ALPACA +385.96% (Directional Strategy Resonance)

Analysis of a risky but profitable trade on ALPACA/USDT.

Despite the threat of delisting and centralized ownership of the issue, the cluster chart and indicators from the Dashboard showed signs of a local deficit - this provided a justified entry.

The decision to fix +385.96% of profit was made against the background of a sharp growth and possible manipulation.

An example of how even in unstable conditions, volume analysis and risk management can bring results.

Table of content

Coin: ALPACA/USDT

Risk: high

Understanding level: beginner

It is worth mentioning right away: the deal was risky, because the asset was among those that Binance plans to delist. This is a factor that can significantly affect liquidity and volatility.

It is also important to consider that, according to available data, the project team controls approximately 70% of the entire issue, which can significantly affect the price behavior.

Reasons for entry

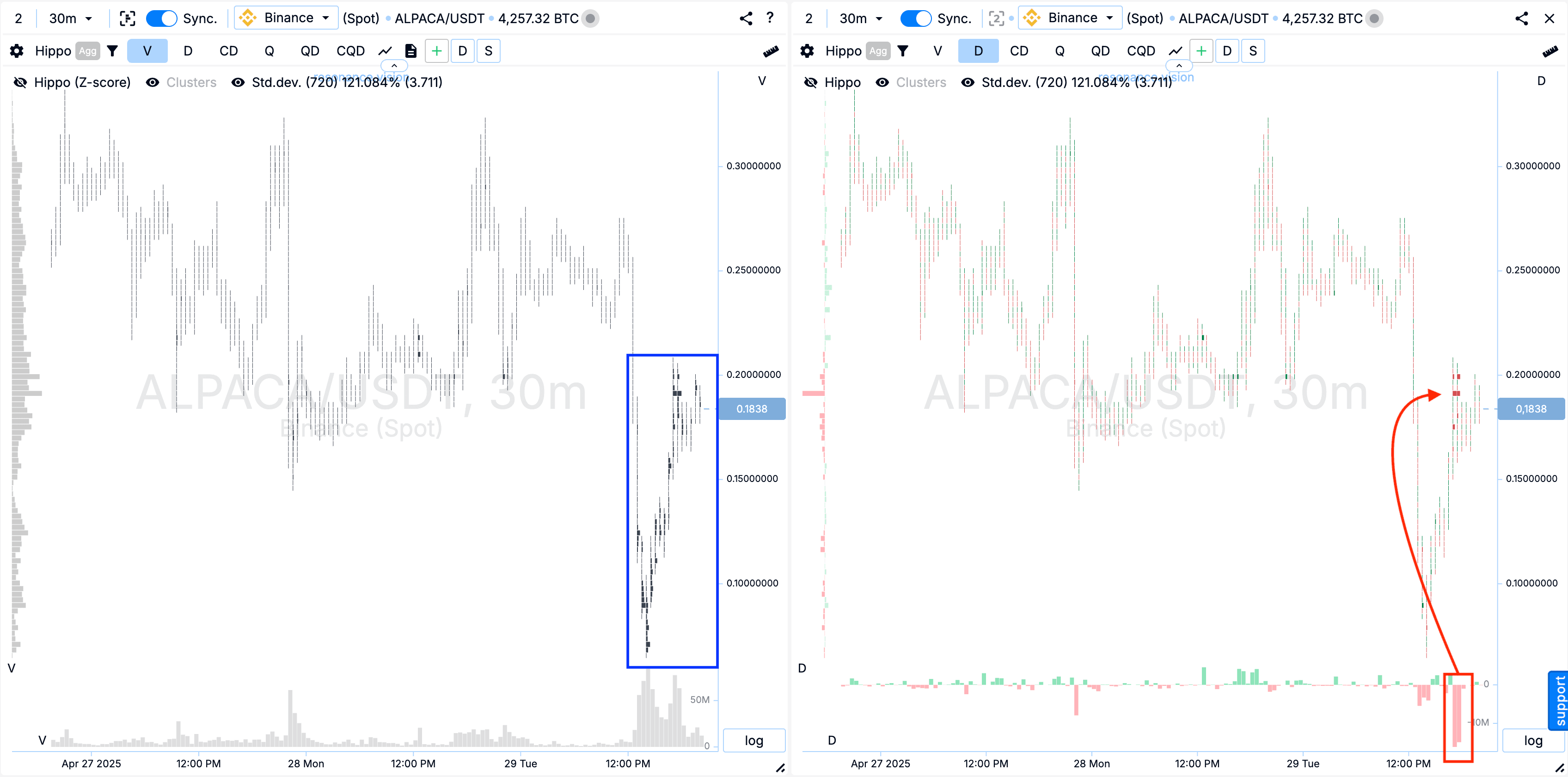

Cluster chart:

Noted that clusters by volume (blue rectangle) were formed. In which there were large sales, and the price on the marked sales no longer shows the result (red rectangle with an arrow).

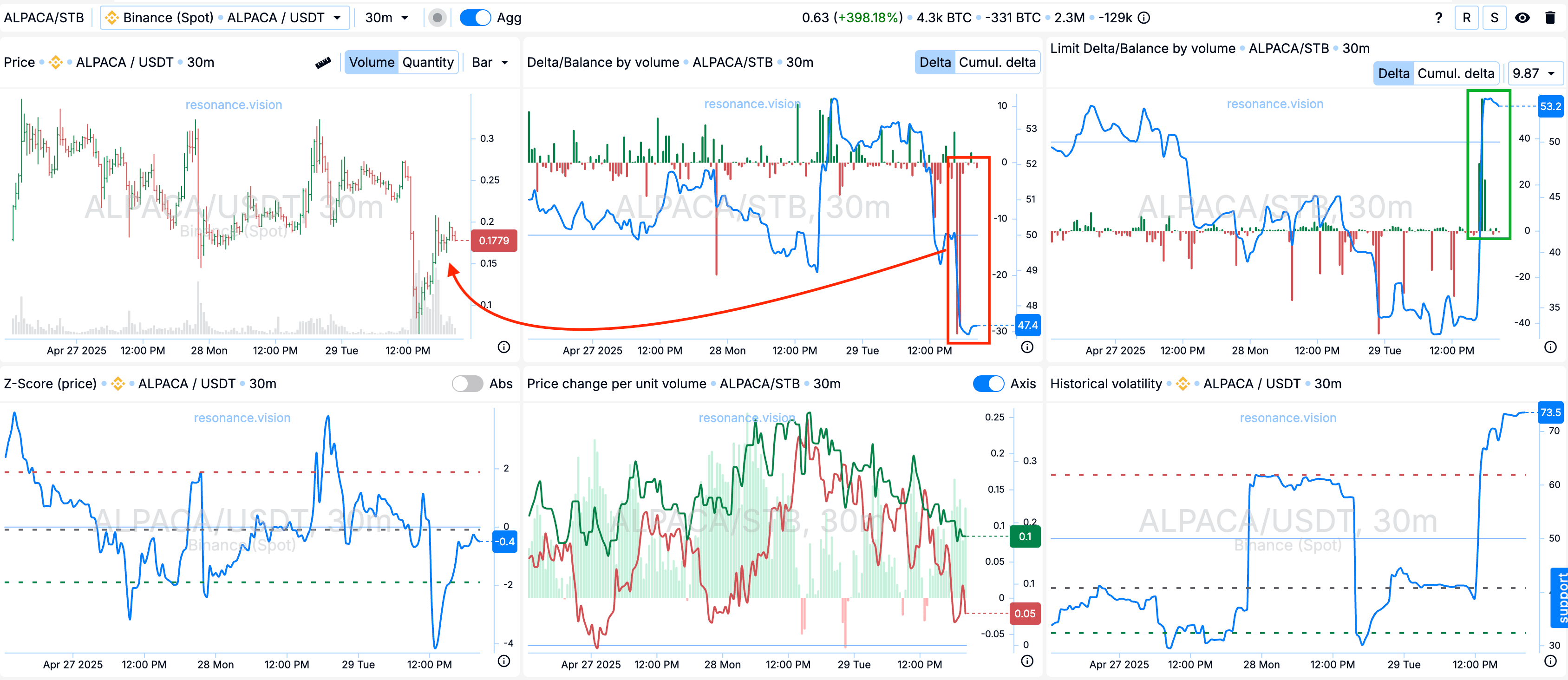

In Dashboard

Delta/Balance by volume: It is also clear that the market sales were working more in aggregate, and the price is not falling (red rectangle with an arrow).

Limit Delta/Balance by volume: At this point, we see a predominance of purchase orders by limit orders (green rectangle). Which potentially indicates that the market sales are being held by limit orders. There is probably more volume in limit orders for purchase.

Reasons for exit

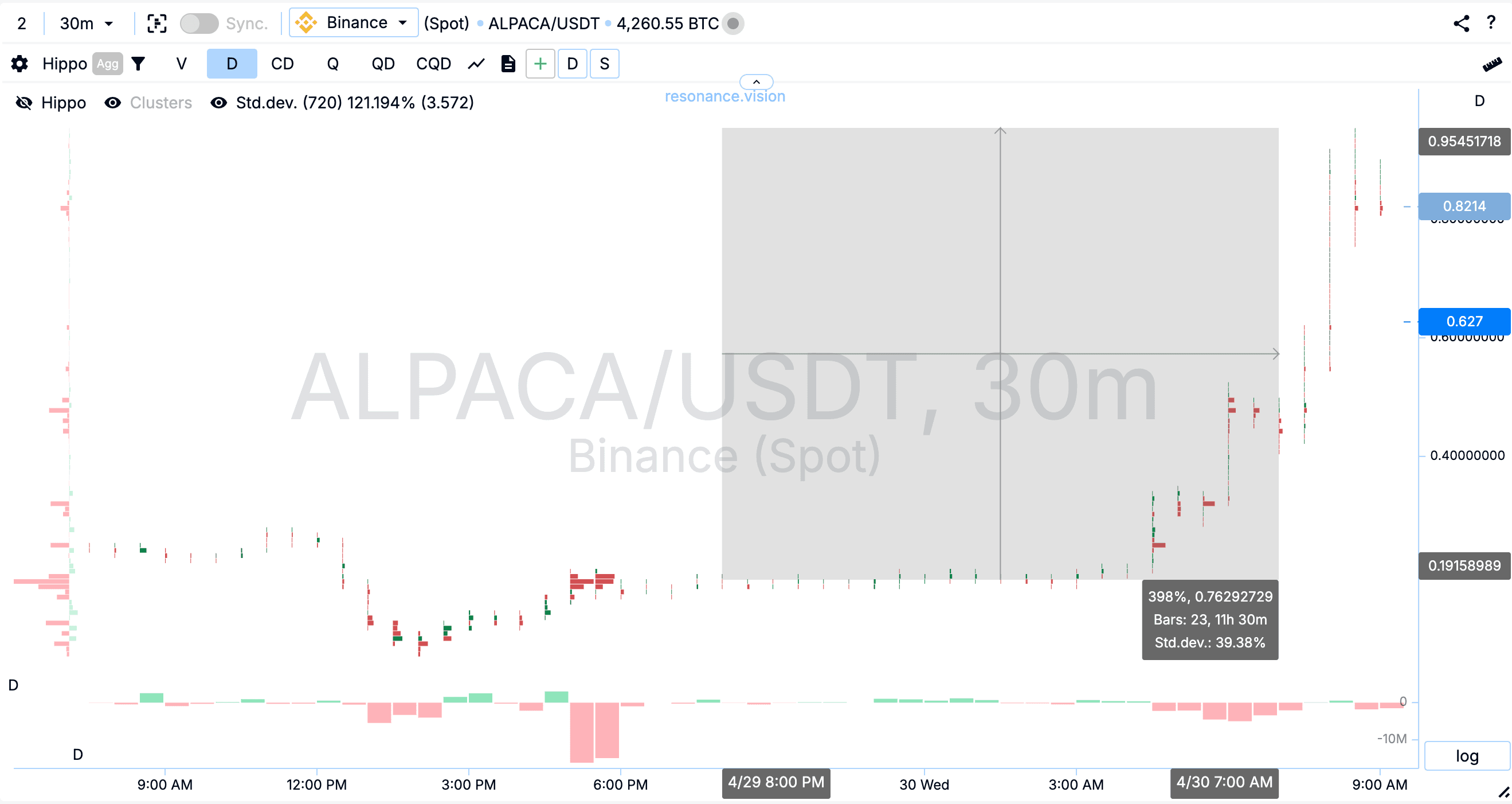

Cluster chart:

Considering potential volatility and the likelihood of manipulation, it was decided not to take risks and fix the entire position. Moreover, the price went almost +400% from the entry point - an excellent result that should not be jeopardized.

Result

We managed to fix the profit in the amount of +385.96%, and the R/R was 1/16.

Conclusion

Despite the increased risks associated with the upcoming delisting and high concentration of emissions in the hands of the project team, the ALPACA/USDT deal was successful.

The entry was justified by a combination of cluster volumes and confirming indicators for limit and market data, which indicated the formation of a local deficit.

However, in the conditions of possible manipulation and limited liquidity, it was reasonable not to delay the exit. The decision to take profit after the impulse movement of +385% allowed not only to preserve the result, but also to minimize the risks of an unpredictable rollback.

This is a clear example of how a strategy based on volume analysis and reasonable risk management can bring significant results even in unstable conditions.

Follow new articles in our telegram channel.

No need to invent complex schemes and look for the “grail”. Use the tools of the Resonance platform.

Register using the link - get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.