T +33% (Directional Strategy Resonance)

In this analysis, we will take a detailed look at how a local deficit formed against the background of prevailing market sales, which provided grounds for opening a position. We will show how to read clusters and deltas, where to look for signs of inefficiency of participants and at what stage it is worth fixing profits. We will emphasize key signals for entry and exit, including the importance of assessing standard movements and price behavior with large orders.

Table of content

Coin: T/USDT

Risk: medium

Understanding level: beginner

Reasons to enter

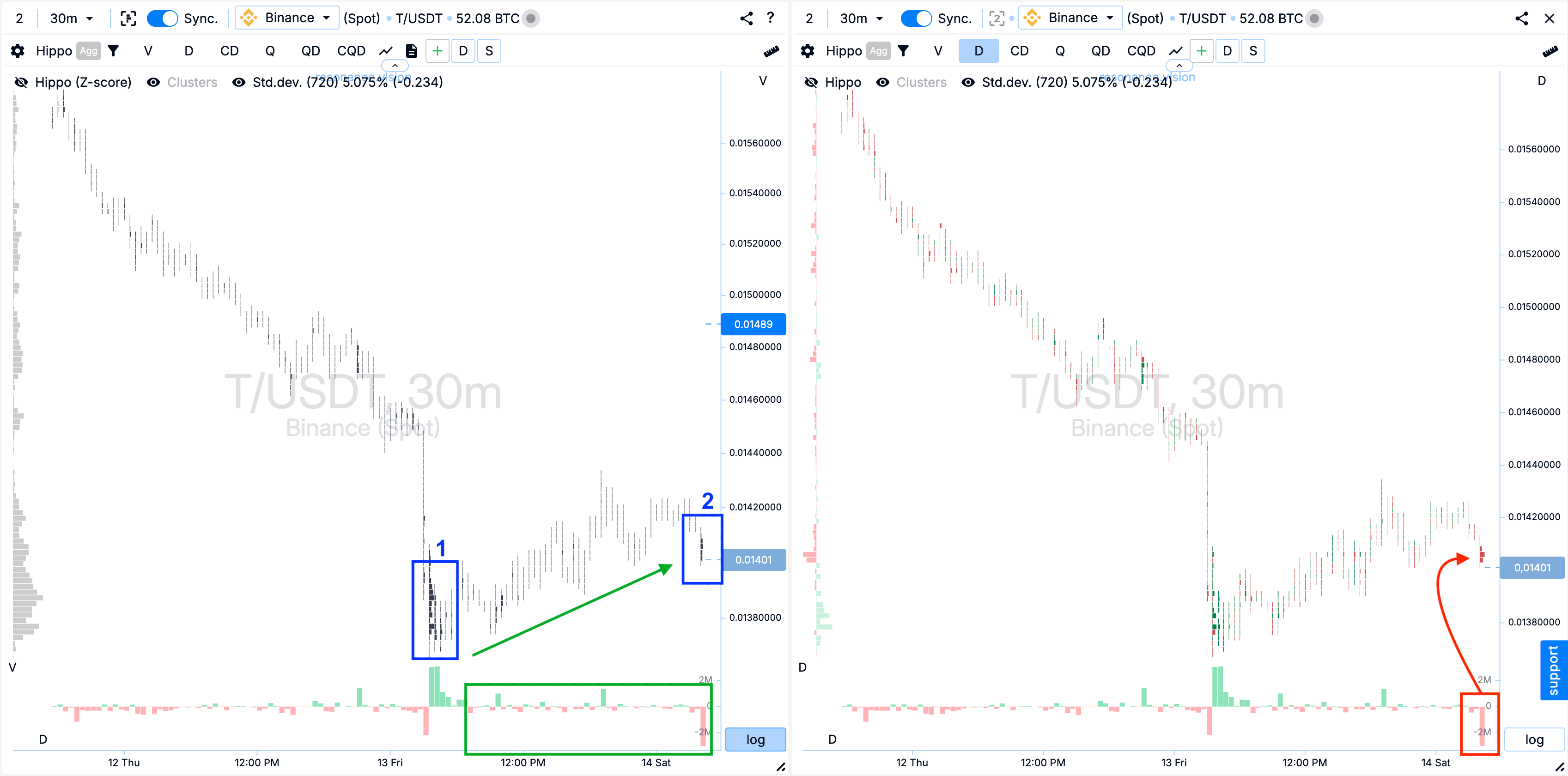

Cluster chart: In rectangle #1 — after the impulse decline, large clusters by volume were formed. They show that sales gradually gave way to large market purchases. Then we see that the activity of the sellers decreased and their efforts were insignificant and did not lead to a decrease in the price. At the same time, market purchases successfully moved the price up (green rectangle and arrow).

In the price range of rectangle #2 — it is clear that large clusters by volume have reappeared. The delta shows that market sales prevailed here (red rectangle with arrow). But the sellers’ efforts did not lead to a noticeable decrease in the price.

In the Dashboard

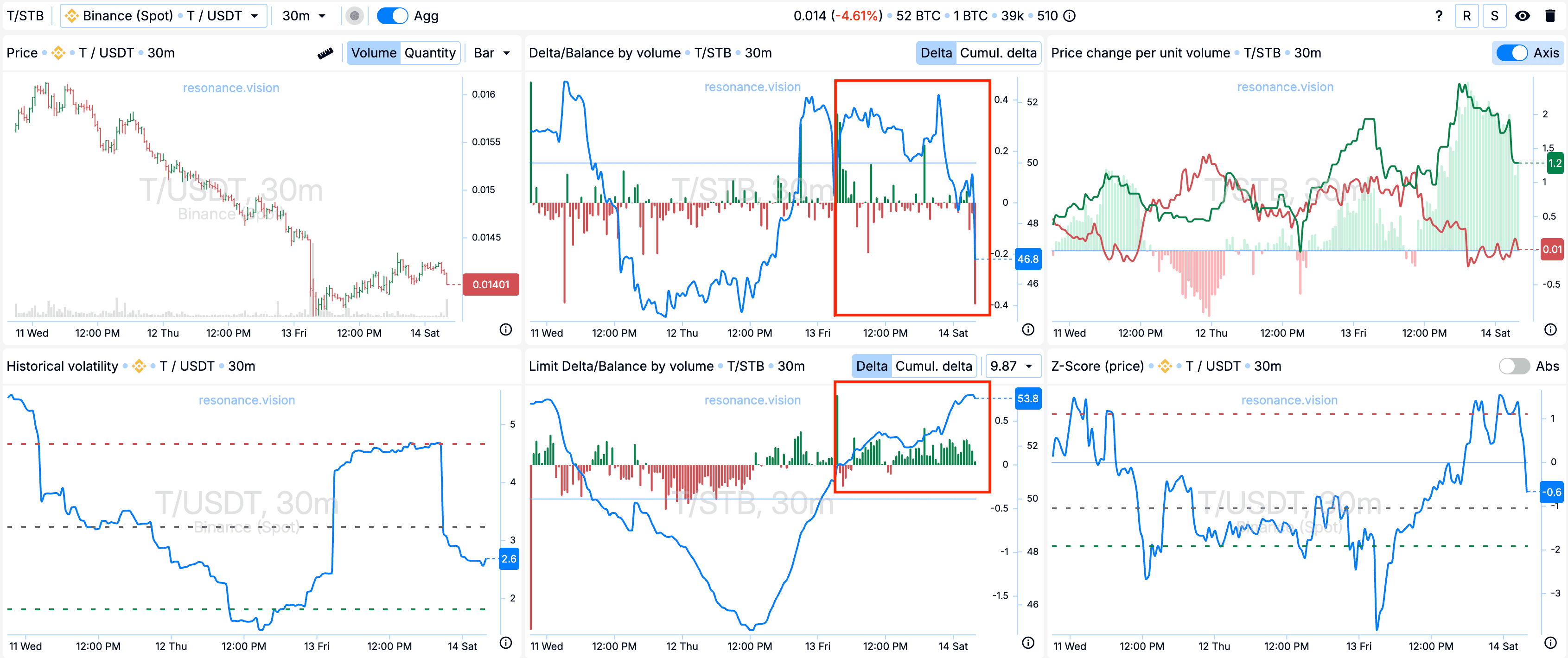

Delta/Volume Balance and Limit Delta: According to the aggregated data, since the momentum decline, the balance of market orders has continued to shift downwards. This indicates the prevalence of sales. However, the opposite picture was observed for limit orders - the balance was shifting upwards. This may indicate an emerging local deficit, since limit orders effectively absorb market sales. And a deficit, as we know, leads to price growth.

Exit Reasons

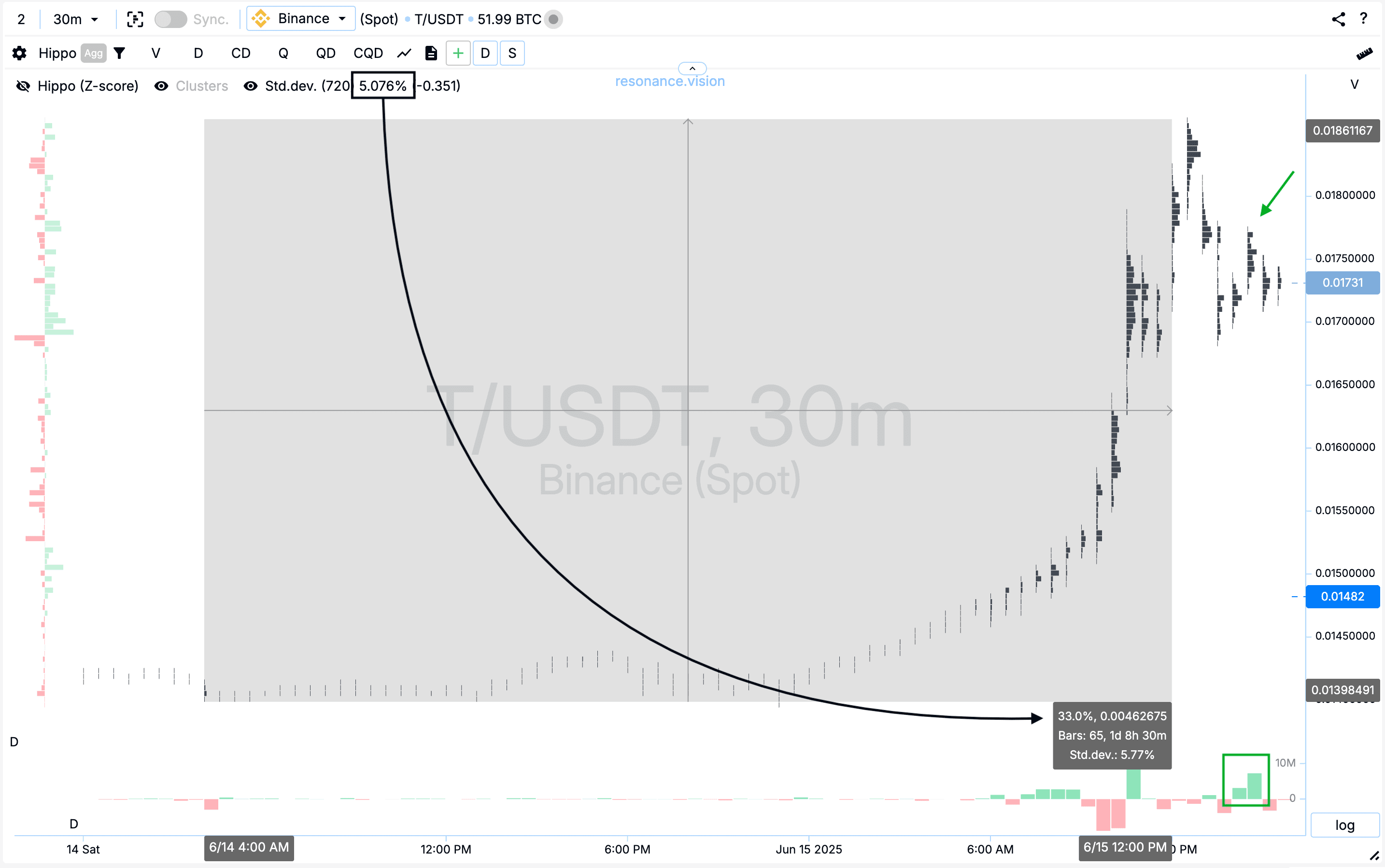

Cluster chart: The price movement was 33%, while one standard movement for this asset is 5.076%. This is abnormal, as it exceeds 6.5 standard deviations.

Also noted repeated market purchases, which no longer led to further price growth (rectangle with an arrow). This may indicate a weakening of the initiative or strength of buyers.

Conclusion

We managed to clearly track the behavior of market participants: despite the dominance of market sales, the price decline was stopped by buyers. The holding back of subsequent active market sales confirmed the presence of demand and provided grounds for entering a position.

As a result of the deficit, the price increased significantly and the situation changed dramatically. Repeated purchases ceased to lead to further growth, which indicated a weakening of demand and a decrease in the effectiveness of buyers.

This analysis once again emphasizes how important it is to comprehensively analyze volume, delta and the impact of volume on price in order to make informed trading decisions.

Follow new articles in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.