PHB +15.2% (Resonance Directional Strategy)

PHB/USDT — a trade with an emphasis on sellers’ inefficiency and a change in initiative. Despite the clear predominance of market selling, the price did not go down — and later began to rise even on small purchase volumes. This became the starting point for entering a long. The trade was completed after an increase of more than 15% — almost two standard deviations. A great example of how a weak price reaction to volumes can become a strong signal for a reversal.

Table of content

Coin: PHB/USDT

Risk: Medium

Understanding level: Beginner

Entry reasons

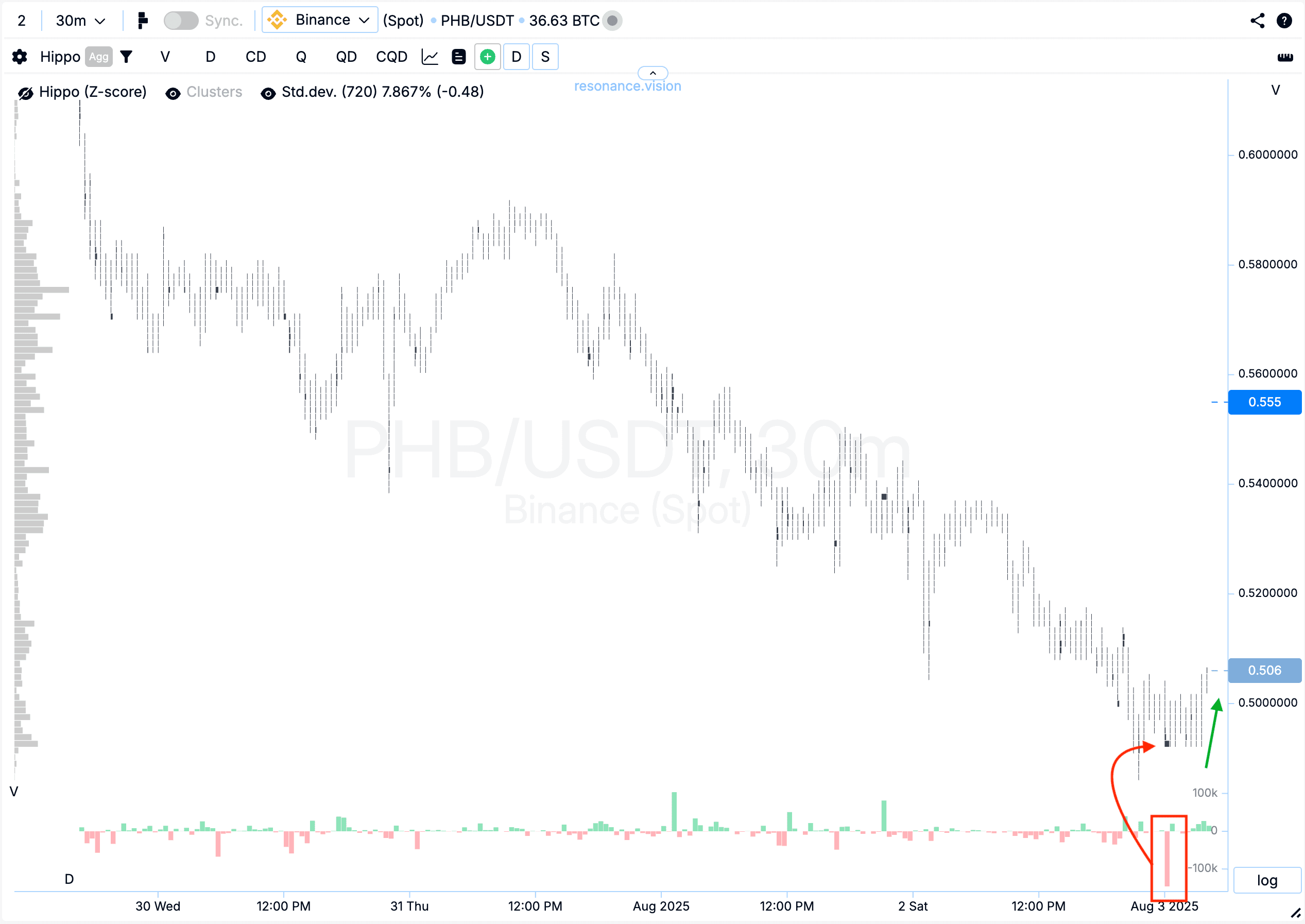

Cluster chart: After the price declined, I paid attention to the delta histogram — there was a noticeable dominance of sell volumes (red rectangle with arrow). However, despite this pressure, the price didn’t continue to fall. Then, with relatively small buy volumes, the price started to rise (green arrow). This may indicate that the initiative has shifted to the buyers.

In the Dashboard

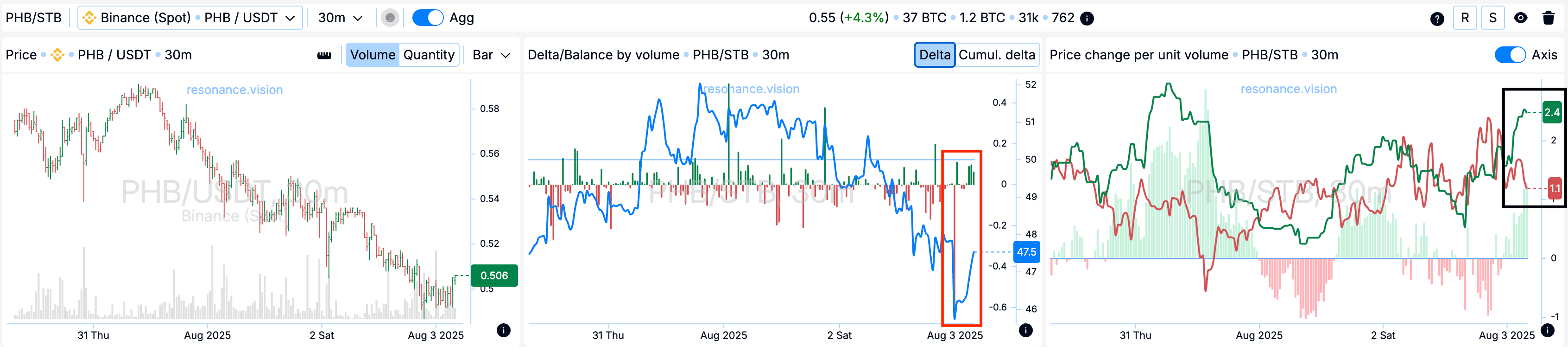

Delta / Volume balance: Aggregated data confirms what was observed on the cluster chart. After a strong dominance of market sells — clearly seen on the delta — buying activity began to appear, and the balance shifted toward buyers (red rectangle).

Price change per unit of volume: The effectiveness of market orders also shifted — the buyers’ impact on price became significantly stronger, which is visible in the divergence in their favor (black rectangle).

Exit reasons

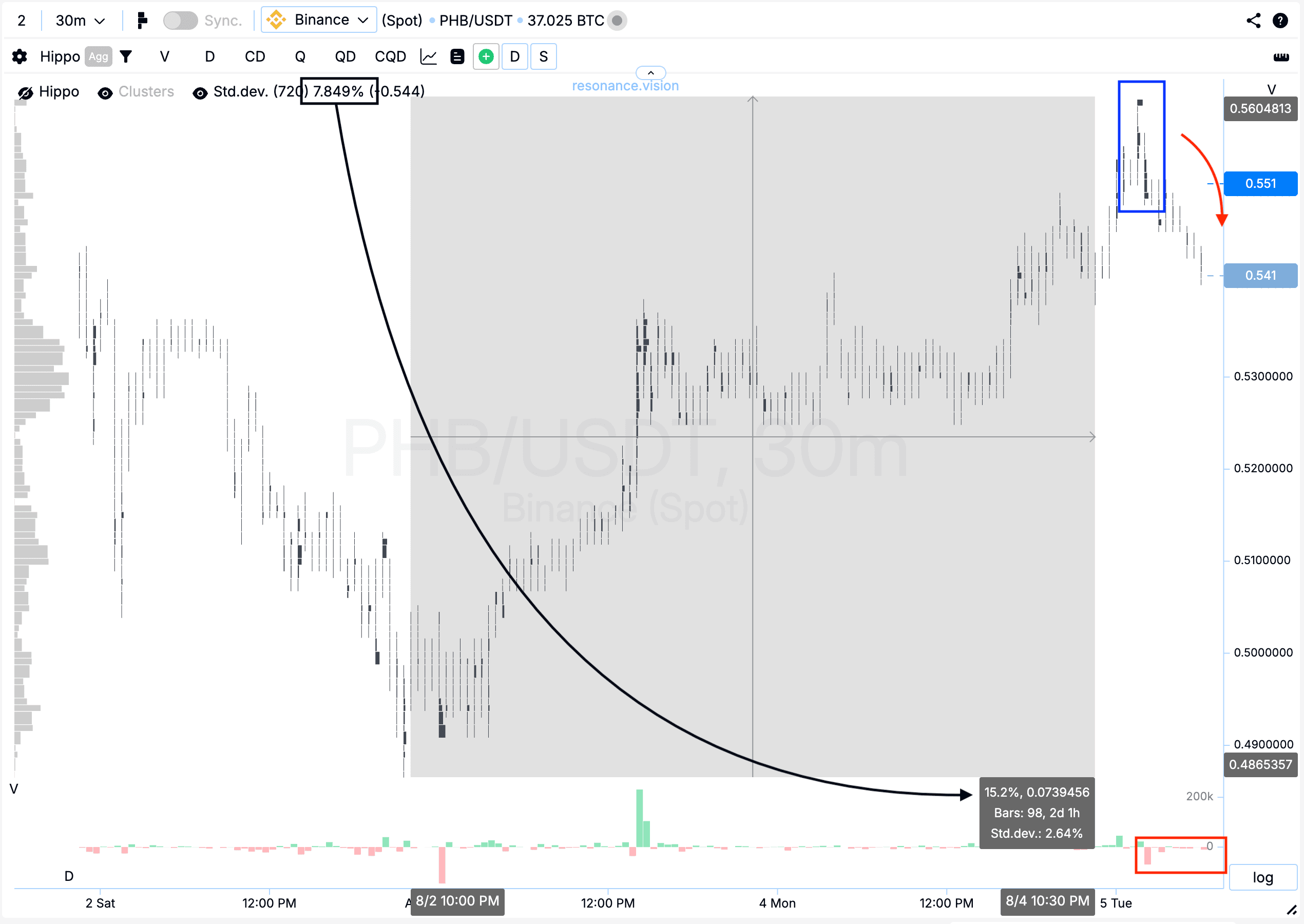

Cluster chart: Volume clusters formed in the upper part (blue rectangle), after which the price began a clear downward move on relatively small market sells (red rectangle and arrow).

Additionally, the price move upward exceeded 15%, which is nearly equal to two standard deviations — for this asset, one standard deviation is 7.849% (black rectangle and arrow).

Conclusion

This PHB trade is a good example of why it’s important to track not only volume dominance but also price reaction to that volume. Despite active market selling, the price held steady — the first signal of seller inefficiency. The trend reversal and price increase on light buying confirmed the hypothesis that buyers took over.

This breakdown clearly shows how combining cluster charts, delta, and an understanding of price behavior helps in making well-grounded decisions at every stage of the trade — from entry to exit.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.