NOT +32.1% (Directional Strategy Resonance)

A breakdown of the NOT/USDT trade: how cluster analysis, delta, and volume efficiency helped spot weakening sellers, find an entry point, and lock in profits after an abnormal rally and increased volatility.

Table of content

Coin: NOT/USDT

Risk: medium

Level of understanding: beginner

Reasons for entry

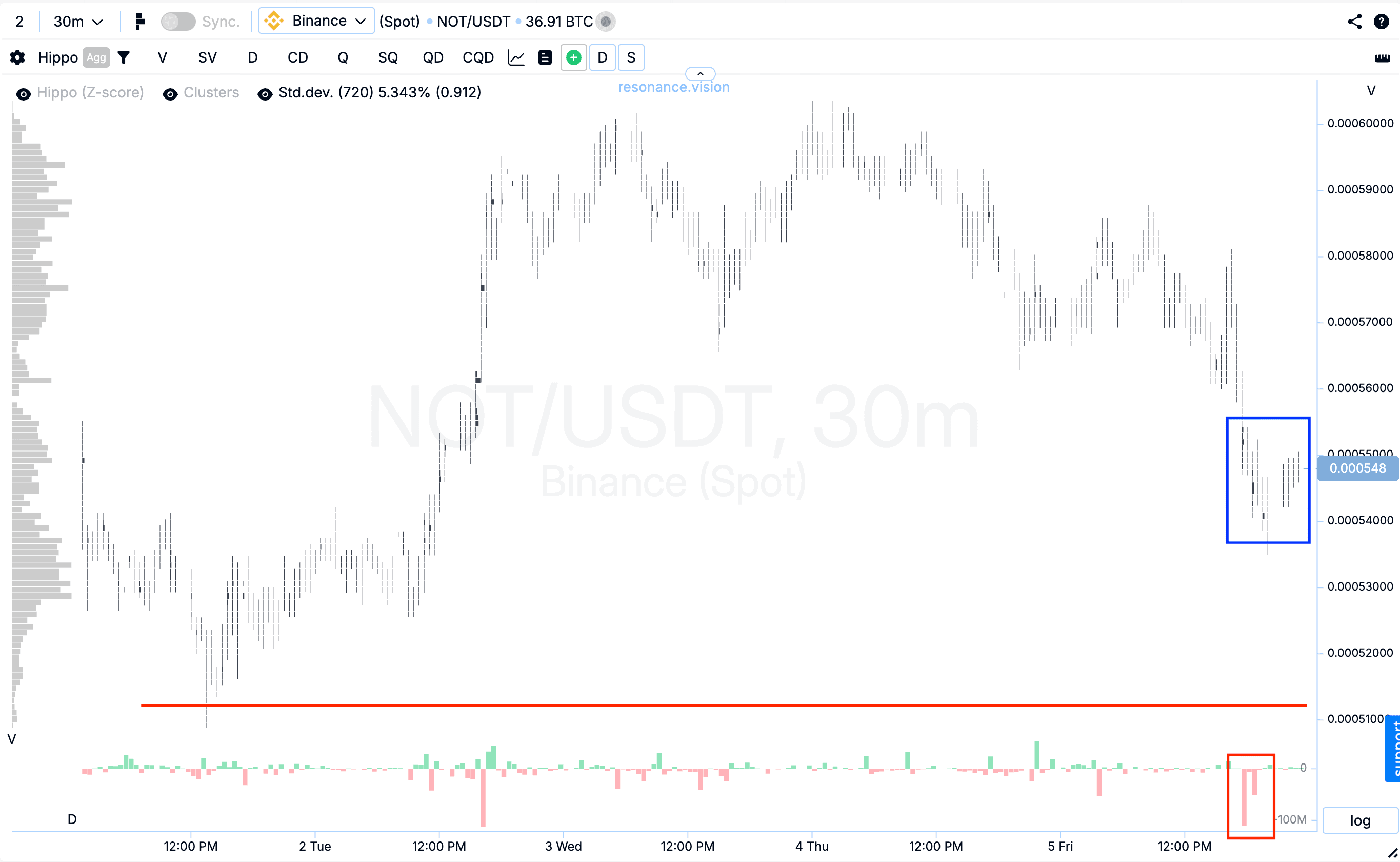

Cluster chart: during the decline, high-volume clusters formed (blue rectangle), inside which an increase in selling volume can be clearly seen (red rectangle). However, despite the pressure, the price failed to update the local low (red line). Such market behavior indicates the formation of a local deficit and a weakening of seller strength — their repeated attempts to push the price lower no longer produce results.

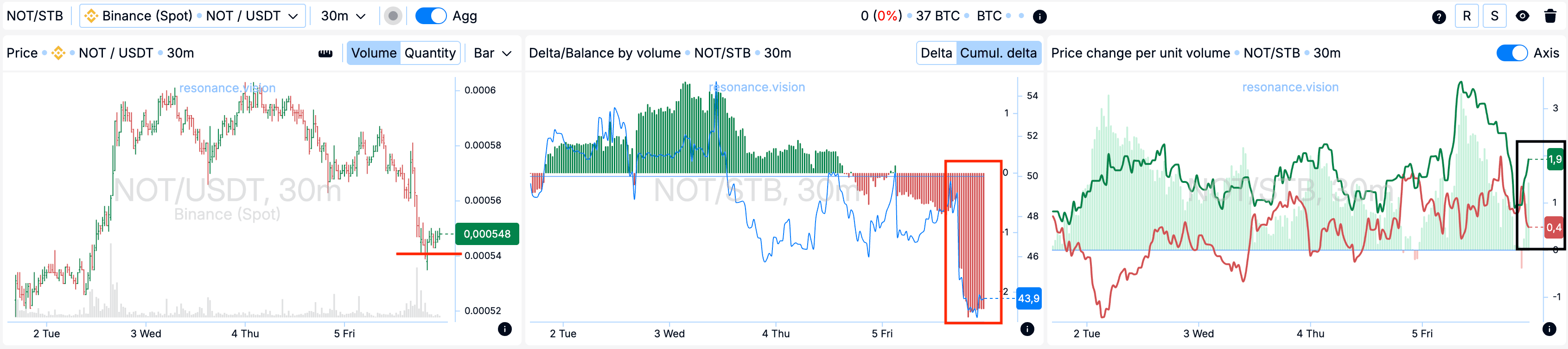

In the Dashboard

Delta / Volume balance: aggregated data across all pairs and exchanges fully confirms the picture shown by the cluster chart. During this period, market sell orders dominated on the extreme bars — this is clearly reflected in the cumulative delta histogram (red rectangle). However, despite the increasing pressure, the price was not falling. This indicates that limit buyers were locally ready to absorb all outgoing market volume, forming local support and showing weakening of sellers.

Price change per unit of volume: the effectiveness of market orders began shifting in favor of buyers (black rectangle). This means that even with comparable trading volumes, buyers started exerting more influence on the price than sellers. Such a shift in efficiency serves as an additional argument in favor of opening a long position.

Reasons for exit

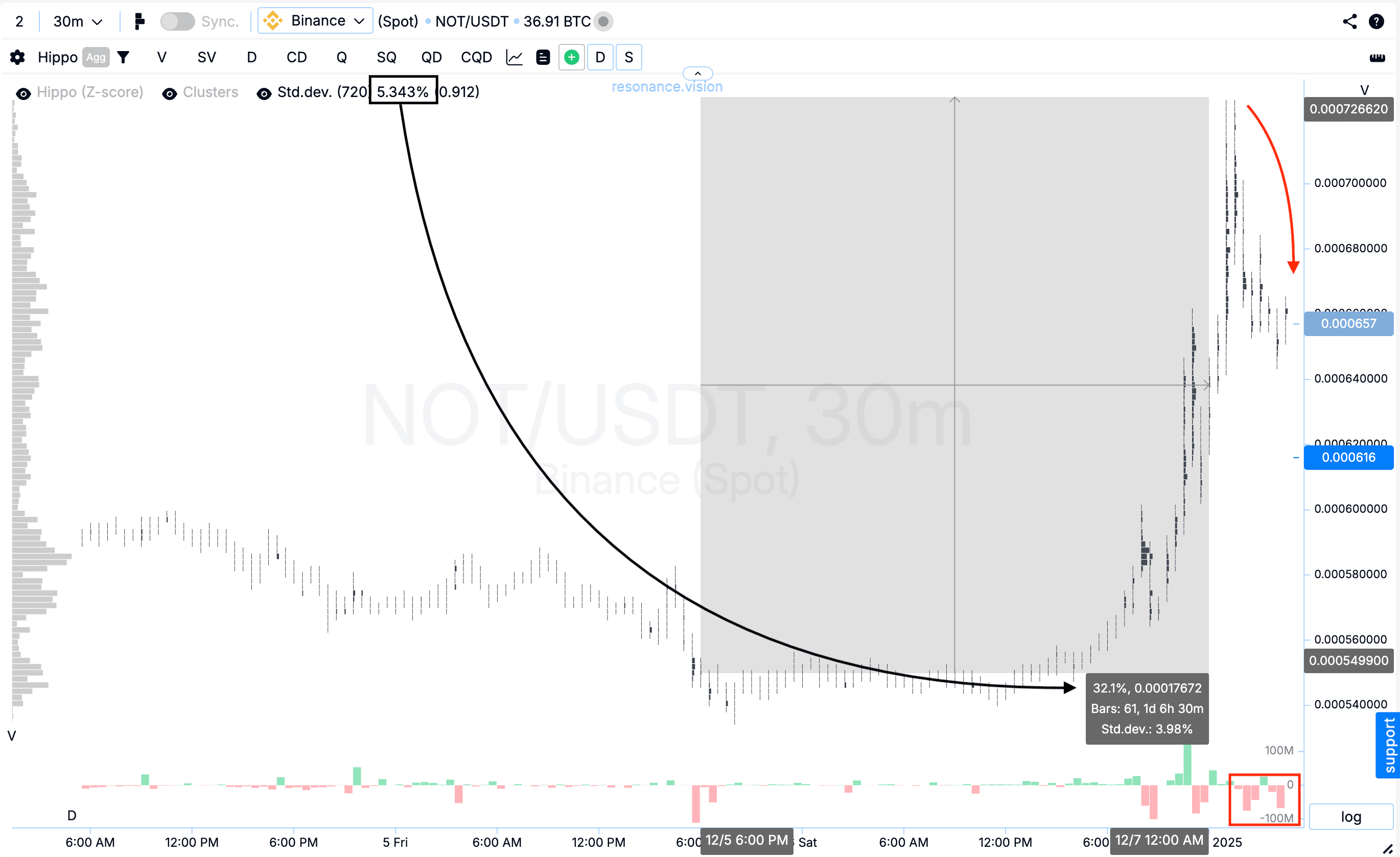

Cluster chart: after the entry point, the price grew by more than 30%, which corresponds to over six standard movements (black rectangle and arrow). In this zone, volatility noticeably increased, and market sells began to dominate, after which the price transitioned into a smooth decline (red rectangle and arrow). Such structure often indicates that the market is entering a balance-searching phase, where prolonged downward movement may follow. Under these conditions, holding the position further carries increased risk, so taking profit was the most rational and calm decision.

Conclusion

During the decline, it was possible to notice signs of a local deficit in time: sellers were increasing pressure, but the price no longer reacted, which indicates weakening of their initiative. Confirmation from aggregated data and a shift in volume efficiency in favor of buyers added arguments for a long position.

The growth after the entry confirmed the idea — the movement turned out to be significant, exceeding six standard deviations. But as soon as the market began moving into a balance-searching phase — volatility increased, buying lost effectiveness, and selling started to smoothly push the price down — it became clear that risks were beginning to outweigh potential profit.

Fixing the position in such a phase is about discipline. The trade was closed properly, at the moment when the main impulse was taken and there was no point in sitting through unnecessary drawdown.

A great example of how combining the cluster chart, aggregated data, and volume efficiency analysis helps not only identify the entry point but also exit on time, preserving the result.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.