USTC +78.73% (Resonance Directional Strategy)

USTC/USDT deal analysis: how signs of local deficit and limit buyer activity helped to take +78.7% of the movement and lock in profits in time.

Table of content

Coin: USTC/USDT

Risk: Medium

Skill level: Beginner

Entry reasons

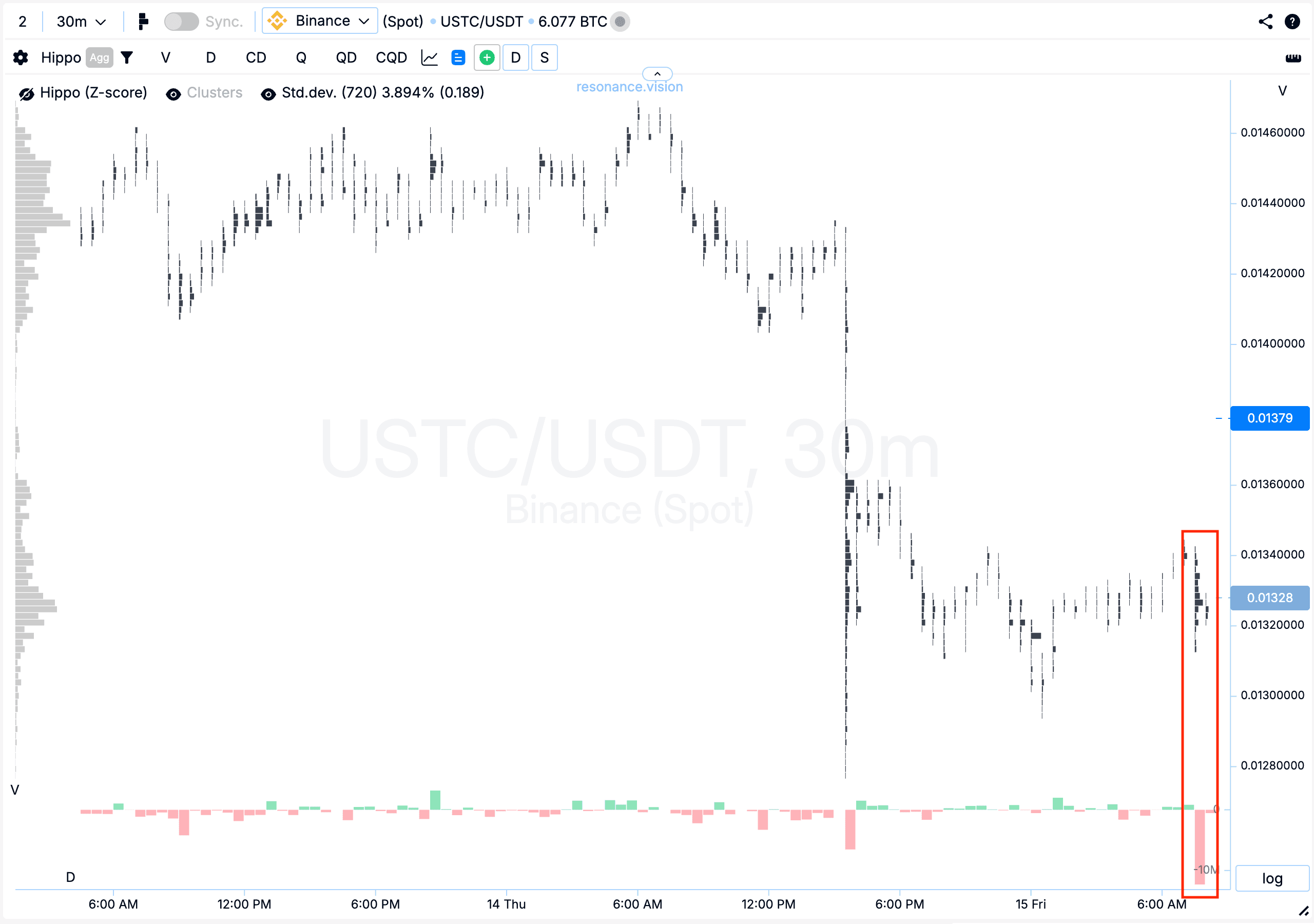

Cluster chart: After an impulse decline, significant volumes started to accumulate. Delta clearly showed that sales dominated (red rectangle), yet the price did not continue falling as expected. Selling pressure without price reaction indicates signs of a local shortage.

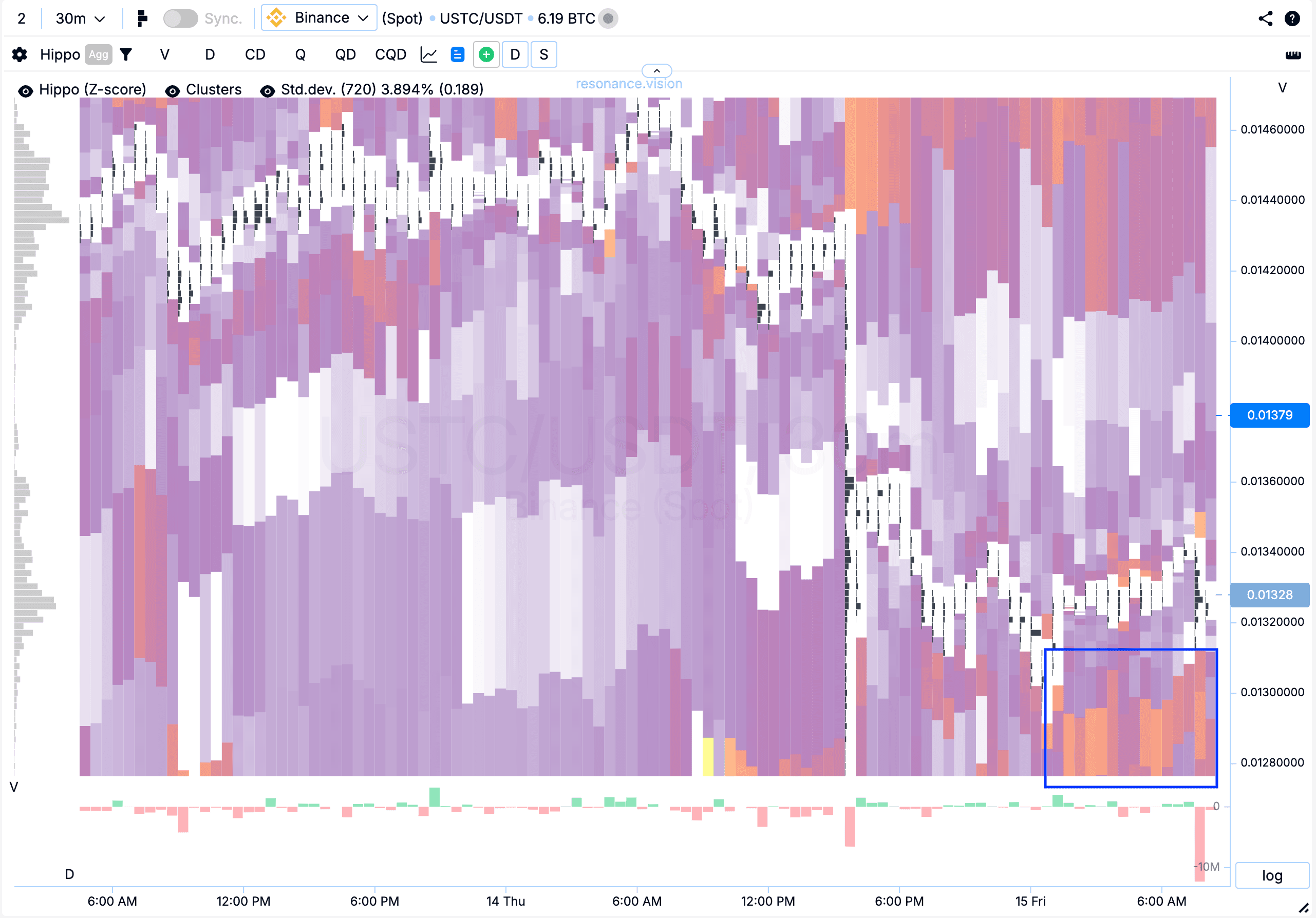

Heatmap (Z-Score): In the lower part of the range, strong limit clusters (blue rectangles) started to form. Such limit activity indicates support — participants were ready to absorb volumes and hold the price in the current range.

In the Dashboard

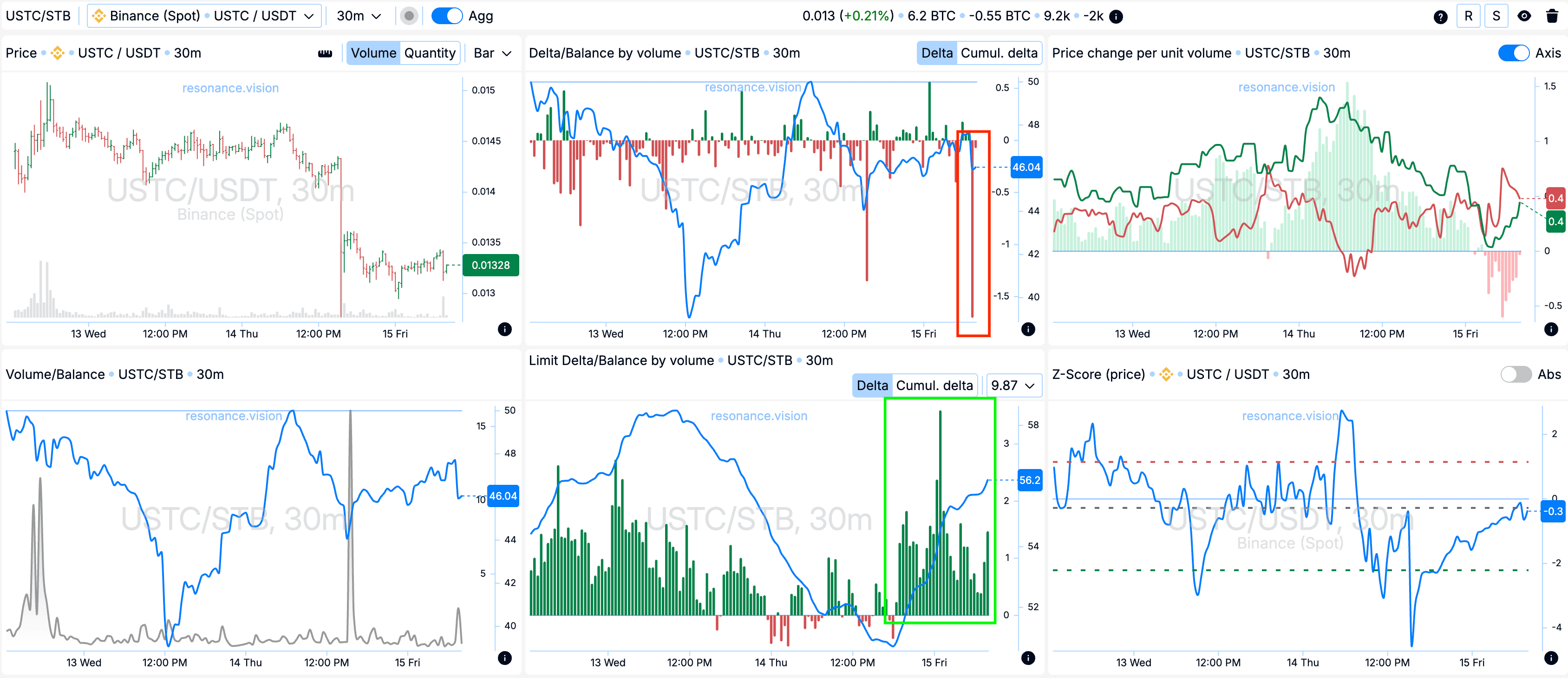

Delta / Volume balance & Limit delta: Aggregated data show a surge in market sales — clearly reflected in the delta histogram (red rectangle). However, despite such pressure, the price stayed stable and did not decline, as noted earlier.

Additionally, after the impulse drop, limit orders started to grow — visible in the positive limit delta dynamics (green rectangle). This behavior suggests dominance of limit buy orders and willingness to actively absorb sell volumes in this price range.

Exit reasons

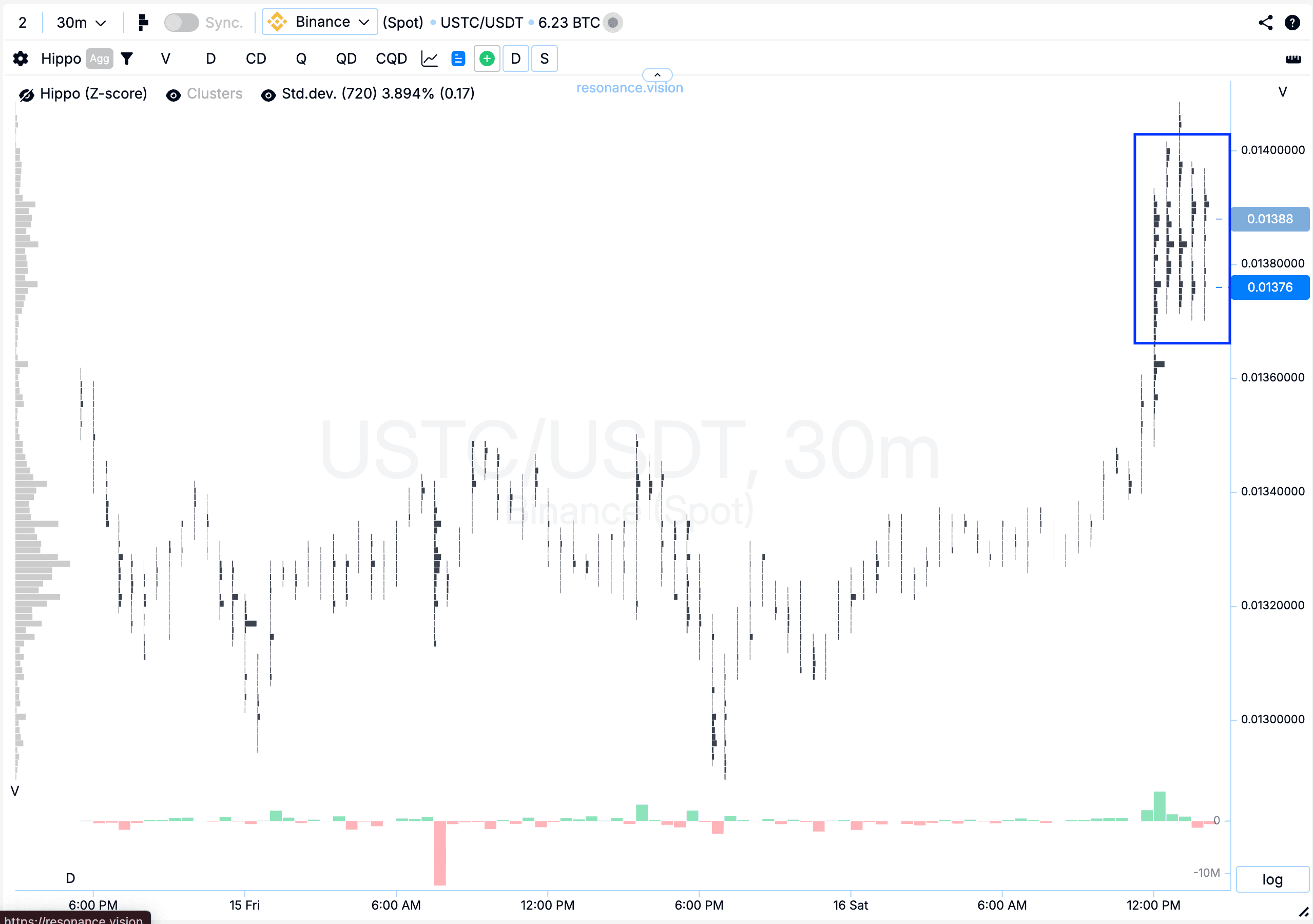

Cluster chart: On the rally, large volume clusters began forming, accompanied by noticeable volatility (blue rectangle). This added risk to holding the position.

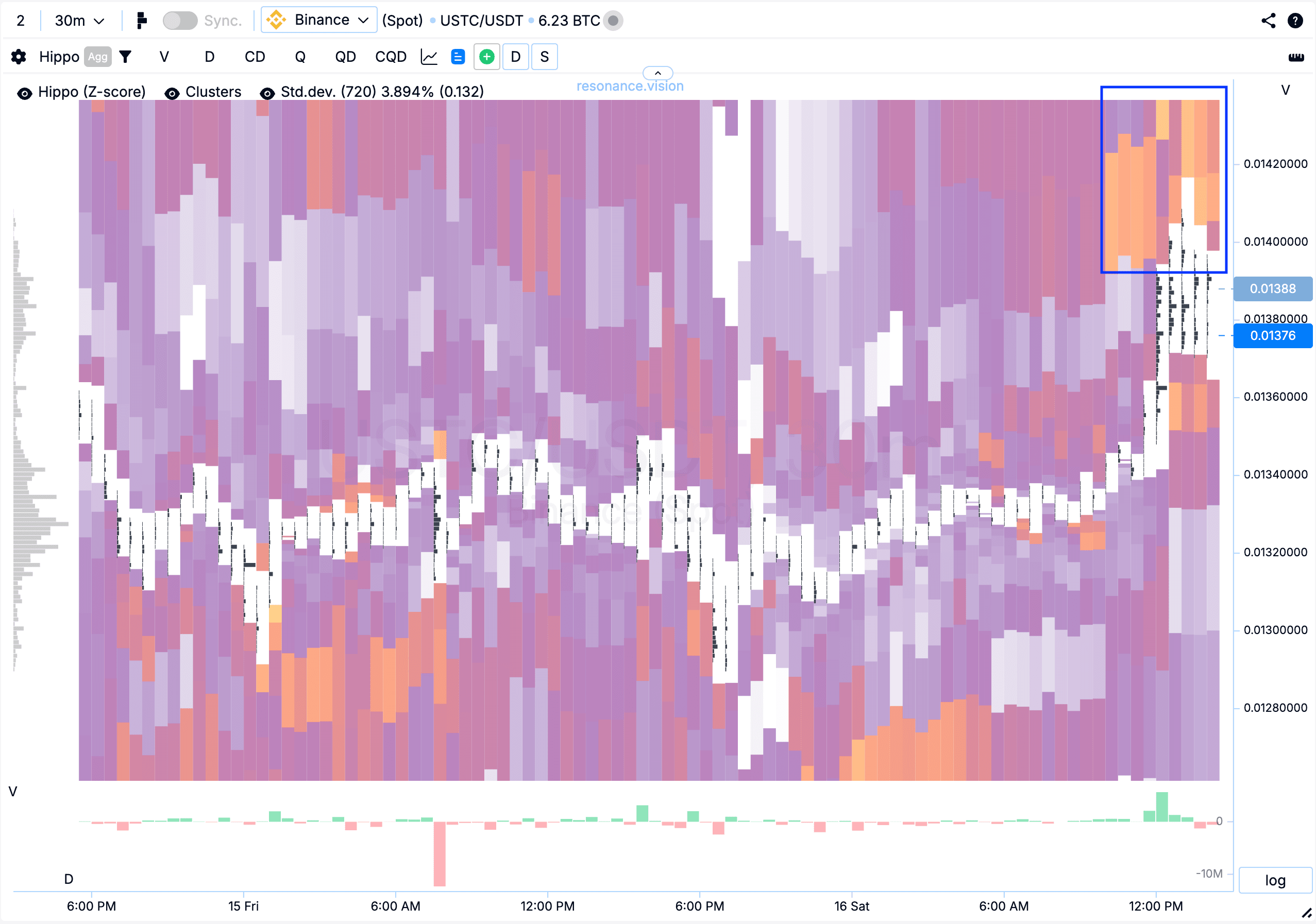

Heatmap (Z-Score mode): Strong limit clusters (blue rectangles) began forming above. Such limit activity may indicate meaningful resistance in the current range.

Result: Managed to lock in +78.73% profit.

Conclusion

This trade was built on clear signs of a local shortage and active limit buying. Despite significant market selling, the price did not fall, confirming seller weakness and the presence of support in the range.

On the rally, the picture shifted: the emergence of large volume clusters and rising volatility indicated higher risks in holding. Additionally, new limit clusters forming above pointed to potential resistance.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.