BANANAGAN +35.2% (Directional Strategy Resonance)

BANANAGAN/USDT trade: demonstrated how a combination of cluster analysis and aggregated data helps spot weakening sellers early and enter long positions. And then, exit wisely when the initiative begins to shift to sellers. Brief, to the point, and without unnecessary fuss.

Table of content

Coin: BANANAGAN/USDT

Risk: Medium

Understanding level: Beginner

Entry Reasons

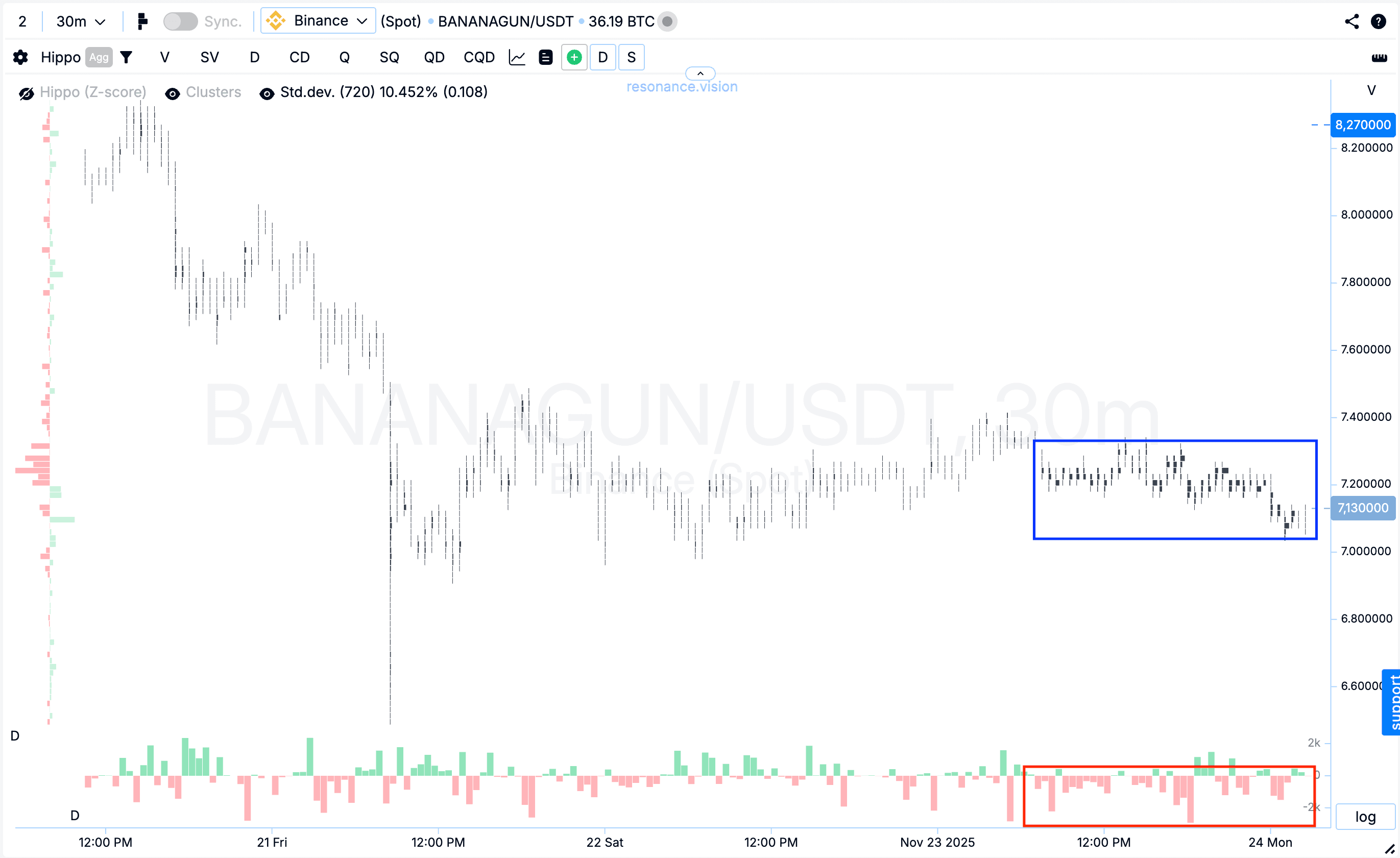

Cluster chart: a large volume cluster formed (blue rectangle), inside which a significant amount of market selling appeared (red rectangle). However, these sell orders no longer pushed the price lower. Such market behavior indicates the emergence of local deficit signals and weakening pressure from sellers.

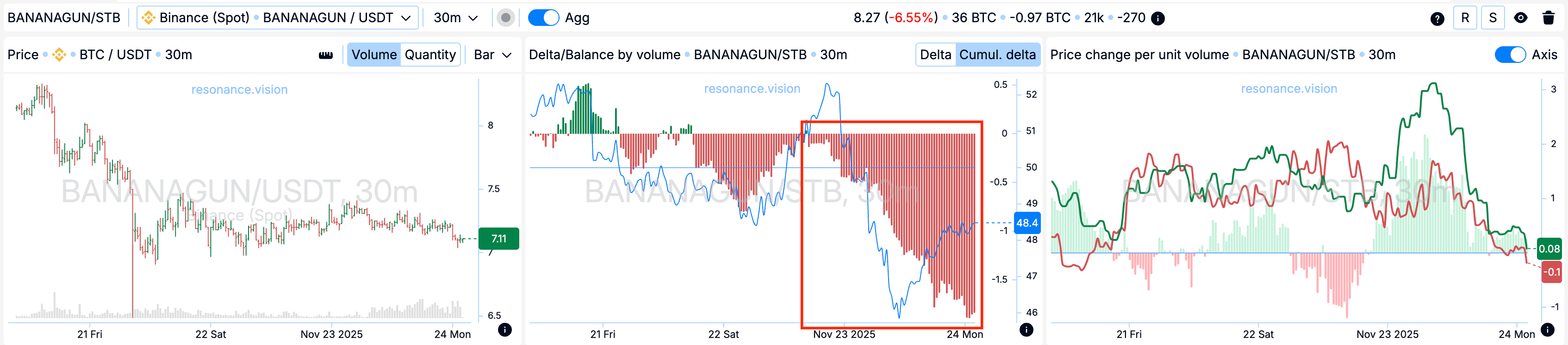

In the Dashboard

Delta / Volume Balance: aggregated data across all pairs and exchanges fully confirms what we see on the cluster chart. Market selling dominated during this period — clearly visible on the cumulative delta histogram (red rectangle). However, despite the dominance of sellers, the market consistently held the price, showing that limit buyers were ready to absorb all outgoing market sell volume. This dynamic creates local support and indicates weakening downside pressure.

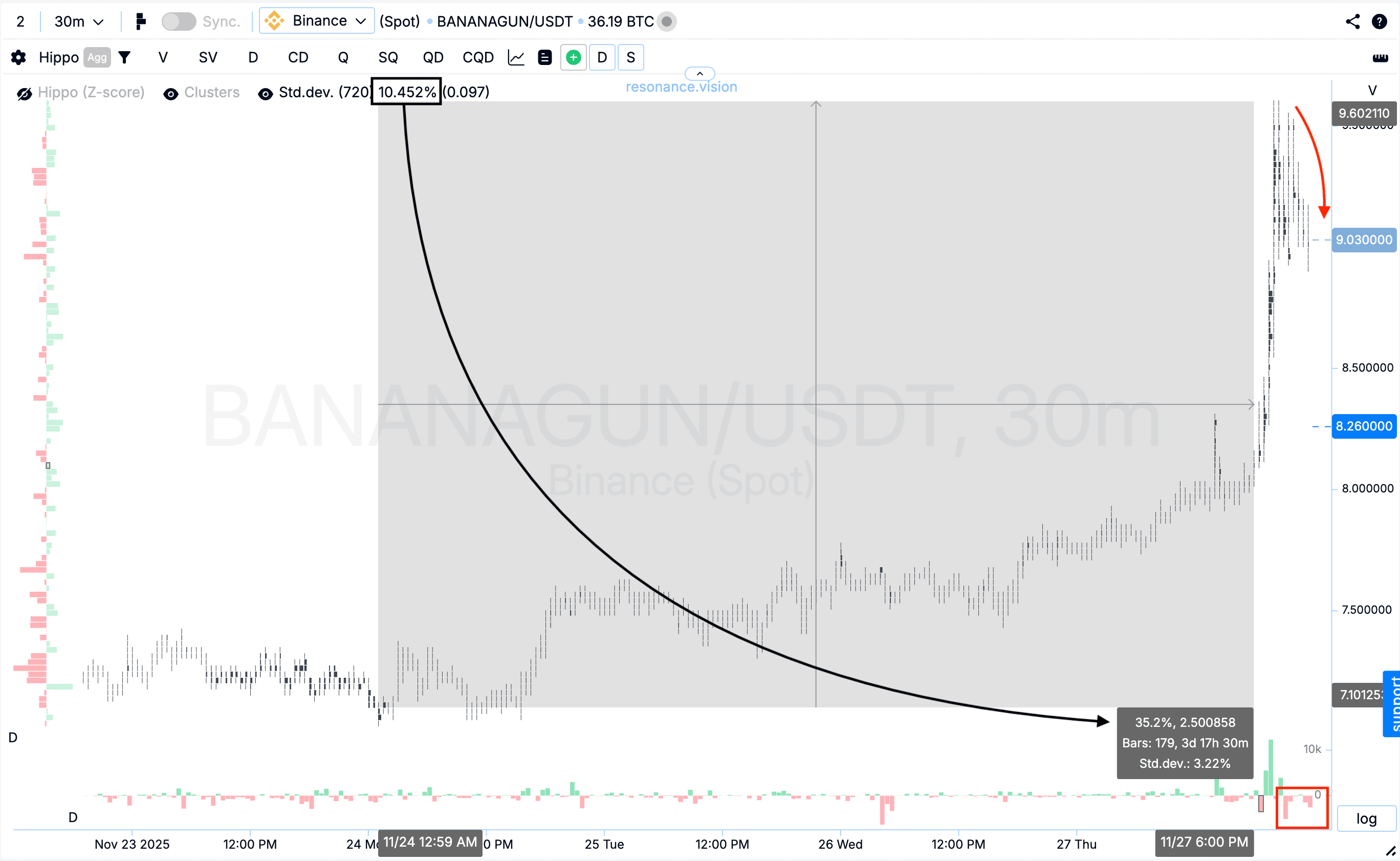

Exit Reasons

Cluster chart: from the entry point, the price increased by 35.2% — more than three standard movements. Then a pullback formed, during which market selling started to dominate again (rectangle and arrow). This behavior indicates a potential shift of initiative back toward sellers. With emerging pressure, holding the position further would have increased risk, so taking profit at this moment was the most rational and balanced decision.

Conclusion

The combination of the cluster chart and aggregated data provided a clear signal that seller pressure was weakening while limit participants were willing to absorb all market sell volume.

After a move of more than three standard deviations and the appearance of a pullback with increasing selling activity, it became evident that the initiative was gradually shifting toward sellers. In such conditions, taking profit wasn’t just the safest option — it was the optimal decision that allowed you to secure the result and avoid entering a higher-risk zone.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.