COTI +21.4% (Resonance Directional Strategy)

In this analysis, we examined the situation with COTI/USDT.

Despite significant buying and large clusters on the rise, the price failed to break new highs, indicating weakening buyers. This was followed by a sharp decline of more than 20%—almost five times higher than the typical price movement for this coin. This dynamic indicates increased volatility and the risk of holding the position, so locking in seemed the optimal solution.

Table of content

Pair: COTI/USDT

Risk: Medium

Skill Level: Beginner

Entry Reasons

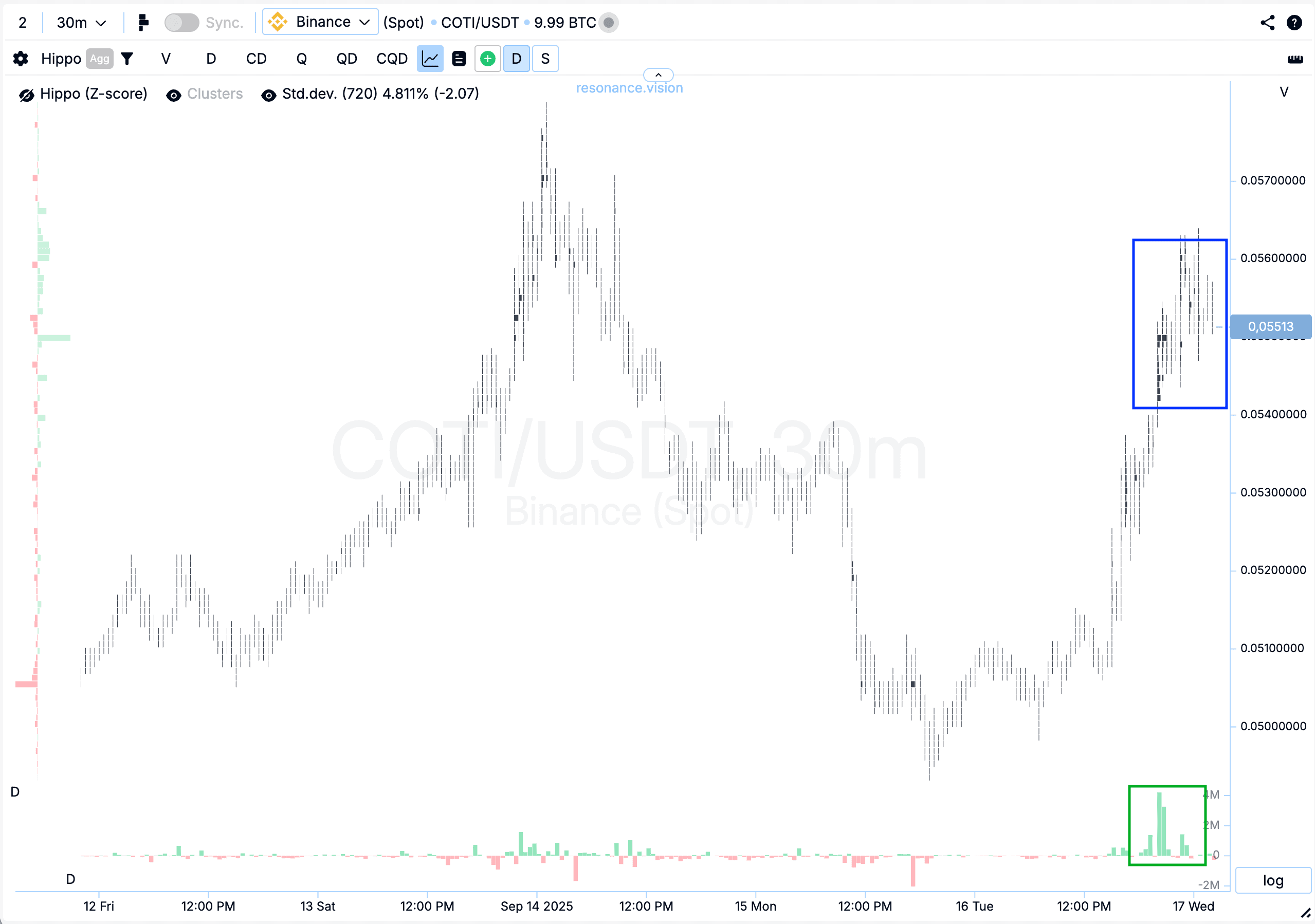

Cluster Chart: During the upward move, large volume clusters formed (blue rectangle). Inside them, buying activity clearly dominated (green rectangle), yet the price failed to update the local high. This dynamic may signal a local surplus and weakening buyer strength.

In the Dashboard

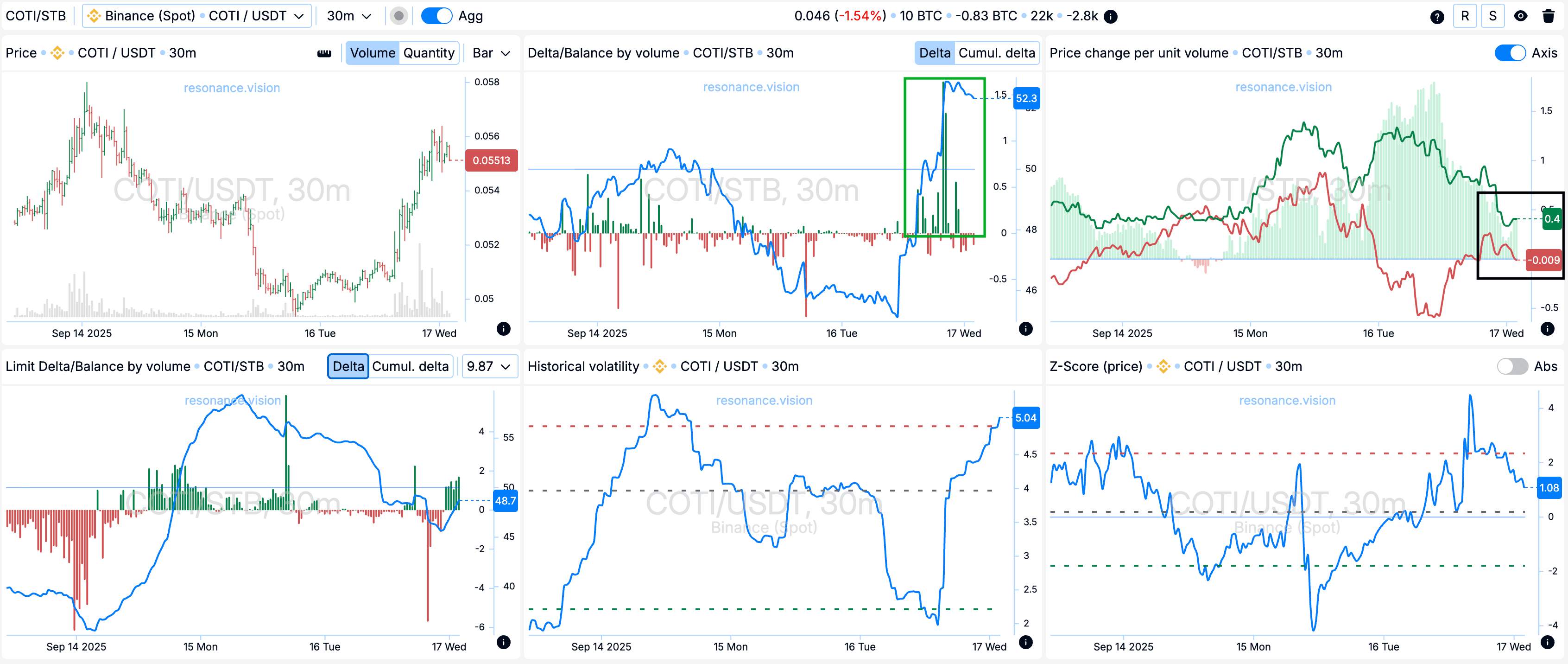

Delta/Volume Balance: Aggregated data shows that significant buying occurred across all pairs and exchanges, which is clearly reflected in the delta histogram (green rectangle). However, despite this pronounced buying pressure, the price did not show the expected growth, as noted earlier.

Price Change per Volume Unit: It is also visible that the impact efficiency of market orders began converging to roughly equal values (black rectangle), indicating reduced buyer effectiveness.

Exit Reasons

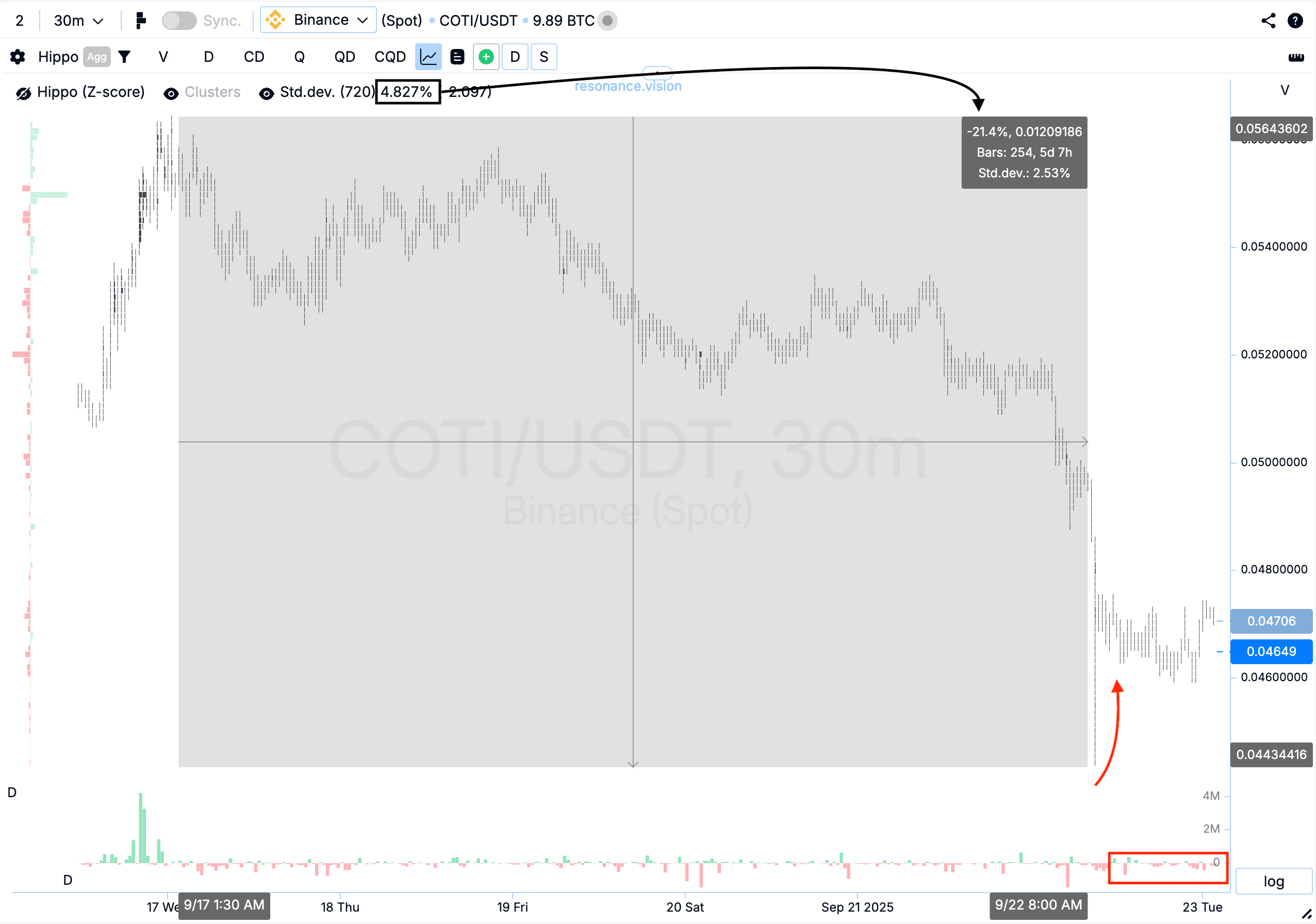

Cluster Chart: After the impulsive decline, the price showed a pullback where market selling no longer exerted pressure (red rectangle and arrow) — the price did not continue to fall. Additionally, it’s worth noting that the move from the local high to the low exceeded 20%. For this coin, one standard move equals 4.427%, meaning the current drop is nearly five standard moves. Such a deviation is considered abnormal and adds risk to holding the position.

Conclusion

The initial picture indicated local buyer weakness — large clusters with buying dominance failed to push the price higher, while aggregated delta data showed strong buying that did not result in price growth. This signaled a potential surplus and declining demand efficiency.

After the impulsive drop, a rebound followed, but market selling no longer pressured the price, showing balance between supply and demand in the new range. However, the 20%+ drop — almost five standard moves — appears abnormal for this asset. In such conditions, exiting the position looks justified, as holding would carry increased risk.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.