PI Network – another failure or a future giant?

PI Network promises ‘crypto for everyone’ through a mobile mining app. But isn’t this freebie turning into a pitfall for investors? We analyse PI’s tokenomics, business model, price trend and potential: short or a chance for a restart?

Table of content

- 01What is PI Network and why is there so much buzz around it?

- 02PI Network’s business model: gift or abyss?

- 03P token price: why does it keep falling?

- 04Exchanges and funding: what do the rates say?

- 05Does PI Network have a chance to restart?

- 06Investment conclusion: should we expect a miracle?

- 07Summary:

What is PI Network and why is there so much buzz around it?

PI Network positions itself as a social cryptocurrency and an ecosystem for decentralized applications that allows users to mine tokens without expensive equipment — just a smartphone is enough. All you need to do is press a button in the mobile app once every 24 hours to receive a reward.

According to the developers, 65% of the tokens will be mined by users, 20% will go to the developers, 10% will be kept in a reserve fund, and only 5% — for liquidity. At first glance — a revolutionary idea, but does it have a future?

PI Network’s business model: gift or abyss?

From an analytical point of view, the model based on a simple action for the sake of reward looks inefficient and unpromising. The main tool is a smartphone app. Users do not need to invest or perform complex actions, but it also creates no real economic value.

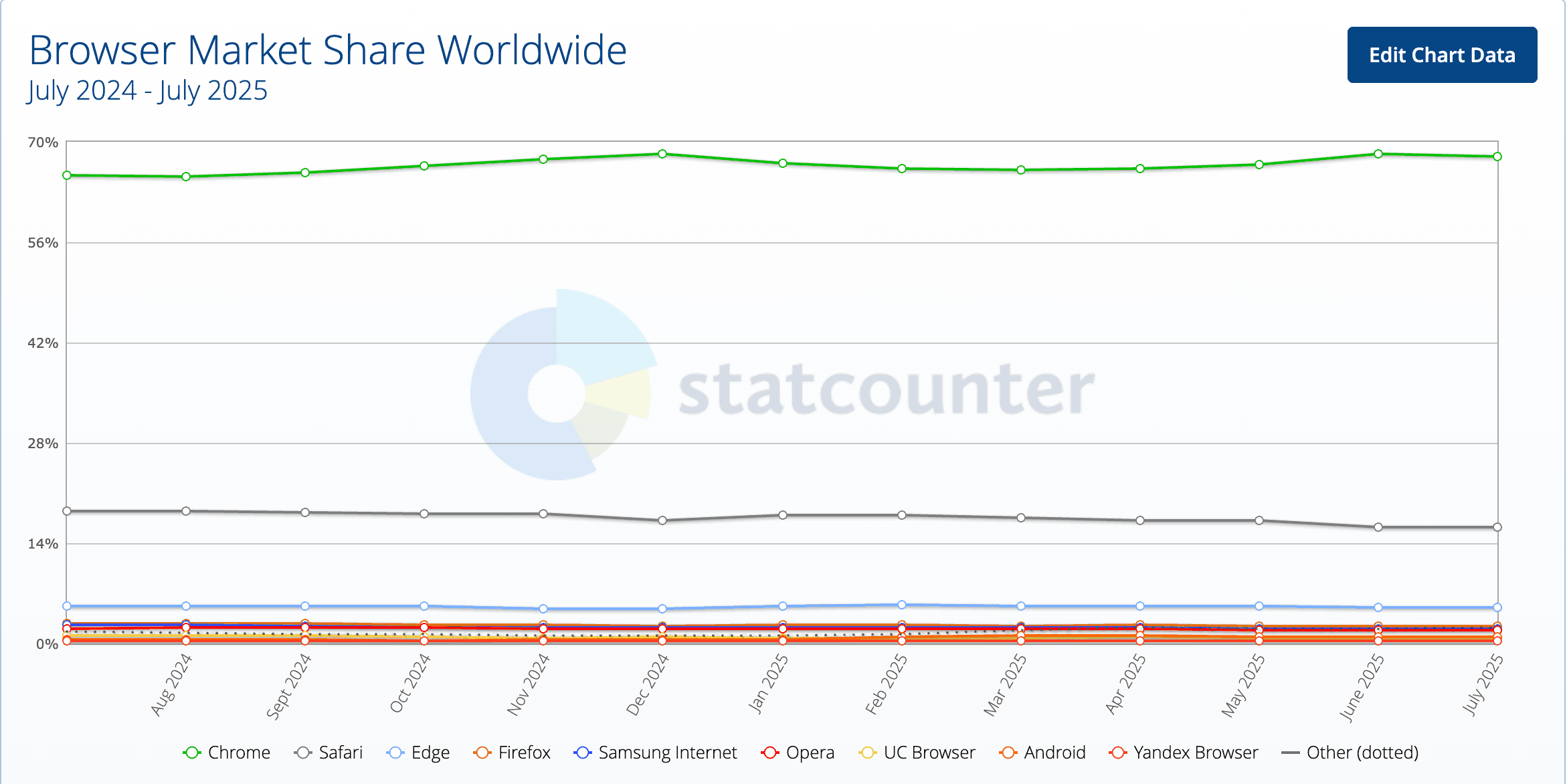

Even additional attempts to build infrastructure, such as their own P-browser, look unconvincing against the backdrop of Chrome’s monopoly (67% of the global market) and Safari (16%).

P token price: why does it keep falling?

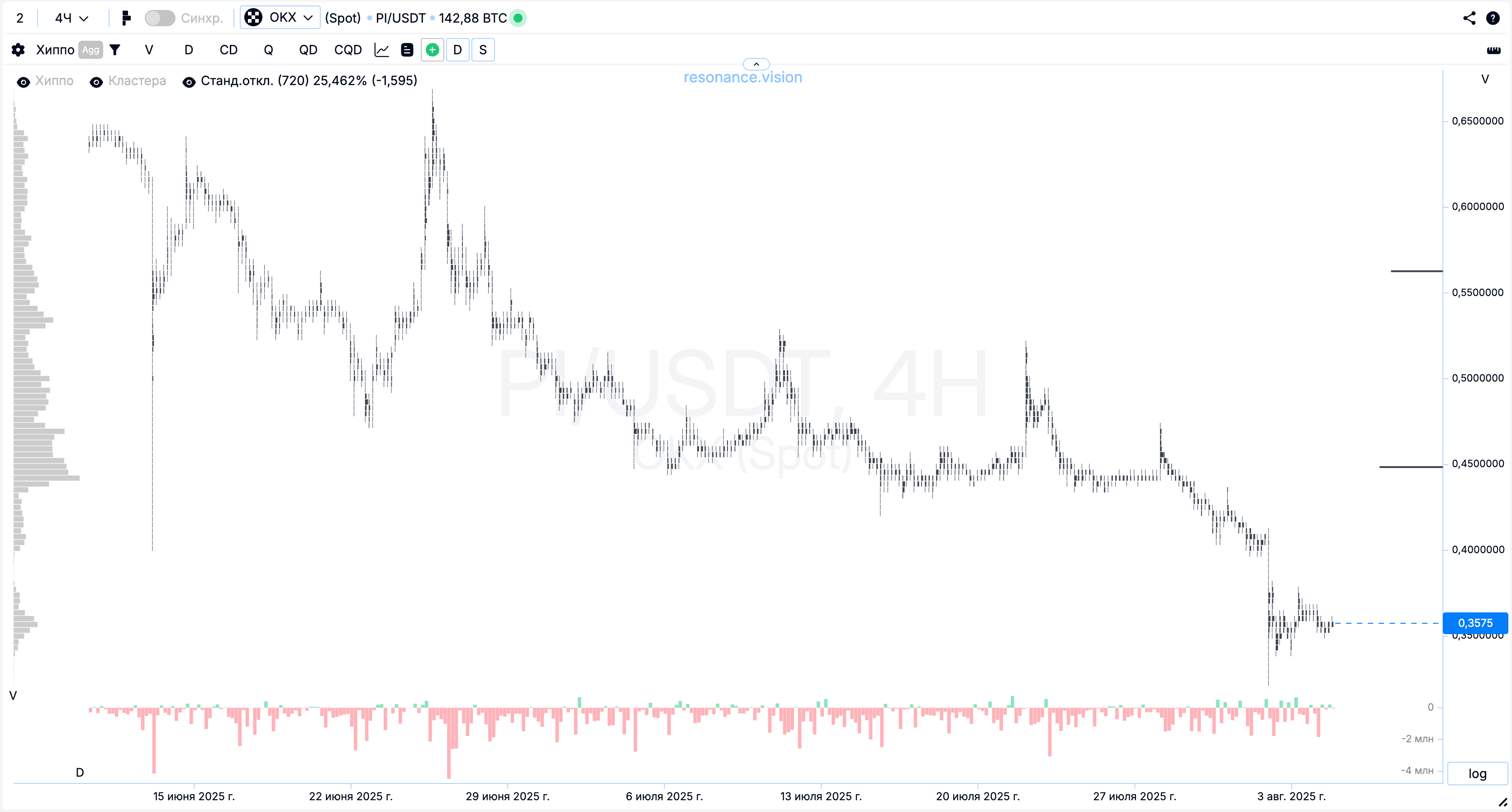

PI Network constantly publishes news, but instead of a positive effect, it is accompanied by… a drop in token price. Since its listing on major exchanges, the price has dropped from ~$1 to ~$0.60, with a few short-lived pumps (up to +182%).

However, the overall trend is downward, as the business model does not provide for stable income, only constant user acquisition.

Exchanges and funding: what do the rates say?

The P token is traded on OKEX, BitGet, and MEXC. At the same time, funding rates are positive: longs pay shorts. This means that short positions have an additional advantage.

Does PI Network have a chance to restart?

PI Network has one important card to play: KYC verification of users. This allows the platform to gather real, verified participants, primarily from low-income countries such as India. Potentially, if the platform can change its business model and offer paid services (similar to Telegram subscriptions), it could monetize its large user base.

But for now — there are no growth drivers. Only speculative spikes and risks for investors.

Investment conclusion: should we expect a miracle?

At this stage, long-term investments in PI look extremely risky. The business model does not create real value, demand is lower than supply, and there are no fundamental reasons for growth. However, short-term short positions may be interesting for experienced traders, especially considering the positive funding.

Summary:

- PI Network has an attractive but populist user acquisition model

- No real source of income

- Constant price decline despite frequent news

- The only hope is a change in the business model and community monetization

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.