LDO +1021.36% (Resonance Directional Strategy)

This analysis details a successful trading strategy on the LDO/USDT pair that brought +1021.36% profit. It covers key signals for entering and exiting a position based on heat map data (Z-Score and volume), as well as Delta/Balance by Volume and Limit Delta indicators from the Dashboard. Particular attention is paid to the logic of position management through add-ons and adaptation to the changing market picture. The presented case, with a medium risk level, demonstrates how a comprehensive approach to market analysis can lead to outstanding results.

Table of content

Pair: LDO/USDT

Risk: Medium

Skill Level: Beginner

Entry Reasons

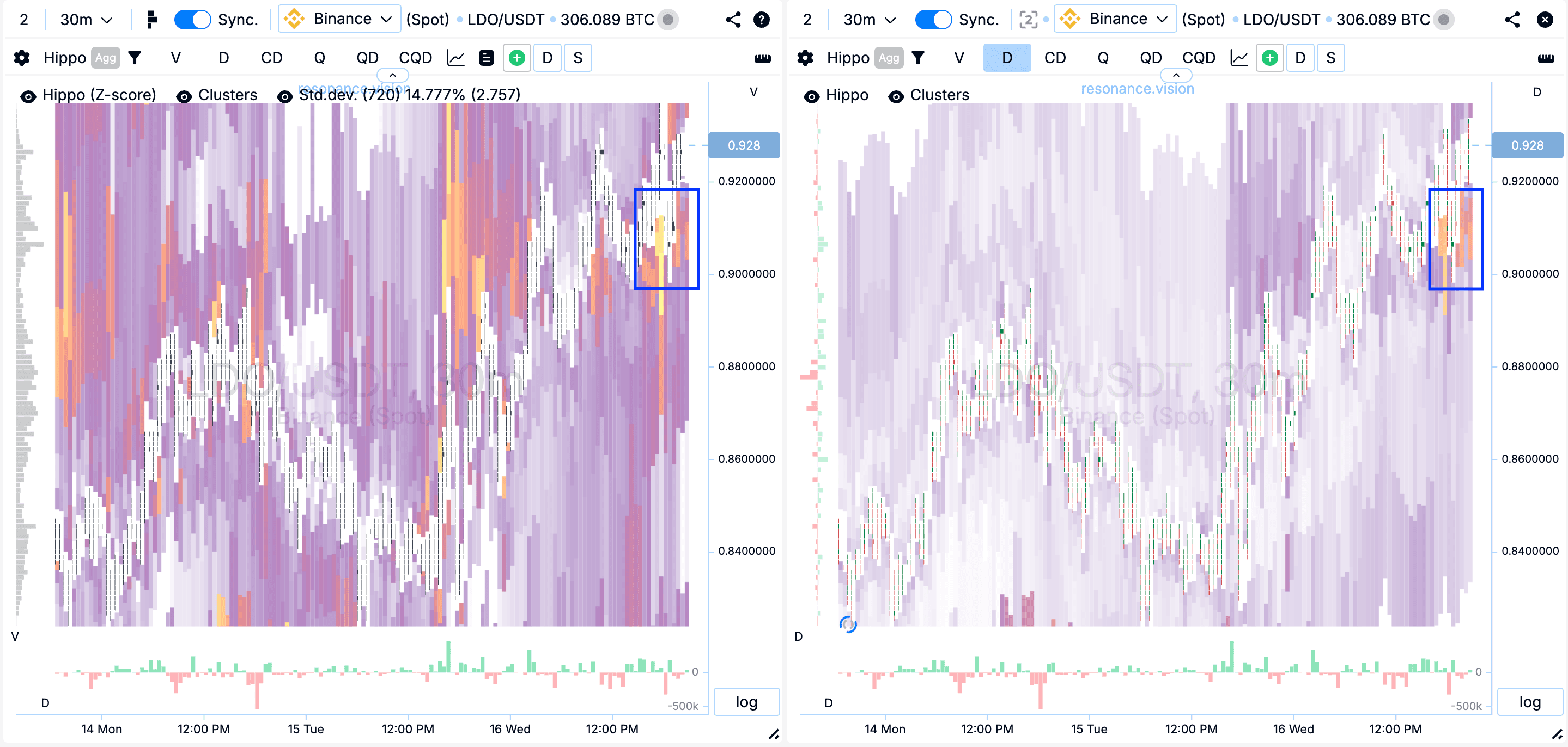

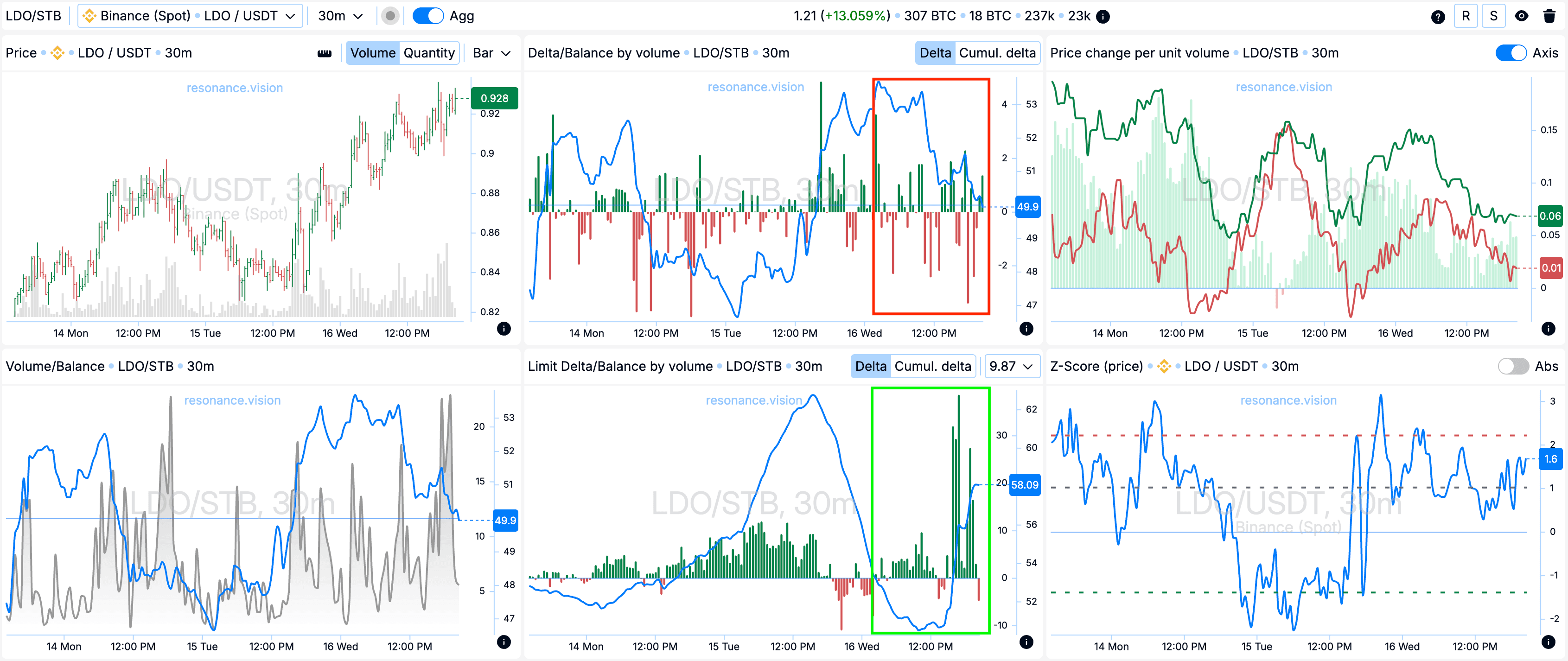

Heatmap in Z-Score and Volume Mode: Clearly defined limit clusters began to form below, both in Z-Score mode and in volume mode (blue rectangles). This may indicate active support in this price range.

In the Dashboard

Delta/Volume Balance and Limit Delta: When evaluating aggregated data, a clear shift in the balance of market orders towards selling is observed, with sell delta bars being significantly stronger (red rectangle). Interestingly, despite this, the price does not decrease.

At the same time, clear spikes are observed in limit orders, indicating a notable dominance of buyers (green rectangle). This potentially suggests that participants are willing to absorb selling volumes with limit orders in the current price range.

Exit Reasons

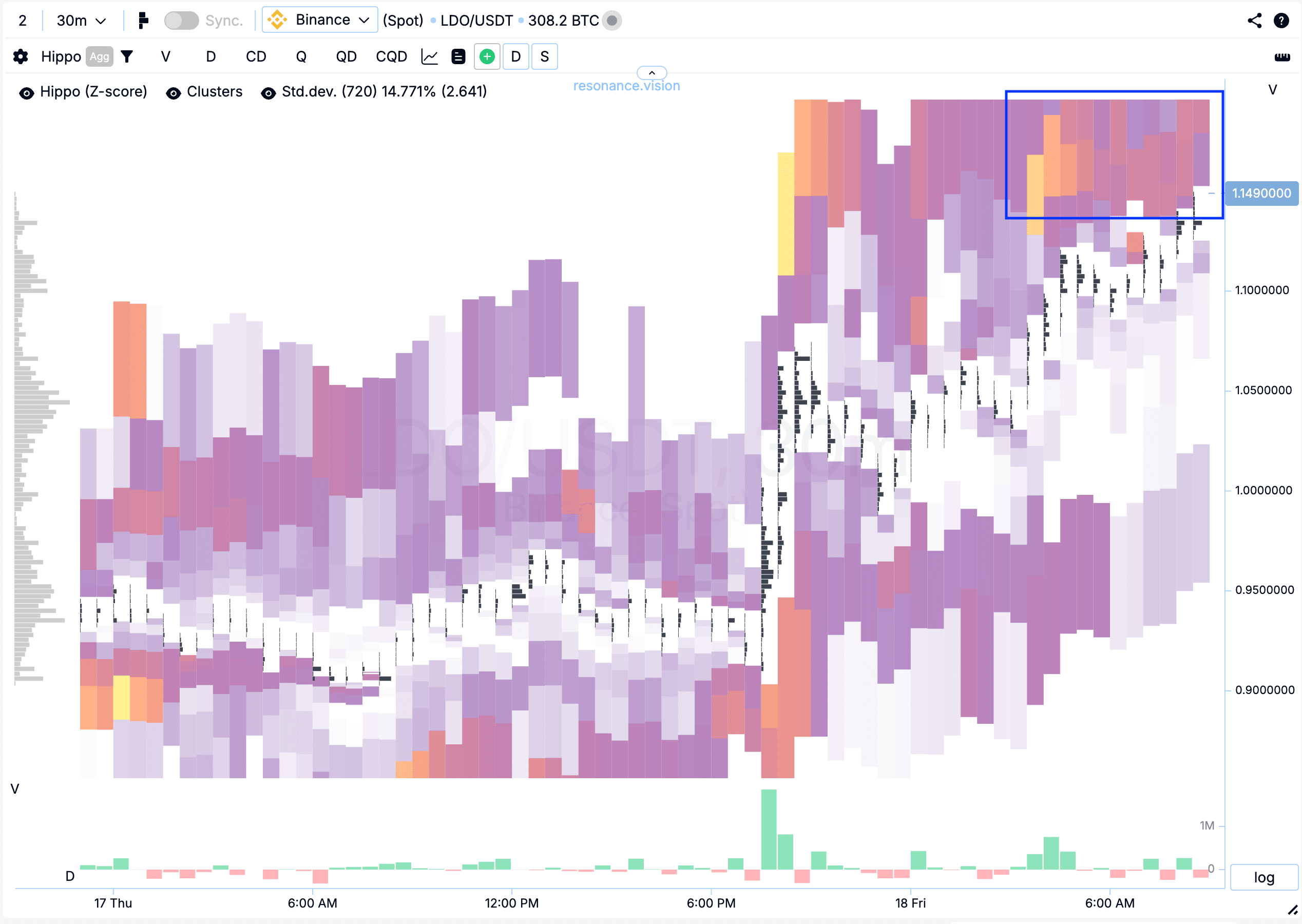

Heatmap in Z-Score Mode: The price is rising, but an anomalous density of limit sell orders is noted above (blue rectangle). At the same time, limit intensity below is extremely weak. This situation potentially points to a possible decline.

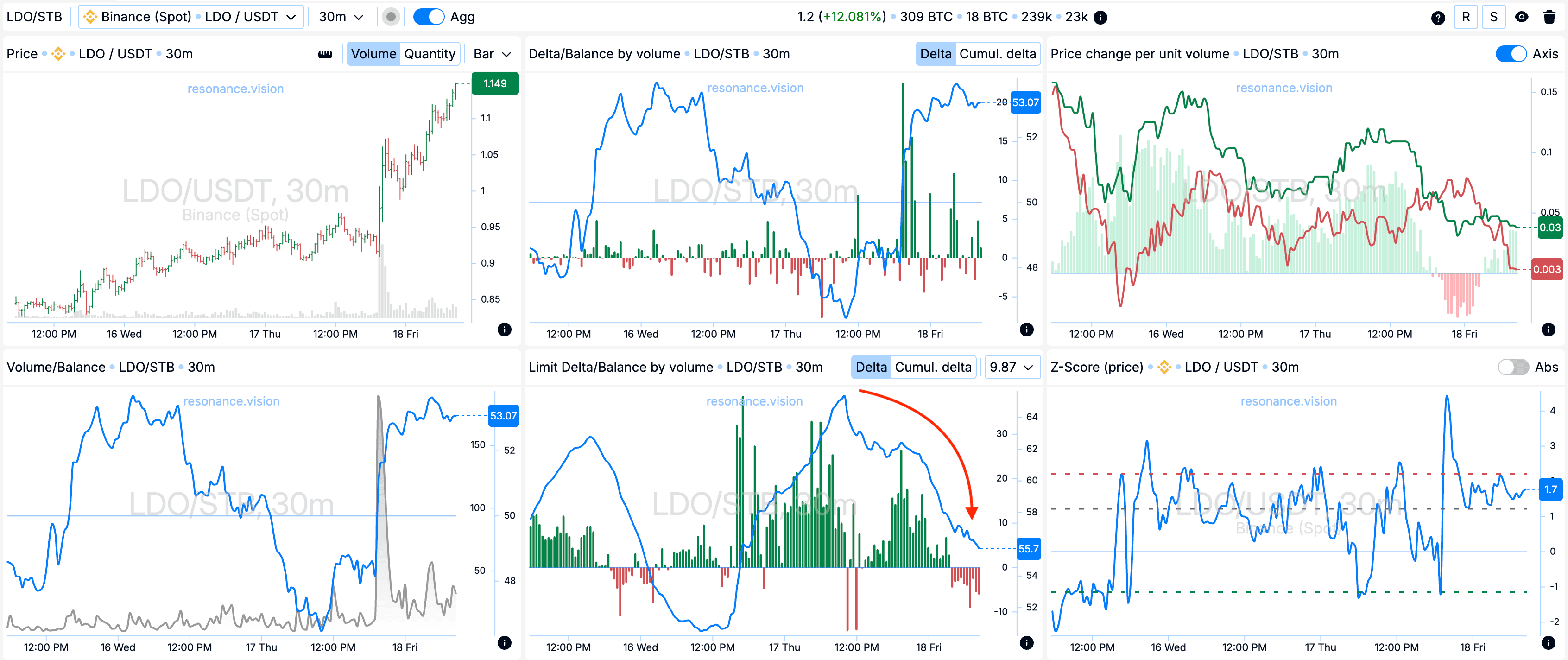

In the Dashboard

Limit Delta/Volume Balance: The balance and histogram indicate the dominance of limit sell orders placed across all pairs and exchanges (red arrow).

Position Management

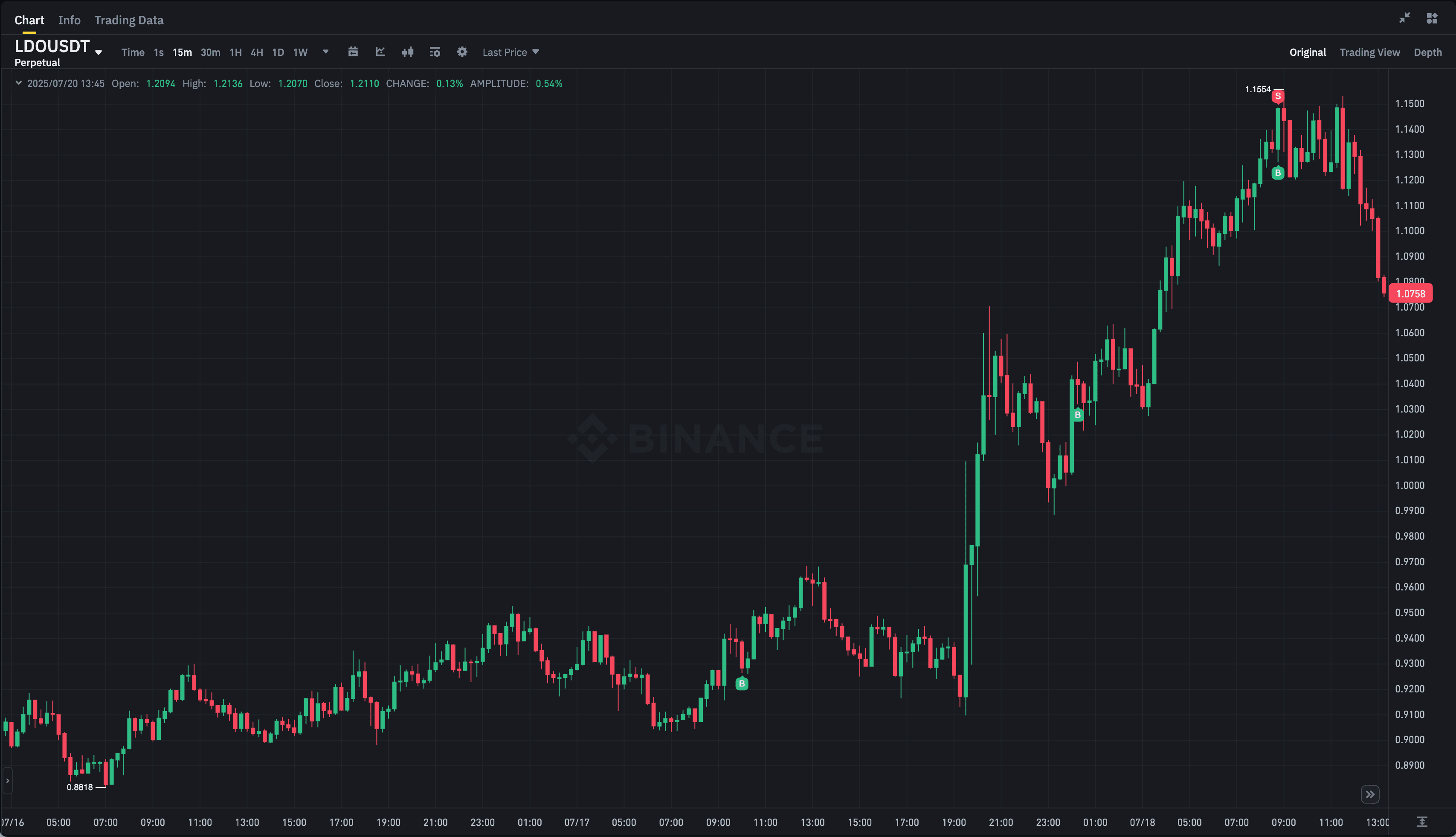

This position brought a good result. Two add-ons were made while holding it, clearly shown in the attached screenshot. Each add-on not only strengthened the overall position but also allowed for effective execution of the trading idea. The final exit was based on the market picture described above.

Result

A profit of +1021.36% was secured.

Conclusion

The position on LDO/USDT demonstrated the effectiveness of a comprehensive approach to decision-making. The initial entry was based on the formation of pronounced buyer limit clusters, indicating active price support. Additional confirmation came from the Dashboard, where, despite the dominance of market selling, spikes in limit buys were observed — showing participants’ readiness to absorb volume.

Successful position management allowed for a significant improvement in the result and effective execution of the trading idea.

This case clearly shows how timely analysis of market data, supported by flexible position management, can lead to outstanding results — even for beginners with a moderate risk level.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.