T +172.66% (Resonance Directional Strategy)

The case study examines entry after an impulse decline, against the backdrop of volume sales that did not lead to a continued decline. Analysis of the cluster chart, aggregated delta, and limit orders showed signs of a local deficit, which became the basis for entry.

The exit was recorded after a change in market initiative: growth slowed down, buyer efficiency decreased, and sellers began to dominate in limits.

An example of competent position management and fixing the result on an abnormal movement.

Table of content

Coin: T/USDT

Risk: Medium

Understanding Level: Beginner

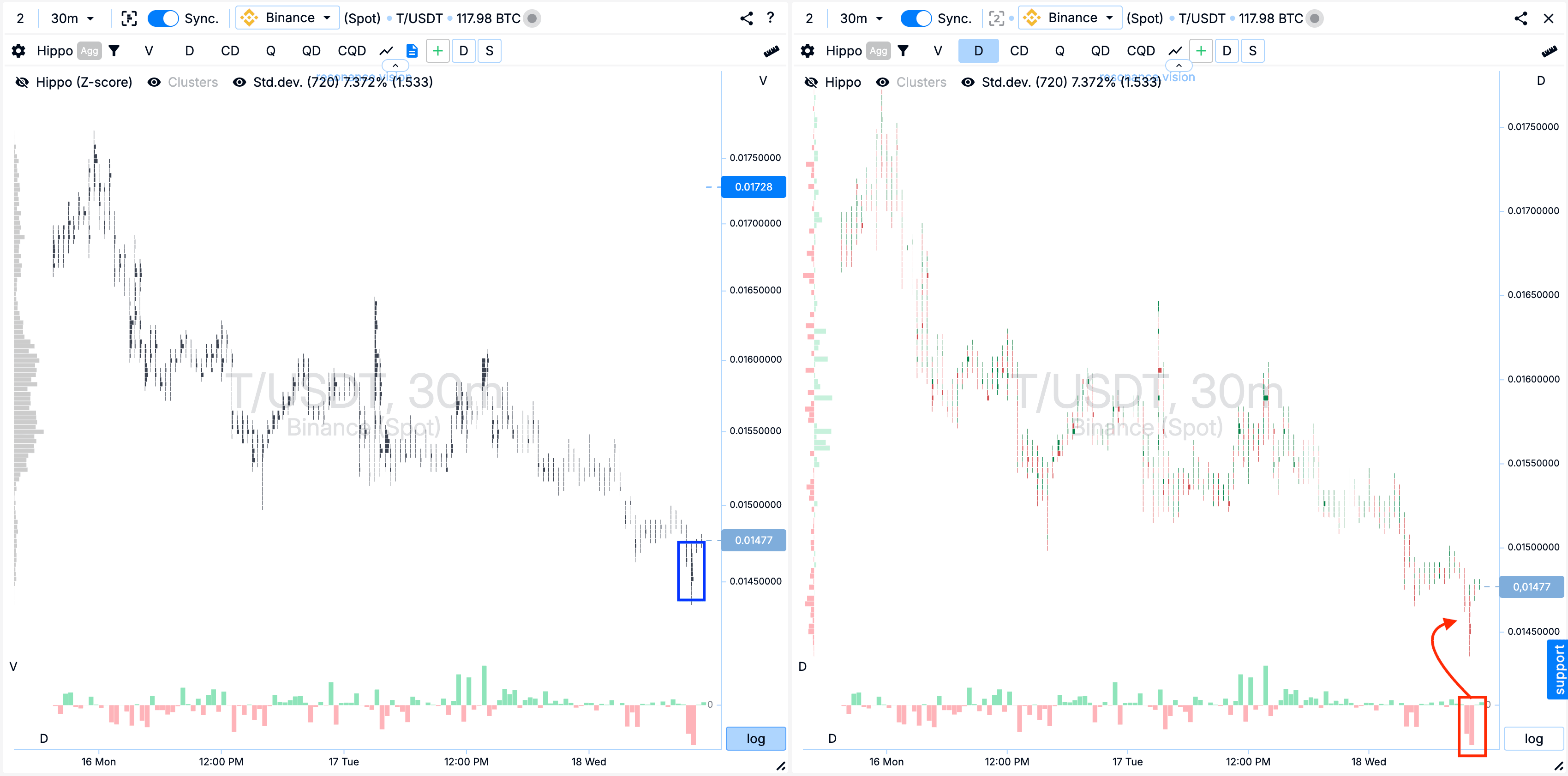

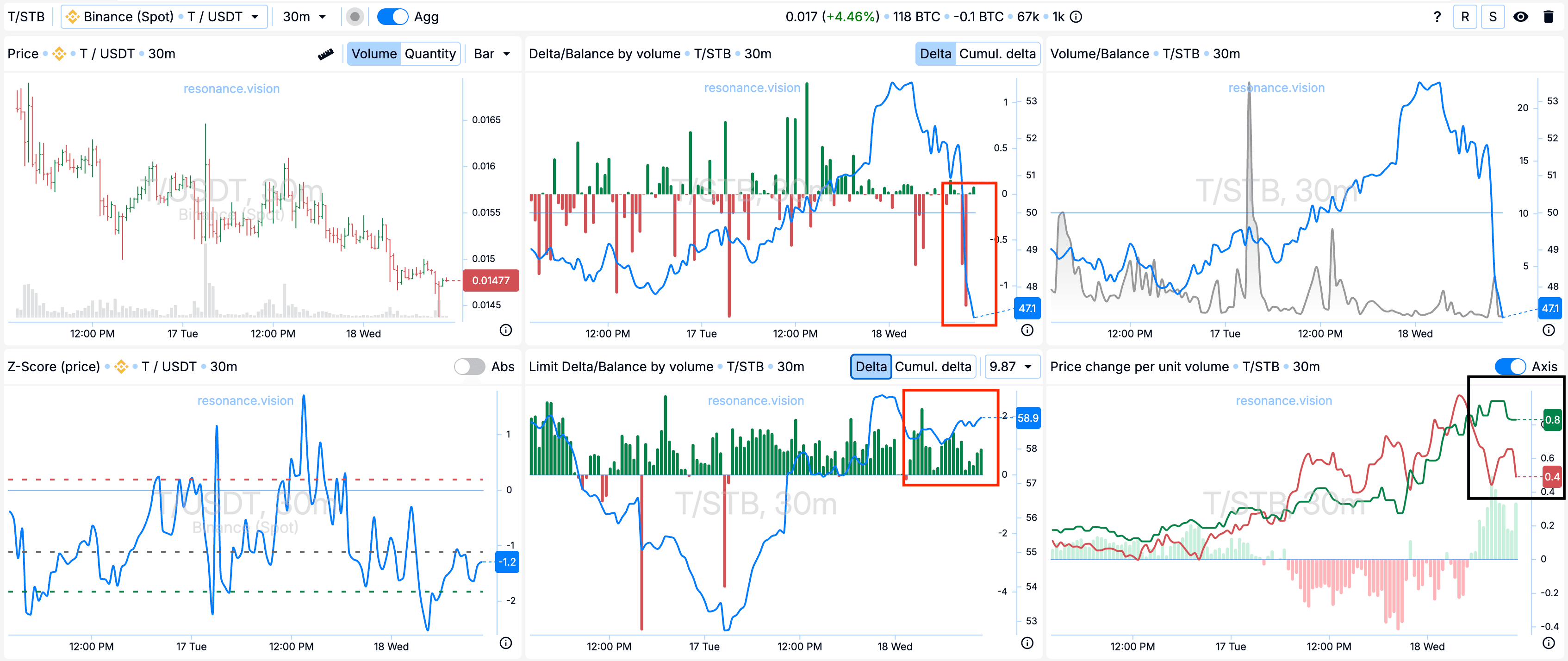

Reasons to Enter

Cluster Chart: Small but noticeable volume clusters (blue rectangle) formed on the decline, accompanied by large volume sales (red rectangle with an arrow). These sales caused a downward impulse, but the price quickly rolled back.

In Dashboard

Delta/Balance by Volume and by Limits: According to the aggregated data, market sales prevail on the market (red rectangle), however, buy orders dominate on limit orders, and the balance continues to shift upward (marked with a red square).

Change in price per unit of volume: The effectiveness of market order pressure began to diverge in favor of buyers - this is visually noticeable on the chart (black rectangle).

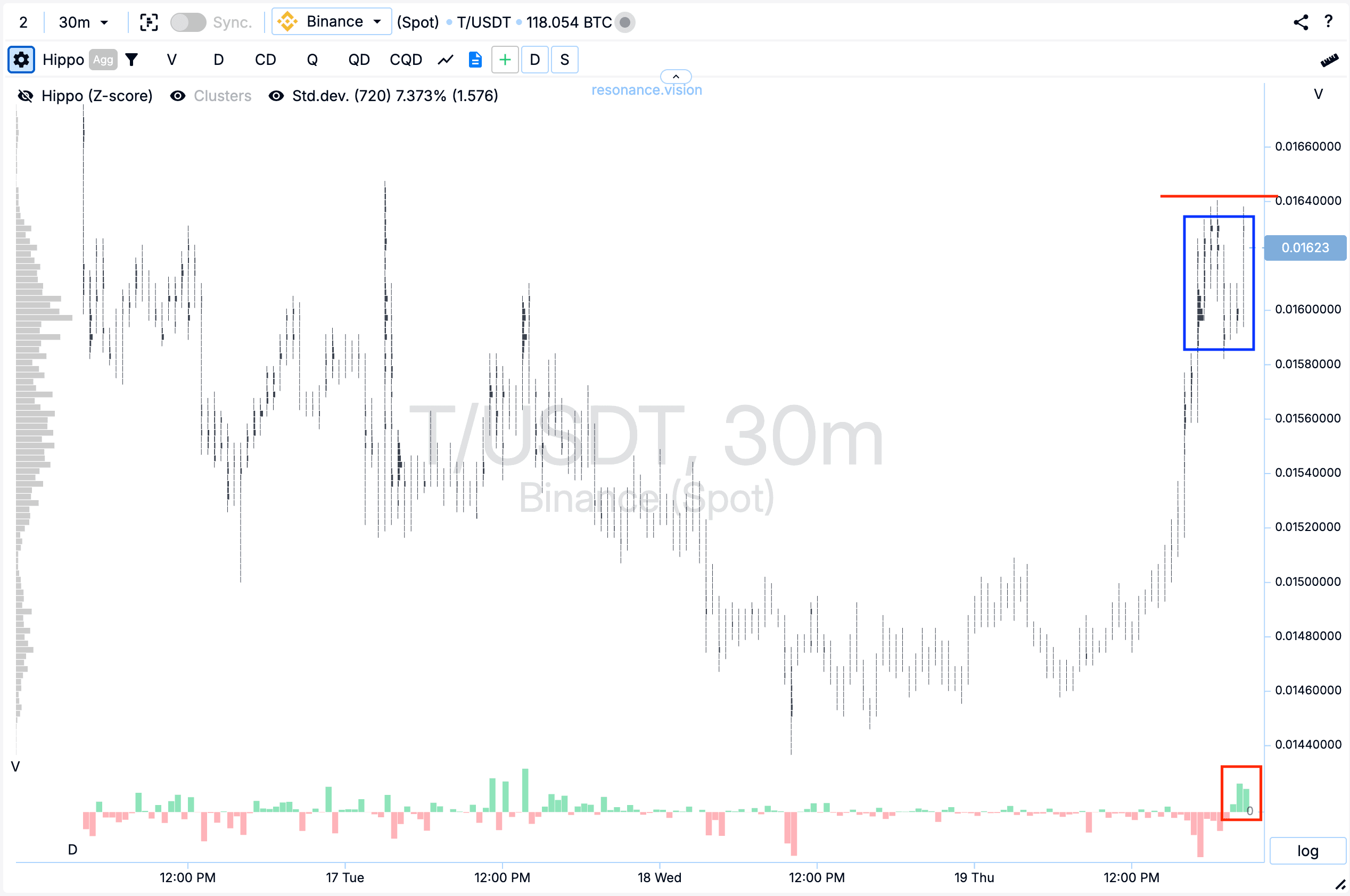

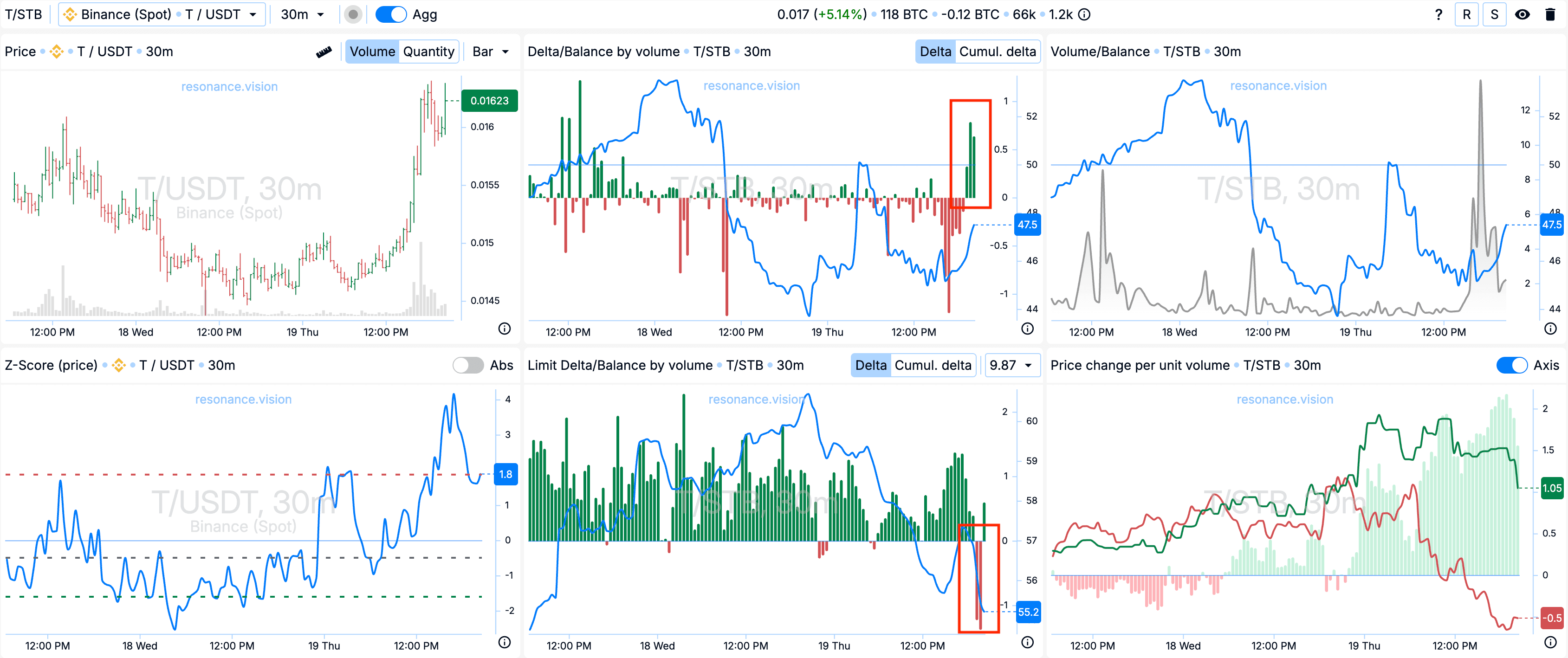

Reasons for exit

Cluster chart: Clusters by volume (blue rectangle) formed in the upper part of the range. At the same time, extreme purchases (red rectangle and line) do not lead to an update of the local maximum, which may indicate a decrease in purchasing efficiency and the potential formation of a local surplus.

In the Dashboard

Delta/Balance by volume and by limits: On the charts (marked with red rectangles) the market picture changes: aggregated for all pairs, there is a predominance of market orders for purchase, while for limit orders, orders for sale begin to dominate, this is evident from the limit delta, as well as from the balance shift towards sellers.

Result

We managed to secure a profit of +172.66%.

Conclusion

An example of a timely entry against the backdrop of ineffective market sellers and the activity of limit support. The price rebound after an impulse decline, stability in volume sales and increased efficiency on the part of buyers formed a logical entry point.

At the exit, the situation changed: the price growth slowed down, extreme purchases stopped giving results, and sellers began to dominate limit orders. Such dynamics signaled a potential change in initiative and the possible formation of a local surplus.

Follow new articles in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.