PYTH +243.97% (Resonance Directional Strategy)

Resonance case: market-sell inefficiency inside a range, confirmation via aggregated metrics, and taking profit after signs of opposing supply appeared.

Table of content

The idea was found inside a sideways range. For day trading, this is one of the most practical scenarios: the seller tries to push the range down, but there is no follow-through, and market-sell pressure stops producing the same result as before. This “inefficiency” often points to limit support and conditions for an upside impulse. Below is a breakdown using the Resonance method: a cluster chart to read how price reacts to volume, and aggregated metrics (delta/balance, order-impact efficiency) to confirm that the buyer is truly holding the range.

Entry reasons

Cluster chart

My attention was drawn to the buyer’s reaction while the asset was moving sideways. The downside breakout attempt failed: price was held and pushed back into the range (blue rectangle). Then market-sell pressure appeared again, but price did not react with a drop (red rectangle). This indicated buyer interest in the price range and a willingness to absorb selling, which increases the probability of an upside move.

The stop-loss was placed beyond the selling-holding area: if price returns below this zone, the range-holding logic will be broken.

Dashboard: aggregated metrics

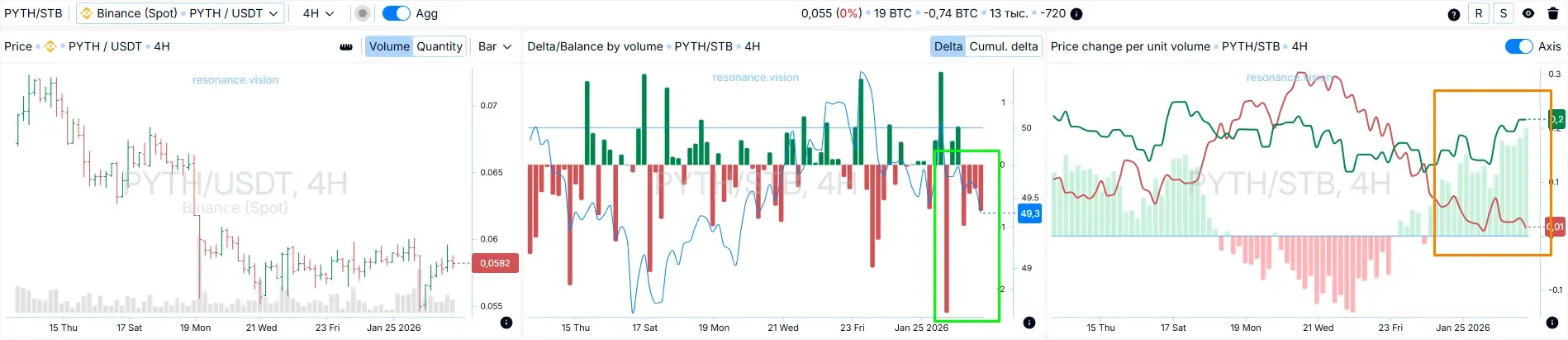

Delta / volume balance:

Large sells went through, but price stayed in the range (green rectangle). Aggregated data confirms buyers’ intent to hold price and maintain the range.

Price change per unit of volume:

The efficiency of market-order impact shifted in favor of buyers (orange rectangle). This means buying became more effective: price reacts to buying better than to selling.

Exit reasons

Cluster chart: opposing supply appears

To examine participant behavior in more detail, we switched to the 1-hour timeframe. Dense volume forming at the top of the move often points to growing opposing supply and increases the probability of a stall or pullback. Under these conditions, taking profit was a logical decision.

Result

We managed to lock in 20% of clean movement.

Trade conclusion

Volume analysis through assessing volume’s impact on price provides an edge in trading: the seller failed to push the range lower, while the buyer held price and absorbed supply. After the impulse played out and signs of opposing supply appeared, the probability of continuation decreased — which became the basis for locking in the result.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.