PENGO +31.7% (Resonance Directional Strategy)

We examined the entry point using signs of localized shortages during the decline, and confirmed these using aggregated data. We analyzed the moment sellers lost their effectiveness, the shift in initiative to buyers, and assessed the dynamics. We also examined the exit phase separately—increasing volatility, declining buying effectiveness, and the achievement of abnormal price movement. This is an excellent example of how combining cluster analysis and performance metrics helps make informed decisions in trades.

Table of content

Coin: PENGO/USDT

Risk: Medium

Understanding Level: Beginner

Reasons to Enter

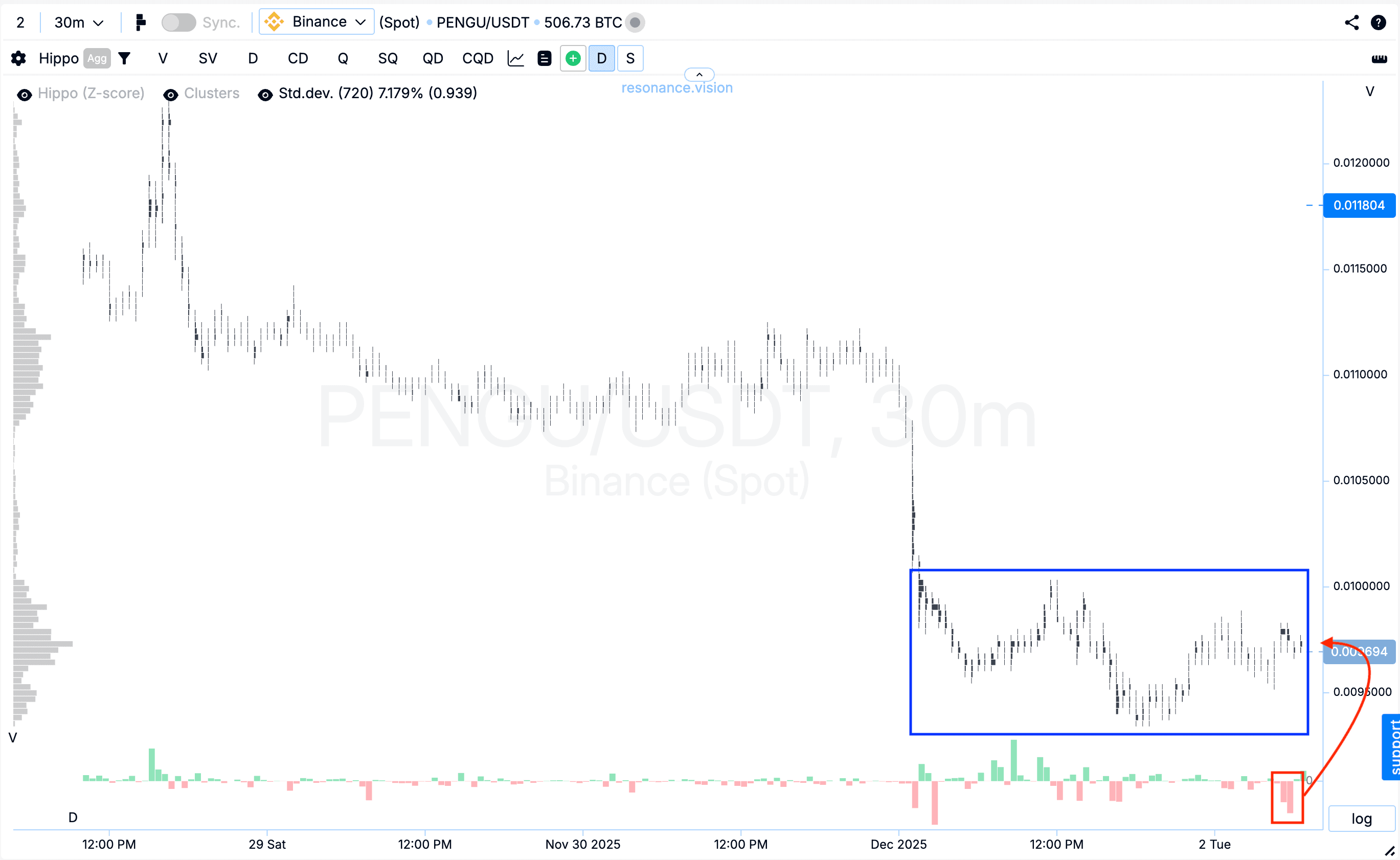

Cluster Chart: During the decline, volume clusters began to form (blue rectangle), within which repeated market selling no longer produced the expected effect and failed to push the price further down (red rectangle and arrow). This dynamic indicates the emergence of a local shortage and a clear weakening of selling pressure.

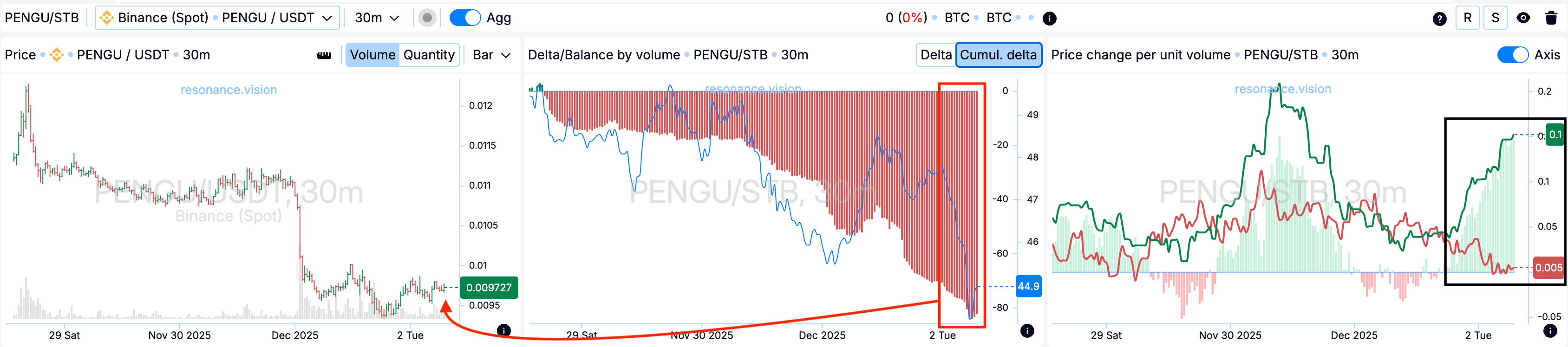

In the Dashboard

Delta / Volume Balance: Aggregated data across all pairs and exchanges shows that market selling volumes increased during this period – this is clearly reflected in the cumulative delta histogram (red rectangle and arrow). However, as selling intensified, the price no longer declined. This market reaction demonstrates the willingness of limit buyers to accept the entire outgoing market volume, which creates local support and confirms the easing of selling pressure.

Price Change per Unit Volume: additionally shows that the effectiveness of market orders has diverged in favor of buyers (black rectangle), indicating an increase in the effectiveness of buying.

Exit Reasons

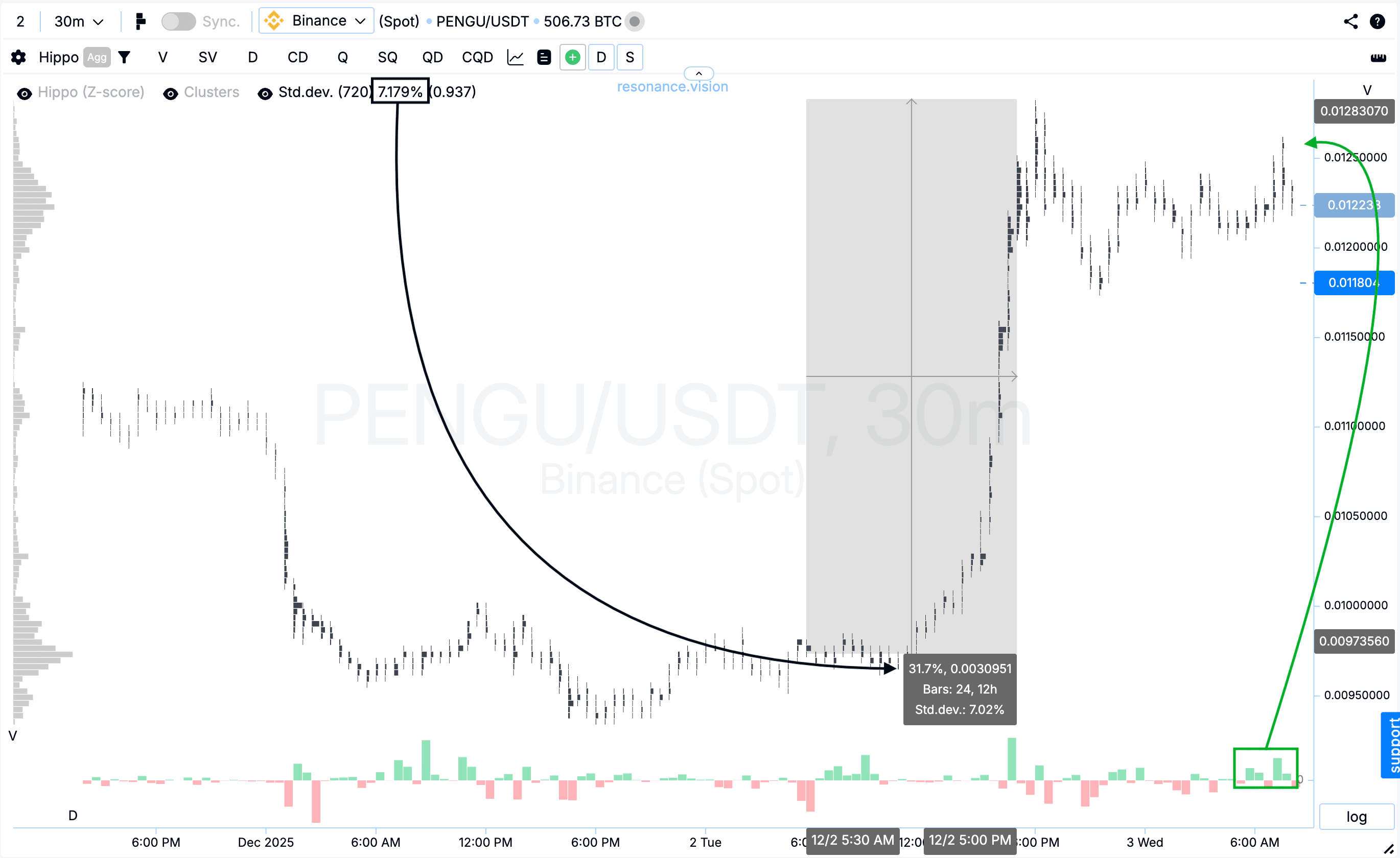

Cluster Chart: After entry, the price rose by another 31.7%, and volatility increased significantly in this price range. Against this backdrop, subsequent market buys ceased to produce results—the price no longer rose (green rectangle and arrow). It’s also worth noting that this move nearly reached 5 standard deviations, while one standard deviation for the asset is 7.179% (black rectangle and arrow). This type of move is considered significant and anomalous. Under these conditions, further holding the position would only have increased the risks, so taking profits was the most prudent and logical decision.

Conclusion

The trade was a good example of how a clever combination of cluster analysis and aggregated data helps enter the market when sellers are weakening and exit when buyers’ effectiveness begins to decline.

During the decline, we noticed a local deficit: repeated market selling stopped putting pressure on the price, which became the key entry signal.

The rally confirmed the correctness of the idea, but as the move progressed, the first signs of buyers’ effectiveness declining began to appear: volatility increased, buying stopped putting pressure on the price, and the move itself became abnormally large compared to standard deviations. At this stage, the risk of a reversal increases significantly.

At that moment, fixation seemed the optimal solution—calm, disciplined work within a system. This approach allows not only to find high-quality entry points but also to consistently maintain results.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.