SKL +43.2% (Resonance Directional Strategy)

A breakdown of the SKL/USDT trade, focusing on buyer/seller imbalances, cluster analysis, and delta. Shows how limit orders and price action helped identify entry and exit points, and manage risk after a strong move. A practical example of a comprehensive approach to trading in a highly volatile market.

Table of content

Coin: SKL/USDT

Risk: Medium

Skill level: Beginner

Entry reasons

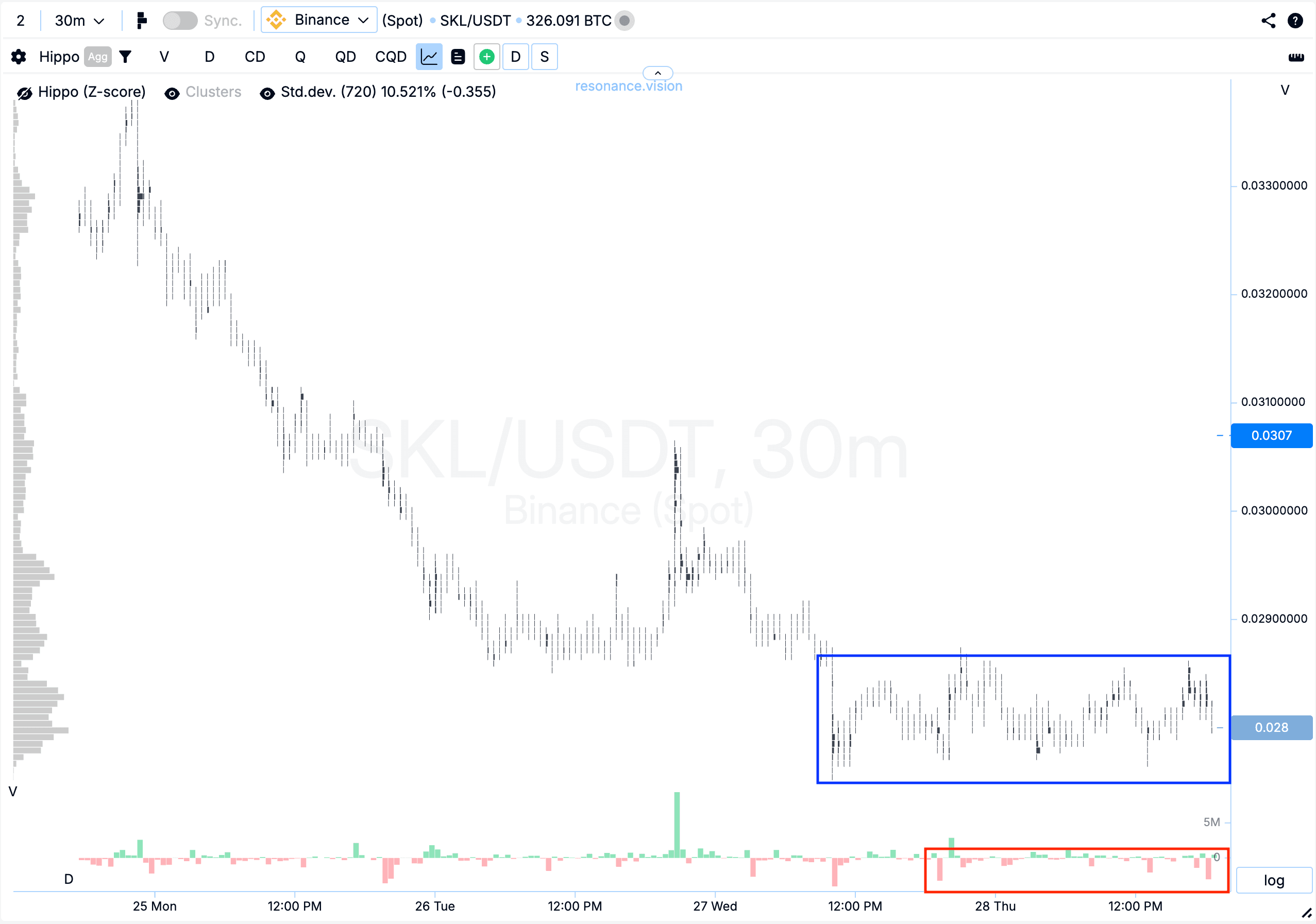

Cluster chart: On the decline, volume clusters started forming (blue rectangle), showing that selling was dominant — confirmed by the delta (red rectangle). However, despite the selling pressure, the price stopped falling and did not update the local low, which may indicate signs of a local shortage and weakening seller initiative.

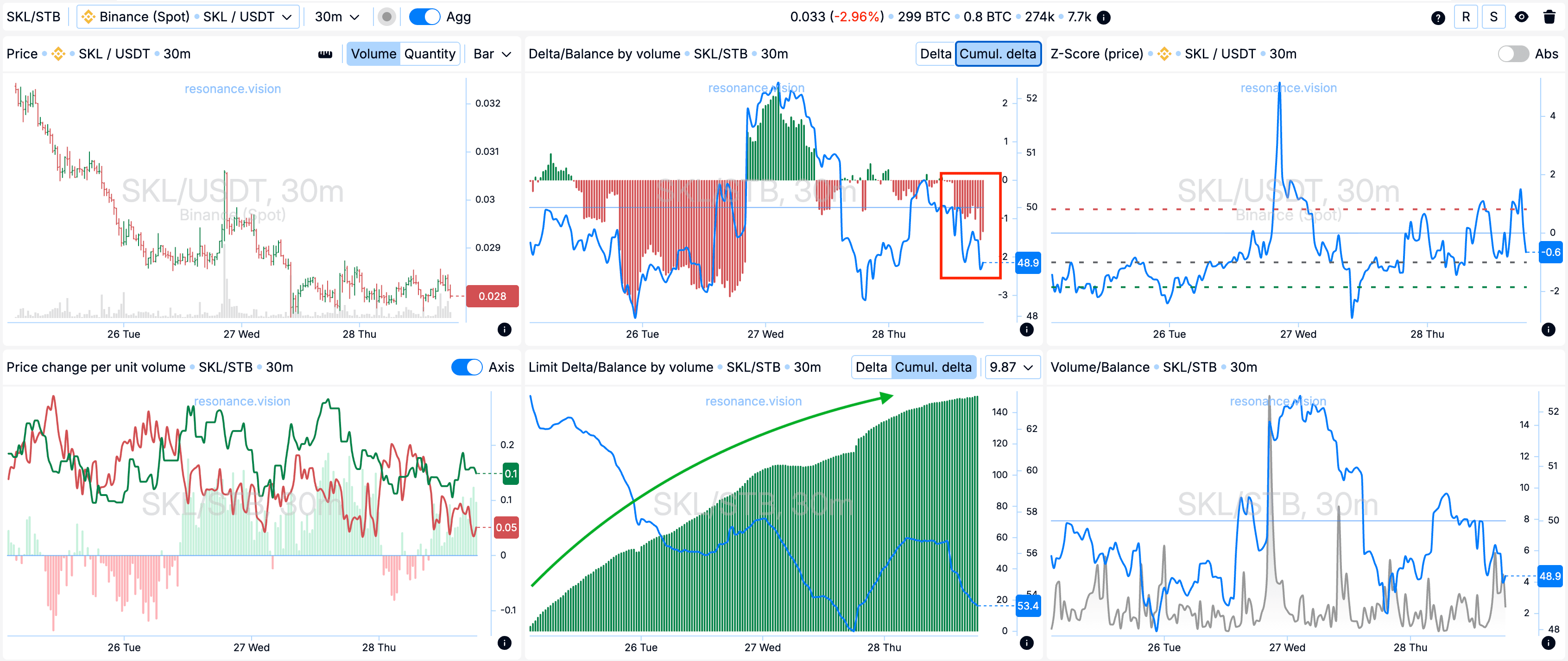

In the Dashboard

Delta / Volume balance and Limit delta: Aggregated data shows clear dominance of market selling — visible on the cumulative delta histogram (red rectangle). However, despite this pressure, the price stopped declining.

At the same time, cumulative limit delta is increasing (green arrow), showing dominance of buy-side limit orders. This dynamic suggests that market participants are actively absorbing sell volumes in this range and preventing further price drops.

Exit reasons

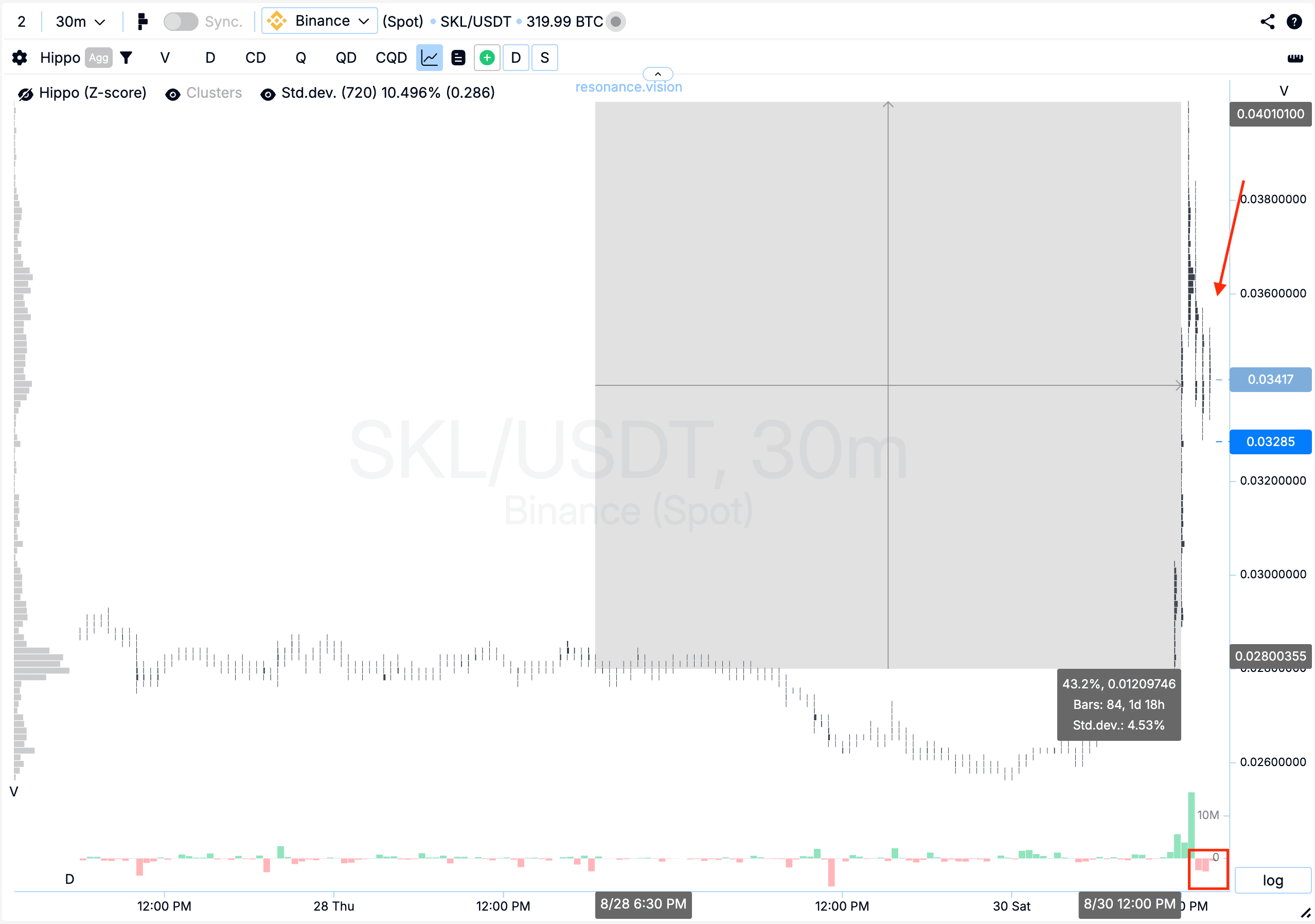

Cluster chart: From the entry point, price grew by more than 40% — a significant move. Afterwards, a pullback and gradual decline appeared, accompanied by heavy selling (red rectangle and arrow).

Further holding carries higher risk, since after such an impulsive move, market participant behavior becomes uncertain.

Result: Locked profit after +40% move.

Conclusion

This trade demonstrates how observing the imbalance between buyers and sellers helps build sound trading hypotheses. Despite heavy market selling, the price stopped falling and failed to update the local low, signaling local shortage and weakening of seller pressure.

The example highlights the value of a comprehensive approach: combining cluster analysis, delta, and limit orders makes it possible to identify quality entry and exit points and execute profitable trading ideas.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.