TWT +22.9% (Directional Strategy Resonance)

In this trade, I relied on cluster analysis and Dashboard data: large market sell-offs failed to push the price down, indicating a shortage and active limit buyers. This became the key to entry. The final twist was a surge in selling volumes and increased volatility—a signal to lock in the result and take profits in time.

Table of content

Coin: TWT/USDT

Risk: Medium

Skill Level: Beginner

Entry Reasons

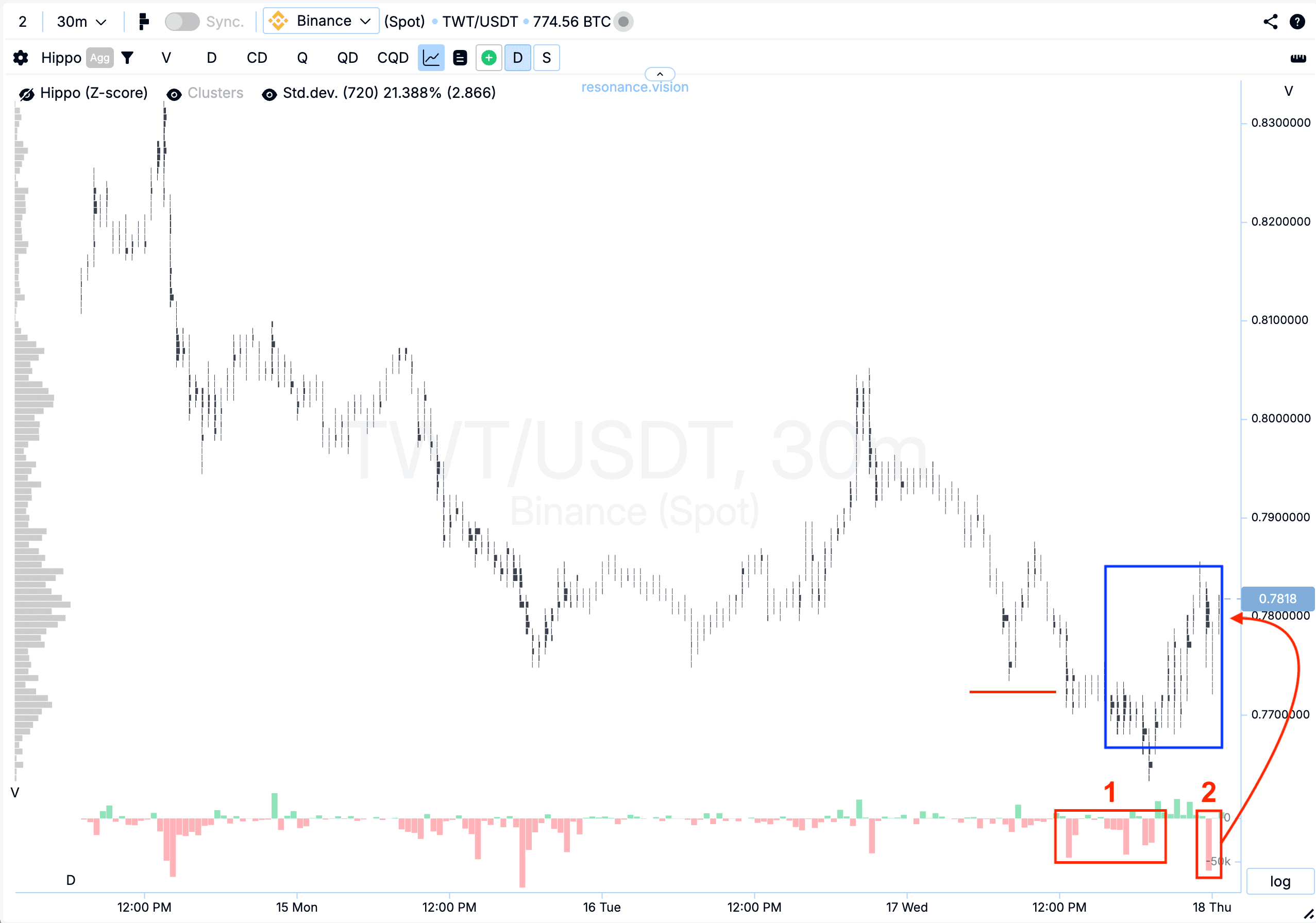

Cluster Chart: Volume clusters began to form (blue rectangle). The first waves of selling (red rectangle #1) didn’t meaningfully update the local low (marked by the line), already signaling reduced selling pressure. A second round of selling (red rectangle #2) also failed to push the price lower — instead, the price started to rise. This dynamic pointed to the formation of a local deficit and growing buyer interest.

On the Dashboard

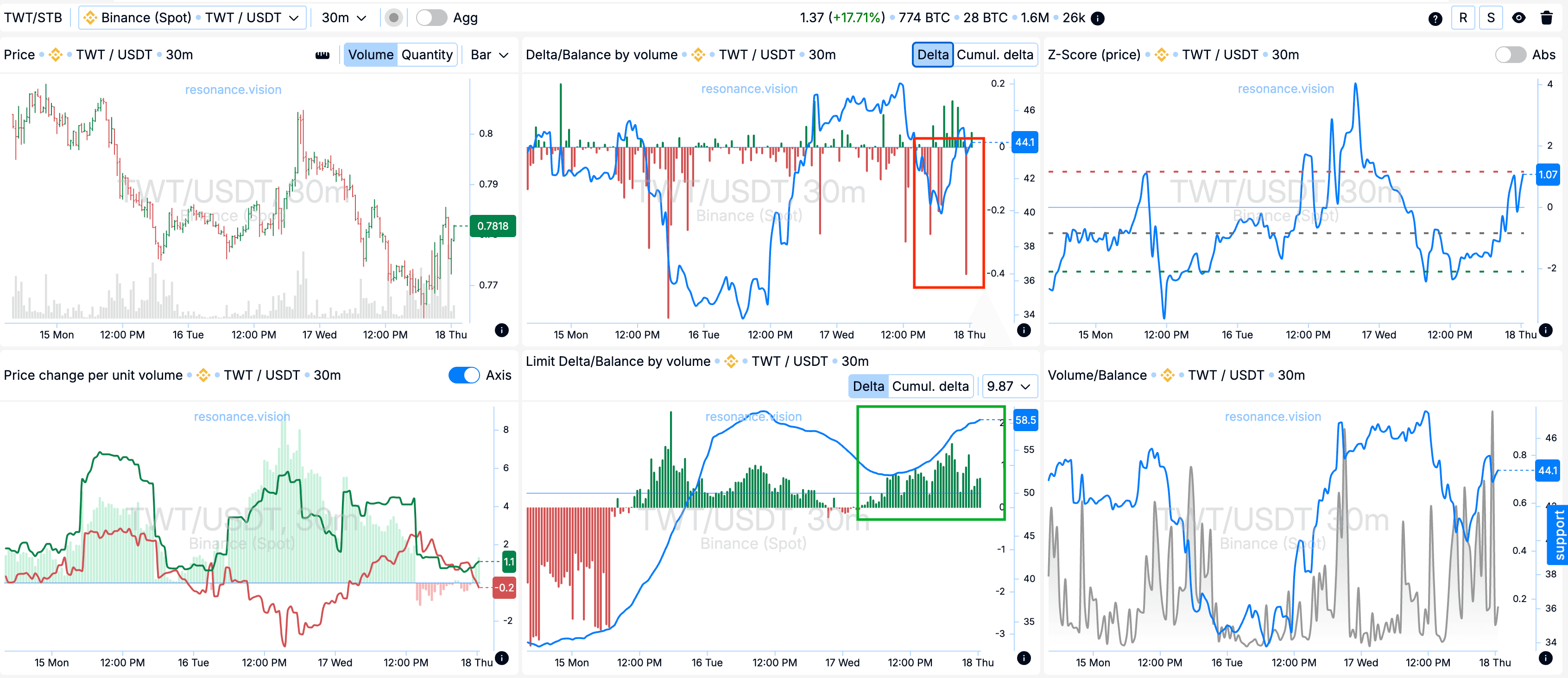

Delta/Volume Balance & Limit Delta: Aggregated data showed a clear dominance of market selling — clearly visible in the delta histogram (red rectangle). Yet, the price wasn’t moving down, which suggested weakening influence from sellers.

Additionally, limit orders revealed rising buyer activity: buy-side limit orders were steadily being placed in larger volumes (green rectangle). This indicated strong presence of limit buyers ready to absorb market selling pressure.

Exit Reasons

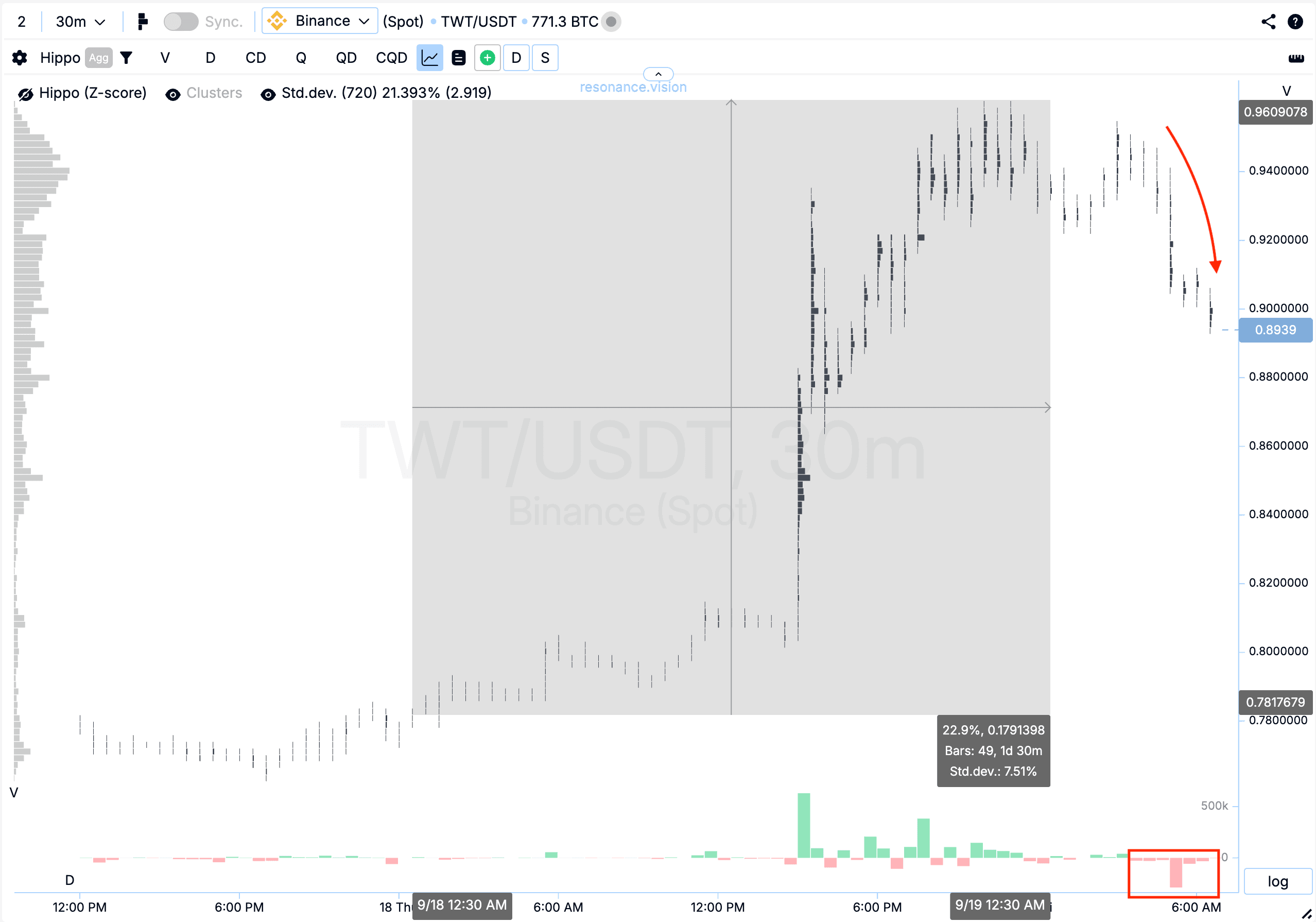

Cluster Chart: From the entry point, the price gained another 23%, which is already an excellent result. However, volatility also increased noticeably, while selling volumes started to dominate, pushing the price lower (rectangle and arrow). In these conditions, holding further would carry increased risk, making profit-taking the most rational choice.

Conclusion

This trade is a strong example of how combining cluster analysis with Dashboard data helps uncover imbalances between buyers and sellers. Despite clear dominance of market selling, the price held steady, signaling a local deficit and willingness from participants to absorb the supply. Additional confirmation came from the growth of limit buy orders actively soaking up sell pressure.

On the exit, the key signals were increased volatility and stronger selling volumes — both pointing toward reduced buyer initiative and rising risk. Closing at this point allowed securing profits while avoiding unnecessary exposure.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.