VIRTUAL +393.26% (Directional Strategy Resonance)

The analysis examined a situation where, during a decline, buyers began to show local initiative: sellers were pressuring the market, but the price barely responded, indicating a weakening of pressure and the first signs of a shortage. Subsequently, aggregated data confirmed a decrease in selling and a shift in the balance toward buying. During the rise, the price showed increased volatility and the formation of large clusters, and market buying gradually began to shift to selling—a signal of weakening initiative. Under these conditions, fixing the position became the optimal and rational decision.

Table of content

Coin: VIRTUAL/USDT

Risk: Medium

Understanding level: Beginner

Entry Reasons

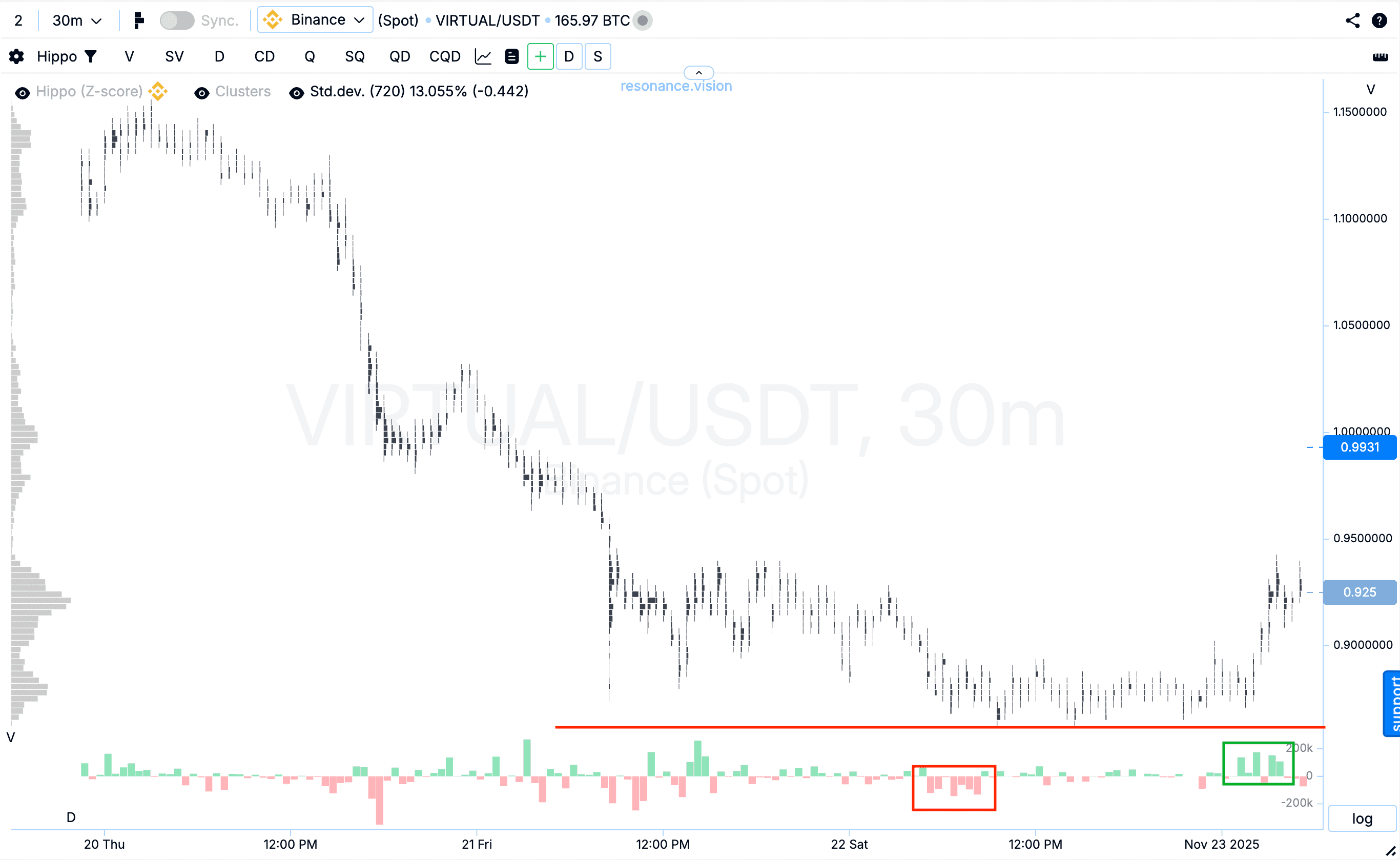

Cluster chart: during the decline, it becomes clear that despite the selling pressure, the price barely reacts and does not move lower (red rectangle and line). Then buy orders start to appear, pulling the price upward and demonstrating a shift of initiative toward buyers (green rectangle).

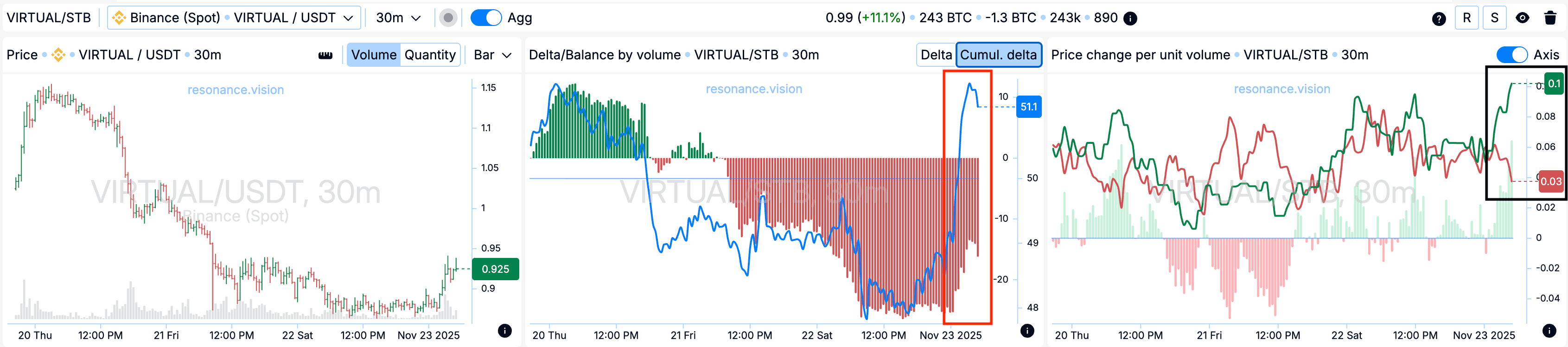

In the Dashboard

Delta / Volume Balance: aggregated data across all pairs and exchanges shows that market selling dominated during this period — clearly reflected by the cumulative delta. However, the selling volume gradually decreased, and the balance began shifting toward buying (red rectangle). This dynamic suggests a likely weakening of sellers and a transition of control to buyers.

Price per unit of volume: the efficiency of market orders started to shift in favor of buyers (black rectangle), adding another argument for opening a long position.

Exit Reasons

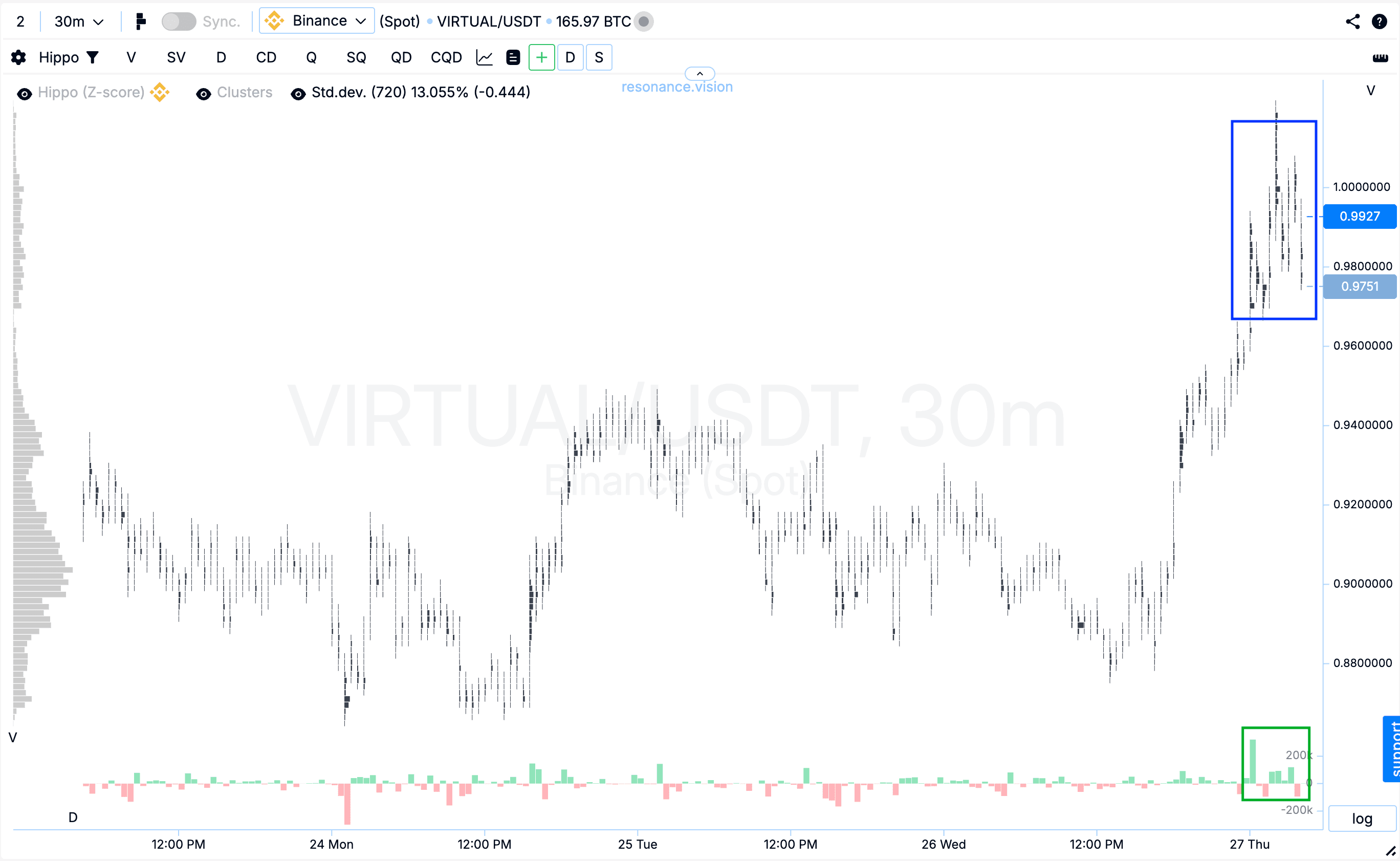

Cluster chart: during the upward movement, large volume clusters began to form while volatility increased (blue rectangle). At the same time, market buying was gradually replaced by selling (green rectangle), which triggered a pullback. In this situation, closing the position was the optimal decision — high volatility and weakening buyer initiative significantly increased the risk of further holding.

Result

As a result, a profit of +393.26% was secured.

Conclusion

The trade on VIRTUAL is a strong example of how combining cluster analysis, aggregated data, and volume efficiency metrics helps you enter at the moment sellers weaken and exit when buyers are truly losing strength.

We observed a shift in market balance, identified deficit signs during the decline, and entered once buyers took control.

The subsequent price movement confirmed the scenario, allowing the trade to be executed calmly and with discipline: securing profits on time and avoiding unnecessary risk. This is a great demonstration of how a systematic approach helps not only to find entry points but also manage exits effectively to preserve results.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.