POL +27.2% (Directional Strategy Resonance)

Market sales inefficiency and the formation of local shortages 📊

Confirmation through delta and price per unit volume change. +27% movement and profit-taking with declining buyer efficiency.

Table of content

Asset: POL/USDT

Risk: medium

Level of understanding: beginner

Entry reasons

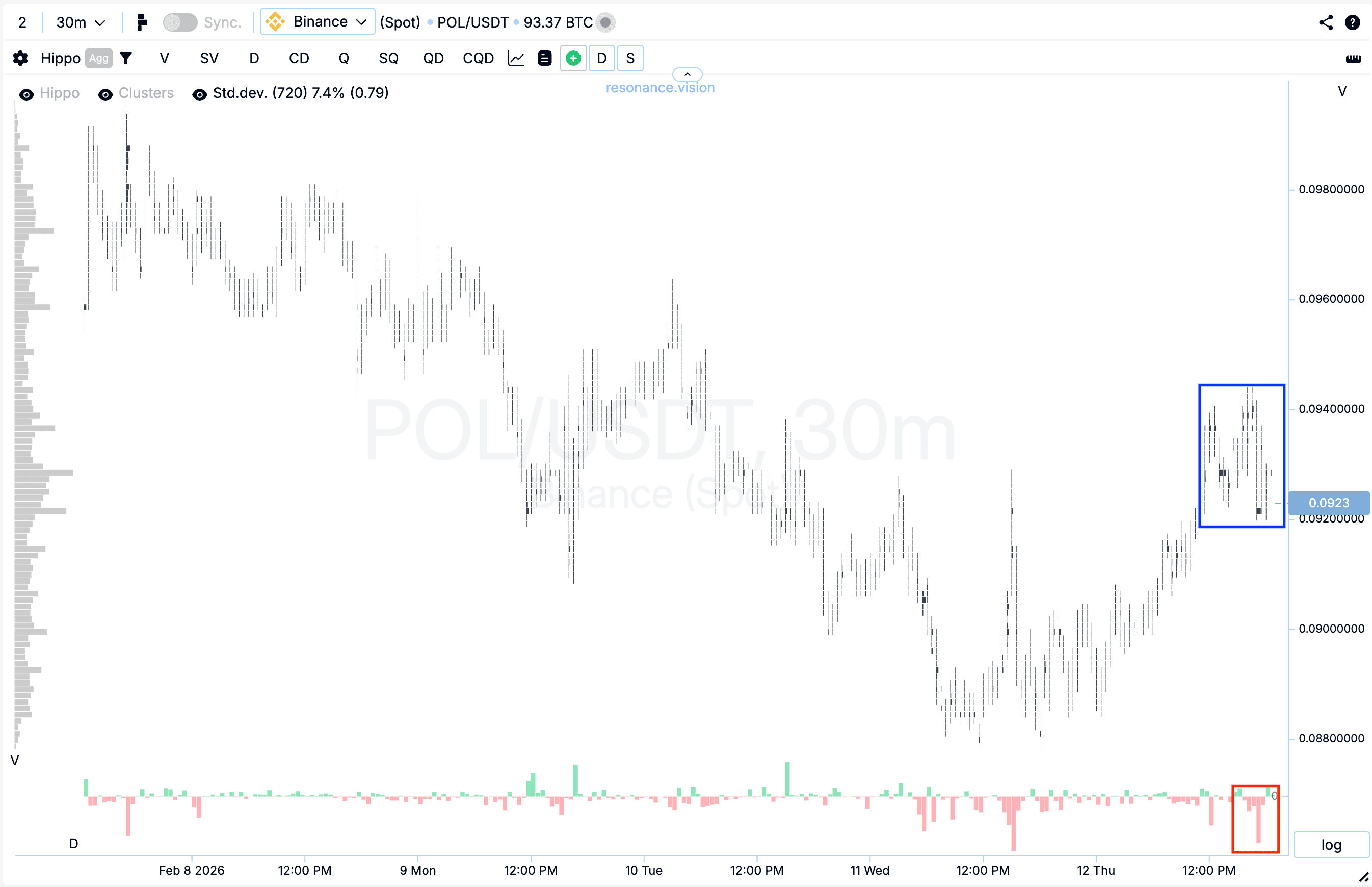

Cluster chart: after the decline, the price began to rise gradually, while significant volumes started to form within the growth range (blue rectangle). Inside these clusters, market sell orders dominated (red rectangle).

However, despite the pronounced pressure from sellers, their effectiveness noticeably decreased — the price stopped reacting with further decline.

Such a reaction indicates the formation of signs of a local deficit and weakening seller initiative. When substantial selling volumes no longer lead to downward price movement, this often becomes an early signal of a possible shift in initiative or a local reversal.

In the Dashboard

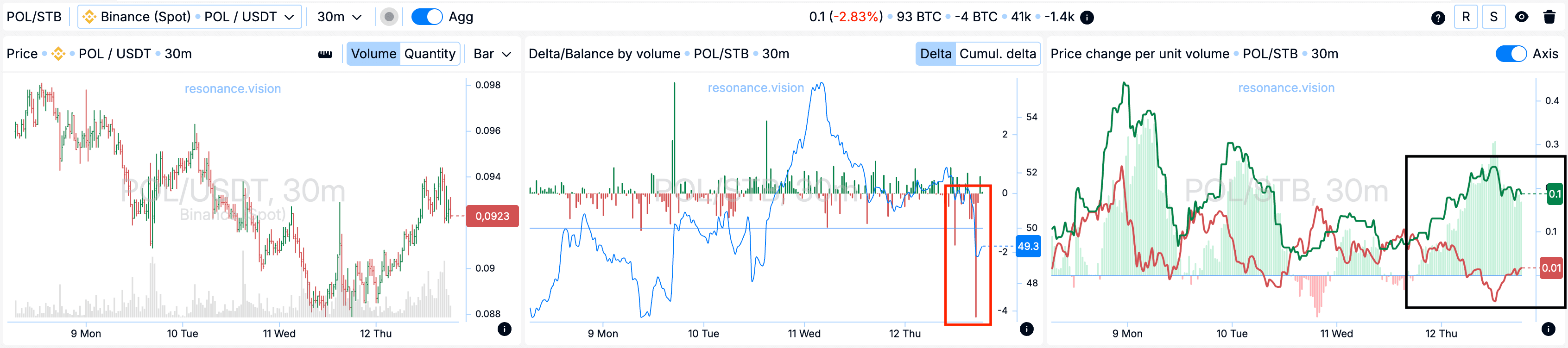

Delta / Volume balance: aggregated data across all pairs and exchanges fully confirms the picture observed on the cluster chart. At the analyzed moment, the market was under pronounced pressure from market sell orders, which is clearly visible on the delta histogram (red rectangle).

At the same time, the price did not demonstrate a corresponding downward reaction. This indicates active absorption of all incoming market volume by limit buy orders. Such a structure forms local support within the current price range.

Price change per unit of volume: additionally, it is visible that the effectiveness of market orders shifted in favor of buyers (black rectangle).

Less volume is required for upward price movement than for downward movement. This confirms the weakening of seller pressure and strengthens the argument in favor of continued upward movement.

Exit reasons

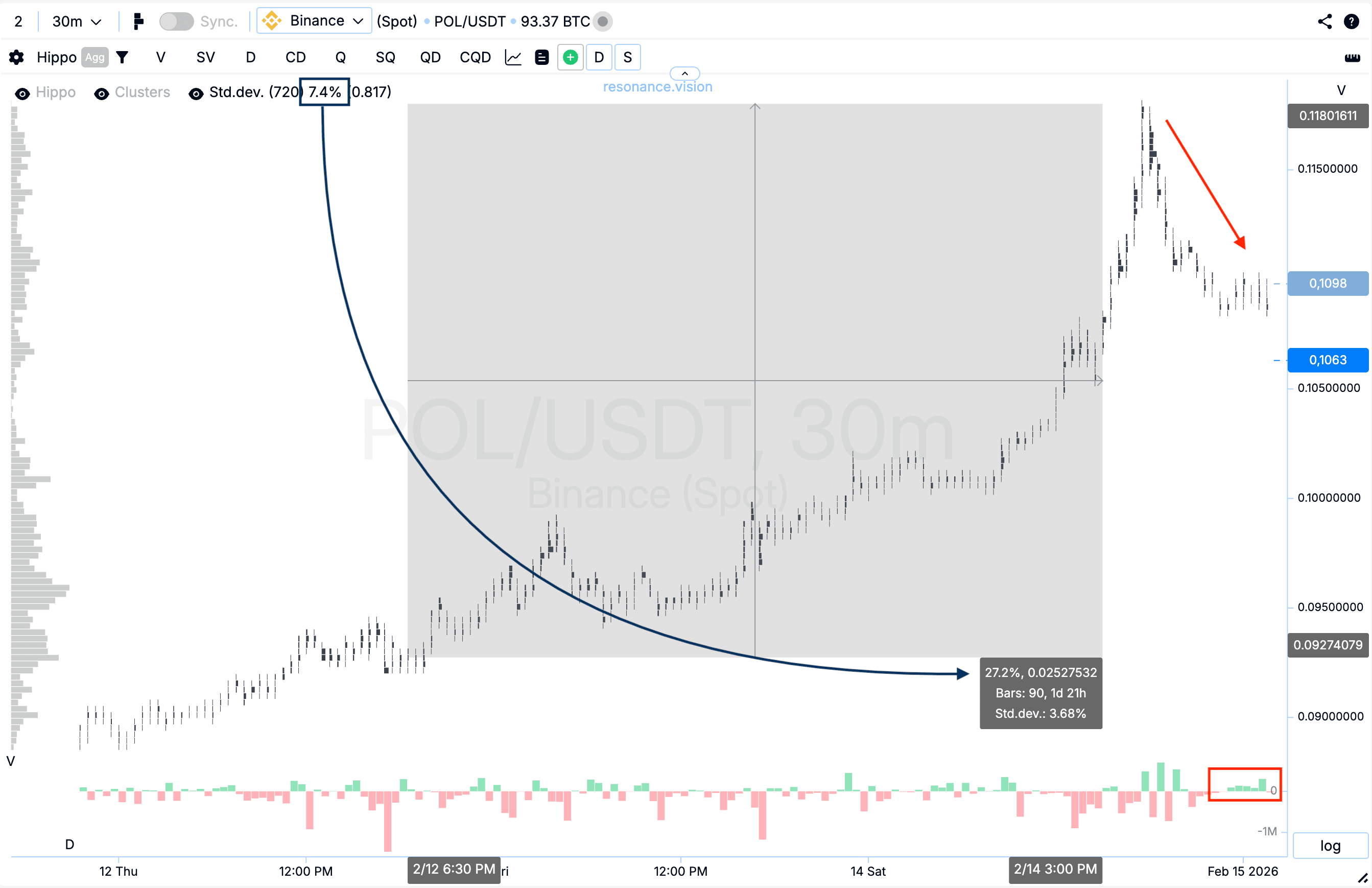

Cluster chart: from the entry point, the price moved approximately another 27%, which corresponds to nearly four standard price movements (black rectangle and arrow).

After that, a significant pullback formed. At the same time, the delta showed dominance of market buys (red rectangle and arrow), however the price no longer demonstrated the previous growth efficiency.

Such dynamics indicate a decrease in buyer effectiveness and an increase in the risk of further position holding, making profit-taking a logical and justified decision.

Conclusion

In this situation, the key factor was not the market sell volume itself, but the price reaction to it. Despite the dominance of selling, clearly visible on the delta histogram, the market stopped declining, indicating reduced seller effectiveness and the formation of signs of a local deficit.

Additional arguments were provided by aggregated data and the price change per unit of volume metric, which allowed for an objective assessment of the shift in initiative toward buyers.

The exit was executed after a statistically significant movement and the appearance of signs of decreasing growth efficiency, as well as the formation of a local surplus. Such an approach allows not only entering impulsive movements, but systematically operating over the long term while managing risk.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.