OGN +35.3% (Directional Strategy Resonance)

OGN/USDT deal breakdown: how to recognize a local deficit on a cluster chart and take profits in time. In this deal, we managed to take over 35% of the movement, avoiding risks amid rising volatility and volume sales.

Table of content

Coin: OGN/USDT

Risk: Low

Skill level: Beginner

Entry reasons

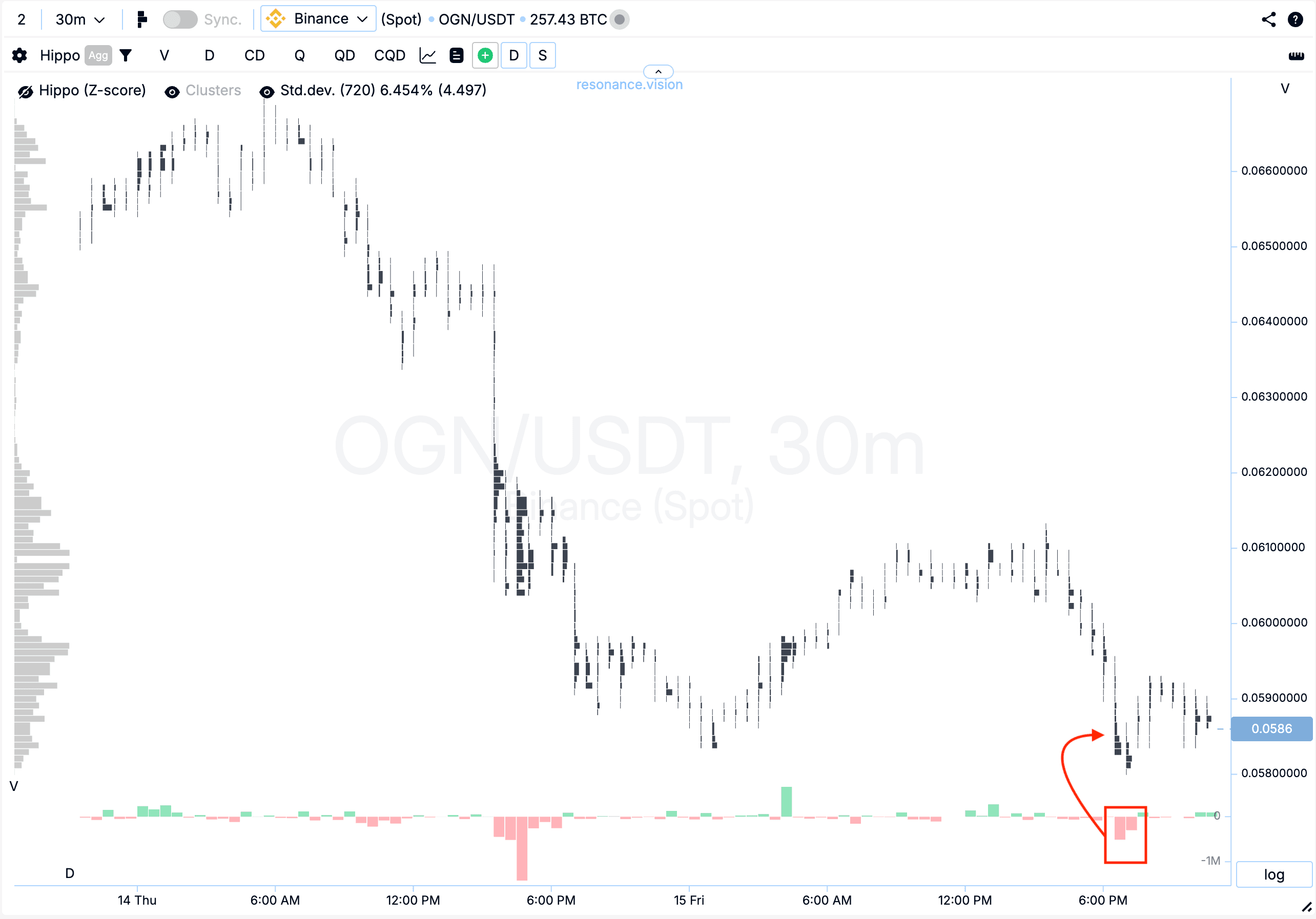

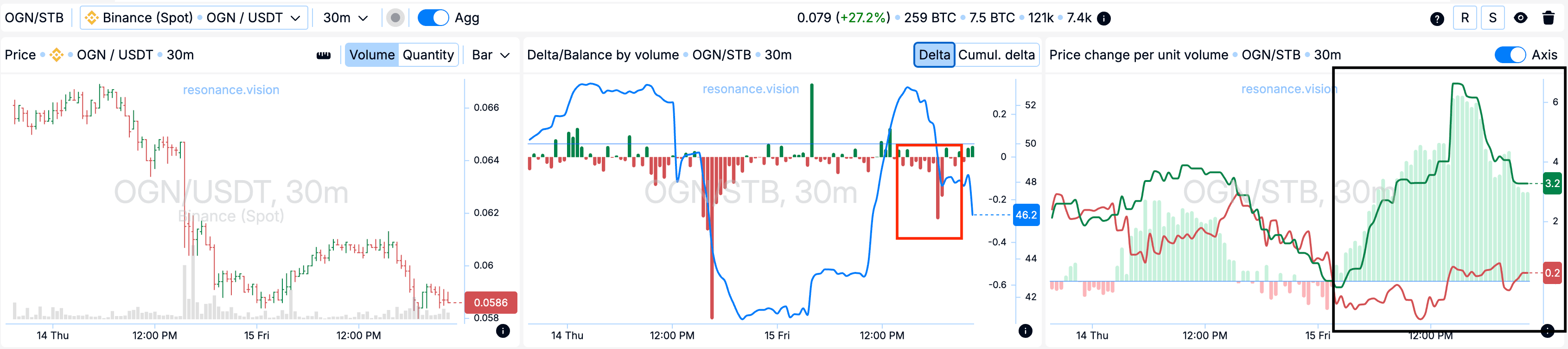

Cluster chart: A W-shaped formation appeared, where during repeated heavy selling (red rectangle and arrow) the price barely updated the local low. This may indicate the formation of a local shortage and weakening selling pressure.

In the Dashboard

Delta / Volume balance: Aggregated data at that moment also showed a clear dominance of market selling — clearly visible in the delta histogram (red rectangle).

Price per unit of volume: Despite selling pressure, the efficiency of market orders remained in favor of buyers — visually noticeable on the chart (black rectangle).

Exit reasons

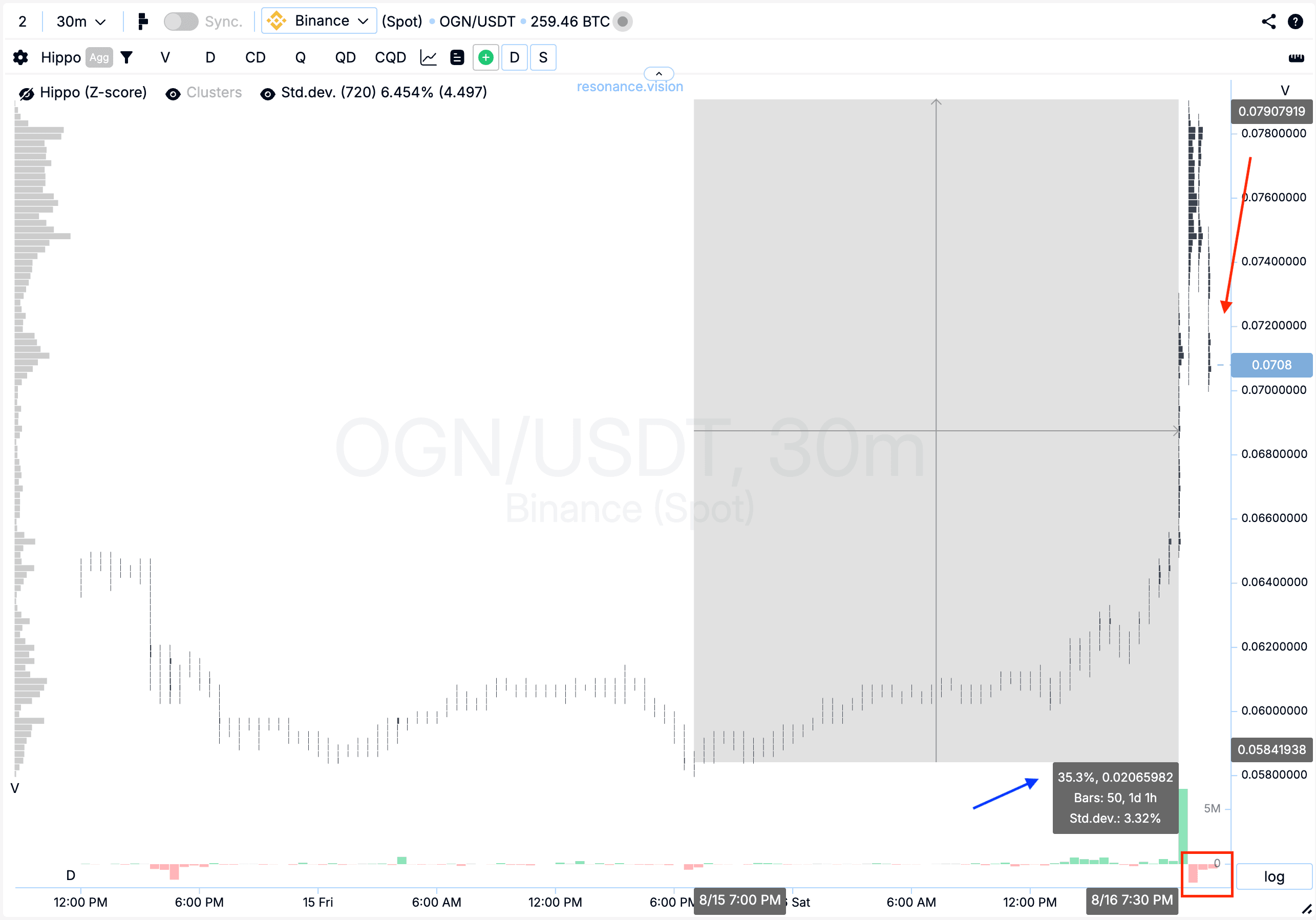

Cluster chart: From the entry point, the price moved up more than 35%, while volatility increased sharply — clearly seen in the outer cluster bars.

However, subsequent heavy market sales triggered a significant pullback (red rectangle and arrow), which raised the risk of further holding the position.

Conclusion

The OGN/USDT trade turned out to be successful: the entry was confirmed by signs of a local shortage and weakening of sellers’ initiative. Despite rising volatility with the appearance of heavy market selling, the position was closed on time, avoiding excessive risks. For beginners, this example clearly shows how important it is not only to find entry points but also to fix profits in time, taking into account increasing market activity.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.