YGG +93.6% (Resonance Directional Strategy)

The YGG/USDT coin demonstrated a clear example of a reversal after a localized shortage of sellers. The entry was confirmed by cluster analysis and aggregated data, including an abnormal Z-Score deviation and low volatility. After a near-100% surge, a decline in the effectiveness of buys signaled profit-taking and exit.

Table of content

Coin: YGG/USDT

Risk: Medium

Understanding level: Beginner

Reasons for Entry

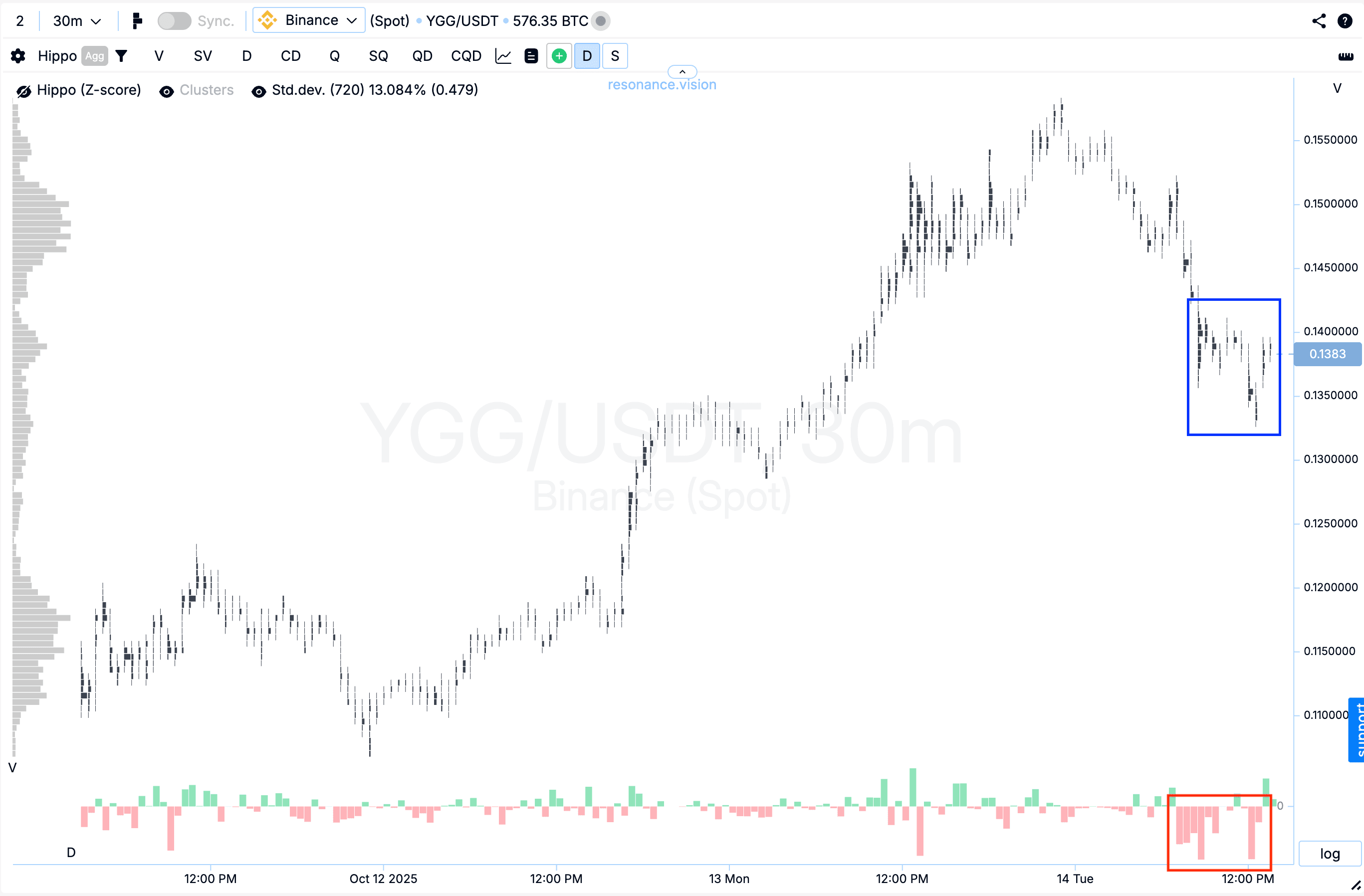

Cluster Chart: During the pullback, large volume clusters started forming (blue rectangle) with a clear dominance of sell volumes inside (red rectangle). However, the price barely reacted and failed to update the local low, indicating a local supply shortage and weakening selling pressure.

In the Dashboard

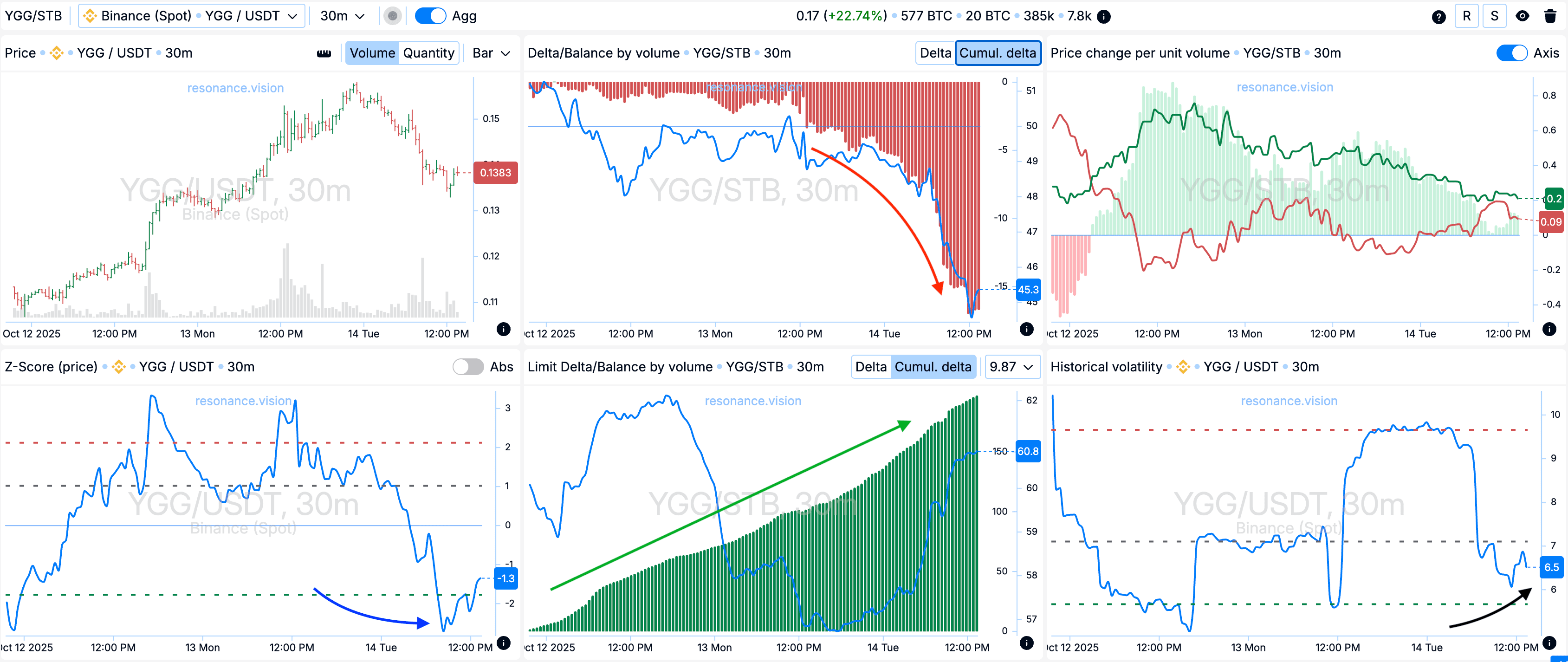

Delta/Volume Balance and Limit Delta: Aggregated data shows a significant increase in sell volumes across all pairs and exchanges, clearly visible on the cumulative delta histogram (red arrow). Yet, despite this selling pressure, the price did not continue to decline — consistent with what was observed on the cluster chart.

At the same time, limit order data shows active placement of buy orders — the cumulative limit delta histogram (green arrow) indicates that buy limit orders are likely absorbing the entire selling flow, preventing further price decline.

Z-Score (Price): At the local low, the price deviated downward by more than two standard deviations (blue arrow). Such anomalies often signal a potential local reversal and the start of upward movement.

Historical Volatility: Currently remains at low levels (black arrow), which often precedes an increase in volatility and the formation of a strong price move.

Reasons for Exit

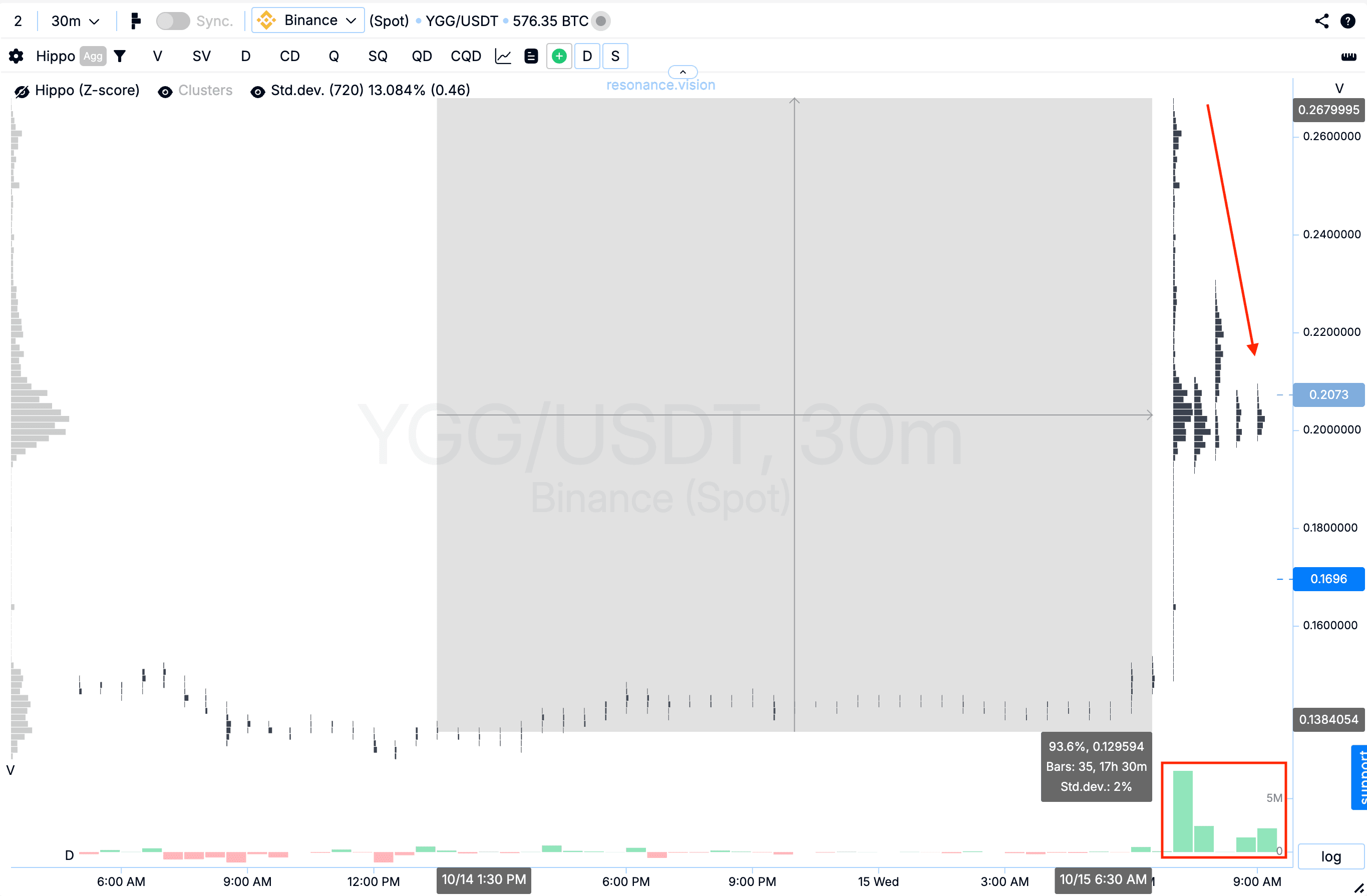

Cluster Chart: After an almost 100% impulsive rise, the price formed a strong pullback. At that moment, delta data showed that market buys continued, but they no longer had a meaningful impact on price (red rectangle and arrow). This dynamic signals decreasing buying efficiency, meaning further holding of the position would be irrational.

Conclusion

The entry was based on a combination of local supply shortage signs and weakening selling pressure, confirmed by both cluster and aggregated data. Additional signals — such as an abnormal Z-Score deviation and low volatility — increased the likelihood of a reversal movement forming.

The impulsive rally validated the accuracy of the multi-layered analysis. However, the subsequent pullback and weakening price reaction to buying activity indicated reduced efficiency. Closing the position at that stage allowed profit fixation before a potential correction or further decline.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.