PYTH +32.6% (Resonance Directional Strategy)

An example of how competent analysis of volumes and price reaction can help identify a shift in the balance between buyers and sellers. Despite active selling, the price held and rose by more than 30%, confirming the effectiveness of supply and demand analysis. An excellent case study for understanding why it’s important to monitor not only volumes but also how the market reacts to them.

Table of content

Pair: PYTH/USDT

Risk: Low

Skill Level: Beginner

Entry Reasons

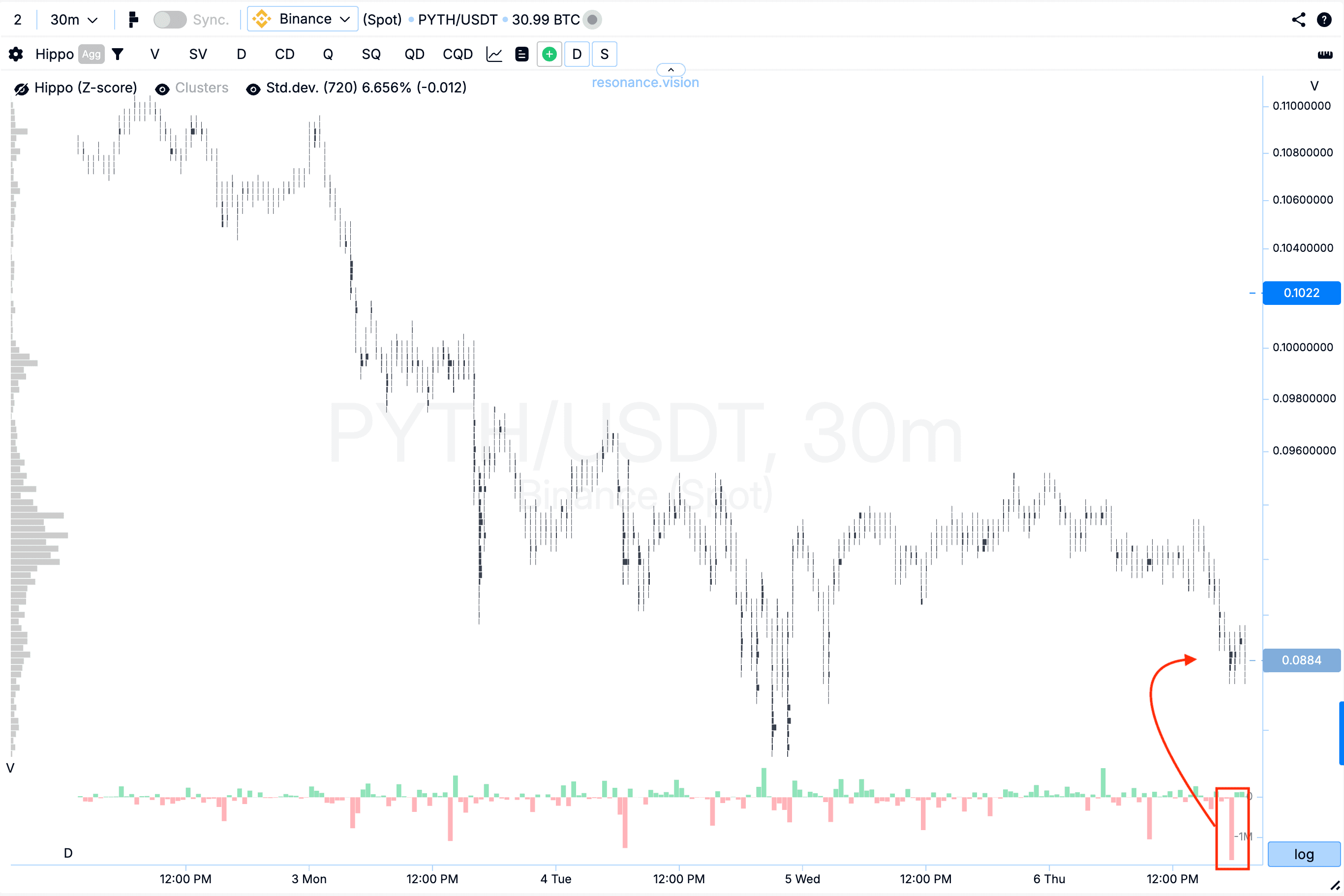

Cluster Chart: During the decline, a W-shaped formation developed, where significant selling volumes appeared during the second downward move. However, these volumes failed to push the price to new local lows (red rectangle and arrow). This dynamic indicates signs of a local shortage and weakening selling pressure.

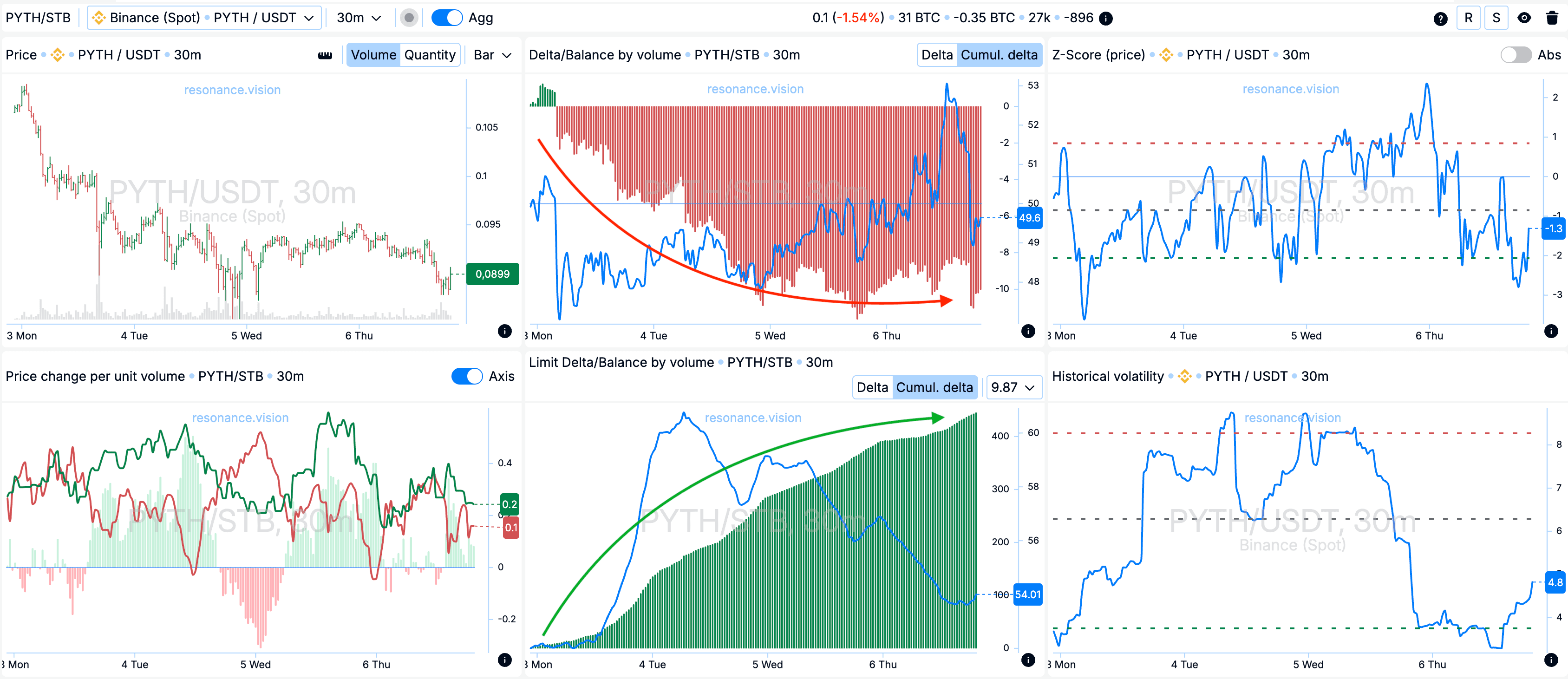

In the Dashboard

Delta / Volume Balance and Limit Delta: When analyzing aggregated data across all pairs and exchanges, the same pattern noted on the cluster chart is confirmed. During this period, selling volumes dominated the market — clearly visible on the cumulative delta histogram (red arrow). At the same time, there was a noticeable increase in buy limit orders, reflected on the cumulative delta histogram (green arrow). This indicates that participants were willing to absorb all market sell volume through limit bids, forming local support.

Exit Reasons

Cluster Chart: From the entry point, the price rose another 32.6%, after which a pullback formed — subsequent buying attempts became ineffective as the price stopped rising (green rectangle and arrow). Additionally, the price movement reached nearly 5 standard deviations, while for this asset, one standard move equals 6.656% (black rectangle and arrow). Such a move can be considered substantial and abnormal. Under these conditions, holding the position further would carry increased risk, making profit-taking the most rational decision.

Conclusion

This analysis clearly shows how crucial it is to understand the interaction between supply and demand. Despite active selling, the price failed to set a new low, signaling a local shortage and the willingness of participants to absorb all market sell volume via limit orders. This allowed identifying a shift in balance and entering the position at a moment of minimal risk.

A growth of over 30% and the occurrence of an abnormal price move confirm the effectiveness of analyzing volumes and price reactions. Remember — it’s the behavior of volume relative to price that reveals what’s truly happening in the market. Stick to proper risk management, and over time, you’ll see consistent results.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.