STRK +73.9% (Directional Strategy Resonance)

A review of the STRK trade with a focus on volume behavior: where a local shortage emerged, how limit buys created support, and why the subsequent weakening of buyer effectiveness signaled an exit. Pure supply and demand logic – no unnecessary noise.

Table of content

Coin: STRK/USDT

Risk: Medium

Understanding level: Beginner

Entry Reasons

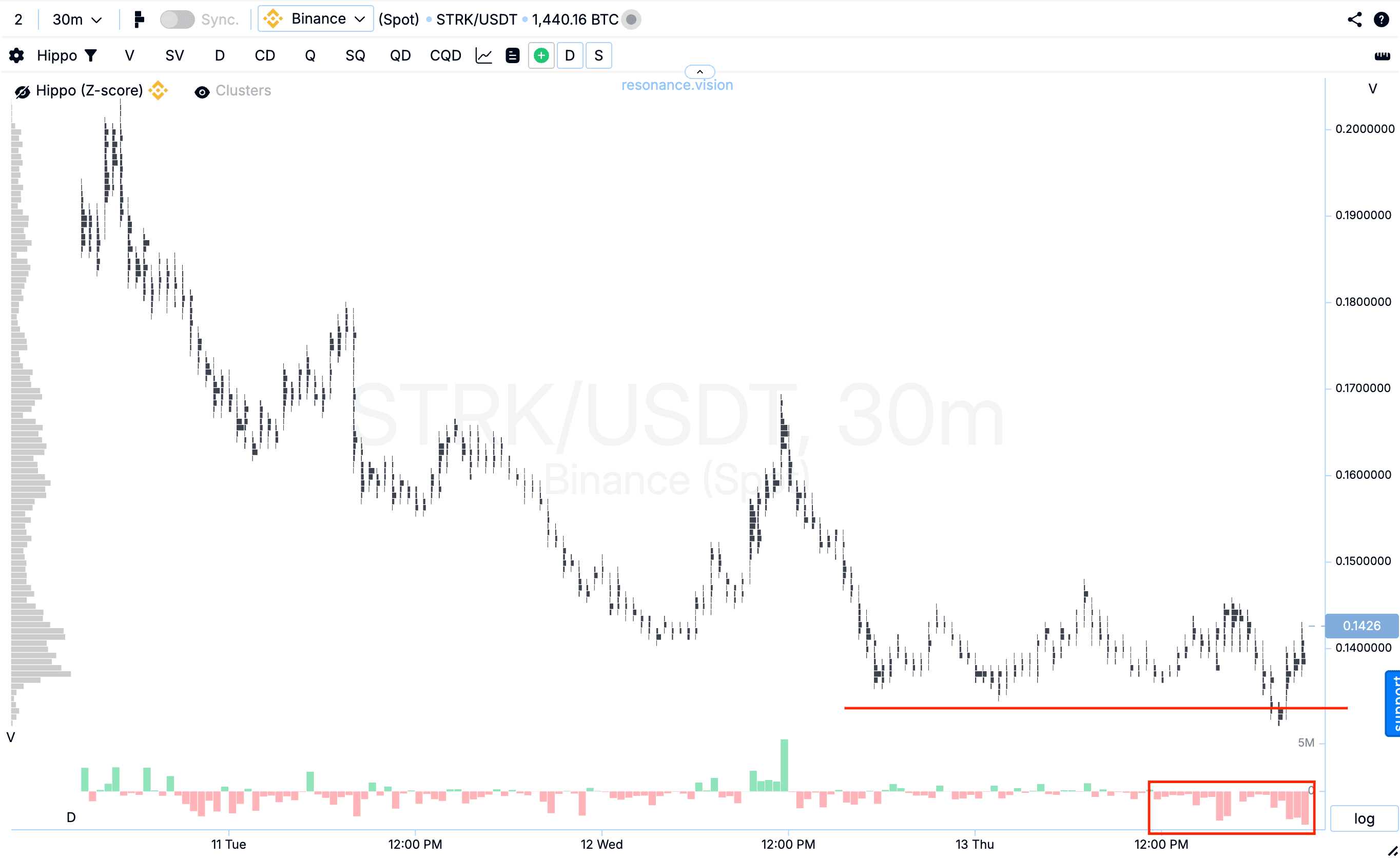

Cluster chart: during the decline, selling volumes started to increase (red rectangle), but their influence had already weakened — the price failed to significantly update the local low (red line). This reaction indicates the formation of a local deficit and a decrease in seller strength.

In the Dashboard

Delta / Volume Balance and Limit Delta: aggregated data across all pairs and exchanges confirms the picture seen on the cluster chart. During this period, the market was under pressure from market selling — this is clearly visible in the cumulative delta histogram (red arrow). However, at the same time, limit order data shows a noticeable increase in buy limit volumes (green arrow). This dynamic indicates that market participants were actively absorbing incoming selling volume with limit buy orders, forming local support and preventing the price from dropping further.

Exit Reasons

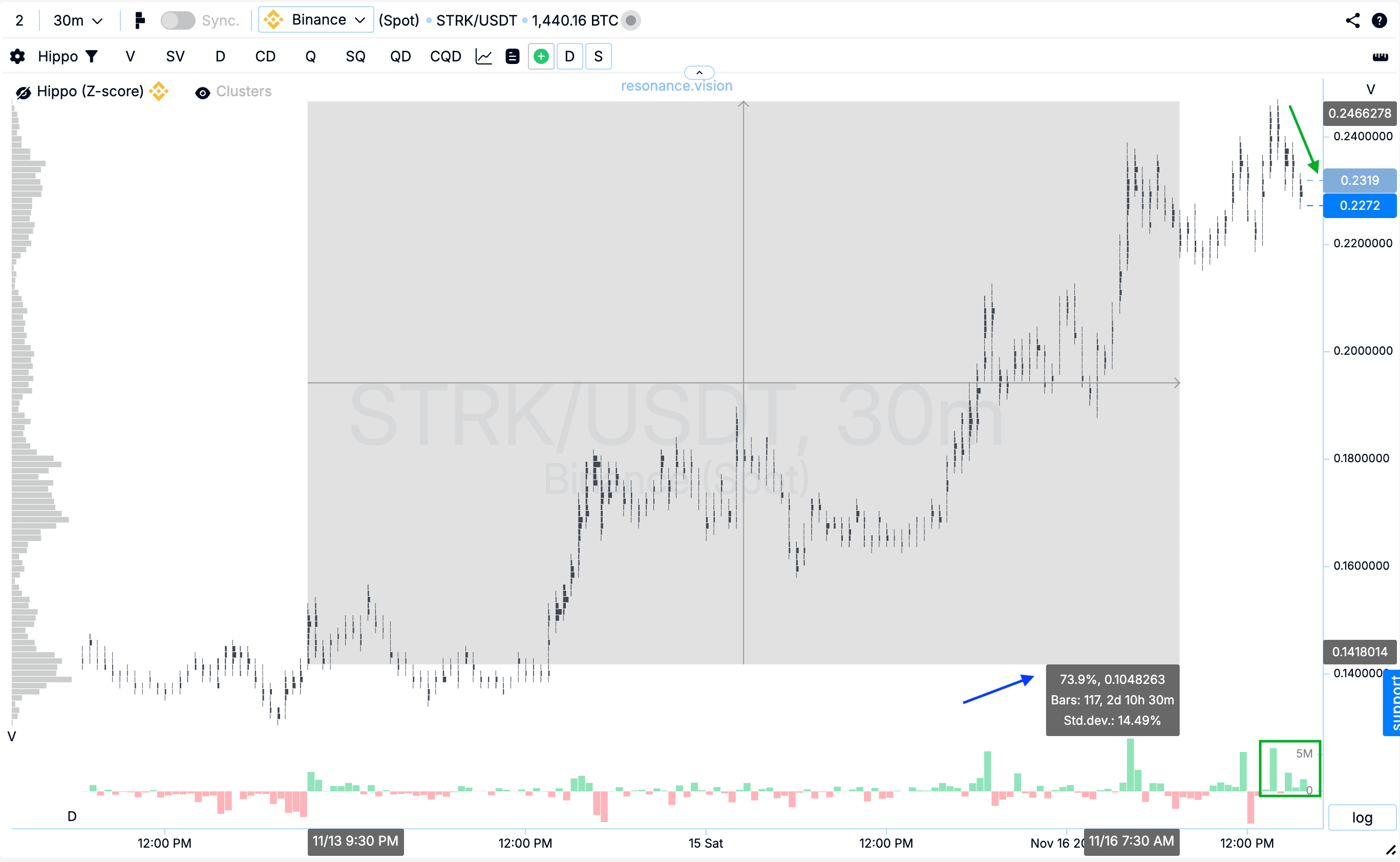

Cluster chart: from the entry point, the price moved up by 73.9%. However, the subsequent buying volumes stopped having a noticeable impact on the price — their efficiency was decreasing, volumes began to shrink, and the price started to gradually retrace downward (green rectangle and arrow). This behavior indicates the formation of a local surplus, where buyers are no longer able to push the price higher. In such conditions, closing the position is the most balanced and rational decision.

Conclusion

The situation with STRK developed in an interesting way: we observed weakening sellers — volumes increased during the decline, but the local low was not significantly updated. This gave grounds to assume a deficit formation, which was confirmed by the Dashboard data: sellers were pressing with market orders, but participants absorbed the flow entirely with limit buy orders, holding the price.

However, later the buying volumes decreased, their influence on the price faded, and the price transitioned into a smooth pullback. This is a sign of a local surplus and a loss of buyer efficiency.

In such conditions, continuing to hold the position would have been unjustifiably risky.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.