BTC Market Review - November 19, 2025

In this BTC review, we analyze only current market data, without attempting to predict the future.

We examine how market and limit orders are performing, assessing volumes, the balance index, and price reaction.

Table of content

In this market review, we are not attempting to predict the future or predict what will happen next. Our goal is to state the facts we have at the current moment. We base our actions on these facts, not on our expectations and hopes.

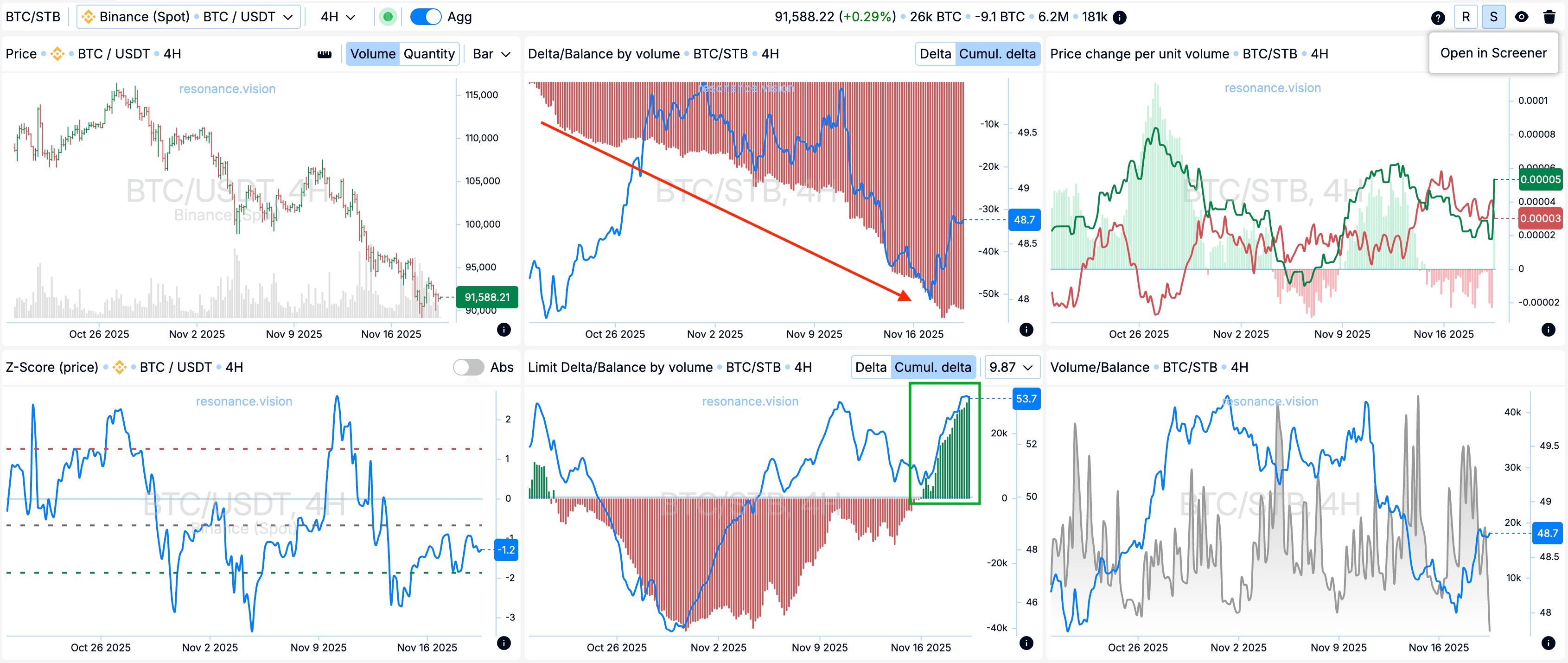

Market Orders (red line)

Sell market orders predominate, and the balance continues to shift toward sell orders. This indicates selling pressure and their effectiveness as the selling price continues to decline.

Limit Orders (green rectangle)

Limit orders indicate that more and more buy orders are being placed, but as the price continues to decline, these volumes are not sufficient to create a supply shortage.

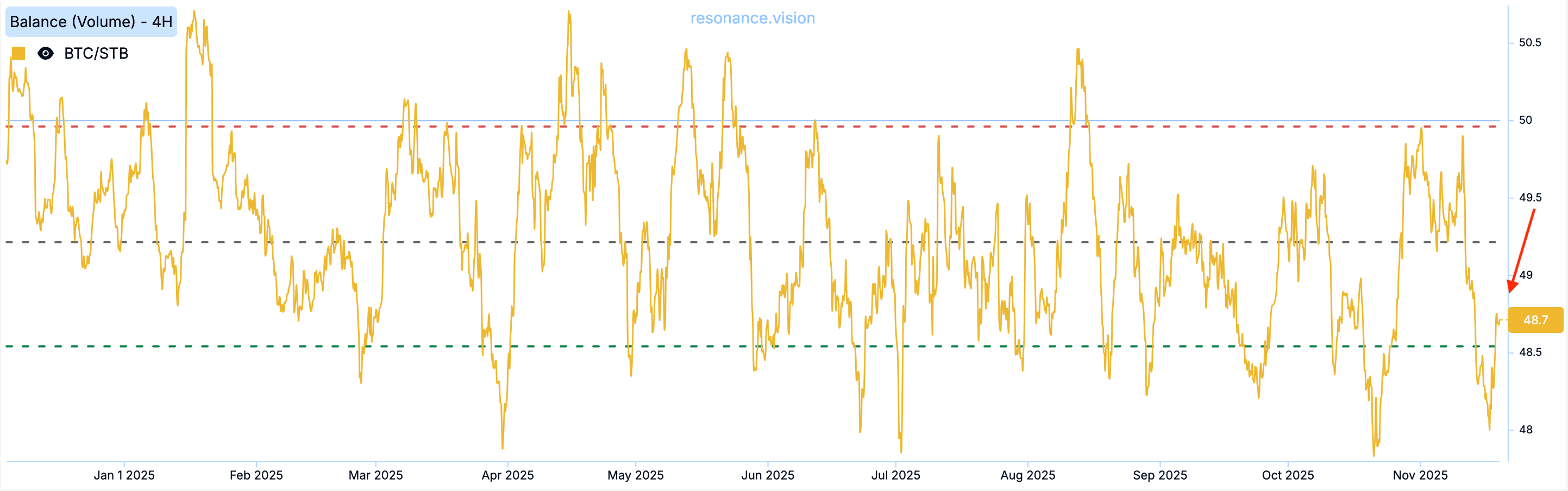

Balance Index

The Balance Index is declining and is currently located closer to the green percentile line.

Price Dynamics

Despite the increase in interest in limit orders, the volume of buy orders placed is still insufficient to create a shortage. As a result, selling continues to be effective.

Summary:

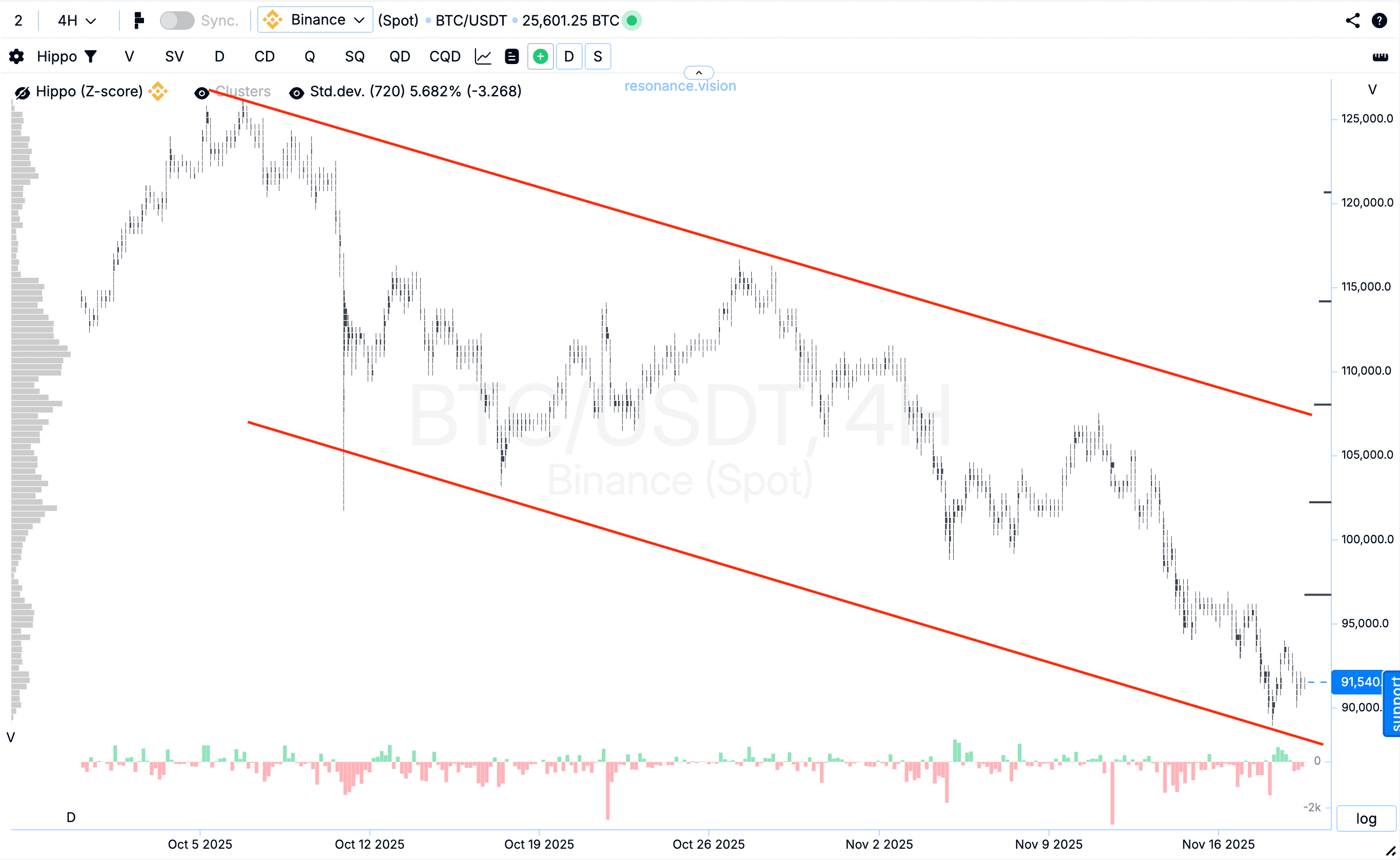

Currently, according to Charles Dow’s theory, BTC is experiencing a downward trend. Lows are being made, but highs are not being made. There are currently no signs of a trend reversal.

Which implementation method do you use most often?

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.