QKC +27.2% (Resonance Directional Strategy)

A QKC/USDT breakdown focusing on clusters, aggregate data, and price reaction to market selling. We look at signs of local shortages, seller inefficiencies, and confirmation of an entry point with over 27% movement.

Table of content

Pair: QKC/USDT

Risk: Medium

Skill Level: Beginner

Entry Reasons

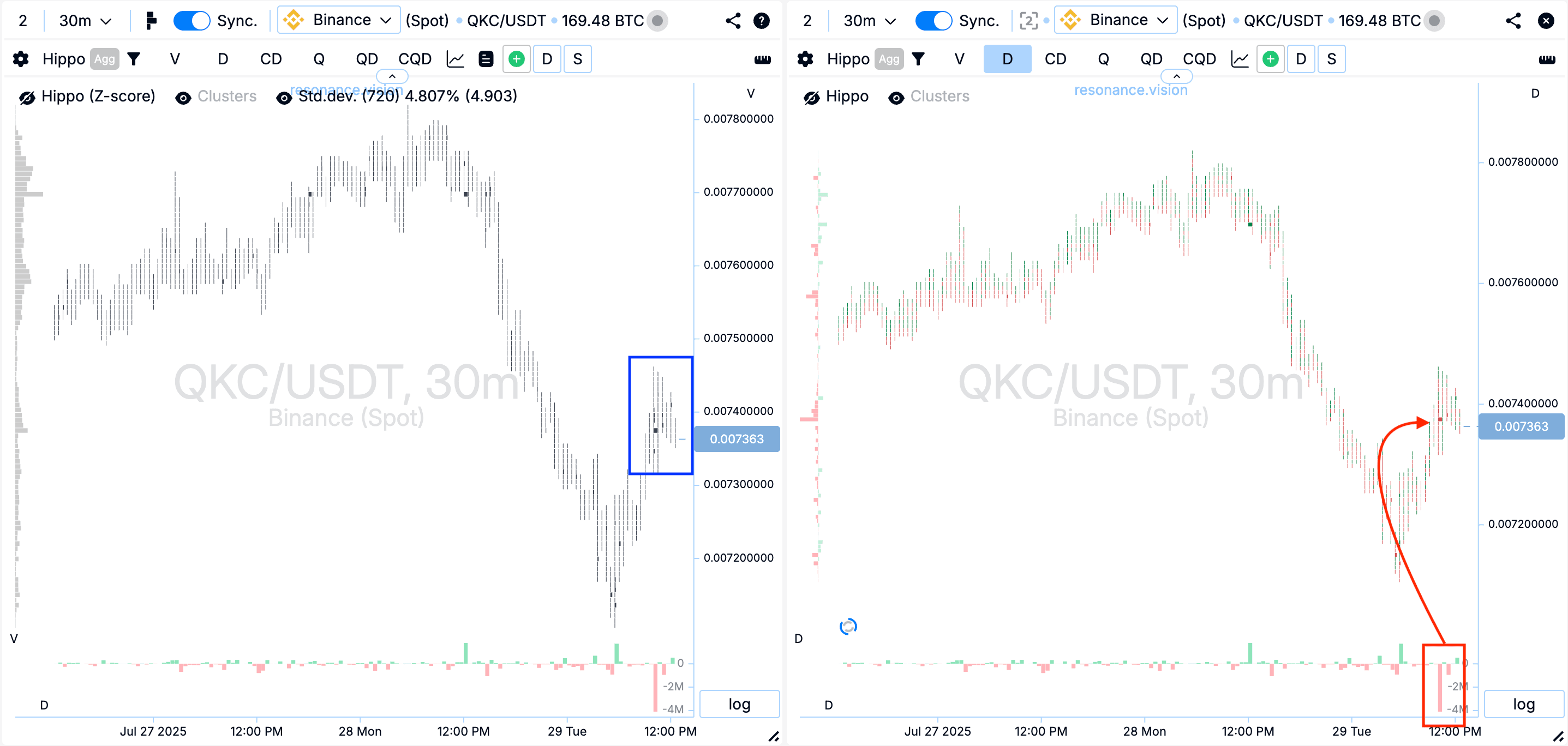

Cluster Chart: Large volume clusters began to form (blue rectangle), accompanied by aggressive market selling (red rectangle with arrow). However, the price barely reacted — no expected drop followed. This may indicate signs of a local supply shortage and seller weakness.

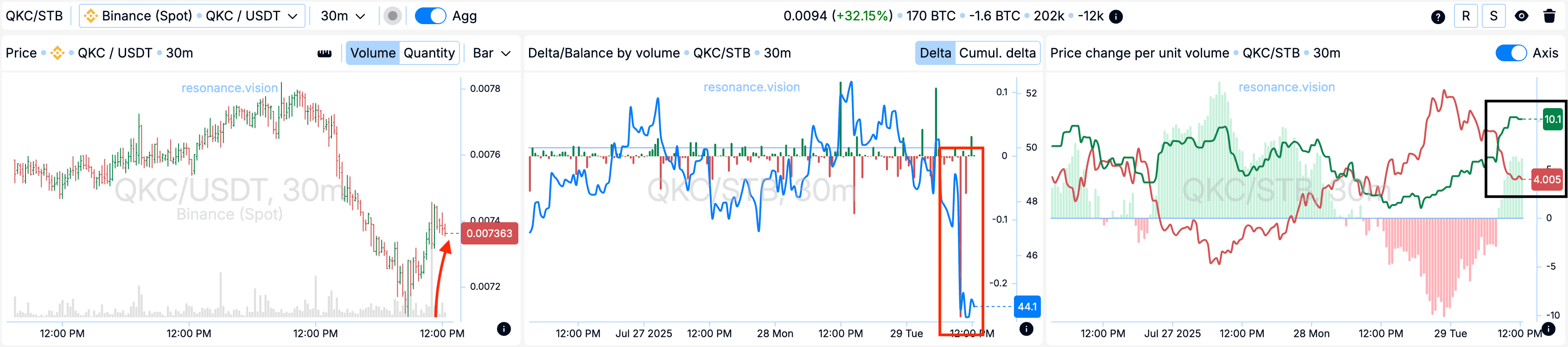

On the Dashboard

Delta / Volume Balance: Aggregated data shows a clear dominance of market selling across all pairs and exchanges (red rectangle). Yet the price still doesn’t drop, reinforcing the idea of a local shortage and supporting the case for a long position.

Price Change per Volume Unit: The efficiency of sell pressure began shifting in favor of buyers — visible on the chart (black rectangle).

Exit Reasons

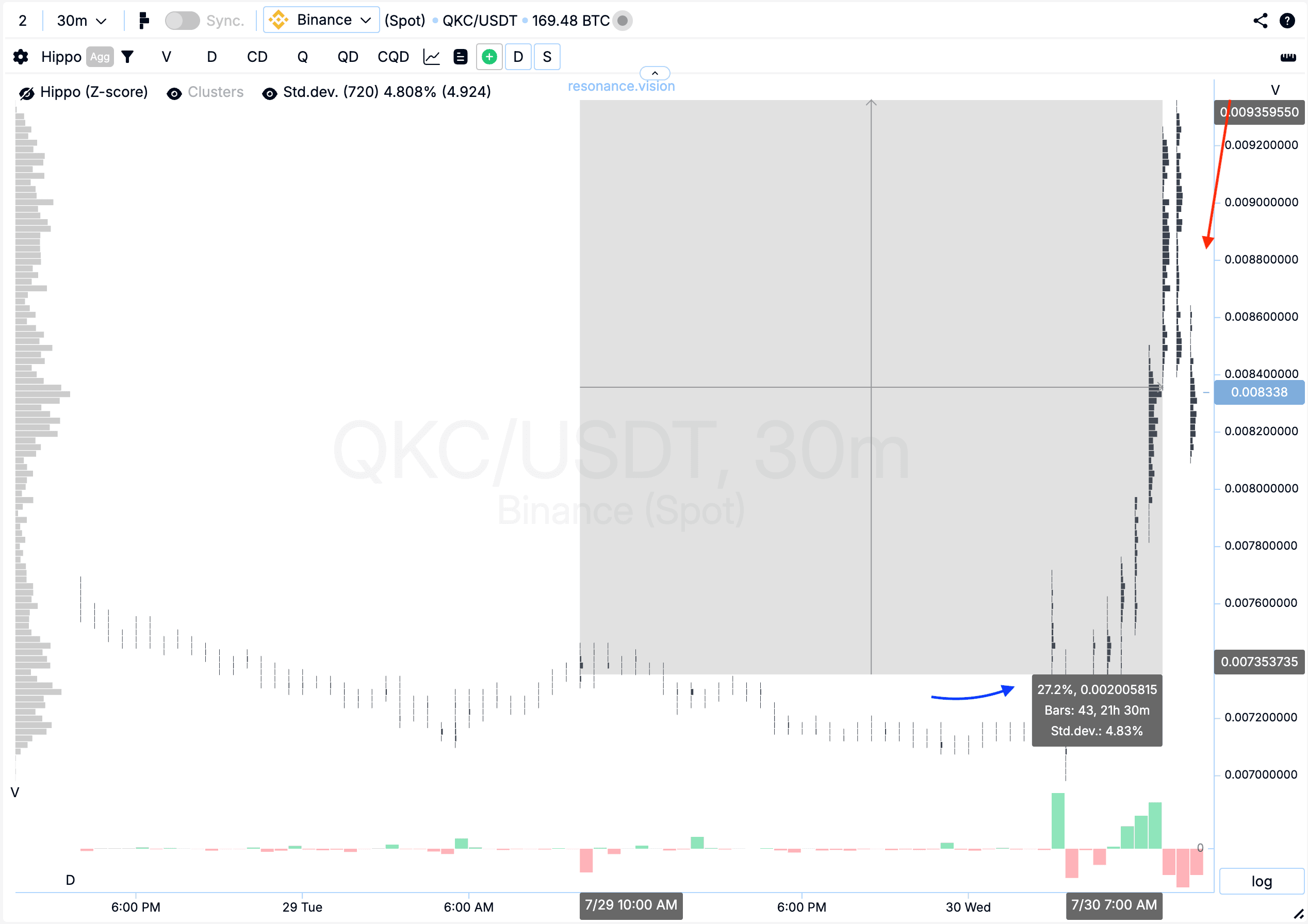

Cluster Chart: After the impulse move, market selling reappeared, leading to a slight pullback (marked with red arrow). Still, from the entry point, price gained over 27% (blue arrow), confirming the strength of the impulse and marking a meaningful move.

Conclusion

Despite significant selling pressure — visible both in cluster data and the aggregated delta — price remained steady, signaling a local shortage and weak sellers. The response was quick: after entry, price moved over 27%, confirming the validity of the hypothesis and the quality of the entry point. The setup played out confidently.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.