ENA: A Classic Long Entry Setup

A local-supply shortage case and a solid long setup. The seller is pressing with volume, but price fails to print new lows — sells become inefficient and buyer support shows up. Next comes the impulse and a logical exit where buying strength fades and limit resistance forms. A clear example of how supply/demand analysis delivers real results — you can use it as a template.

Table of content

If you’re looking for a clear example of how to find trade ideas not off “indicators,” but off the real interaction of supply and demand, this case is for you. This is a practical breakdown you can reuse as a template when analyzing the crypto market through volume, clusters, and limit activity.

Where to look: The asset was found via the screener on the 30m timeframe.

Core logic: With market sells dominating, price stopped moving lower. This is a typical “sell inefficiency” situation: there’s plenty of volume pressure, but no follow-through in the form of continued downside. This pointed to local scarcity forming and provided a basis for entering the trade.

I also want to note that during market screening, similar shortage footprints were spotted on most coins. This became an additional argument for taking the position.

Entry reasons

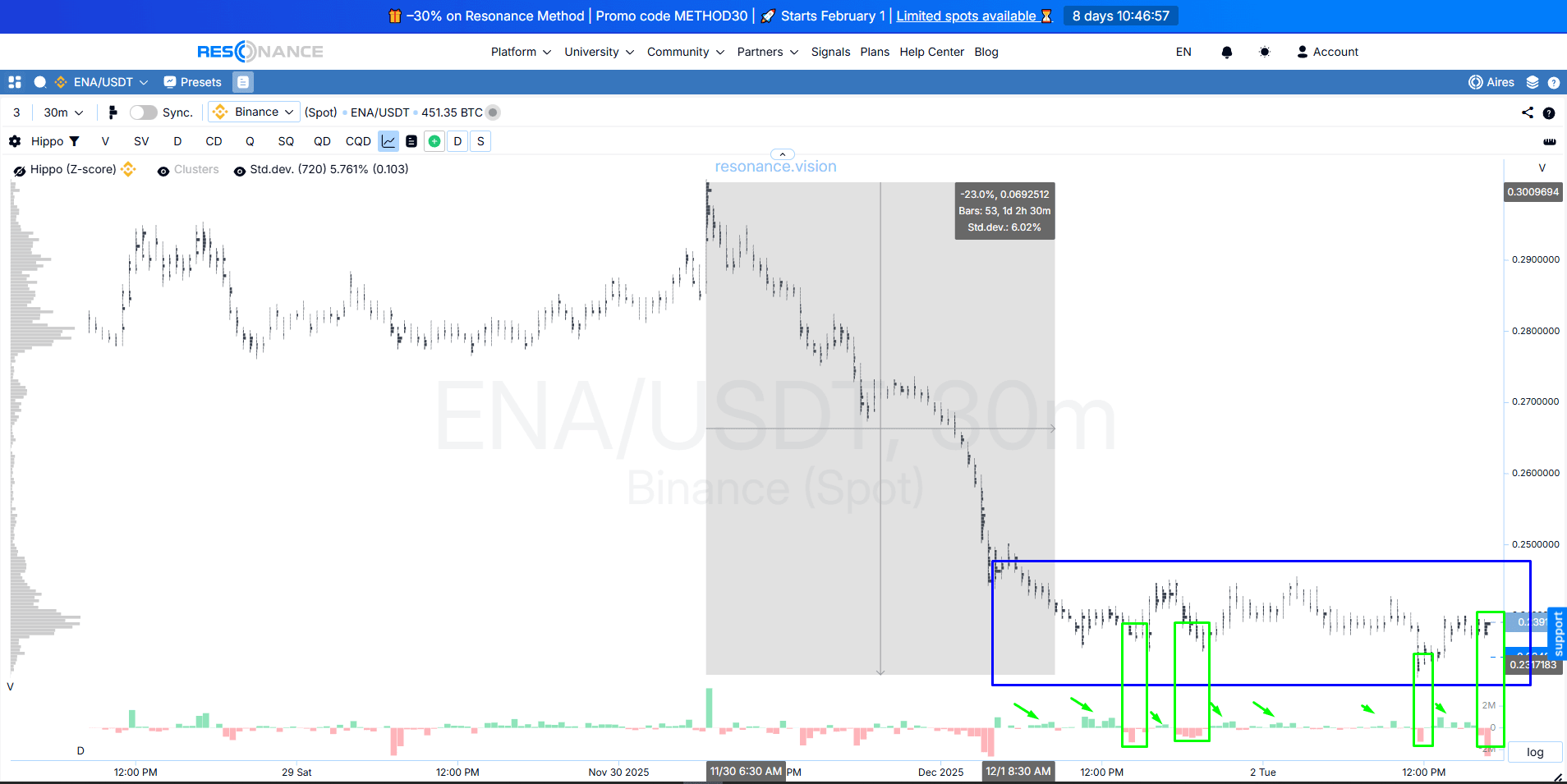

1. Cluster chart: sells stopped printing local lows

After a strong drop, a stable range formed (blue rectangle) — a consolidation zone. Inside the range, sells stopped leading to meaningful new lows (green rectangles): the seller is there, but their effort is inefficient. We can also see that the buyer became more active. This is visible in the green bars of the delta histogram (green arrows).

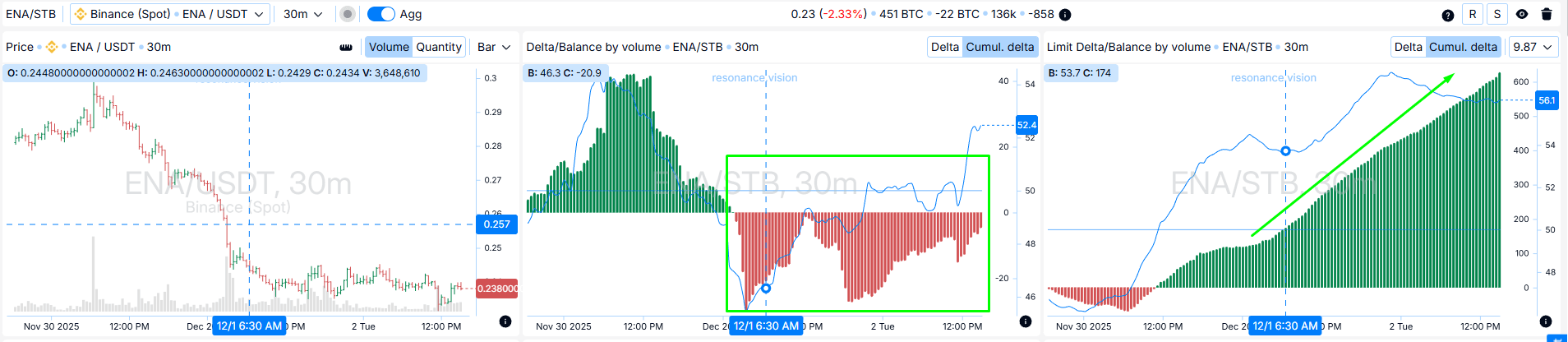

2. Dashboard: confirmation via aggregated metrics

Delta/volume balance:

Aggregated data across all pairs and exchanges confirms the inefficiency of market sells (green rectangle). Cumulatively, sells dominate, but there is no meaningful price decline.

Limit Delta/volume balance:

In the order book across all exchanges, we see limit buy orders increasing (green arrow). This is an important detail: the buyer is building limit support, which raises the odds of the range holding and a subsequent impulse. This is exactly the range where we place the stop-loss.

Exit reasons

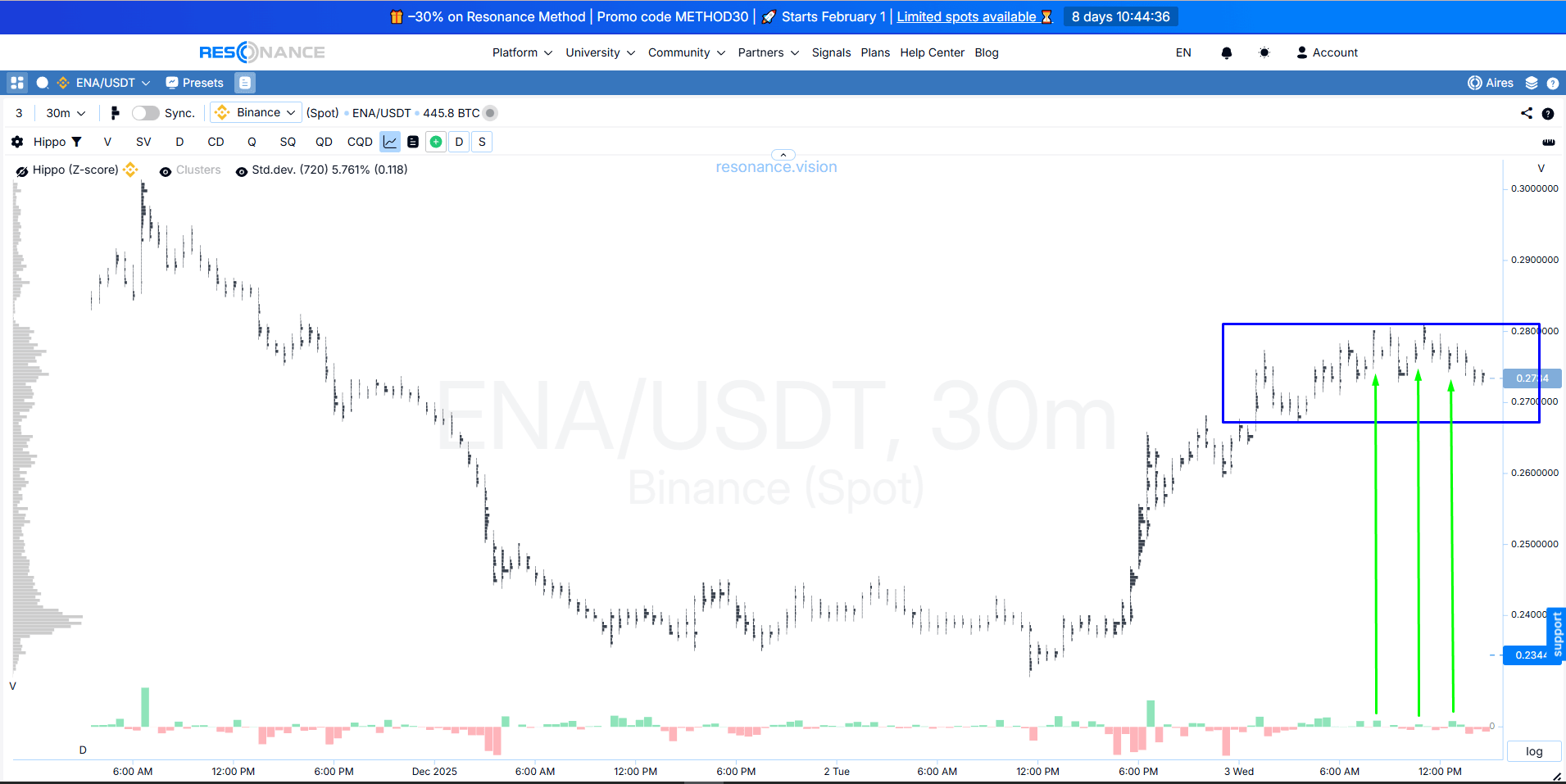

1. Cluster chart: weakening price response to market buys

After the deficit state formed, price made a meaningful move and a range started to form (blue rectangle). The response to market buys became weaker (green arrows). Price even shows a small pullback. This indicates a possible shift of initiative to sellers.

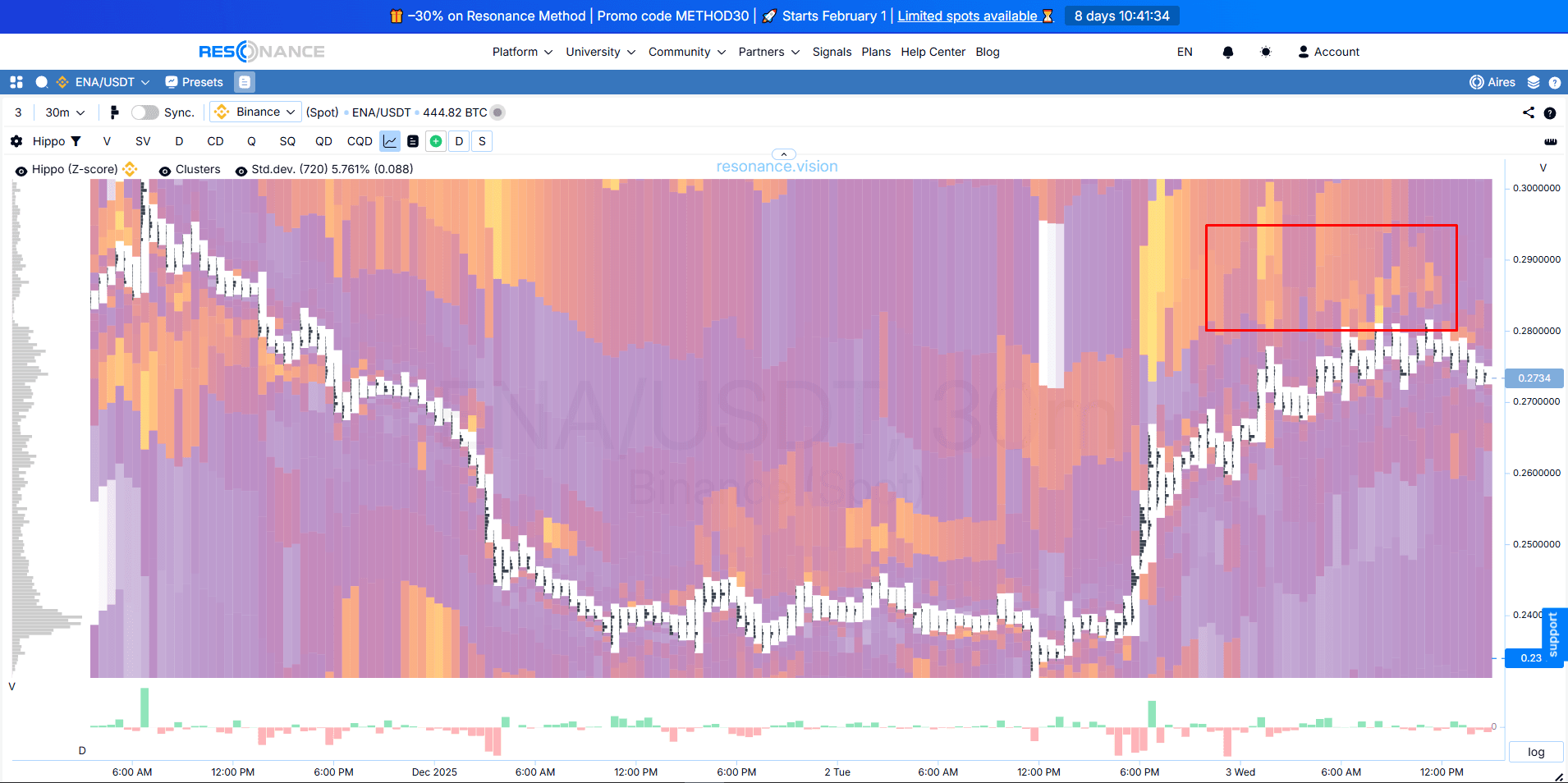

2. Heatmap: limit resistance zone

On the heatmap, a large cluster of limit sell orders is recorded (red rectangle). This creates an additional barrier to continuing the move higher. In this zone, the “quality” of continuation deteriorates, so closing the position becomes logical.

Trade conclusion

This case clearly demonstrates how analyzing the cluster chart and limit orders, combined with aggregated metrics, helps identify the formation of a local shortage. The entry was taken on signs of sell inefficiency, and the exit — after a strong price move, signs of weakening buyer strength, and resistance from limit sellers.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.