SOL +132.27% (Directional Strategy Resonance)

In this analysis, I’ll show you how I used a heat map (Z-Score) to identify abnormal limit densities and manage a position with additional buy-ins. We’ll explore entry logic, price reaction to clusters, and how to intelligently leverage an idea without being overly greedy.

Table of content

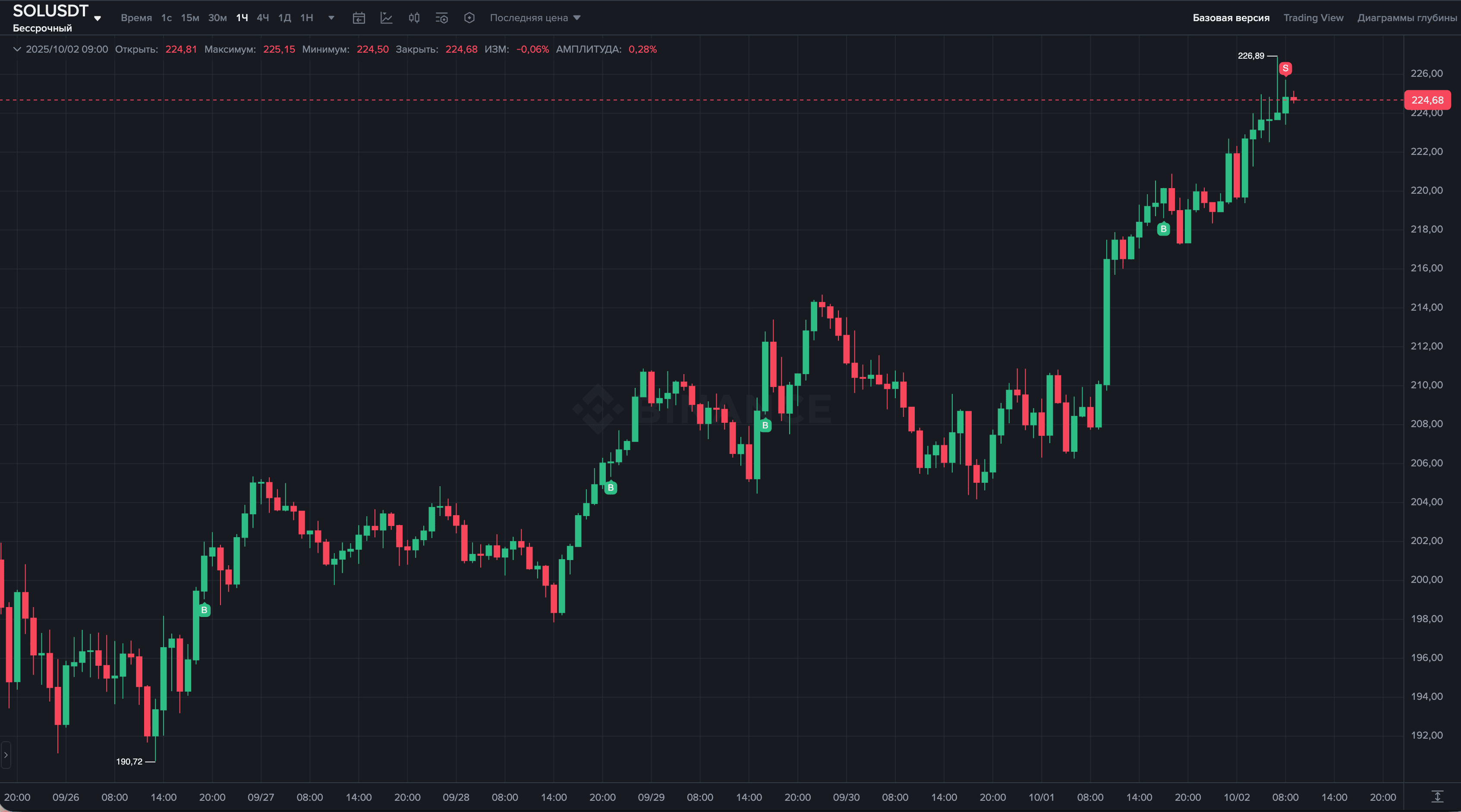

Pair: SOL/USDT

Risk: Low

Skill Level: Beginner

Entry Reasons

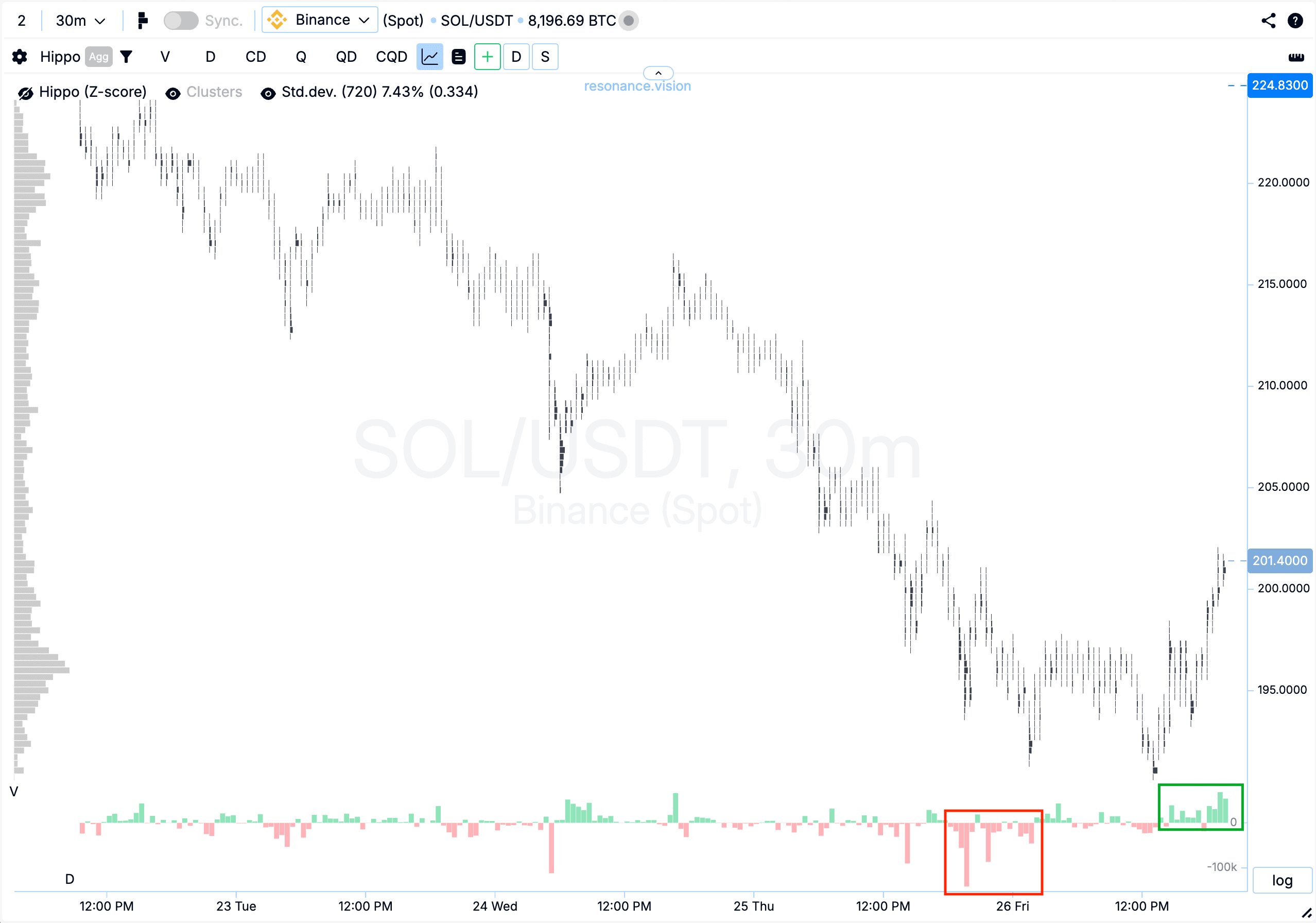

Cluster Chart: After significant market selling (red rectangle), the price entered a small consolidation. Then, heavy buying (green rectangle) appeared, pushing the price upward. This indicates buyer efficiency and signals that the initiative shifted to their side.

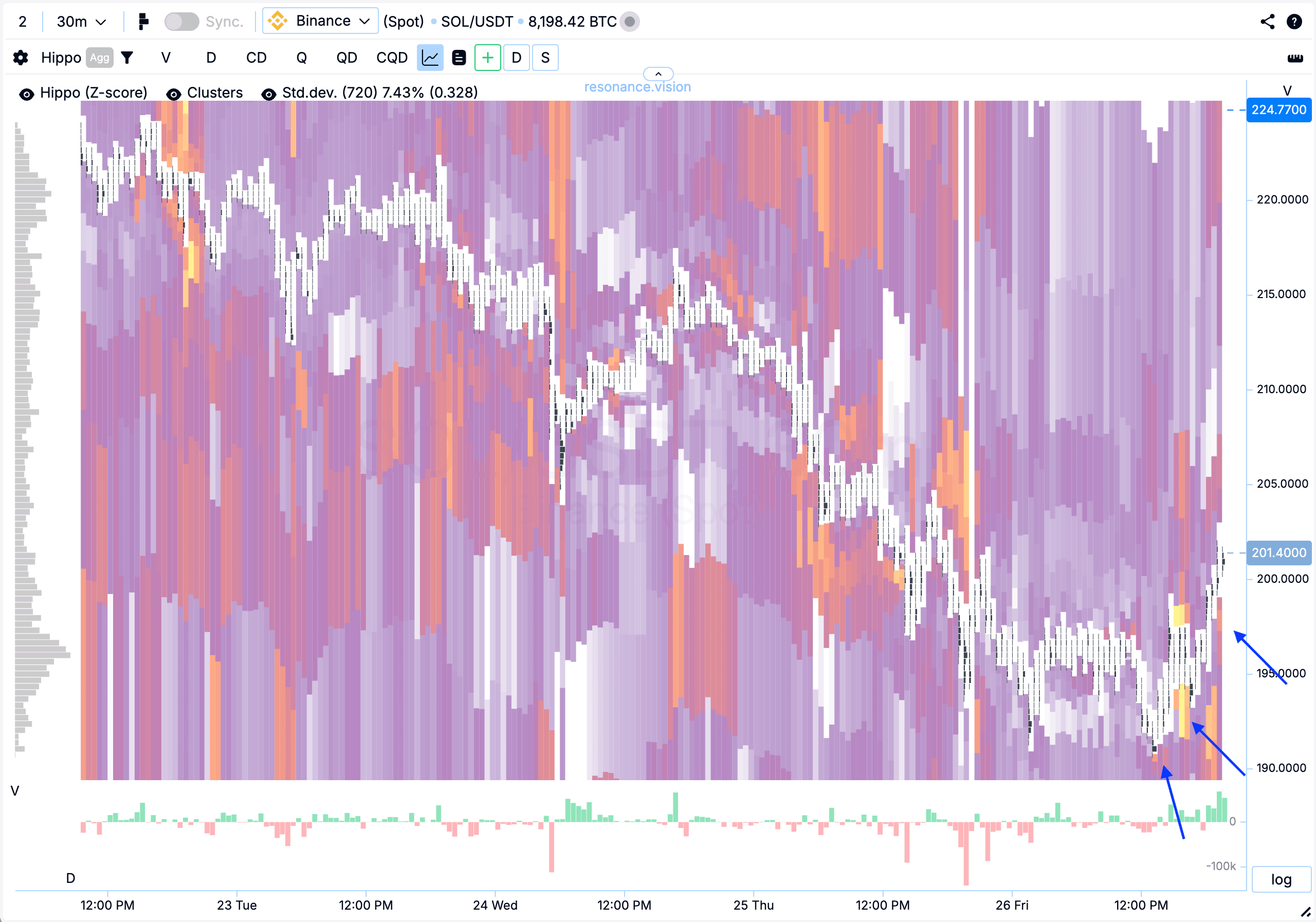

Heatmap (Z-Score): A gradual upward shift of buy limit orders is visible — highlighted on the map as abnormal clusters (blue arrows). This dynamic points to signs of a local deficit and the readiness of participants to absorb all market selling.

In the Dashboard

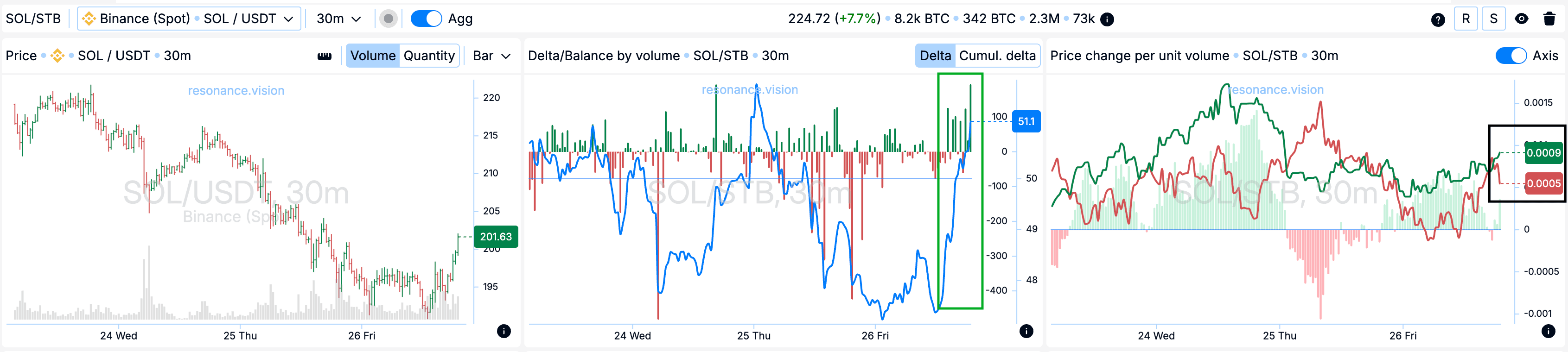

Delta/Volume Balance: Market buy orders clearly dominated — visible in the delta histogram. The balance also continued shifting toward buyers (green rectangle), confirming their activity.

Price Change per Volume Unit: The efficiency of market orders’ impact on price also began to tilt in favor of buyers (black rectangle).

Exit Reasons

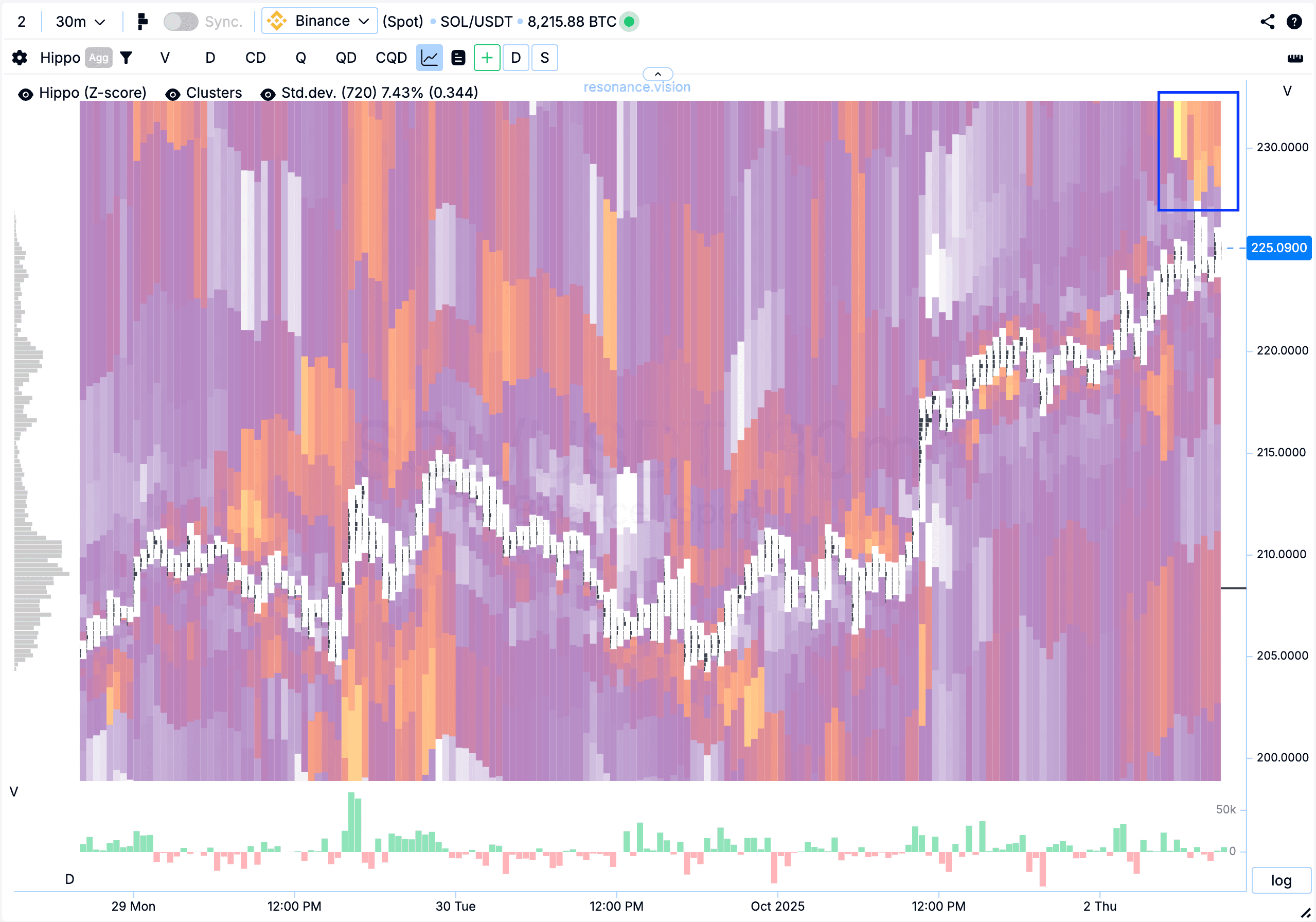

Heatmap (Z-Score): Abnormal sell limit clusters appeared above (blue rectangle), partially absorbing market buys. In such conditions, locking in gains without greed is rational: the pronounced sell walls held the price and may signal a potential decline.

Position Management

This trade delivered a solid result. During the holding period, additional scaling-in was done, strengthening the overall position and allowing more effective execution of the trading idea.

Result:

The position was closed with a profit of +132.27%.

Conclusion

This trade shows how combining cluster charts, heatmaps, and Dashboard data helps identify high-potential points. After significant selling, the appearance of heavy buying and active buy-side limit orders indicated buyer interest and local deficit formation. This formed the basis for the long setup.

On exit, the key factor was abnormal sell-side limit clusters above, which partially absorbed market buys. This signaled reduced buyer effectiveness, making profit-taking the rational choice.

This example highlights the value of integrated analysis: combining cluster charts, delta, Z-Score, and position management allows timely evaluation of market balance and efficient execution of trading ideas.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.