DOLO +52.3% (Directional Strategy Resonance)

The analysis is based on volume and price reaction analysis: as sales increased, their effectiveness declined, indicating the formation of a localized shortage. Combining the cluster chart, delta, and Z-Score allowed us to objectively determine the entry point and promptly detect movement when buying momentum waned.

Table of content

Coin: DOLO/USDT

Risk: High

Understanding Level: Beginner

Reasons to Enter

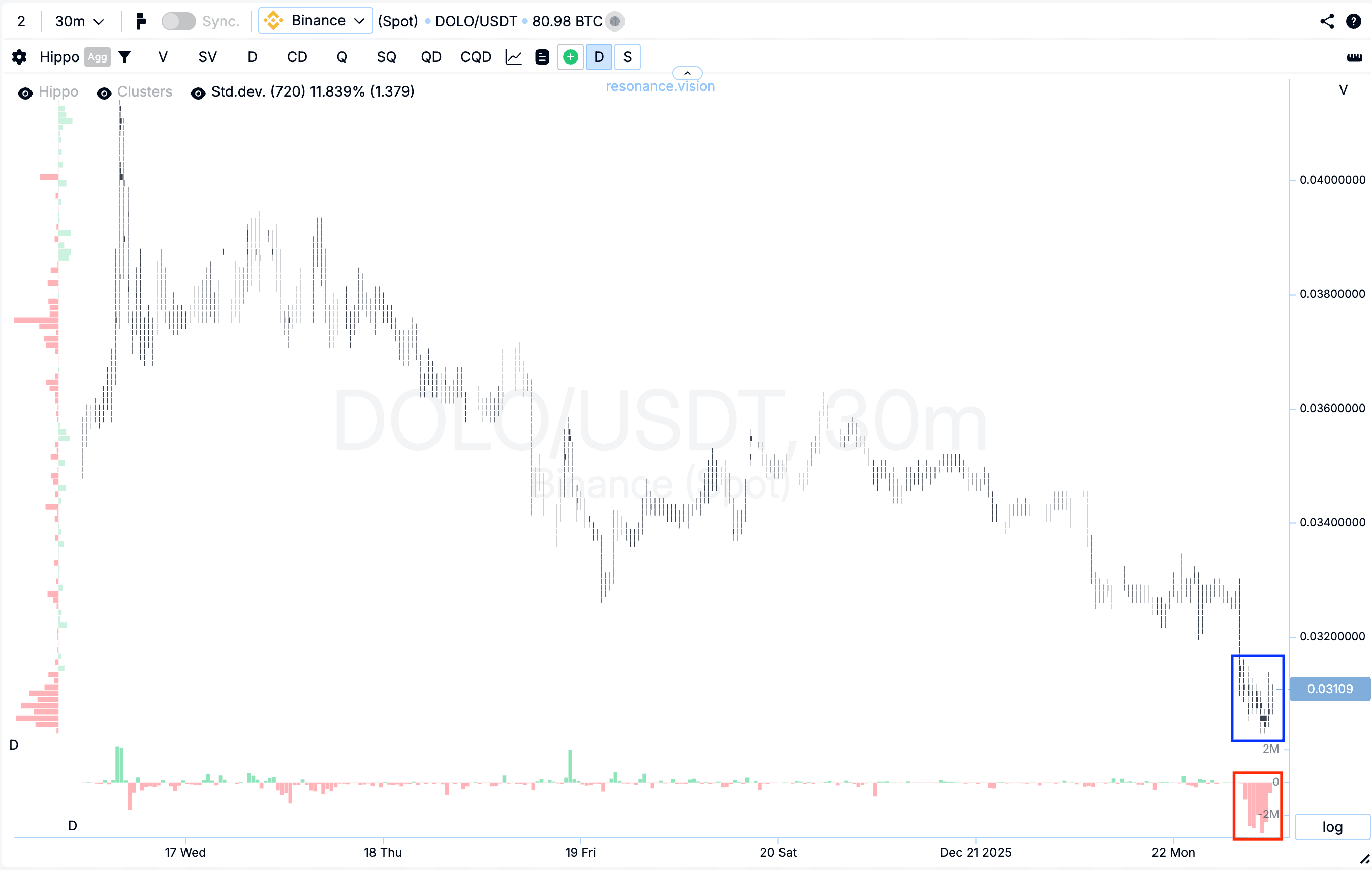

Cluster Chart: During the decline, abnormal volume clusters formed (blue rectangle). These volumes were accompanied by active market selling, but their effectiveness significantly decreased – the price stopped declining significantly (red rectangle). This reaction indicates the formation of a local shortage and a weakening of selling pressure, which often signals a possible change in momentum or a local reversal.

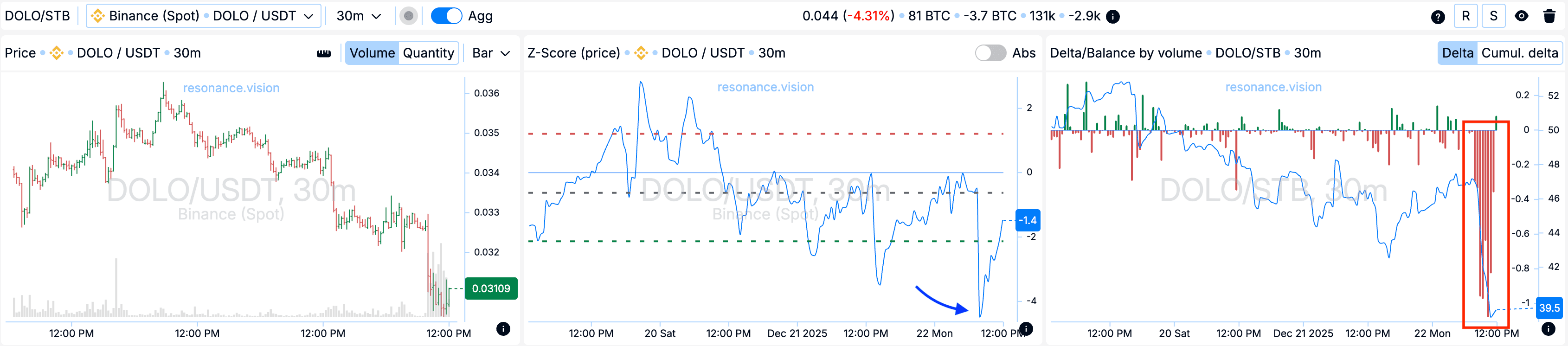

In the Dashboard

Delta / Volume Balance: Aggregated data for all pairs and exchanges fully confirms the picture observed in the cluster chart. During the period under review, the market was under significant selling pressure, which is clearly visible in the delta histogram (red rectangle). Despite this, the price held, indicating that limit participants are actively absorbing all incoming selling volume, forming local support.

Z-Score (price): Additionally, at the peak, a downward price deviation of more than 4 standard deviations was recorded (blue arrow). Such anomalies indicate a possible local reversal or stall.

Exit Reasons

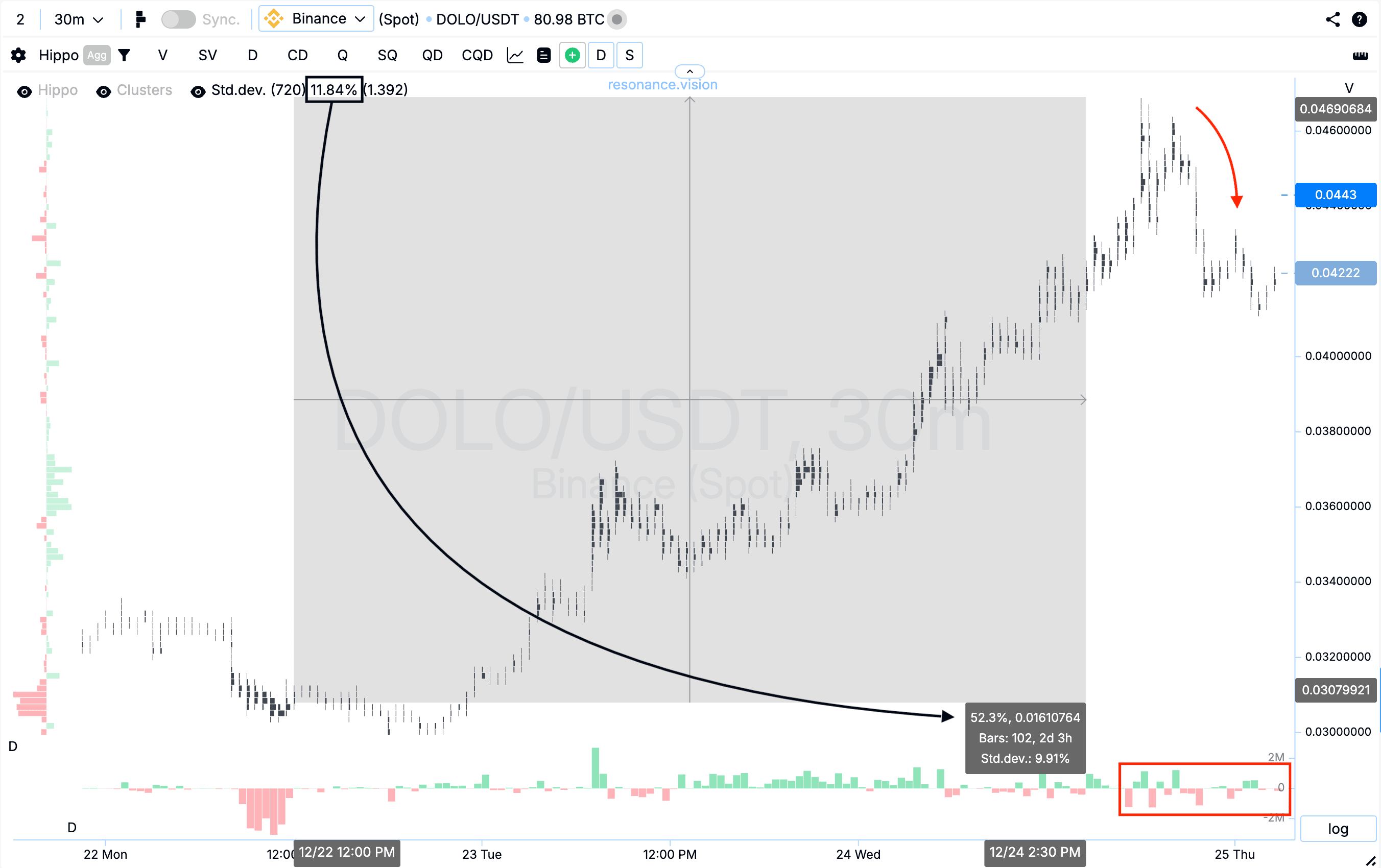

Cluster chart: After the entry point, the price rose by more than 50%, which corresponds to more than four standard price movements for this asset. As this rally continued, market selling began to dominate the market, resulting in a significant pullback. This dynamic indicates a weakening of buyer initiative. Under these conditions, fixing the position seemed a rational decision, allowing the market to recoup the realized gains without increasing risk.

Conclusion

The market clearly demonstrated signs of shortage: sell volumes increased significantly, but their impact on price gradually weakened. A comprehensive assessment of the cluster chart, delta, and Z-Score allowed us to objectively determine the entry point and monitor the movement until buying initiative subsides. This approach to analyzing volume and price reaction allows for trades to be structured with clear logic and a controlled level of risk.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.