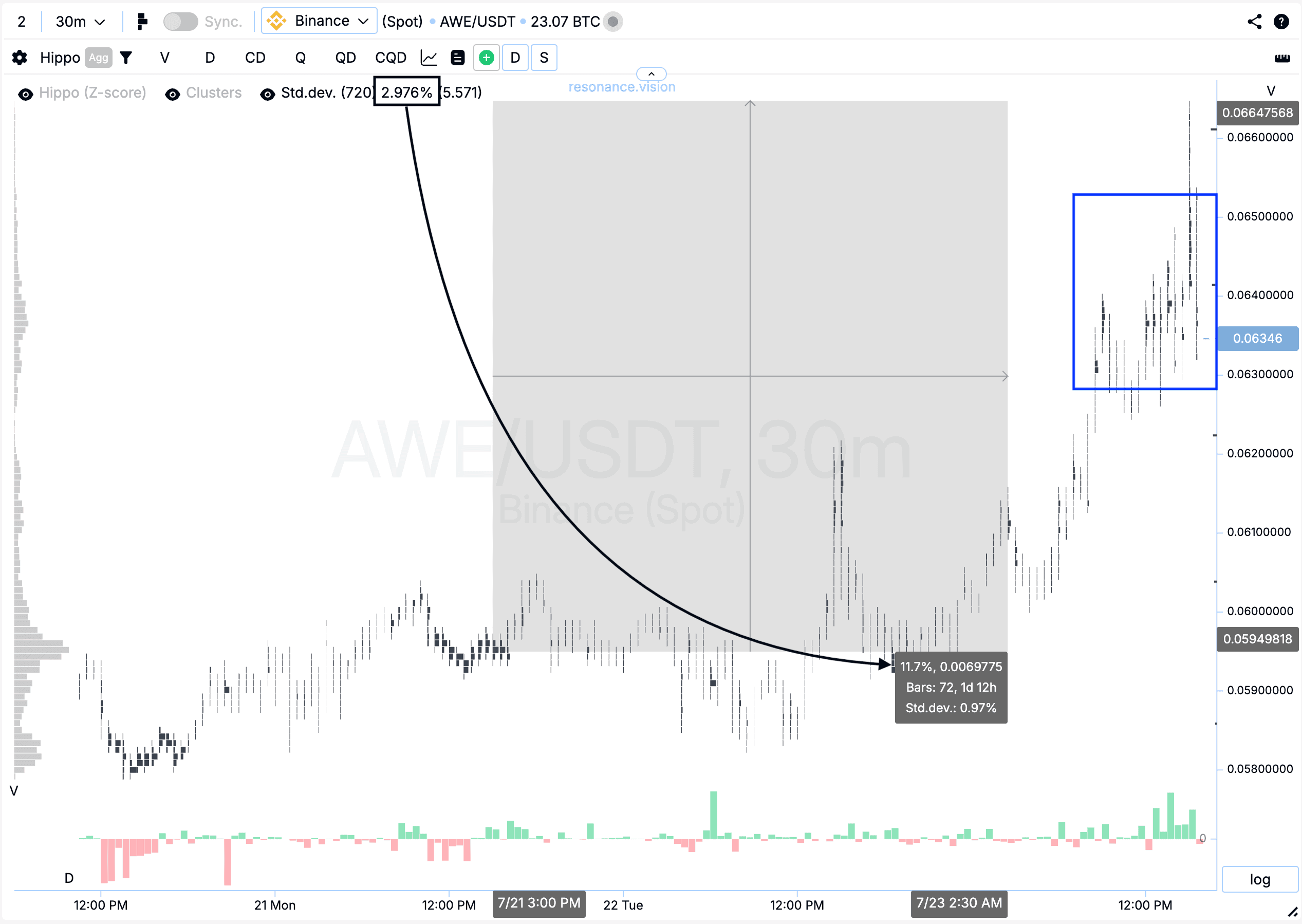

Cluster Chart: Marked the price range where volume clusters formed (blue rectangle). During this period, volatility increased, followed by a sharp impulse move and then a pullback.

Also noted that from the entry point, the price moved up nearly 12%, which exceeds 4 standard deviations for this ticker (black rectangle with arrow). This makes the move statistically abnormal.

Result

As a result, a profit of +132.57% was secured.

Conclusion

From the very beginning, the price showed stable behavior amid dominant selling: sellers were unable to push the price down.

Understanding the interaction between volume, clusters, and aggregated data played a key role. It allowed not just a confident entry but also holding the position until the price made an abnormal move — exceeding 4 standard deviations. This market behavior pattern confirms the presence of a supply shortage and seller inefficiency.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.