MINA +92.22% (Resonance Directional Strategy)

How to recognize ineffective sales, strengthen the position with additional sales and exit in time at the first signs of uncertainty. An excellent example of working on the market with discipline and understanding of volume.

Table of content

Coin: MINA/USDT

Risk: low

Understanding level: beginner

This trade idea was triggered by one of our course students.

It’s great to see that you’re not just learning but actively applying your knowledge in real trades. Today, let’s break this situation down in more detail.

Here’s the post he shared:

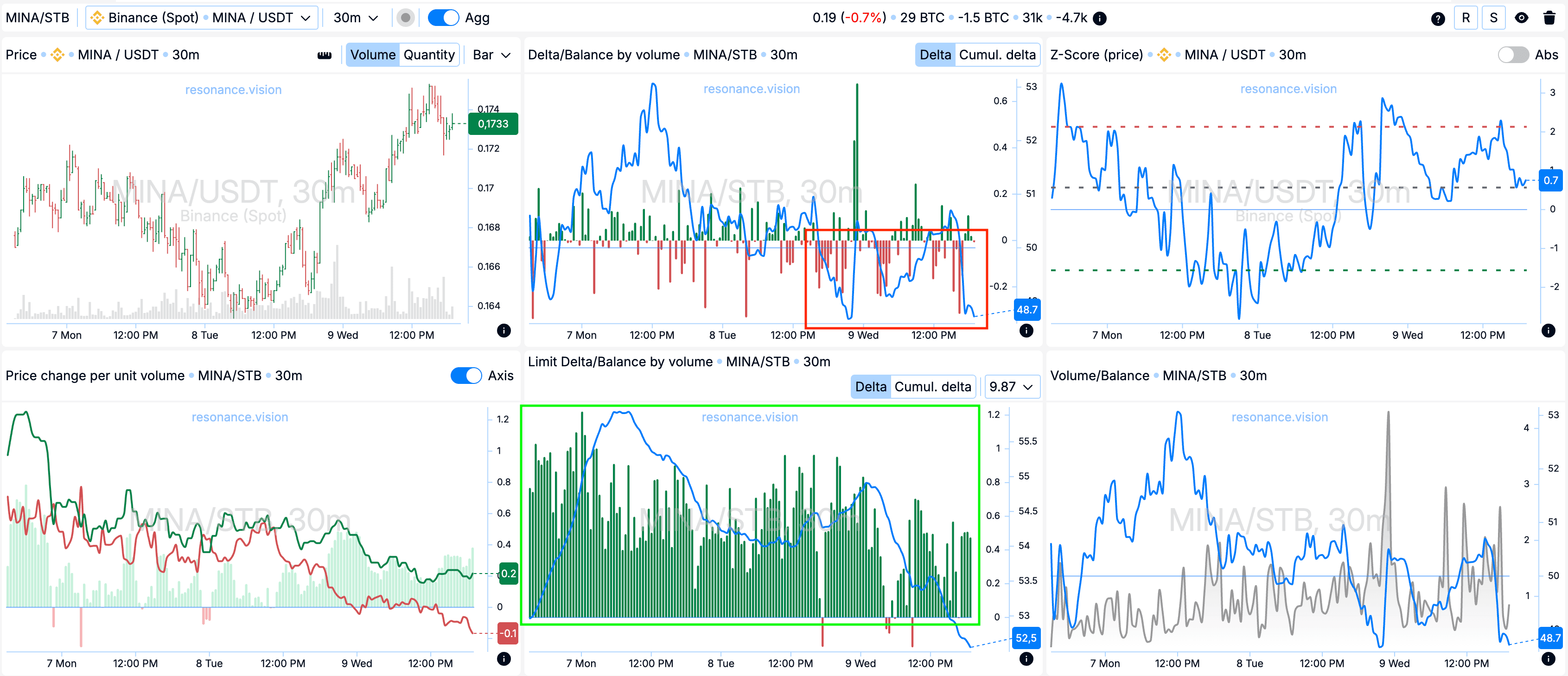

Spotted something on MINA this morning

Started monitoring it on MEXC as well 👇

My thoughts:

Price is gradually rising despite ongoing selling — could indicate inefficiency or supply shortage

More selling observed on Huobi (the most liquid exchange for this ticker)

But on Binance, only the latest bars are red — meaning there’s more buying activity there

Still leaning toward continuation 📈

Drop your thoughts below 💬

But remember - this is just an idea. It still needs to be validated and executed.

Entry Reasons

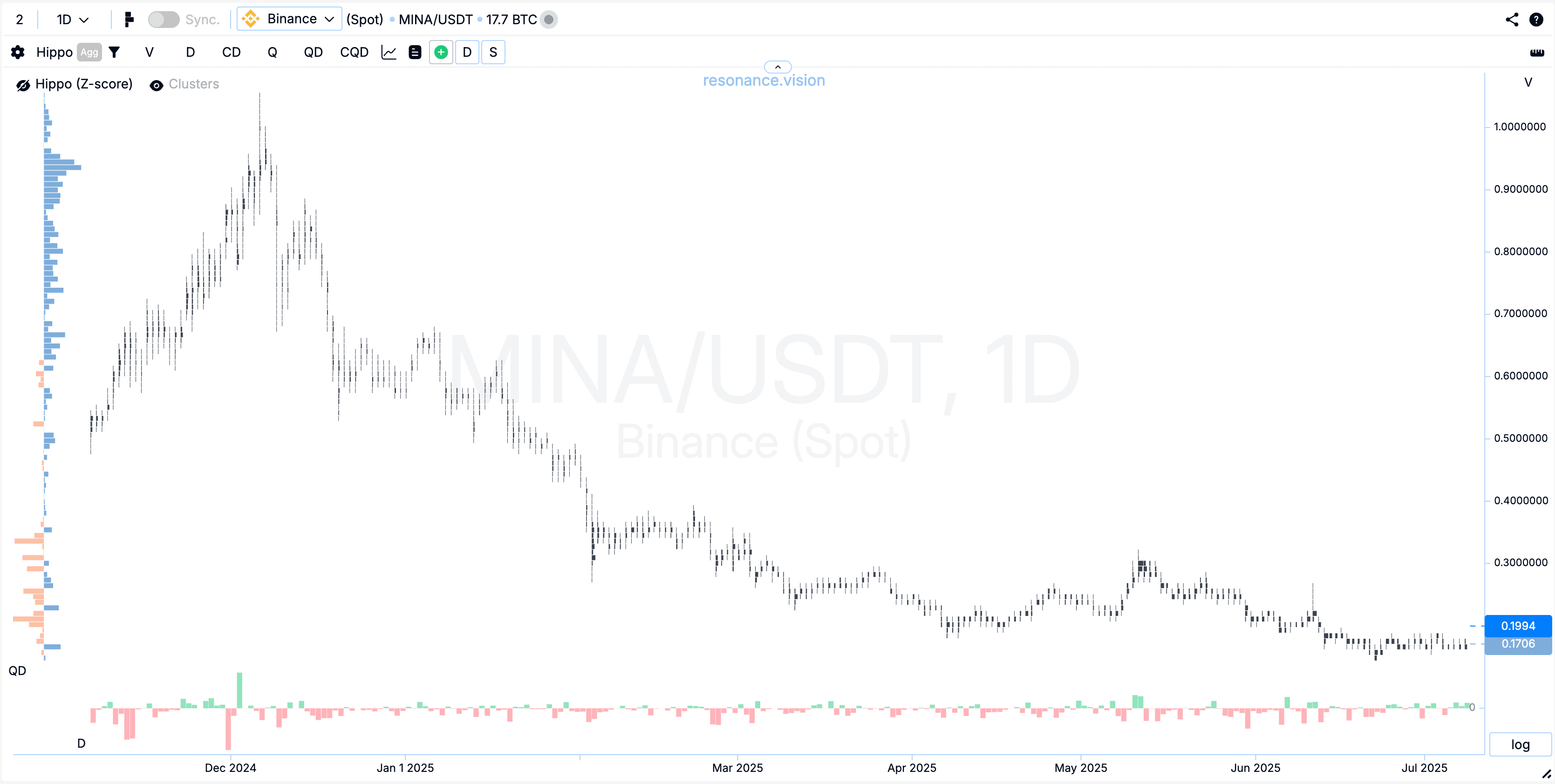

Cluster chart:

On the daily timeframe, we can see that the price had been falling for quite a while during consistent selling pressure. But starting in May, the price stopped declining — despite continued market selling.

On the lower timeframe, we can see that buying activity has started to gradually push the price higher.

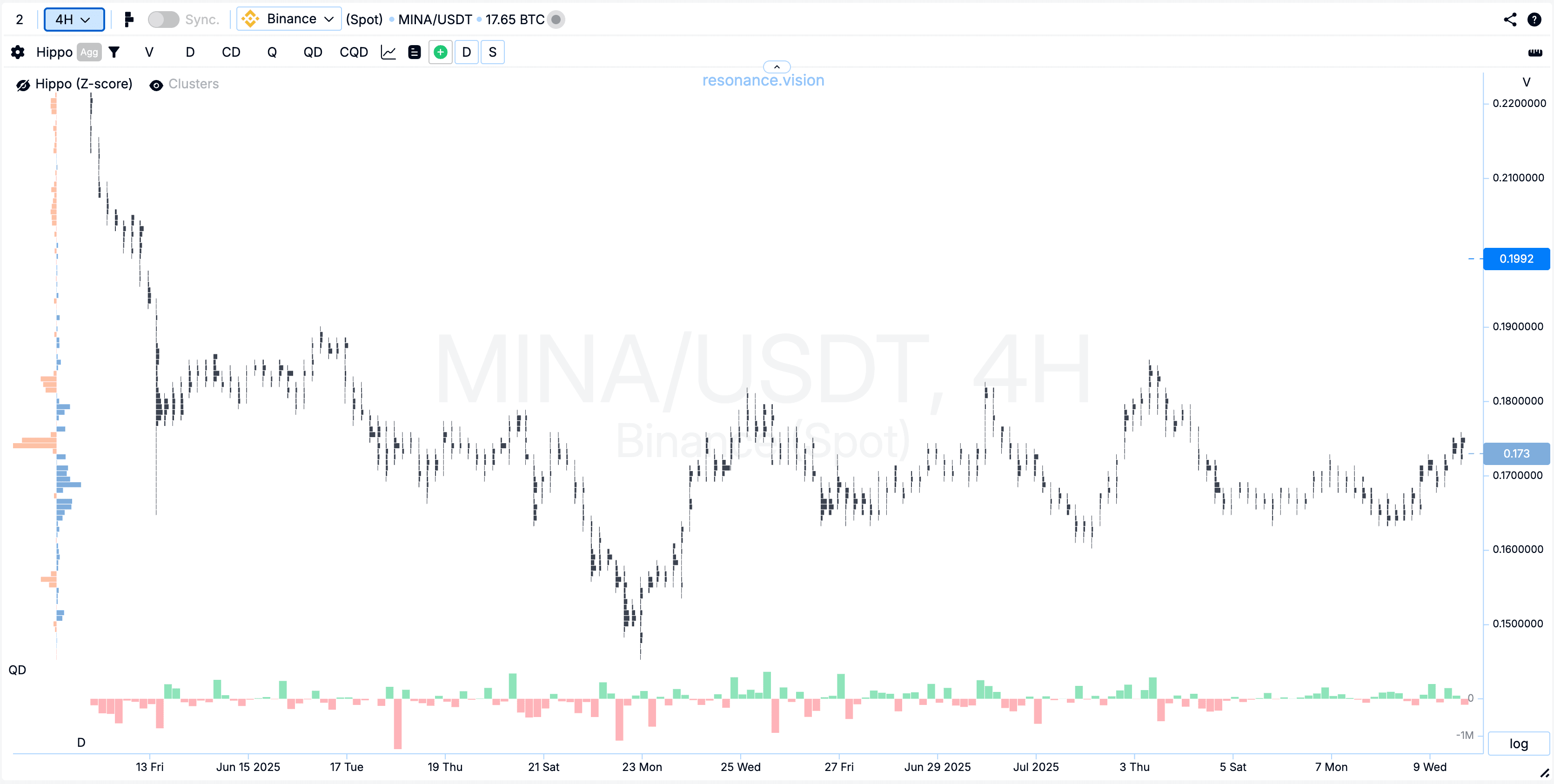

In the Dashboard

Delta/Balance by volume and limit delta:

According to aggregated data, market sells are still dominating, and the overall volume balance continues trending down (red rectangle). However, we also see a persistent placement of limit buy orders — indicated by the rising bars in the limit delta histogram (green rectangle).

This suggests that the selling is ineffective, because the price is rising despite sell pressure — meaning that limit buyers are likely absorbing and even stepping up in price.

Exit Reasons

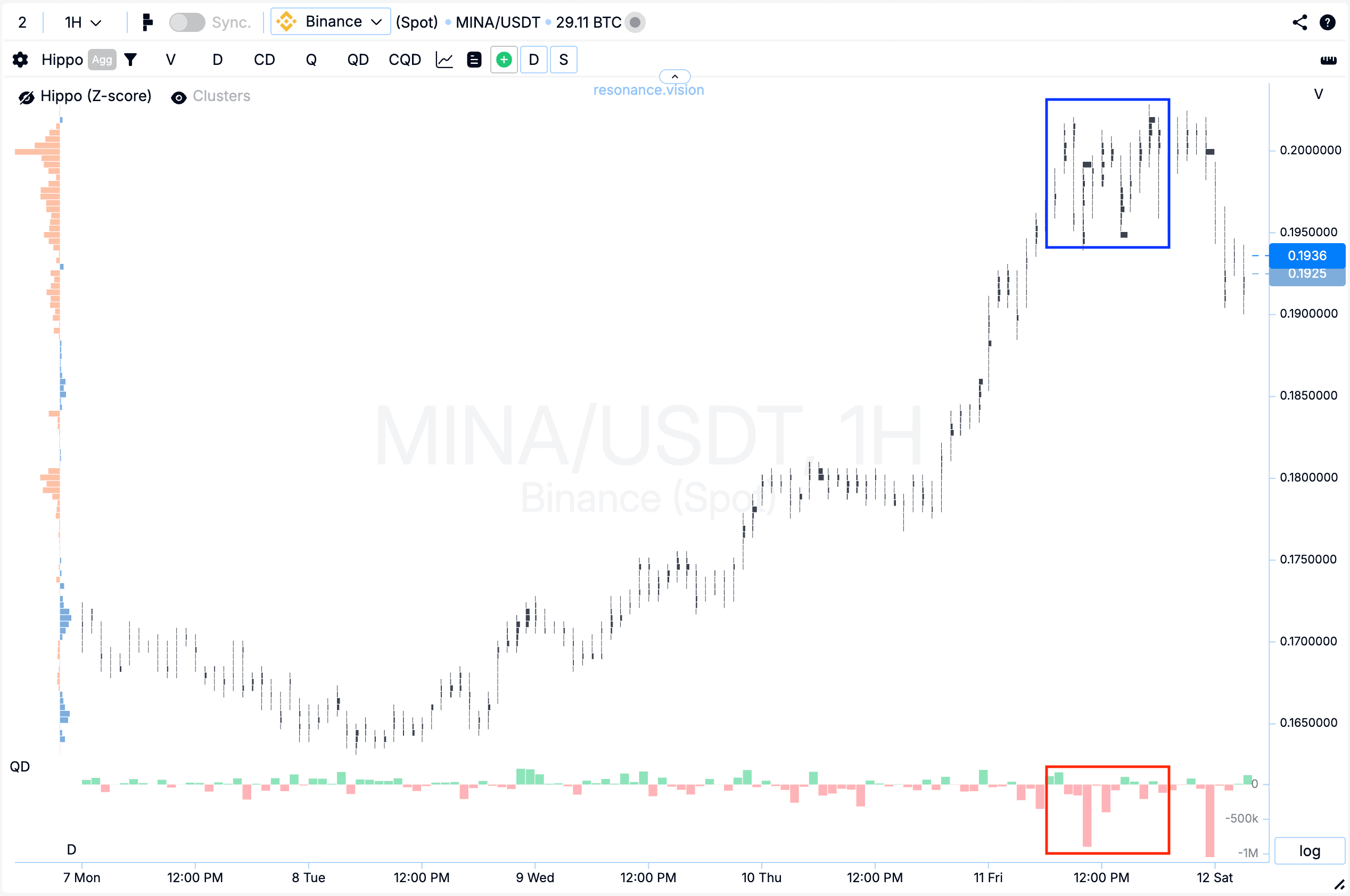

Cluster chart:

During the price rise, we noticed significant volume clusters forming in a wide range (blue rectangle). At the same time, selling activity started to fade (red rectangle).

This introduced uncertainty, which increased the risk of holding the position. That’s why the decision was made to take profit.

Position Management

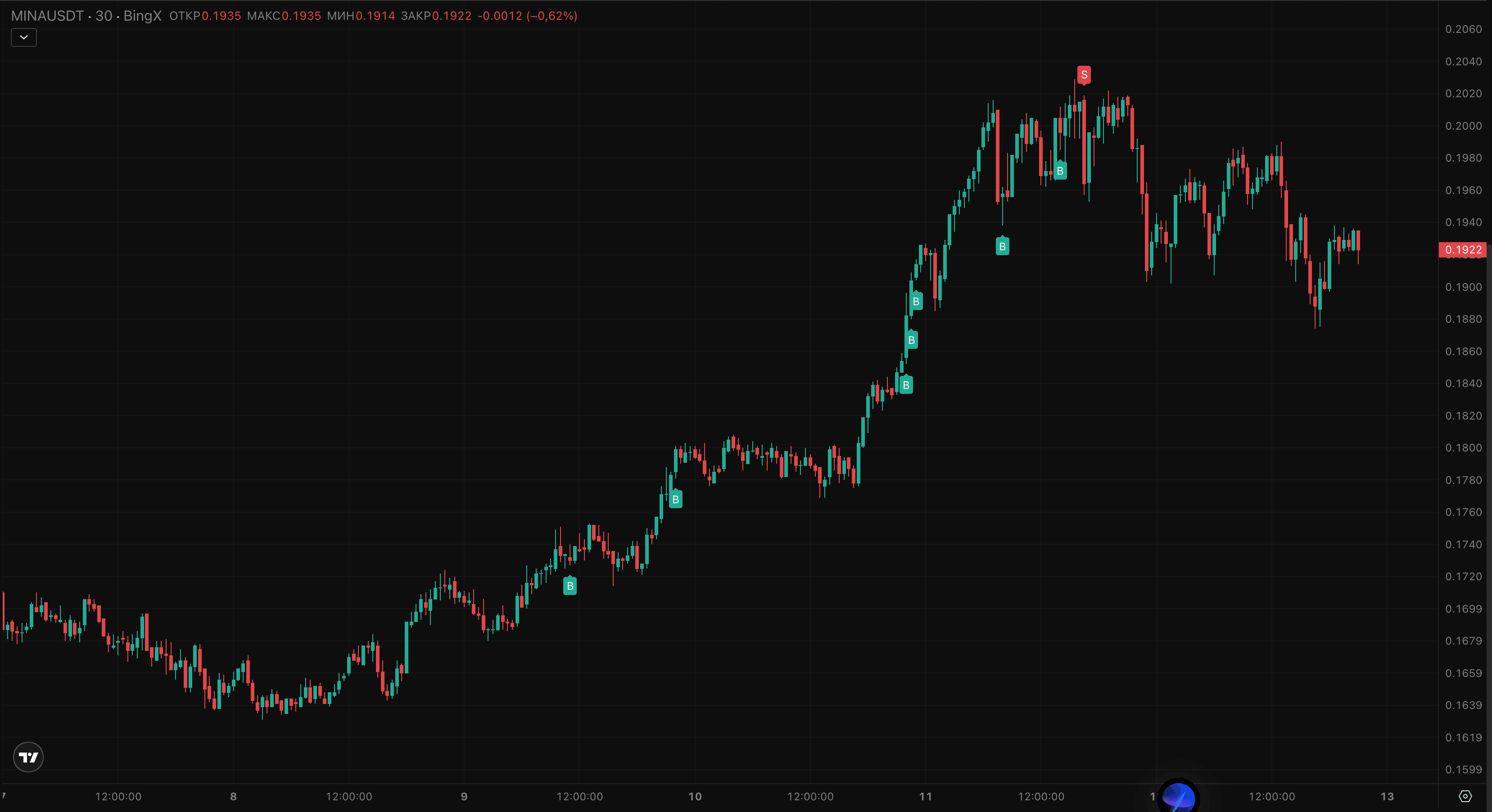

This trade yielded solid results. During the holding period, six additional entries were made — visible on the screenshot.

Each add-on reinforced the overall position and allowed the idea to be worked through more effectively.

This scaling approach proved justified, given the ongoing buyer activity and continued inefficiency of sellers.

Result

The trade closed with a profit of +92.22%.

Note: due to multiple scale-ins, the price on the screenshot represents an average entry point.

In terms of risk/reward:

- 1:3 on price movement

- 1:6 in monetary terms (initial risk / final profit)

Conclusion

This MINA trade is a great example of how combining cluster analysis with aggregated data can reveal what’s hidden from standard candlestick charts.

Despite dominant selling activity, the market held strong — and limit buy orders acted as support, providing opportunities not only to enter, but to build up the position as the setup gained confirmation.

Important: even with a low-risk setup and a good entry, the final decision to lock in profit was made in the face of growing uncertainty.

That’s what discipline looks like — not waiting for miracles, but securing gains when the market hints at a potential reversal.

This breakdown is not just a trade report — it’s also an educational case study showing how to manage a position from idea to outcome.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.