ARK Ecosystem: What Is This Project and How to Profit from It?

A review of one of the oldest altcoins — ARK: where it stands now, how to assess its potential, and how to actually profit from it. We break down the project’s strengths and weaknesses, use cases, token liquidity, and three practical strategies: from speculation to grid bots. For those looking for a seasoned asset that still has a chance for profitable moves.

Table of content

What Is ARK Ecosystem?

ARK is a blockchain platform designed to simplify the launch of new blockchains. If you need your own token or a decentralized solution for your business — ARK offers quick infrastructure deployment without deep coding. The platform provides customization, flexibility, and relative ease of use, which is especially relevant for startups.

Who Uses ARK?

Despite the fact that ARK as a platform does not generate direct income, the project has real use cases:

- ARK Scooters — a decentralized electric scooter rental system.

- BC Diploma — storing academic certificates on the blockchain.

These examples demonstrate the viability of the project as well as the presence of partnerships, which reduces the risks of disappearance or project collapse.

ARK Price and Liquidity Analysis

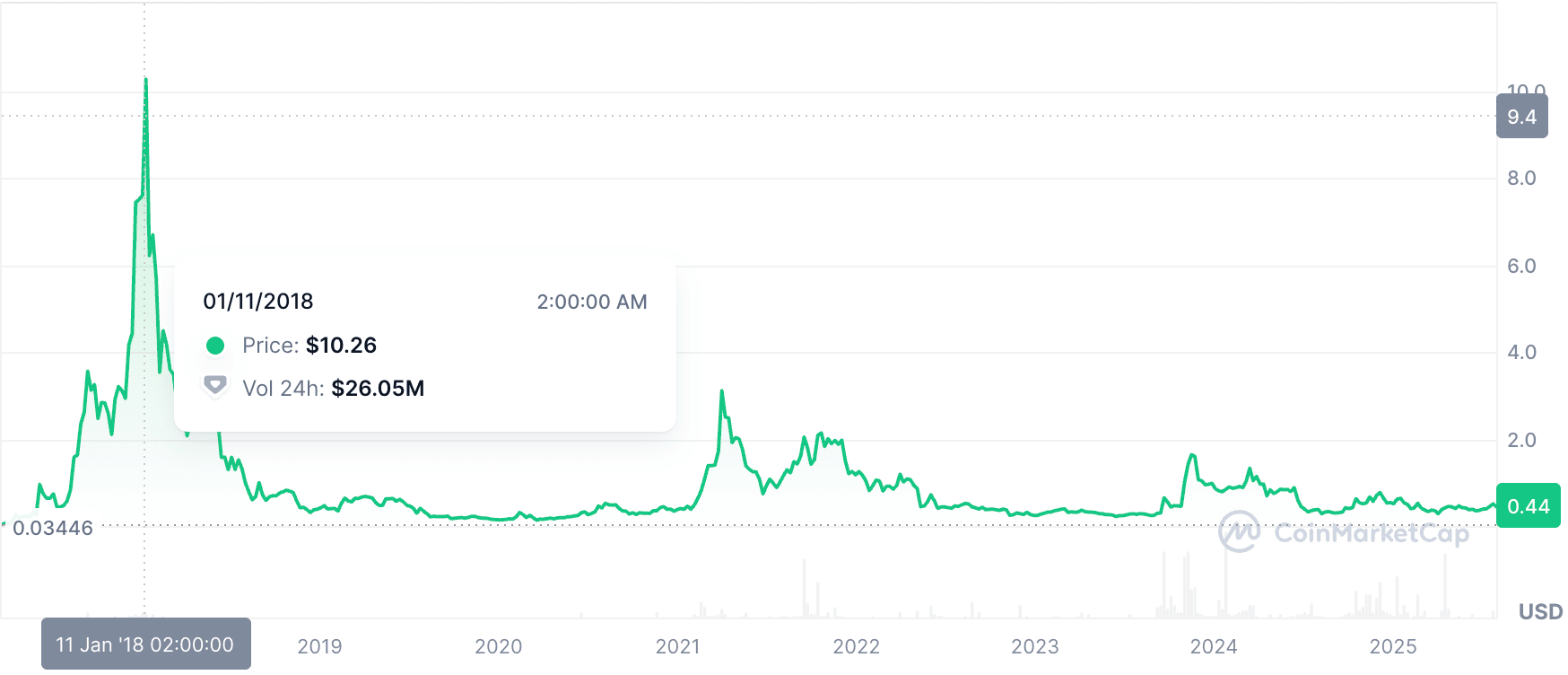

The ARK token appeared back in 2017, making it a “veteran” among altcoins. Its history looks like this:

- Starting price — around $0.10

- Peak in 2021 — nearly $3

- Current price — within the range of $0.30–$0.40

- Actively traded on exchanges, including Binance

However, trading volumes often remain low, resulting in low liquidity. This means ARK’s price can move sharply even with relatively small buy or sell volumes.

How to Profit from ARK: 3 Strategies

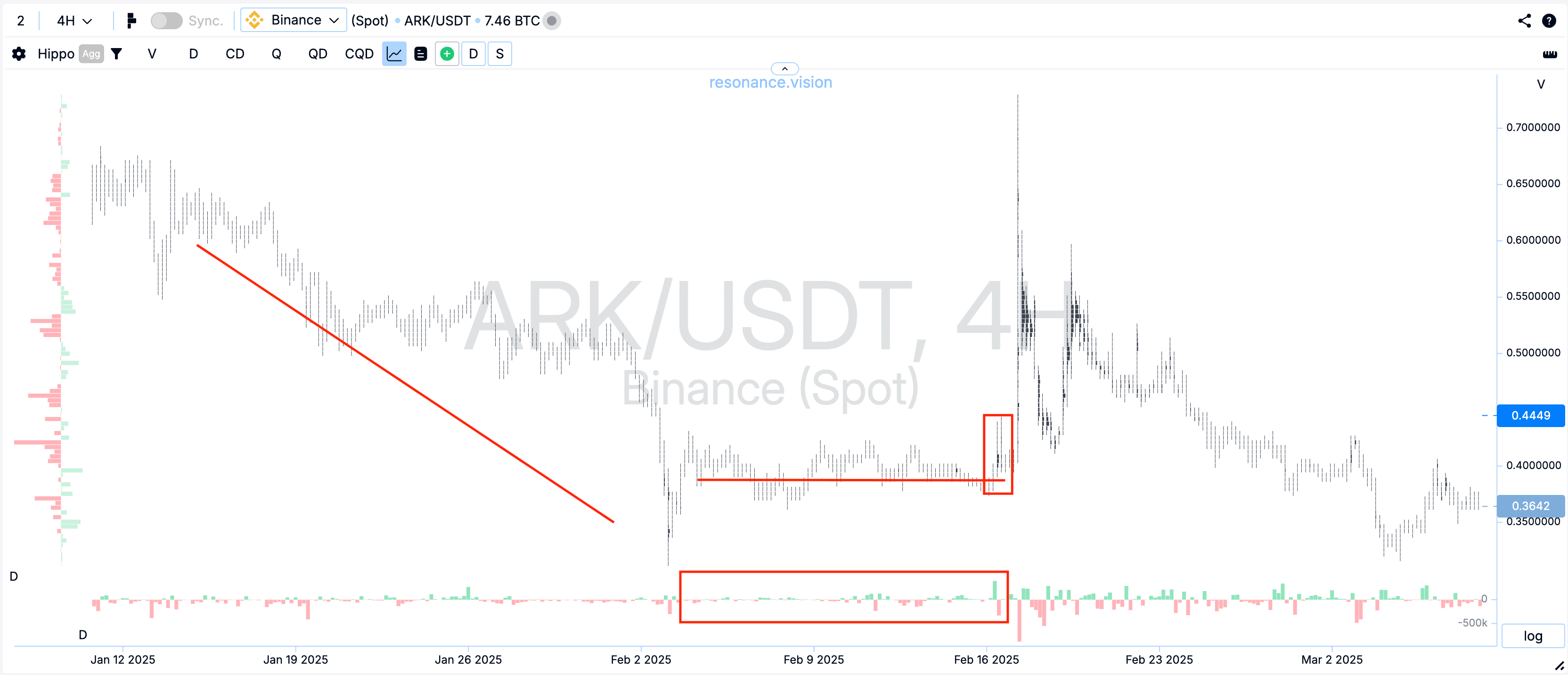

1. Buying in a Deficit Zone

This strategy is suitable for traders who analyze market behavior. Signs of a “deficit” include:

- Large sell orders without price decline

- Buy orders pushing the market upward

- Stalling at local lows

Goal: enter during a pullback and exit during a pump (partial closing of positions is possible with 50%+ profit from the move).

2. Speculating on Futures (With Caution)

ARK has a tendency toward impulsive movements, which attracts traders who trade futures with leverage. But it is important to consider the next points:

- Risks are very high due to low liquidity

- Price drops of 30–40% are not uncommon

- Funding and prolonged waiting reduce profits

Recommendation: only suitable for experienced traders

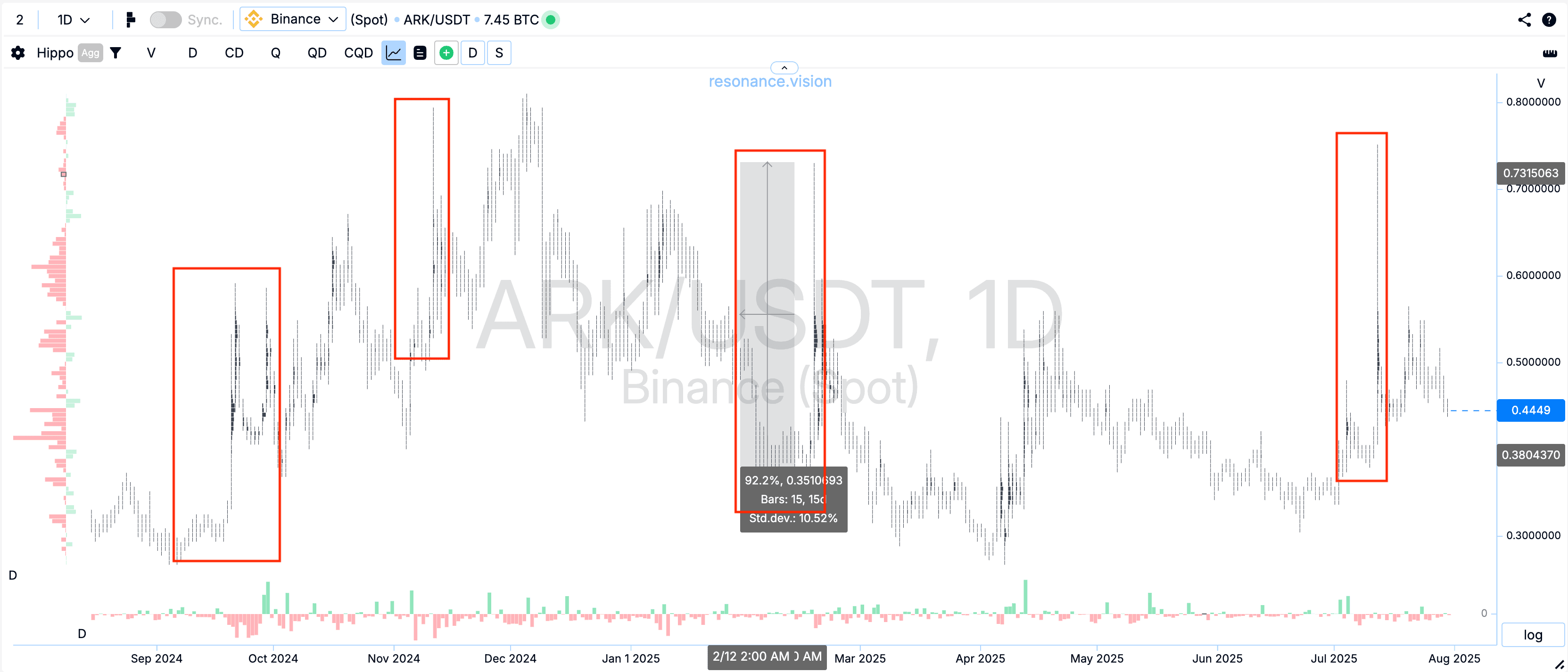

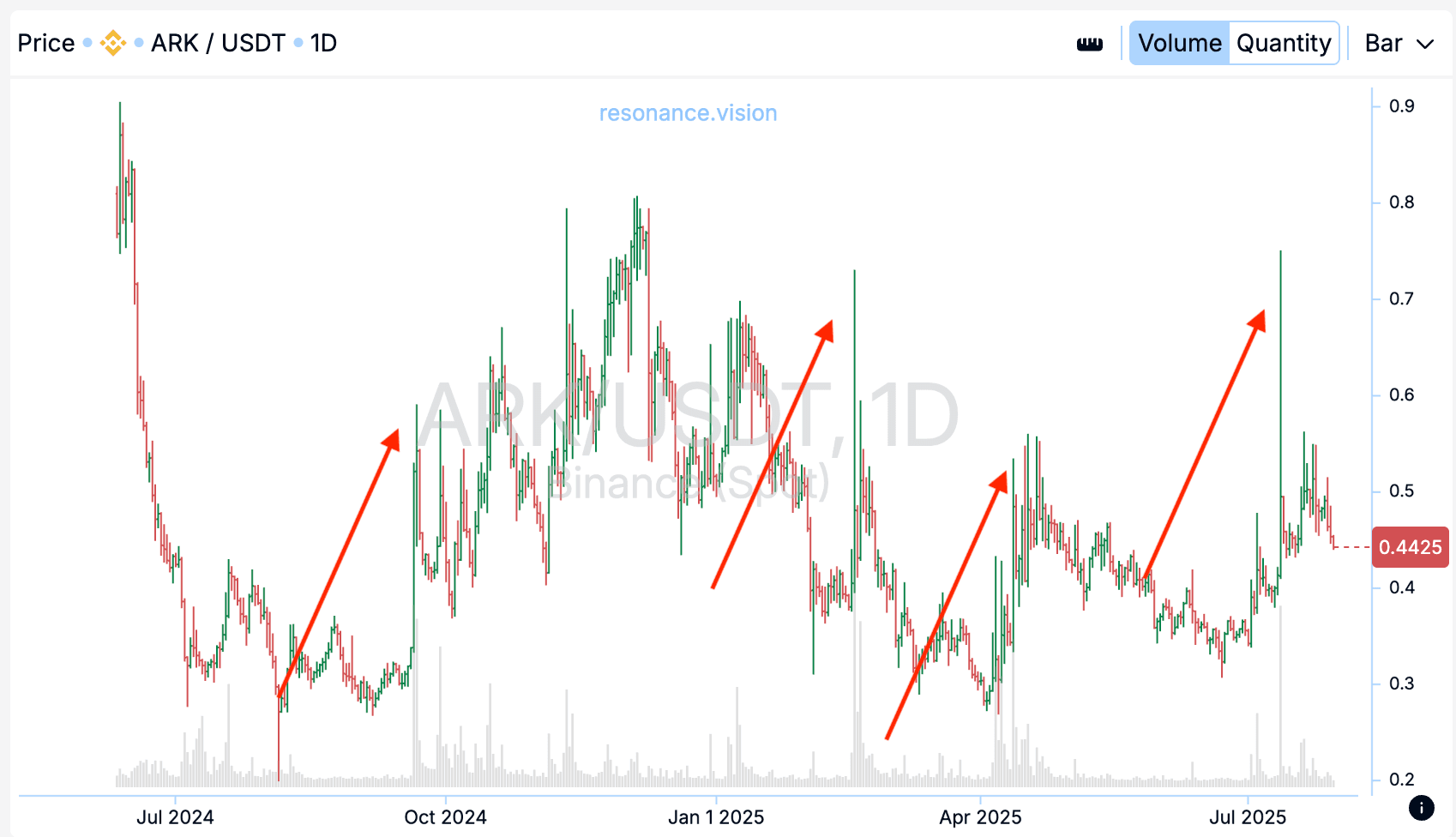

3. Grid Bots — The Best Strategy for ARK

ARK’s price has been moving sideways for a long time (between $0.20 and $1.00), which means ideal conditions for grid bot trading.

Advantages:

- Daily micro trades with fluctuations of 0.7–4%

- Chance to earn even during periods of low volatility

- High profit potential during strong impulses

Optimal choice: using a grid bot on the BingX exchange, where cashback and bonuses are available.

Conclusion: Is It Worth Investing in ARK?

ARK is not a newcomer — it has a history and real partnerships

The project is alive — unlike many altcoins from 2017

Risks — low liquidity

Best strategy: launching a grid bot within the $0.20–$1.00 range, with a focus on long-term sideways movement and periodic spikes in volatility.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.