OG +392.24% (Directional Strategy Resonance)

The OG/USDT coin demonstrated a great example of how combining cluster analysis and limit order data can help identify the moment of a shift in the balance of power. Despite active selling, the price was held up by limit buyers, signaling a local shortage. Subsequent growth confirmed this idea, and the appearance of density from above signaled profit-taking.

Table of content

Coin: OG/USDT

Risk: Low

Experience Level: Beginner

Entry Reasons

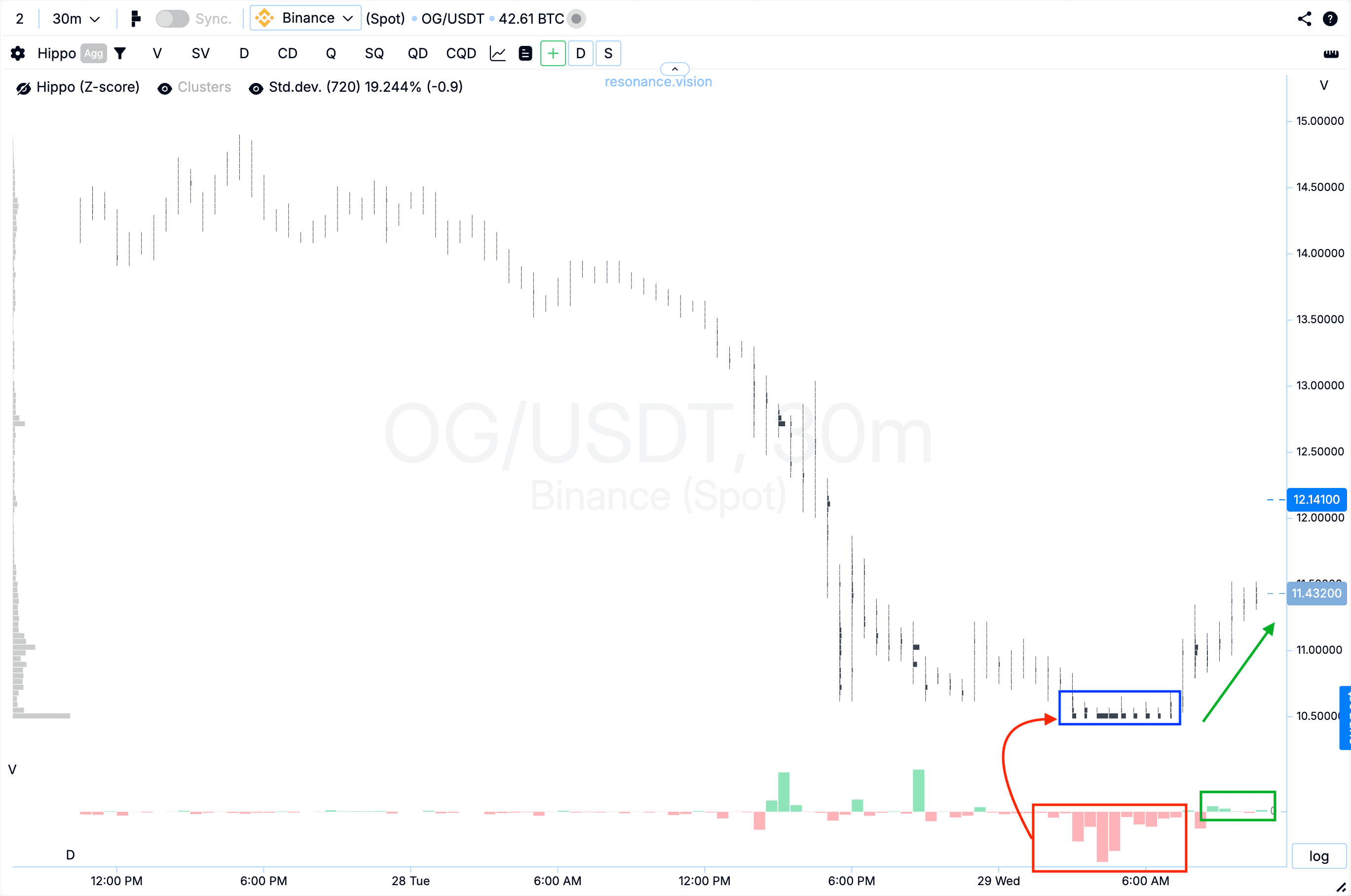

Cluster Chart: Volume clusters began to form (blue rectangle). At that moment, sell volumes were significantly dominant, yet the price was no longer falling (red rectangle with arrow), indicating weakening selling pressure. Later, with relatively small buy volumes (green rectangle and arrow), the price started to rise — confirming a local shift in balance toward buyers.

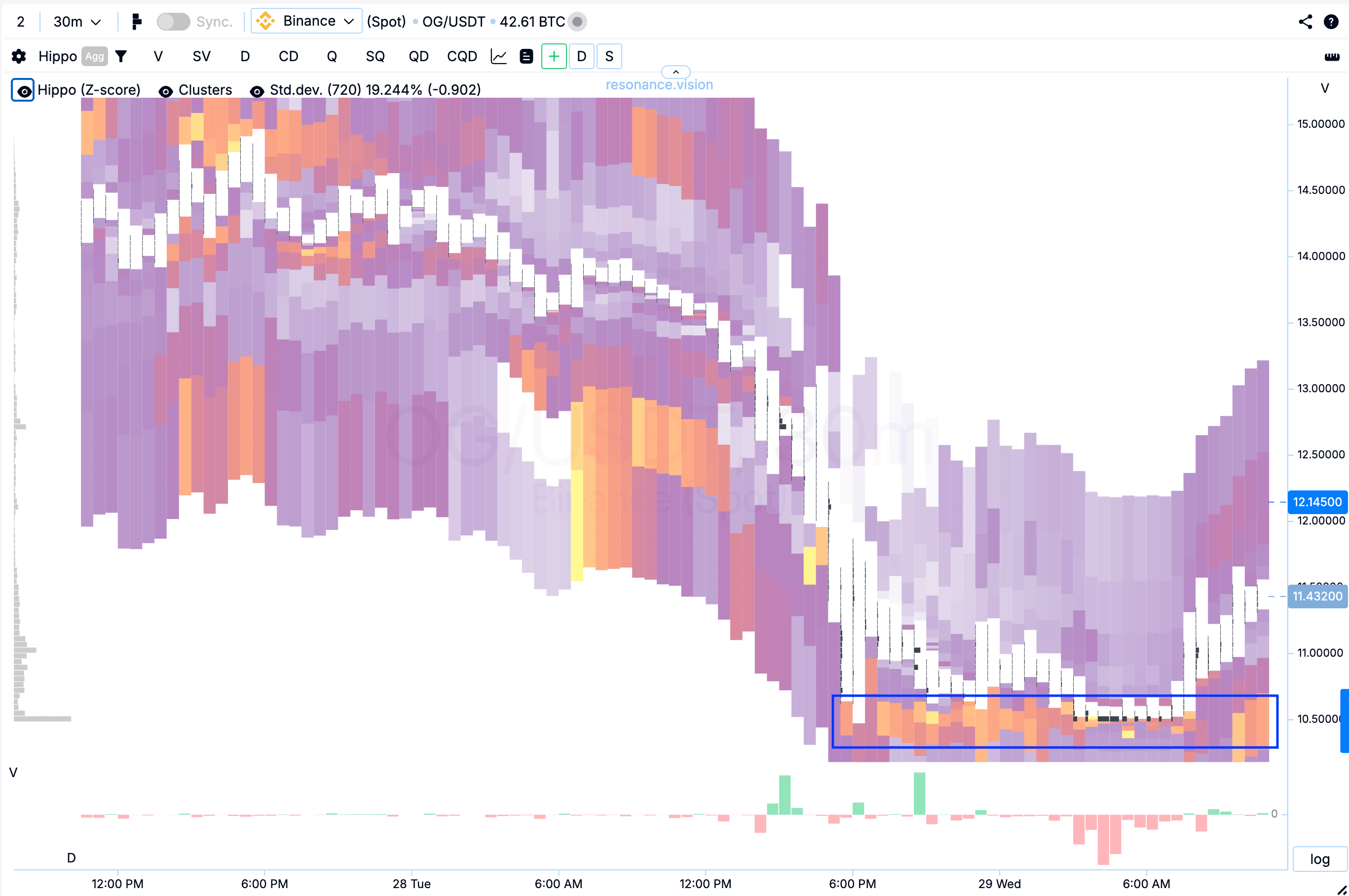

Heatmap (Z-Score): A clear accumulation of limit buy orders (blue rectangle) absorbed all the market sell volume. This reaction indicates local supply shortage and participants’ willingness to buy market sells with limit orders — confirming price support.

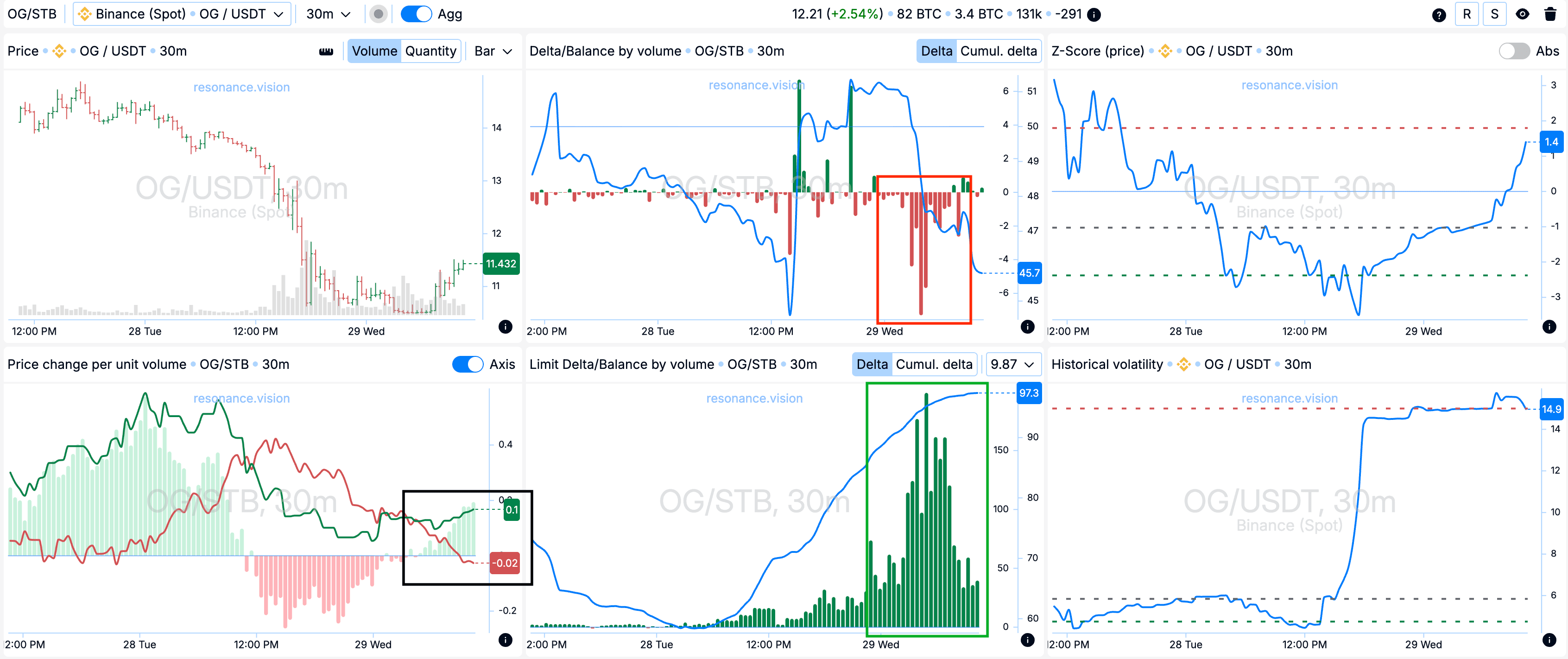

Dashboard

Delta / Volume Balance and Limit Delta: Aggregated data across all pairs and exchanges confirm what’s seen on the cluster chart. At that moment, market sells were dominant (red rectangle), while limit buy orders increased significantly (green rectangle). These limit orders effectively absorbed the entire market sell flow, signaling support from limit buyers and a local shortage of supply.

Price Change per Volume Unit: The efficiency of market orders’ impact on price also began to shift in favor of buyers (black rectangle).

Exit Reasons

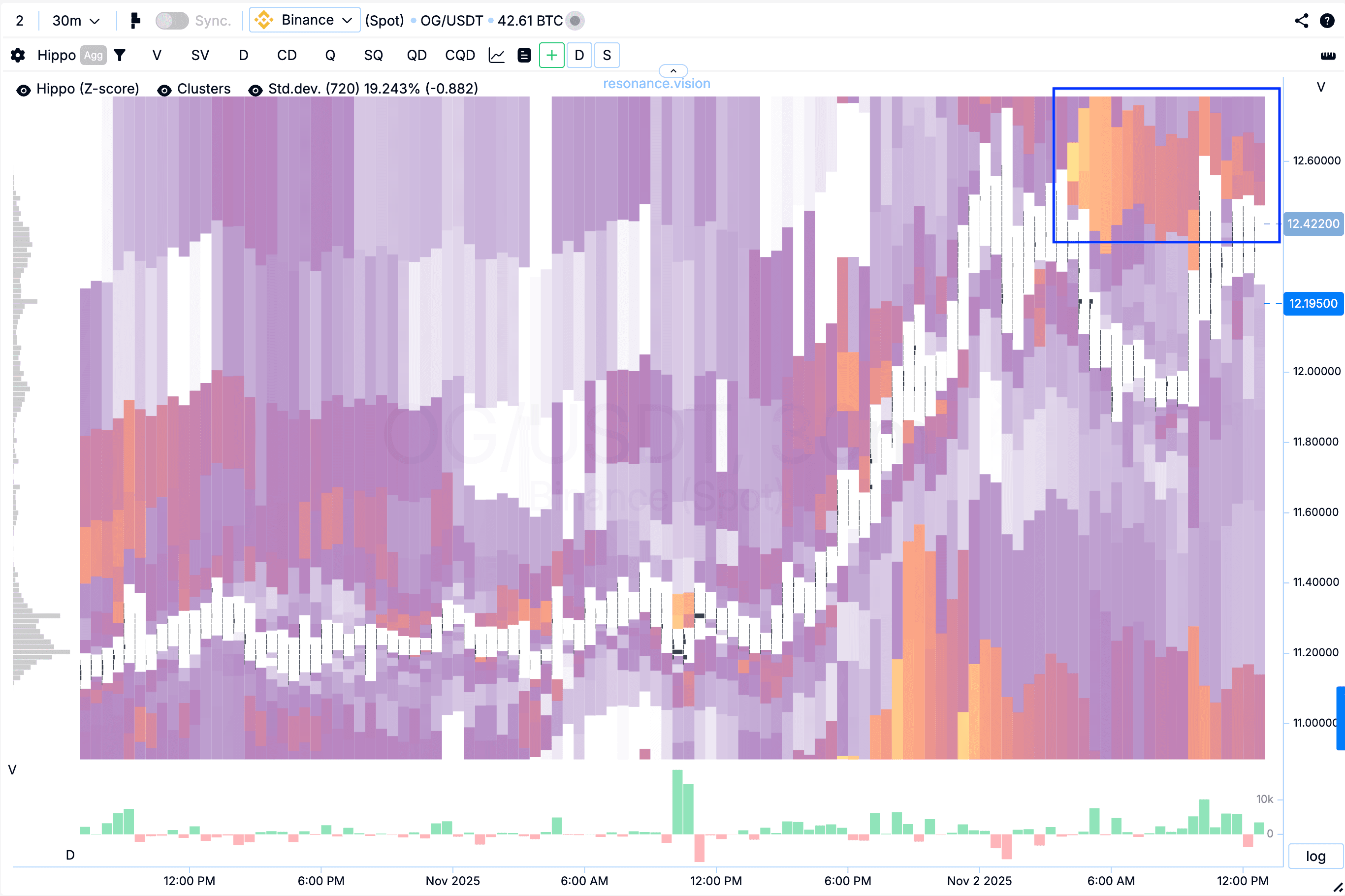

Heatmap (Z-Score): In the upper part, abnormal limit sell densities appeared (blue rectangle), which market buys began to partially hit. This dynamic indicates emerging resistance from sellers. In such conditions, locking in profits instead of being greedy is a rational choice, as these dense zones often become triggers for subsequent price corrections.

Result

A profit of +392.24% was secured.

Conclusion

The entry was justified by the combination of local supply shortage signals and active limit buying, confirmed by both cluster and aggregated data. Additional confirmation came from the shift in market order efficiency toward buyers, reinforcing the probability of continued upward movement.

The subsequent price growth confirmed the analysis. After abnormal limit sell densities appeared, the price started meeting resistance from sell-side liquidity, making profit-taking the most rational decision. The key takeaway — always respect risk management: discipline and systematic profit-locking consistently yield positive results over time.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.