UNI +26.2%. Day Trading (Resonance Directional Strategy)

A fast UNI trade based on supply/demand logic: selling pressure is present, but there’s no result. Clusters and limit activity — step by step.

Table of content

A very fast trade. Perfect for those who trade intraday (day trading). The focus is on traded volumes and limit activity — everything the cluster chart shows.

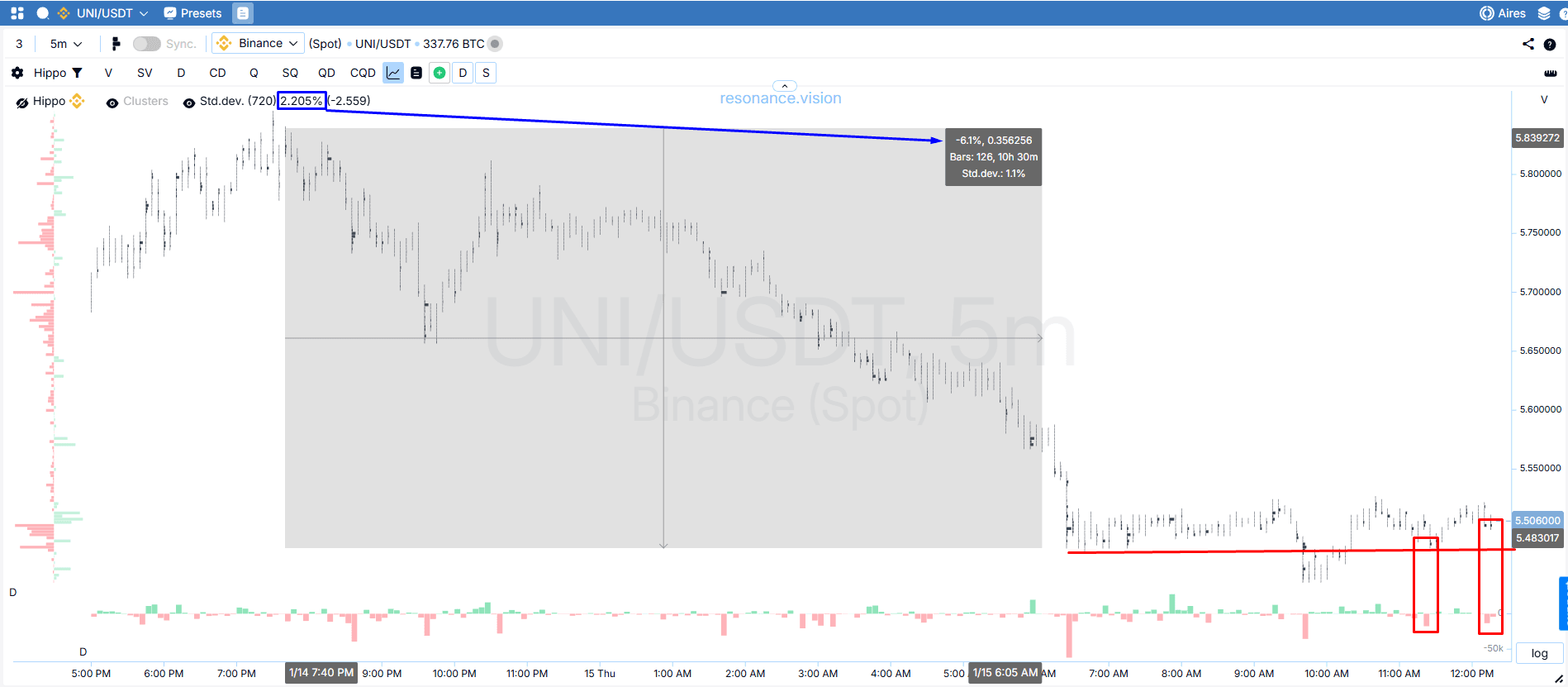

The coin was selected via a crypto screener on the 5-minute timeframe. What stood out was the sharp drop in the asset and the dominance of selling that stopped impacting price. When pressure is present but there is no result, it means demand is absorbing supply.

Reasons for entering the position

Cluster chart: the coin’s price drop and the subsequent “break in selling efficiency”

The asset dropped by 6%, which corresponds to 3 standard deviations (blue arrow).

A range started to form on the cluster chart (red line), and it is clearly visible that selling is being held back by limits, while local lows are not being updated (red rectangles).

This often indicates a local deficit and increases the probability of a rebound. This is exactly where the entry was made — with a very tight stop behind the last area where selling was held.

Reasons for exit

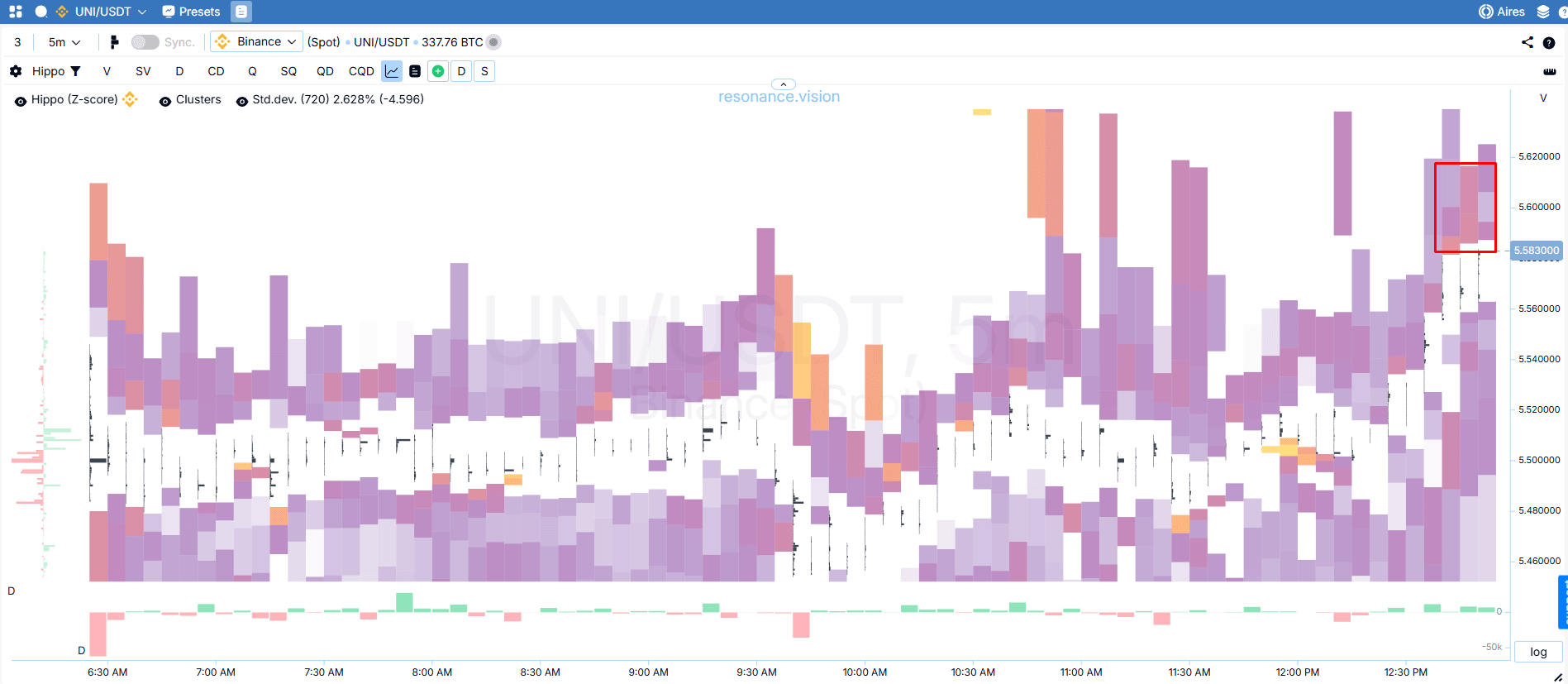

Heatmap: as price moved up, sell limits began to appear (red rectangle). The decision was made to close the position: limit orders will hinder further progress, and this increases the probability of a pullback in the asset.

Trade result

We may have captured only 1.3% of clean movement, but thanks to the tight stop, the risk/reward ended up greater than 1:2.

After the sharp drop, we saw the formation of a local deficit — by assessing the impact of volumes on price. The entry was executed on selling inefficiency.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.