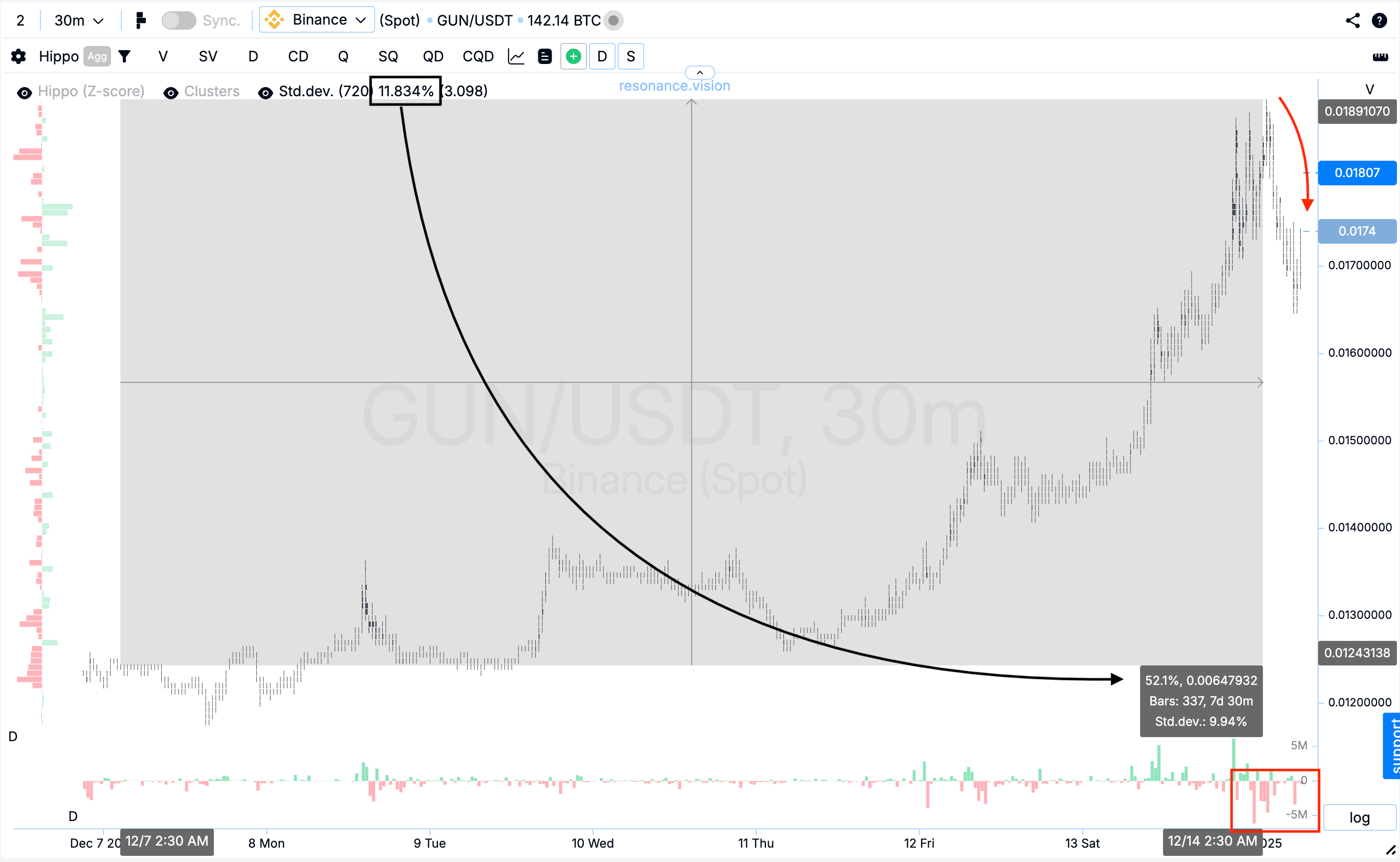

GUN +52.1% (Resonance Directional Strategy)

A GUN/USDT trade analysis based on cluster analysis and aggregated data. It shows how the dominance of market selling in the absence of a price decline indicates a local shortage and provides an entry point, while rising counter-volume helps lock in profits early. A good example of careful volume management without forecasts or expectations.

Table of content

Coin: GUN/USDT

Risk: medium

Level of understanding: beginner

Reasons for entry

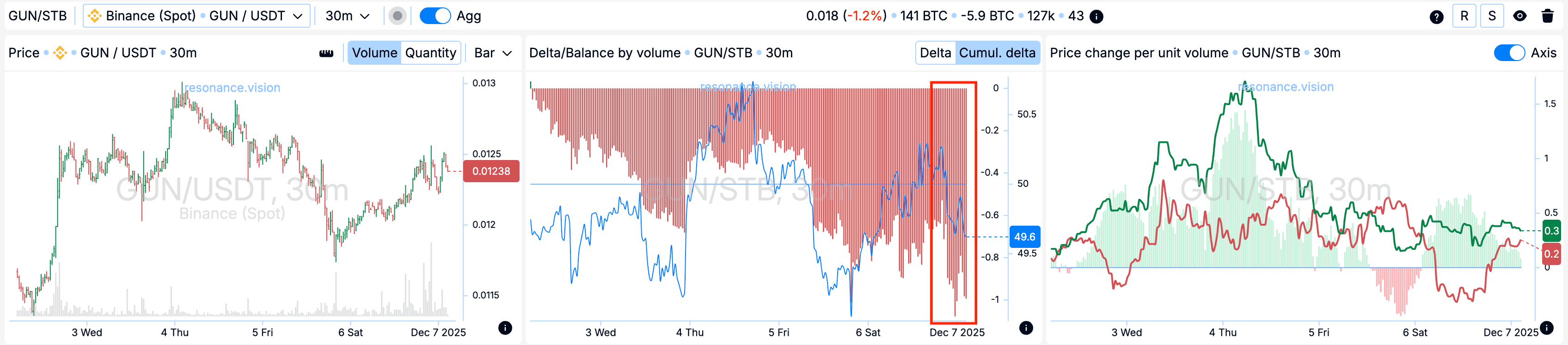

Cluster chart: large volume clusters formed (blue rectangle), inside which significant market sell orders were executed (red rectangle). However, despite this pressure, the price stopped declining. Such market behavior indicates increasing demand and the formation of a local deficit: sellers continue to spend volume, but their efforts no longer lead to further price decline.

In the Dashboard

Delta / Volume balance: aggregated data across all pairs and exchanges confirms the picture observed on the cluster chart. At that moment, market sells clearly dominated, which is distinctly visible on the cumulative delta histogram (red rectangle). However, despite this pressure, the price did not decline, indicating the presence of limit demand ready to absorb the entire incoming market volume. This reaction forms local support and confirms seller weakness.

Reasons for exit

Cluster chart: after the entry point, the price increased by more than 50%, which corresponds to over four standard movements; for this asset, one standard movement equals 11.83% (black rectangle and arrow). After that, a noticeable pullback followed, and large selling volumes began to appear in the market (red rectangle and arrow). This reaction indicates weakening buyer initiative and increasing counter pressure. Under these conditions, closing the position was the most rational decision, allowing the already realized move to be secured without increasing risk.

Conclusion

This trade clearly demonstrates how working with cluster charts and aggregated data allows for an objective assessment of market conditions without attempting to predict future movement.

The result is a calm and rational trade, where both entry and exit were driven not by emotions, but by changes in volume efficiency and the balance of forces between market participants. This approach allows movements to be captured in a systematic way.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.