SAND +123.49% (Directional Strategy Resonance)

This analysis examines a SAND/USDT trade, where a combination of cluster analysis, heatmap, and Dashboard data helped identify a shift in the buying and selling mood. Despite market selling pressure, the price held thanks to limit support from below, prompting a long entry. Profit-taking occurred after buying activity weakened and volume efficiency declined.

Table of content

Pair: SAND/USDT

Risk: Medium

Skill Level: Beginner

Entry Reasons

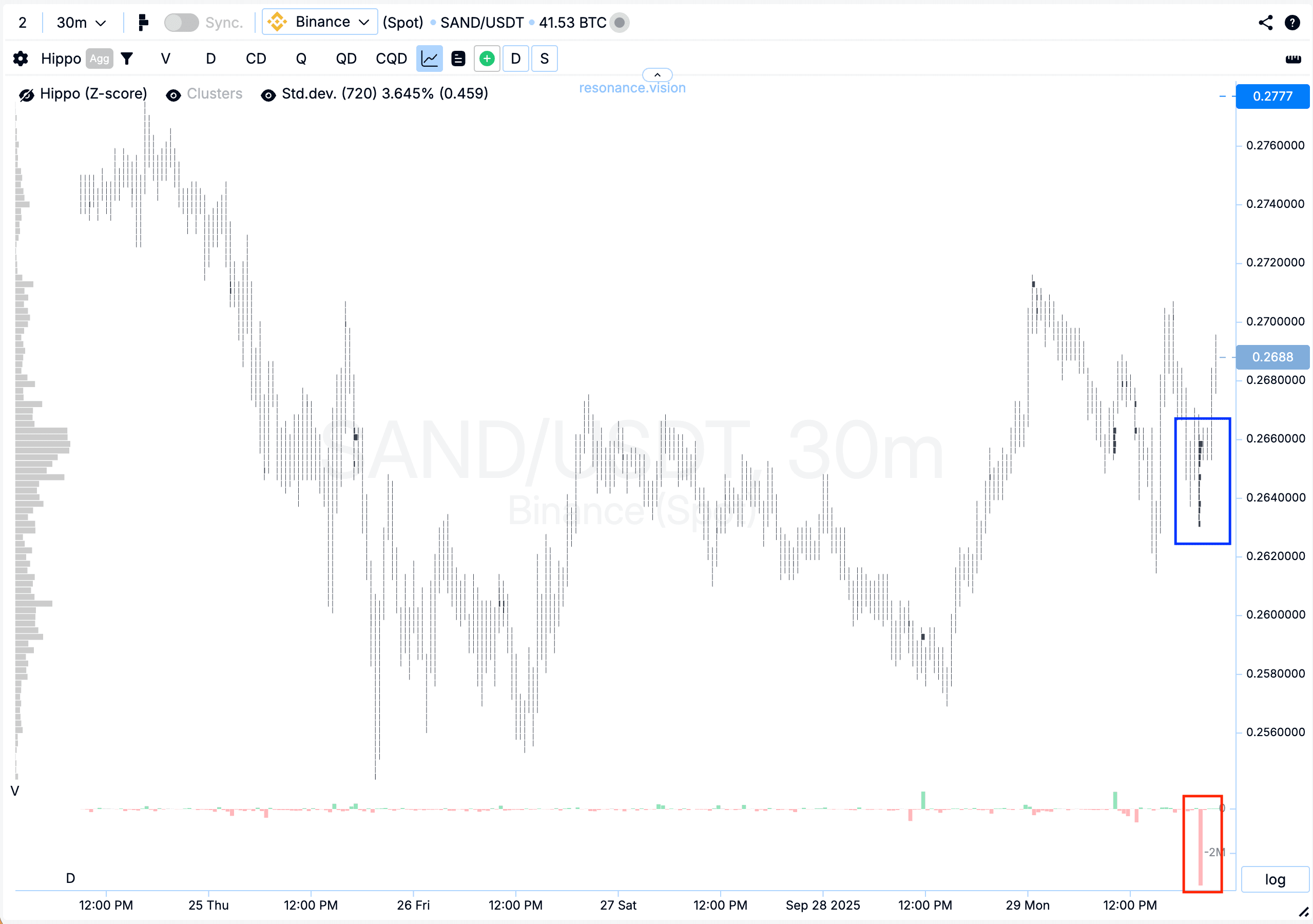

Cluster Chart: Volume clusters began to form (blue rectangle) where selling activity dominated (red rectangle). Despite seller pressure, the price did not break the local low and held within the range. This indicated a local deficit and weakening seller initiative.

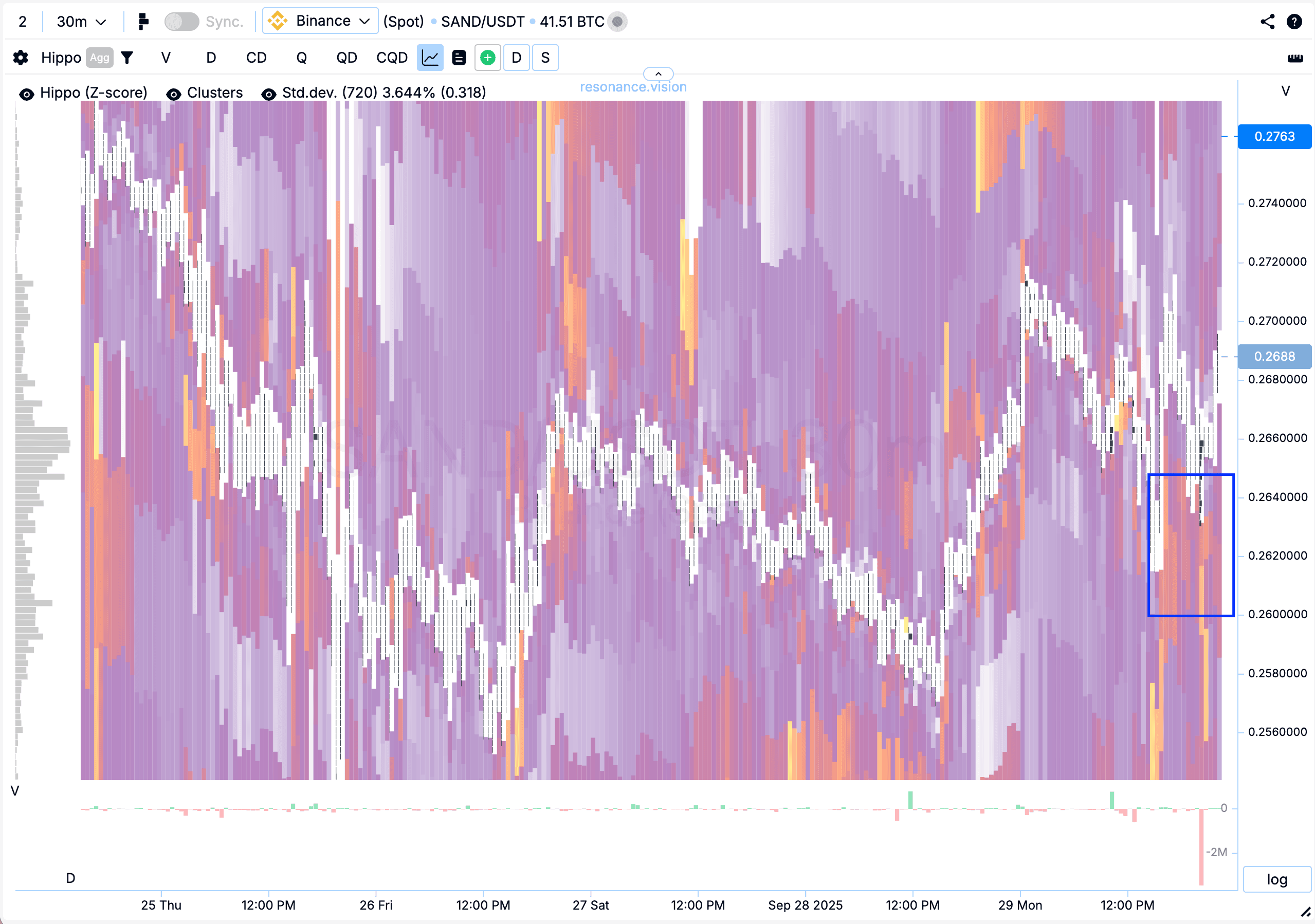

Heatmap (Z-Score): Abnormal buy-side limit densities (blue rectangle) absorbed incoming market sell orders. This behavior suggests a local deficit remains, showing buyers’ willingness to defend the level.

In the Dashboard

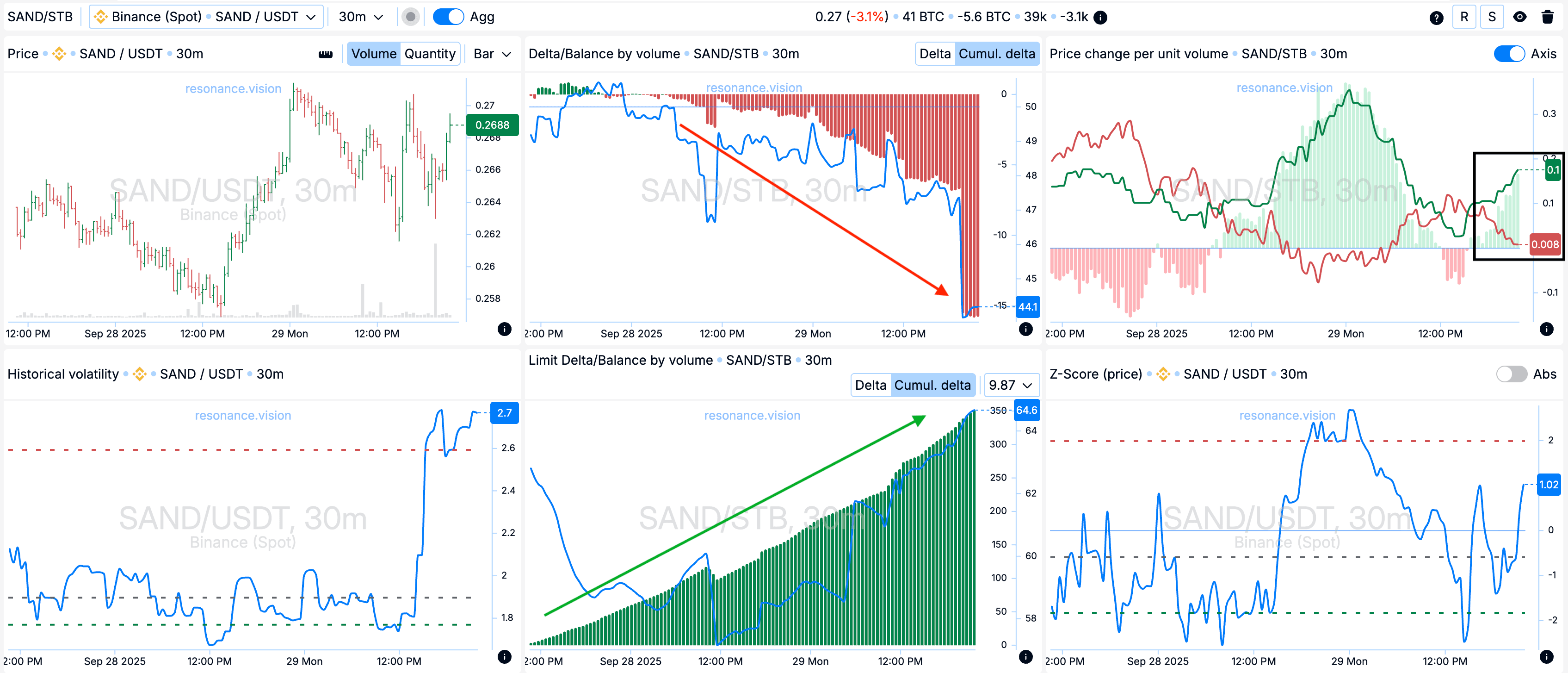

Delta / Volume Balance and Limit Delta: Market sell orders clearly dominated — confirmed by the cumulative delta histogram (red arrow). However, despite selling pressure, the price stayed stable. Meanwhile, limit buy orders increased, reflected in the limit delta histogram (green arrow).

Price Change per Volume Unit: The efficiency of market orders began diverging in favor of buyers (black rectangle).

Exit Reasons

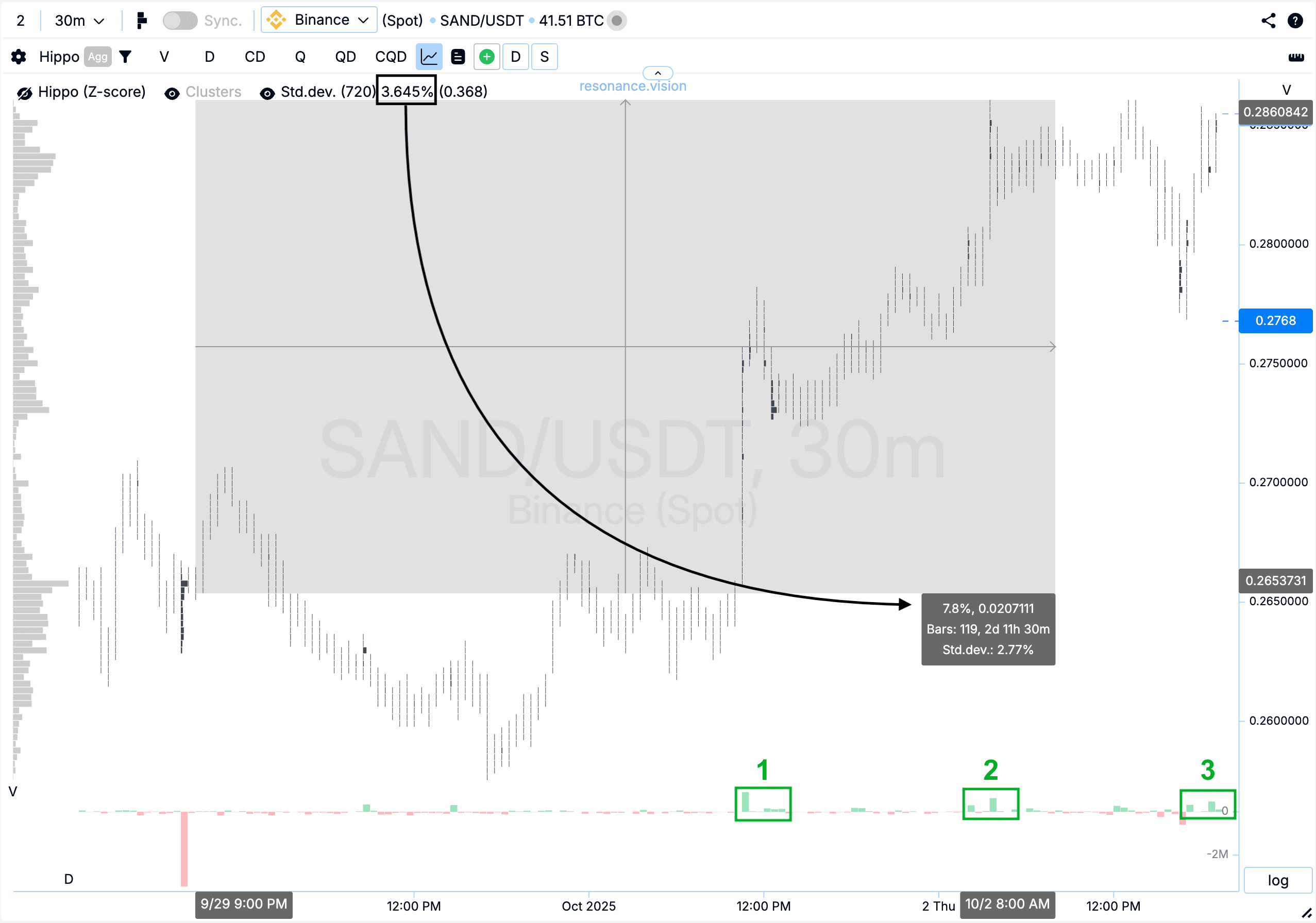

Cluster Chart: From the entry point, the price moved roughly +8%, equivalent to more than two standard moves. However, buying volumes similar to earlier ones (rectangles #1–2) now had less impact — the local high was not updated (rectangle #3). This indicated waning buyer initiative and potential for a pullback.

Result:

Profit secured at +123.49%.

Conclusion

This trade demonstrates how combining cluster chart analysis, heatmaps, and Dashboard data helps identify high-potential entry points. Despite strong selling activity, price stability and rising limit buy orders signaled a local deficit and a shift of balance toward buyers — forming the basis for a long entry.

On exit, reduced buying efficiency and failure to update the local high became strong signals to lock in profits. This approach allowed securing gains and avoiding potential retracement.

This example highlights the importance of tracking behavioral shifts among participants: when market orders start losing strength, it’s often a sign to prepare for an exit.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.