ZEN +216.31% (Resonance Directional Strategy)

Analysis of the ZEN/USDT deal: how to recognize a decrease in buyer efficiency and take profits in time.

In the article, we analyze the moment when powerful market purchases stop pushing the price up, and increasing limit support signals a change in priority in the market.

This case clearly shows why it is not enough to look only at the price - you need to consider clusters, delta and limit orders.

Deal result: +216.31% profit with proper fixation against the background of changing supply and demand.

Table of content

Coin: ZEN/USDT

Risk: low

Understanding level: beginner

Reasons to enter

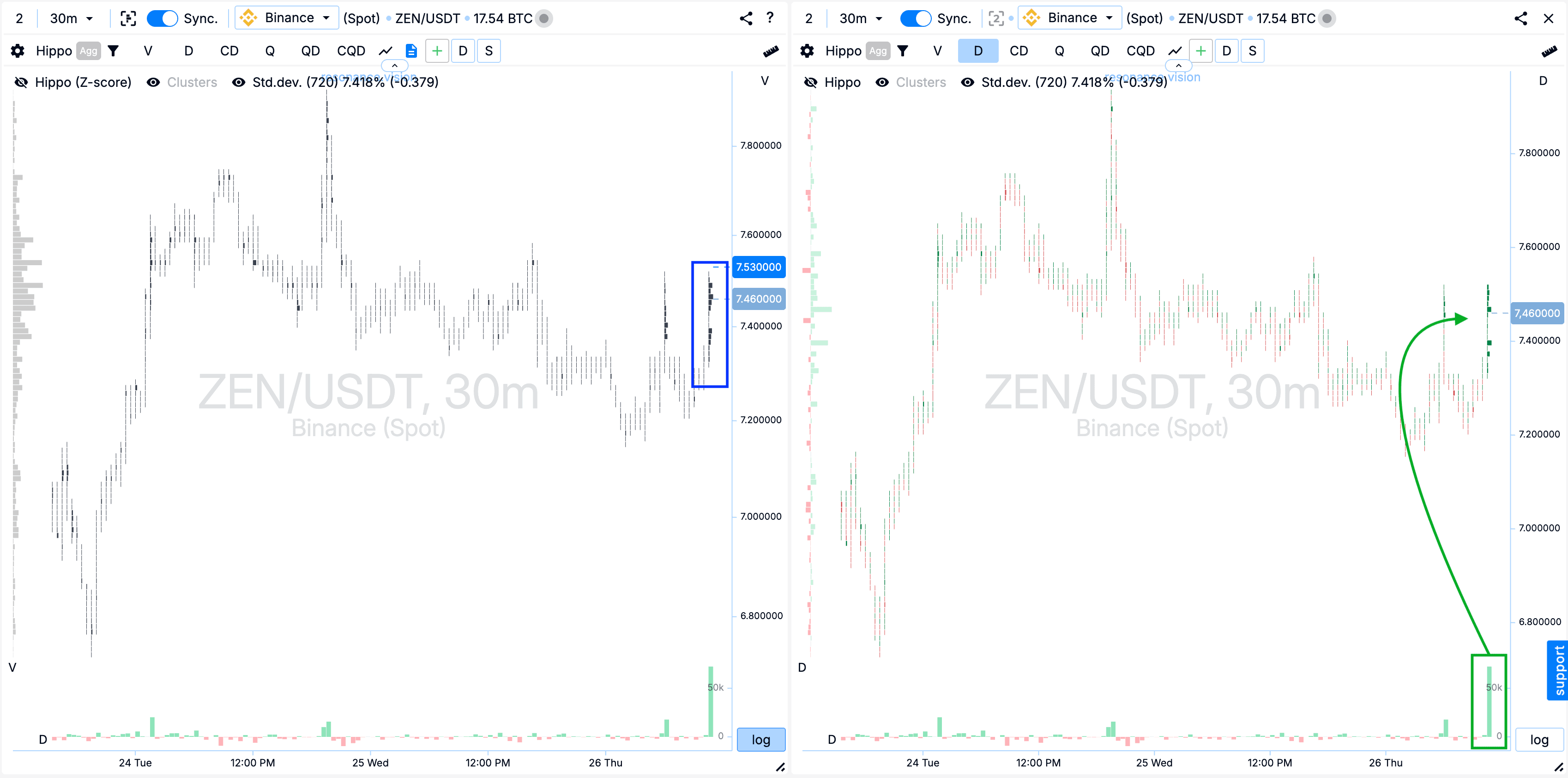

Cluster chart: During the repeated upward impulse movement, clusters by volume were formed (blue rectangle). The movement was accompanied by significantly larger purchases compared to the previous impulse - this is confirmed by the delta (green rectangle with an arrow). However, despite the increase in volumes, it was not possible to update the previous maximum. Such a reaction may indicate a decrease in purchasing efficiency and an unsuccessful attempt to seize the initiative.

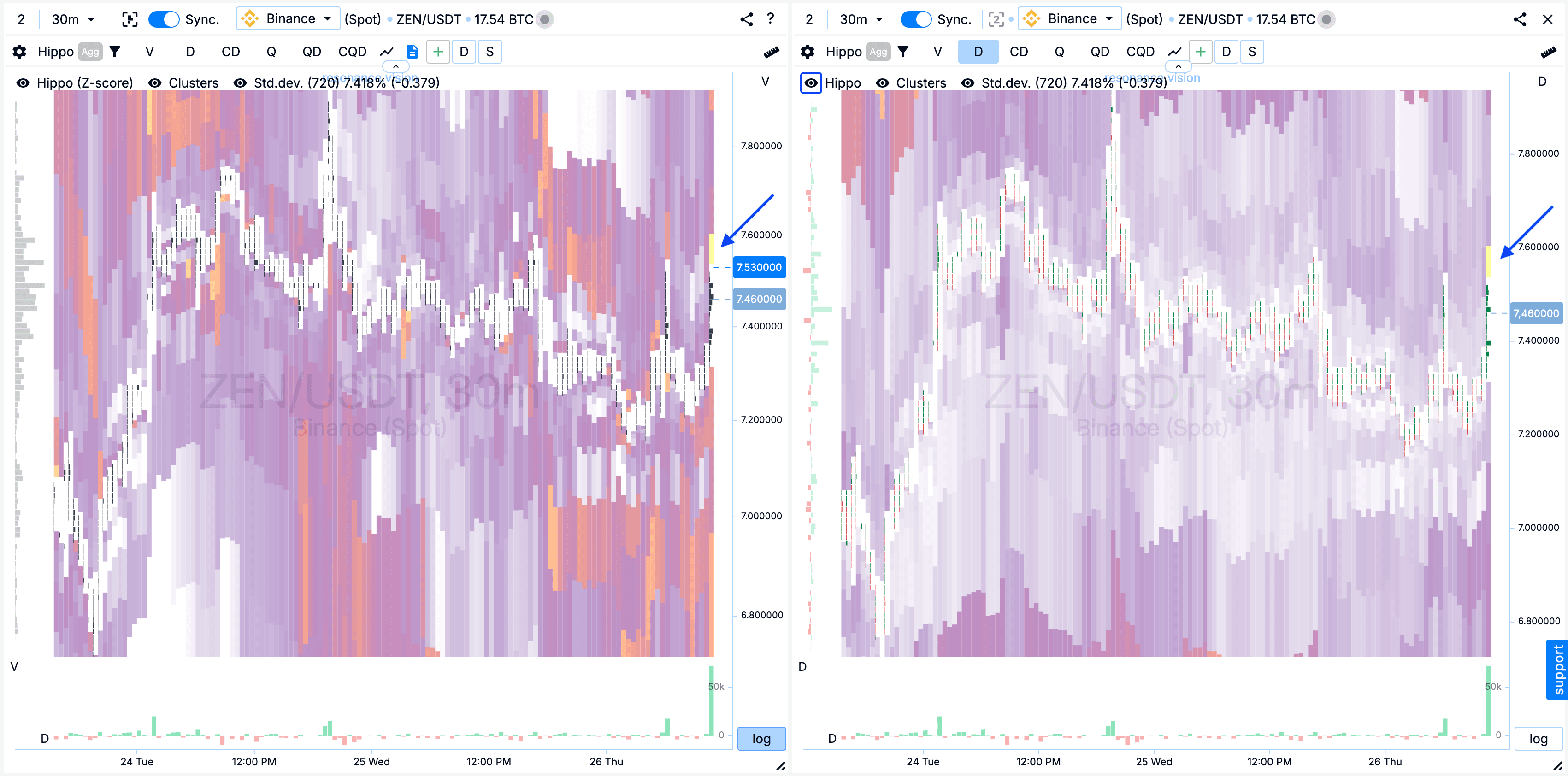

Heat map in Z-Score mode and by volume: I also noted that above the current price there is a clearly defined limit cluster (blue arrows), which the purchases ran into. This cluster acts as a local resistance for further price growth.

In the Dashboard

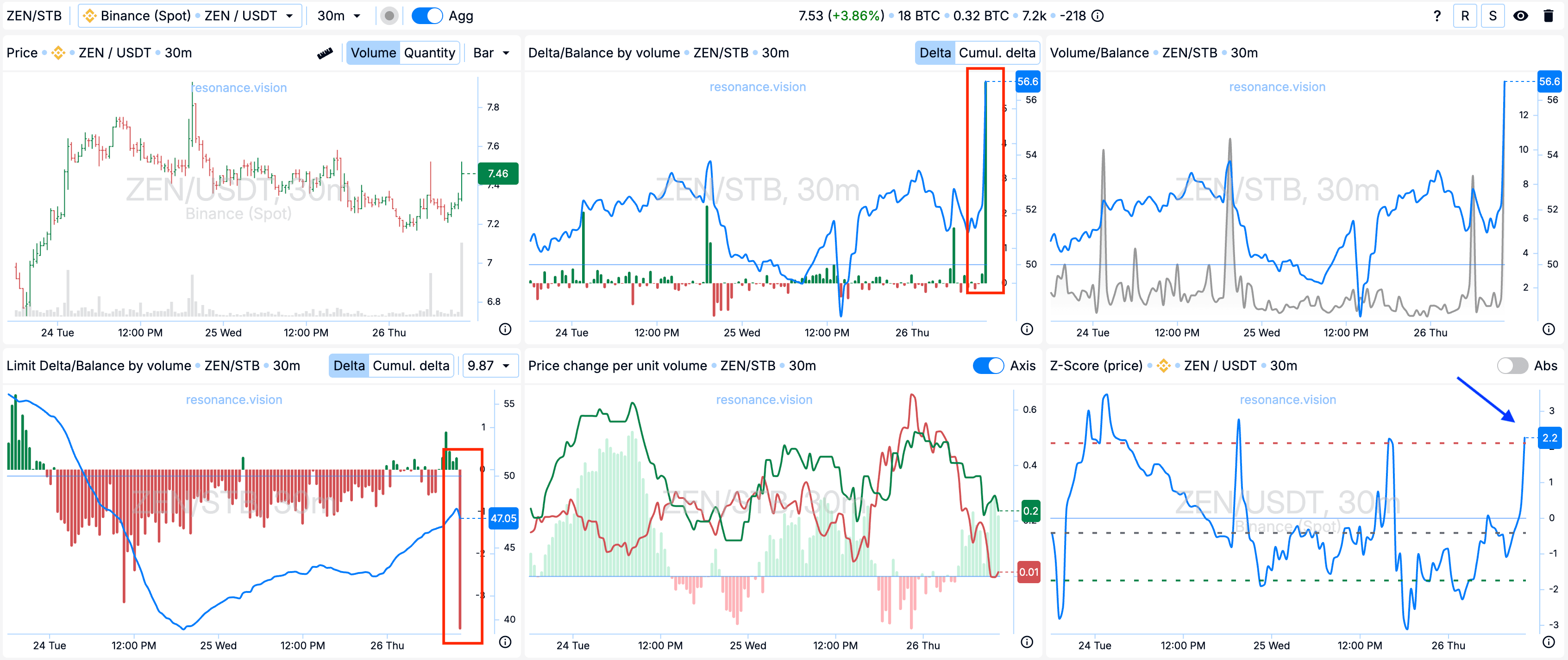

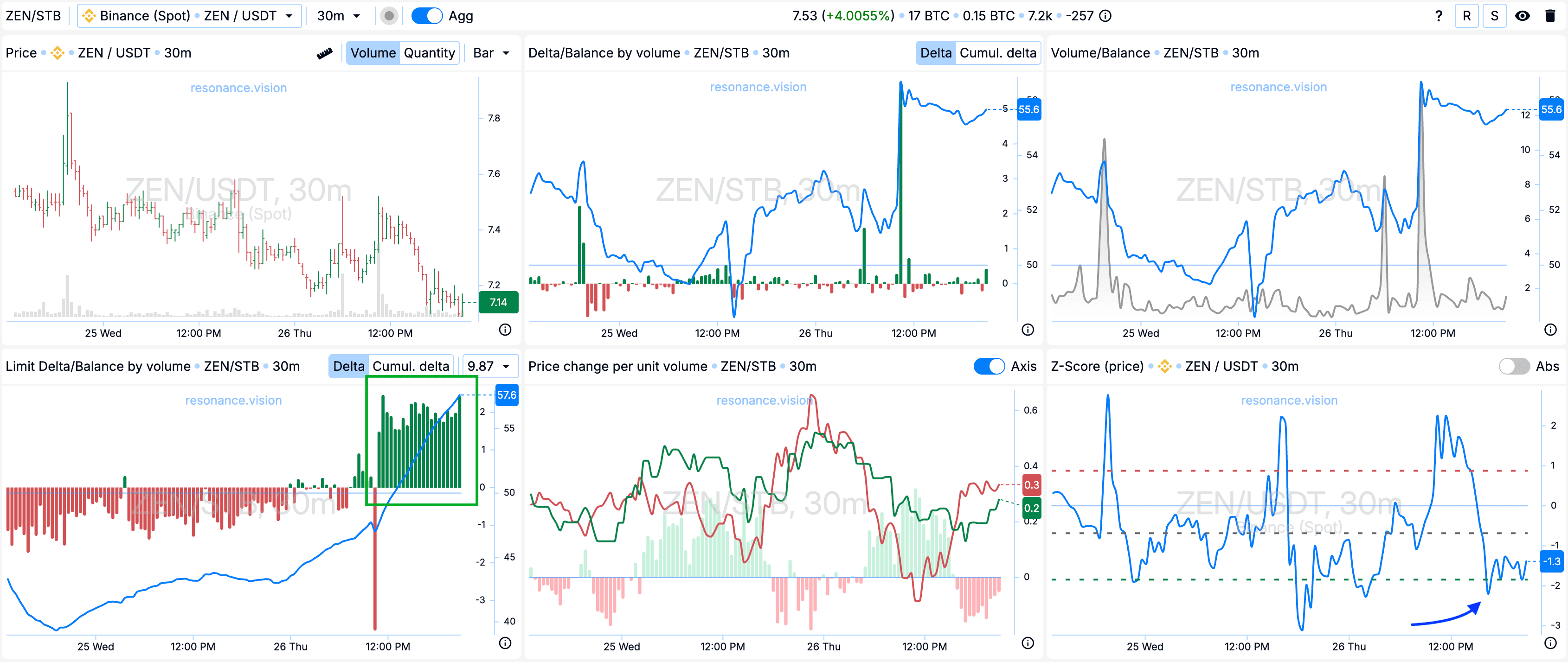

Delta/Volume Balance and Limit Delta: According to the aggregated cumulative data, market purchases significantly prevail (red rectangle). However, there is an active substitution of sell orders for limit orders - this is evident from the negative dynamics in the cumulative delta histogram (red rectangle).

Z-Score (price): The price has been rejected upwards to values of 2.2 standard deviations (blue arrow), and was also at abnormal values by percentile. The value is abnormal, which potentially adds an argument for a short position.

Reasons for exit

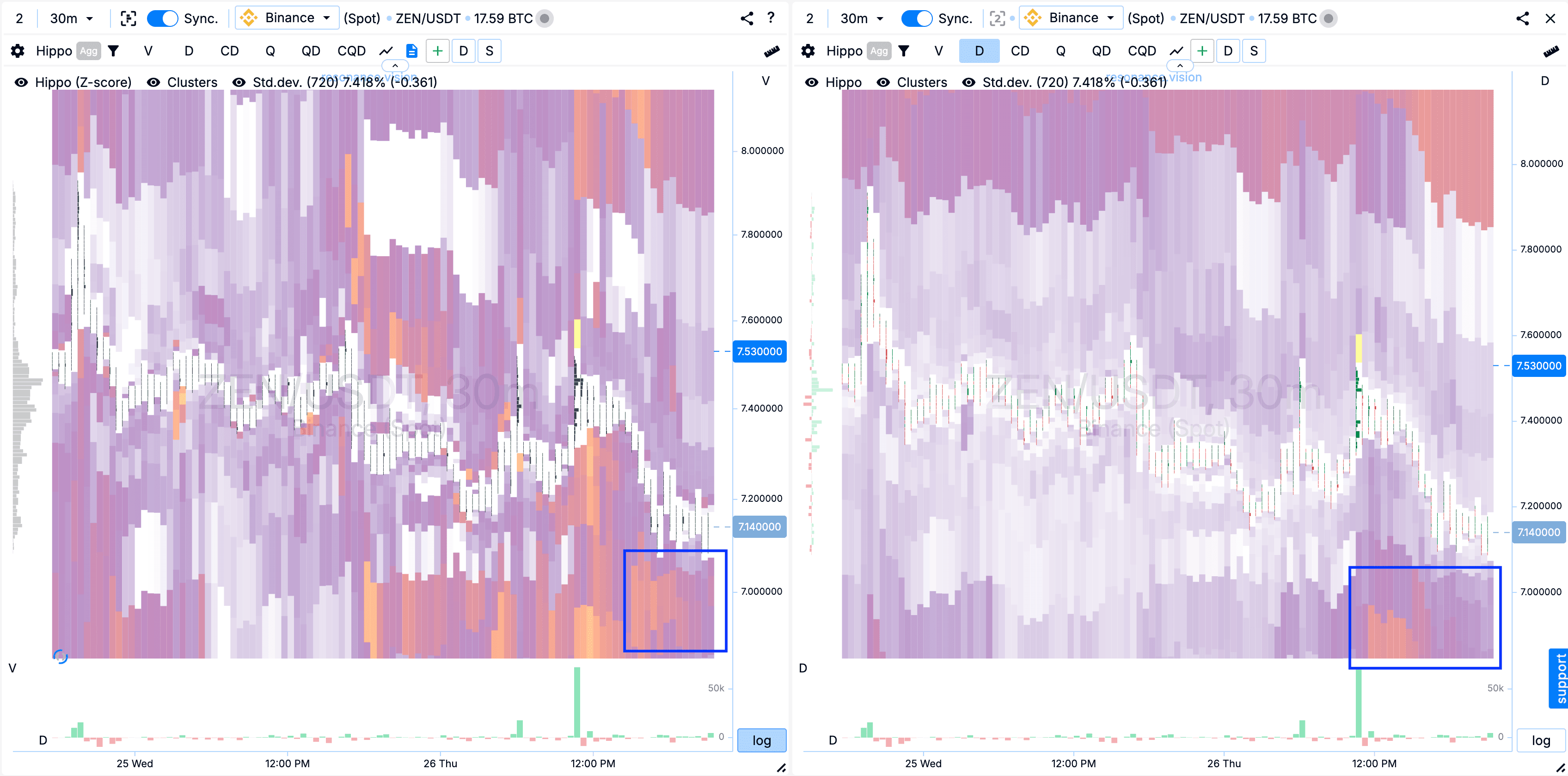

Heat map in Z-Score mode and by volume: Pronounced limit clusters (blue rectangles) began to appear under the price, which may indicate the presence of local support and the likelihood of holding the price or reversing upward. At the same time, limit densities remain weakly expressed at the top, which indicates the absence of serious resistance from sellers.

In Dashboard

Limit Delta/Balance by volume: According to limit orders, more buy orders began to be placed and the balance continues to grow (green rectangle). Which further confirms the local limit support by buyers in the price range.

Z-Score (price): Also now the price has been rejected downwards where at the peak the value was below 2 deviations (blue arrow).

Result

We managed to fix the profit in the amount of +216.31%.

Conclusion

Despite the growth of market purchases and significant volumes, the price was unable to update the previous maximum - a signal of a decrease in the efficiency of demand and the possible formation of a surplus. An additional argument was provided by the heat map data and delta, where buyers encountered limit resistance, which restrained further upward movement.

At the exit, the market situation changed: according to aggregated data, limit support increased, and the price began to stabilize. Such behavior of participants indicated a possible reversal, which became a signal to fix the position. Timely closing of the deal allowed to fix the profit and avoid unnecessary risks.

Follow new articles in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.