OG +62.3% (Resonance Directional Strategy)

OG/USDT 📊 Dominant market selling without breaking the low and signs of local shortage. Confirmation via delta and Z-Score. Impulse movement +60% and profit-taking on rising volatility.

Table of content

Asset: OG/USDT

Risk: medium

Level of understanding: beginner

Entry reasons

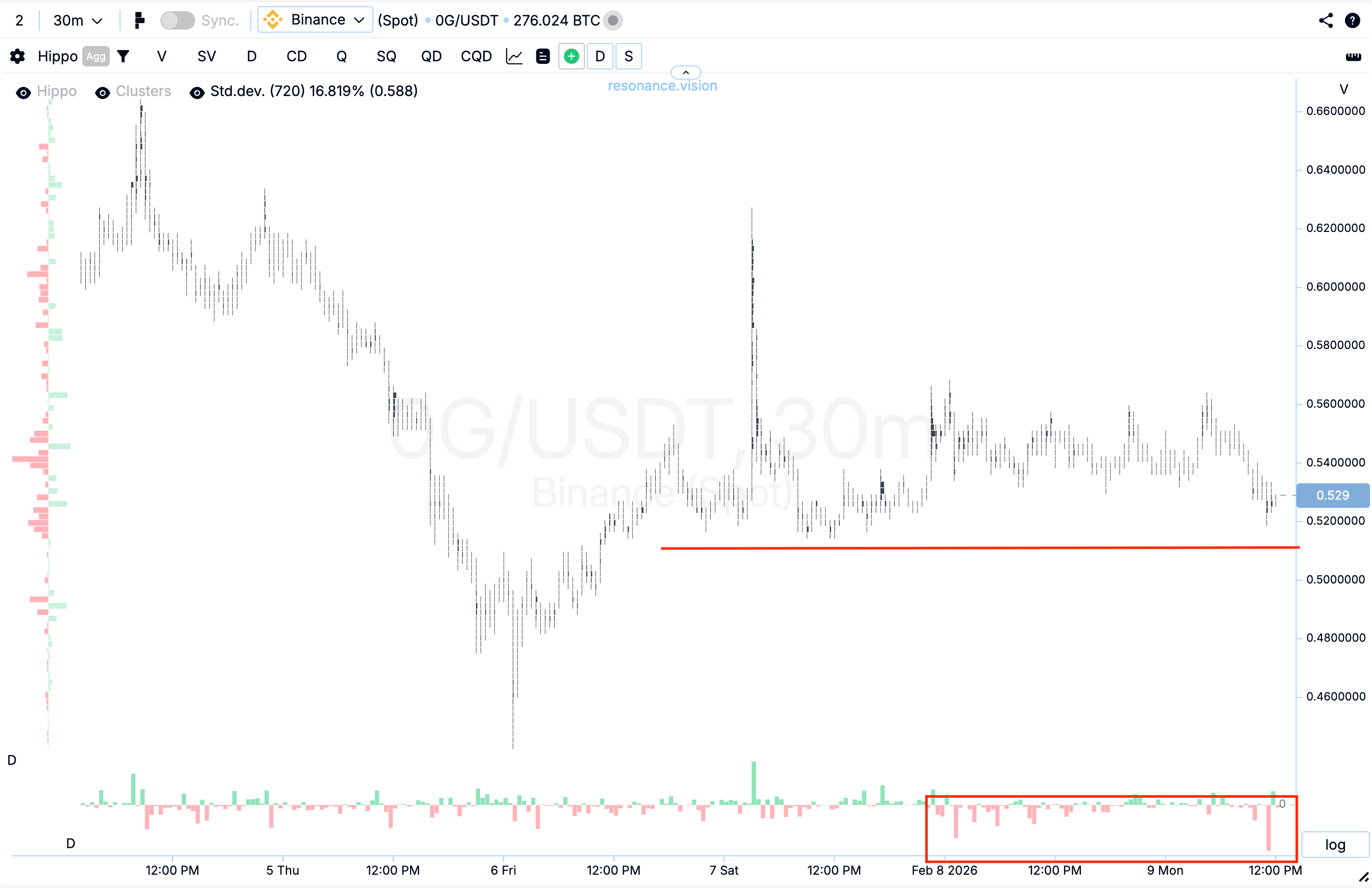

Cluster chart: in a local sideways phase, pronounced pressure from market sell orders was observed — this is clearly visible on the delta histogram (red rectangle).

However, despite the increasing pressure, the price stopped updating the local minimum (red line). This means that sellers continue to expend volume, but their impact on price becomes ineffective.

Such a reaction indicates signs of a local deficit: the market stops declining even under the dominance of selling, which often becomes a trigger for a possible shift in initiative.

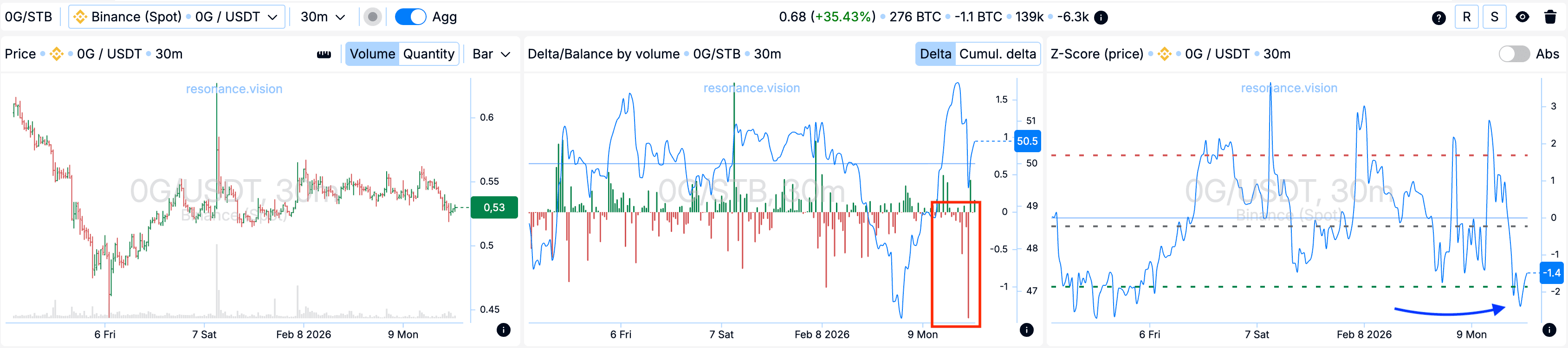

In the Dashboard

Delta / Volume balance: aggregated data across all pairs and exchanges confirms the picture from the cluster chart. During the analyzed period, market sell volumes increased significantly and exceeded the values of the entire previously visible range (red rectangle on the delta histogram).

At the same time, the price did not demonstrate a corresponding downward movement. This indicates the activity of limit buyers who absorb incoming market sell volume. Such a structure forms local support and further confirms the weakening of pressure from sellers.

Z-Score (price): additionally, at the low a price deviation of more than 2 standard deviations to the downside was recorded (blue arrow). Such statistically anomalous values are often accompanied by a halt in movement or the formation of a local reversal, which strengthens the validity of the entry point.

Exit reasons

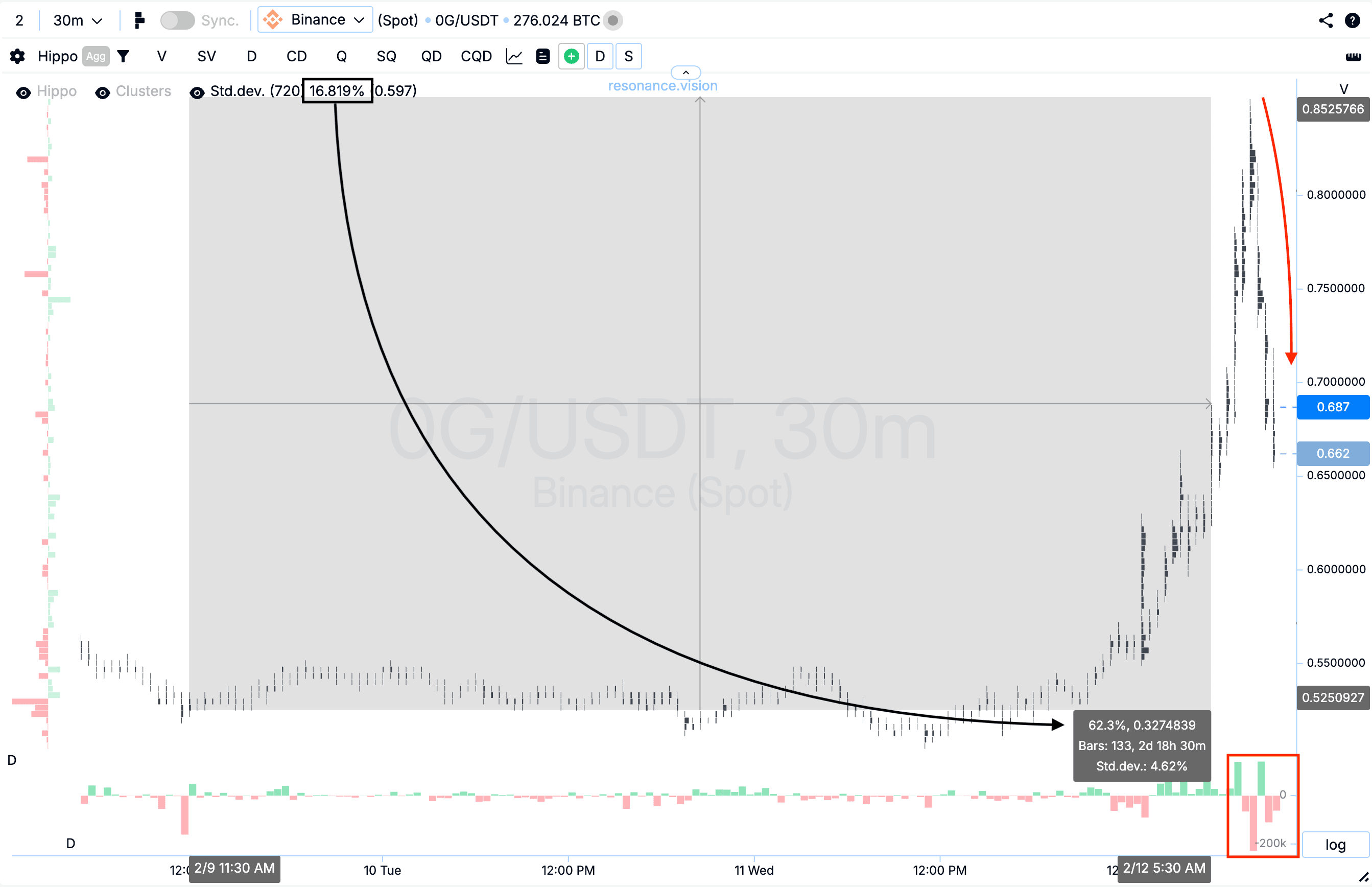

Cluster chart: after the entry point, the price increased by more than 60%, which corresponds to approximately four standard movements (black rectangle and arrow).

Within this range, volatility increased noticeably, after which a pullback formed and buying activity gradually began to give way to sellers.

Under conditions of elevated volatility and signs of weakening buyers, further position holding would have been accompanied by increased risk. Therefore, taking profit in this zone appeared to be the most logical and balanced decision from a position management perspective.

Conclusion

This OG/USDT analysis shows that it is not the mere fact of volume dominance that matters, but the price reaction to it. Despite significant pressure from market sell orders, the price stopped updating lows, indicating a decrease in seller effectiveness and the formation of a local deficit.

Additional confirmation through aggregated data and statistical deviation (Z-Score) strengthened the justification for entry. The exit was executed after a strong impulsive move and an increase in volatility, when the structure began shifting toward higher risk.

It is precisely the combination of volume, price reaction, and statistics that allows for identifying high-quality opportunities even at a basic level of market understanding.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.