ICP +19.3% (Resonance Directional Strategy)

Deal analysis using cluster analysis, heatmaps, and aggregated data. Example of entry based on localized shortages and exit based on increased sales force efficiency while managing risk.

Table of content

Coin: ICP/USDT

Risk: medium

Level of understanding: beginner

Reasons for entry

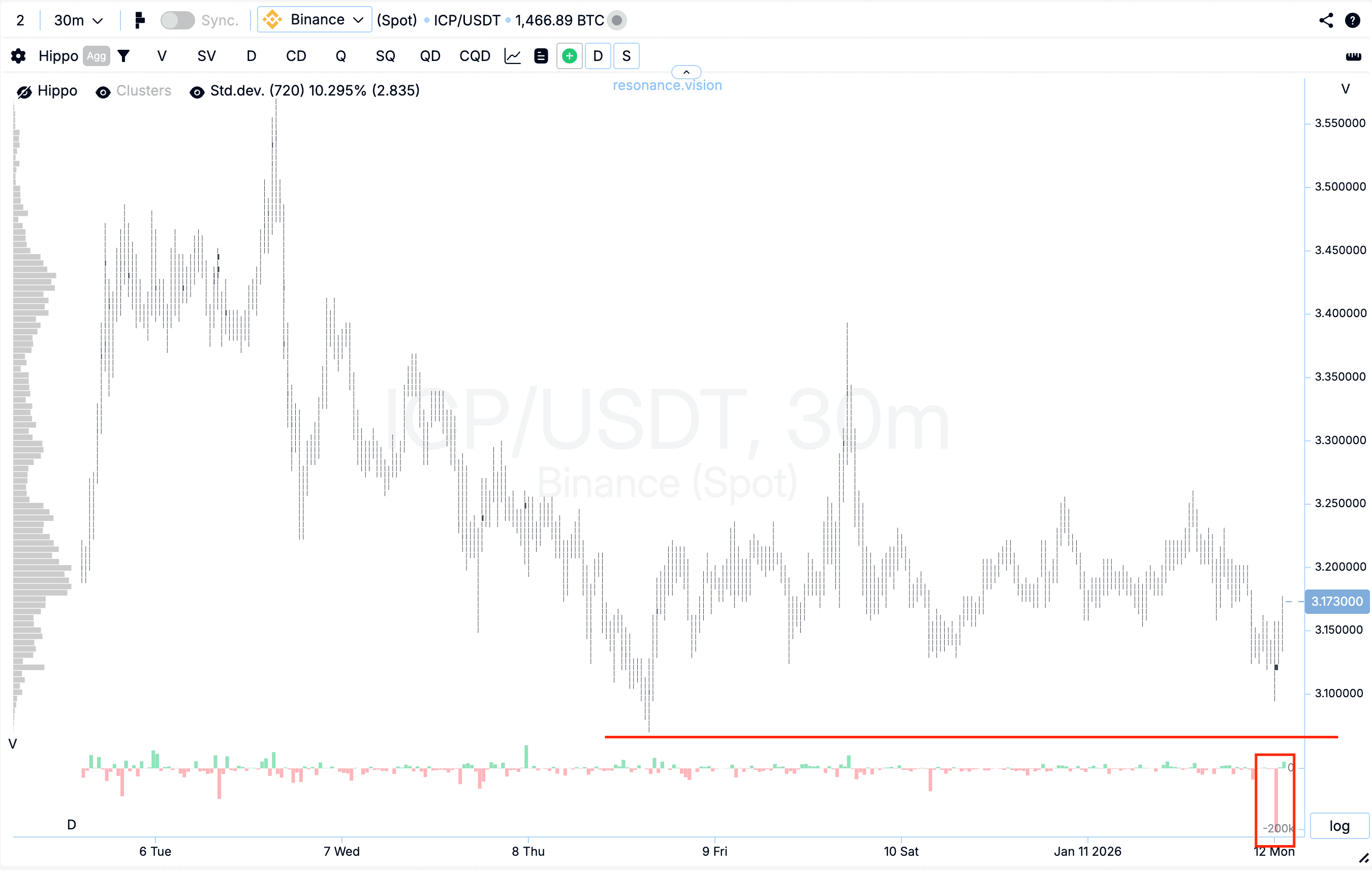

Cluster chart: During the sideways consolidation phase, market sell volumes began to dominate significantly, which is clearly visible on the delta histogram (red rectangle). However, the applied pressure proved ineffective: the price did not decline and failed to update the local low (red line). Such market behavior indicates the emergence of signs of a local deficit and a noticeable weakening of sellers’ initiative.

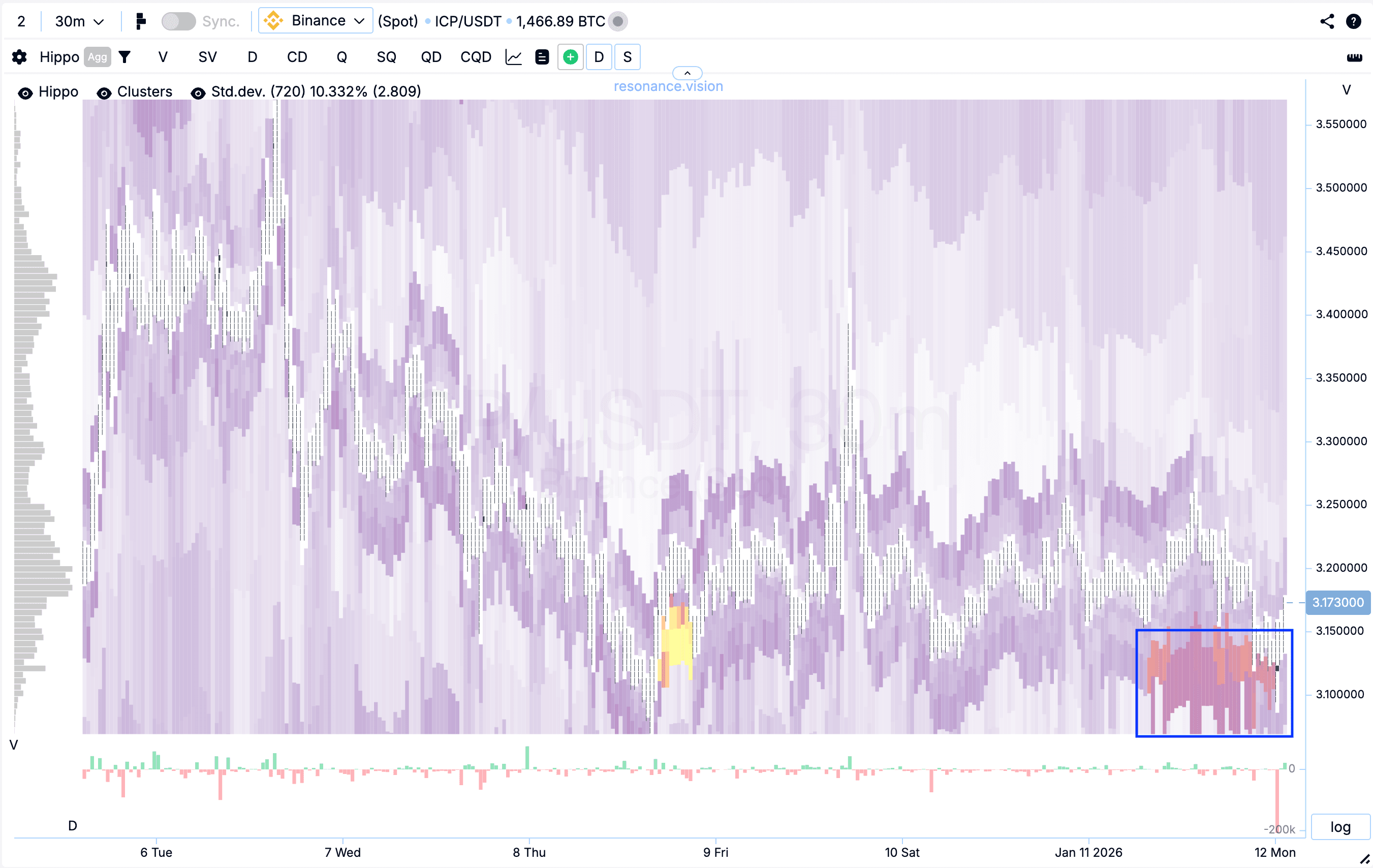

Heatmap in volume mode: Within the analyzed range, anomalous limit buy densities were recorded (blue rectangle), which actively absorbed incoming market sell orders. This structure confirms the persistence of local deficit signs and demonstrates readiness to limit-absorb the entire incoming market sell volume.

In the Dashboard

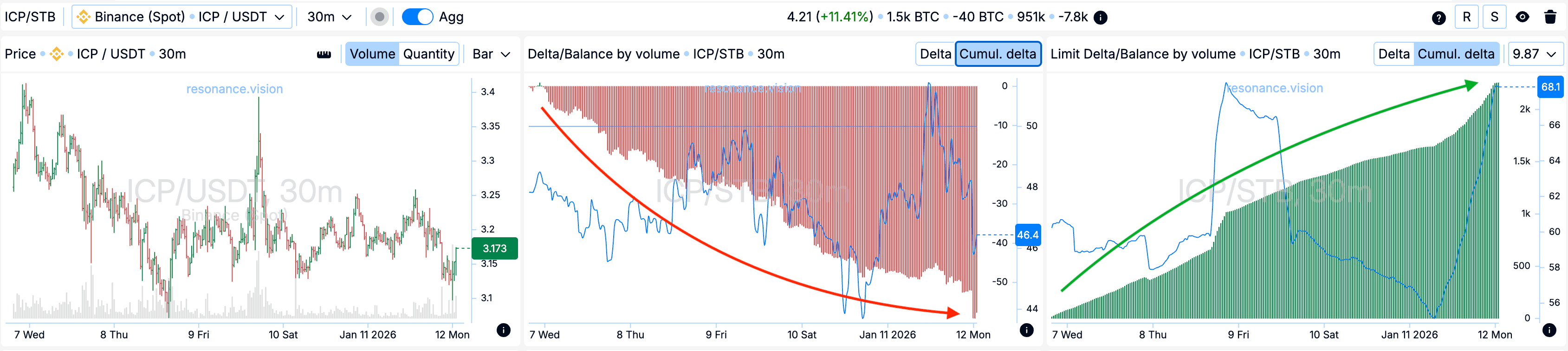

Delta / Volume balance and limit delta: Aggregated data across all pairs and exchanges fully confirm the picture observed on the cluster chart. During this period, market sell volumes increased consistently, which is clearly visible on the cumulative delta histogram (red arrow). At the same time, the price stopped reacting with a decline. Additionally, a cumulative increase in limit buy orders can be observed (green arrow). This combination indicates active absorption of market sell orders by limit participants, forming local support and confirming the weakening of selling pressure.

Reasons for exit

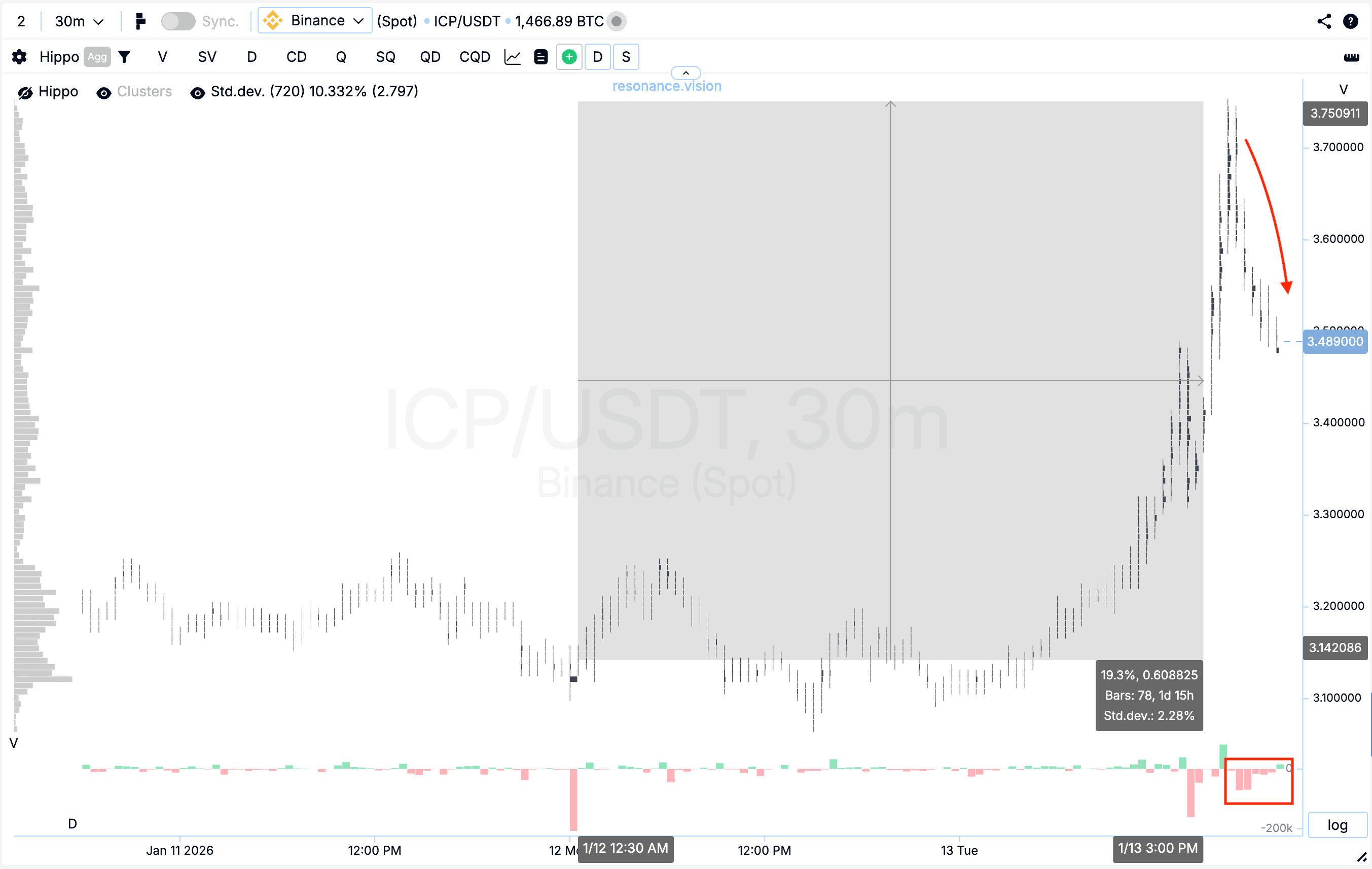

Cluster chart: After the entry point, the price rose by nearly 20%, while volatility noticeably increased in this range. Subsequently, market sell orders began to dominate, against which a smooth price decline formed, indicating increasing effectiveness of sellers (red rectangle and arrow). Under these conditions, further position holding would have led to increased risk, so profit taking was the most logical and balanced decision.

Conclusion

The market clearly demonstrated a classic local deficit scenario: despite the dominance of market sell orders, the price stopped declining, indicating the presence of strong limit demand. A combined assessment of the cluster chart, heatmap, and aggregated dashboard data made it possible to objectively identify the entry point and manage the move until the stage when selling pressure became effective again. This approach—working from volume and price reaction—allows trades to be built with clear logic, well-defined entry conditions, and timely profit taking as risk increases.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.