SEI +176.05% (Directional Strategy Resonance)

In this analysis, we will consider a trade on the SEI/USDT coin, where the key signal for entry was a local deficit - the moment when the price is stable against the background of market sales, and limit orders continue to absorb the volume. We will show in detail how the combination of a cluster chart and aggregated data helps to build a balanced trading decision, as well as exit the position in time, without succumbing to emotions.

Table of content

Coin: SEI/USDT

Risk: high

Understanding level: beginner

Reasons to enter

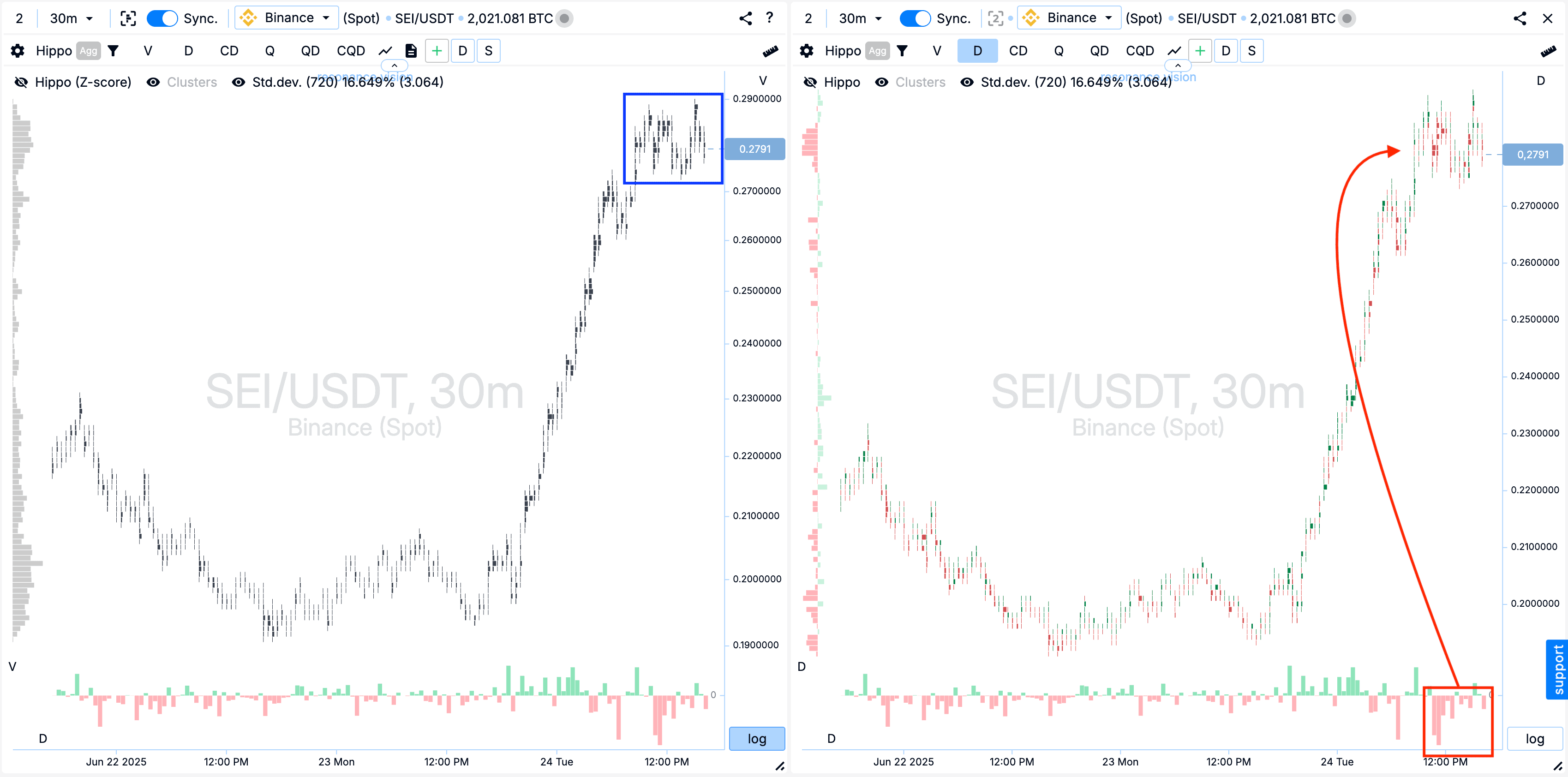

Cluster chart: After a local and significant increase in the price range, clusters by volume (blue rectangle) were formed. The volumes were accompanied by active sales (red rectangle with an arrow), but these sales did not cause the expected decline - the price continues to fluctuate within this range. This may indicate that the initiative remains on the side of buyers, who retain control over the movement.

In the Dashboard

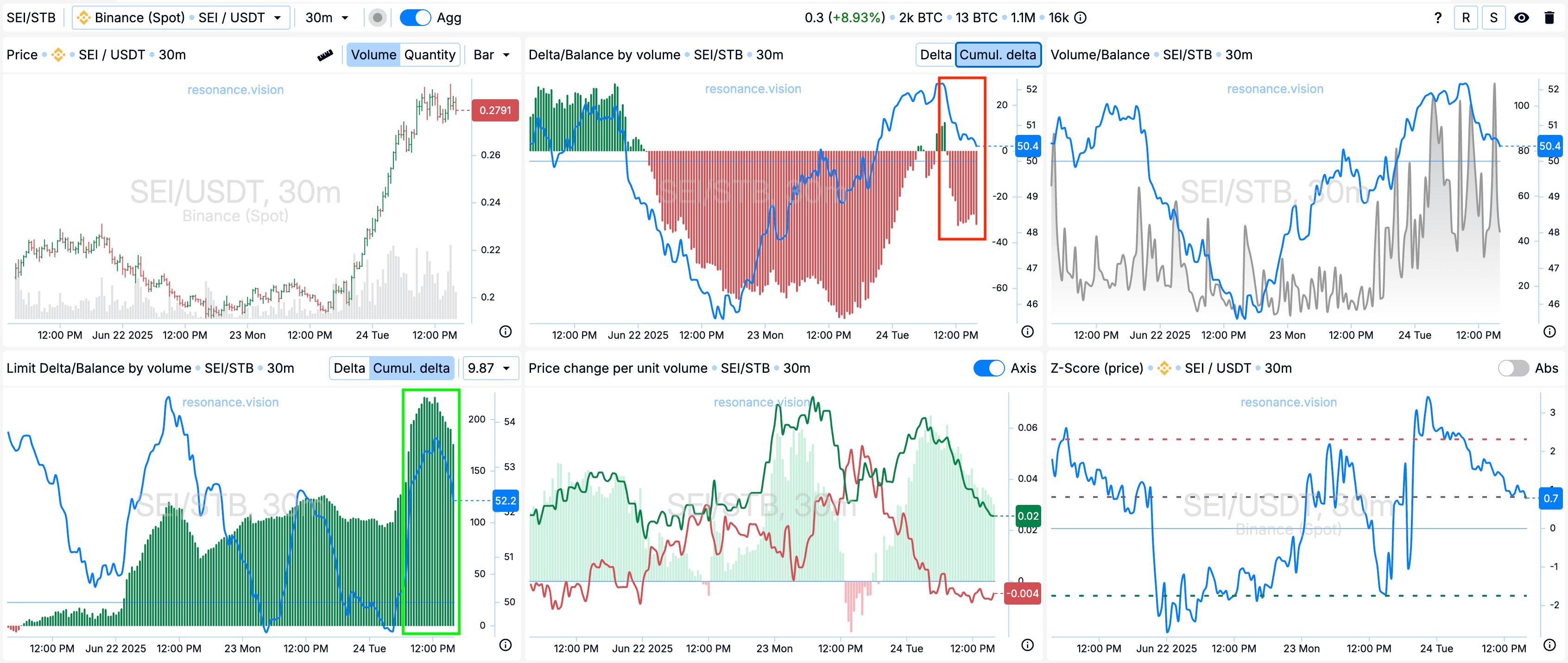

Delta/Balance by volume and limit delta: According to the aggregated cumulative data, market sales prevail (red rectangle). However, active substitution of buy orders is observed for limit orders — this is evident from the positive dynamics on the cumulative delta histogram (green rectangle).

This indicates the presence of local limit support capable of continuing to absorb the incoming market sales volume. This further confirms the hypothesis of a persistent local deficit.

Exit reasons

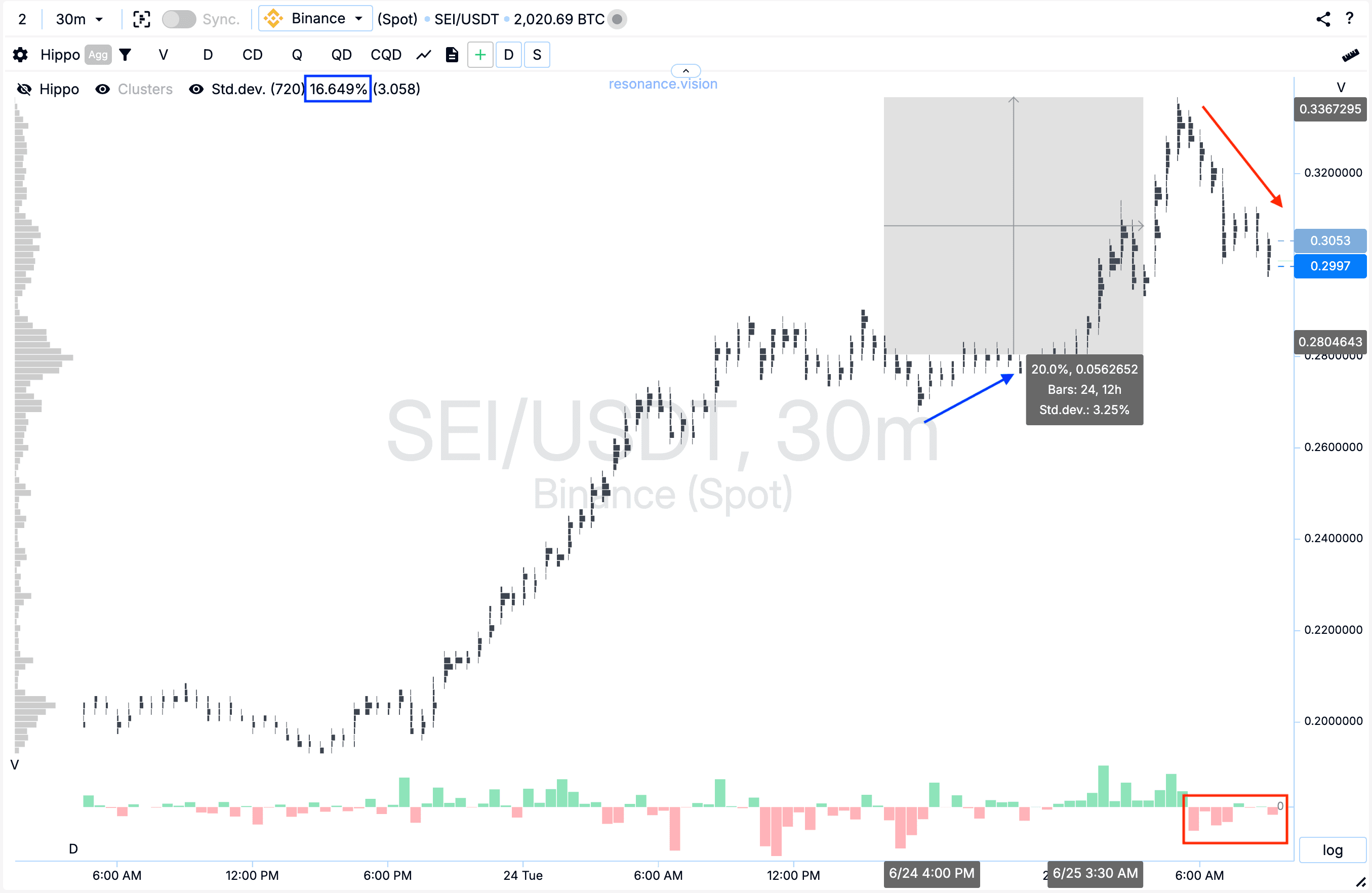

Cluster chart: The price moved up another 20% from the entry point, which exceeds one standard movement (blue rectangle and arrow). Subsequently, market sales began to prevail, the volumes of which gradually decreased, but the price continued to decline (red rectangle and arrow).

This became a signal to fix the entire position — a reasonable decision that allows you to avoid an emotional reaction and not succumb to FOMO in the event of a continued decline.

Result

As a result, we managed to secure a profit of +176.05%.

Conclusion

In this deal, the key factor was not the reaction to the price, but its absence on the sellers’ side. Despite active market sales, the price held steady, and limit support continued to absorb market orders. This gave reason to form a hypothesis about the presence of a local deficit and opened a window for entry.

However, the market does not always move linearly. After growth of more than 20%, signs of a slowdown began to appear: sales intensified, and the price began to decline. This is the moment when it is important to act calmly — timely profit-taking allows you to preserve the result and avoid emotional mistakes. The deal clearly shows how important it is to consider the interaction of market volumes and limit orders in order to make balanced and informed trading decisions.

Follow new articles in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.