Arthur Hayes is selling PEPE, ENA, and ETH: panic or strategy?

Arthur Hayes is selling millions worth of PEPE, ENA, and ETH — the market is frozen in speculation: is it profit-taking, a short strategy, or fear of a market drop? In this article, we break down PEPE and ENA, discuss their outlook, and suggest an action plan in conditions of high volatility.

Table of content

The crypto community is once again talking about a familiar name — Arthur Hayes. But this time, he’s not buying tokens — he’s selling them. And these aren’t small positions:

- Sold ETH for $8.6 million

- Dumped ENA for $4.56 million

- Sold PEPE for $411,000

So what is this? Panic, profit-taking, or a strategy to benefit from a market decline? And how could this affect the market?

In this brief overview, we’ll focus on PEPE and Ethena.

PEPE: a memecoin with no future?

Let’s start with the least serious asset in this list — PEPE.

What kind of token is this:

- A memecoin with no real product or technological foundation

- Complete anonymity of the team

- No development roadmap

- A deflationary model (token burning) — but that’s the only positive

Unlike Dogecoin or even BONK, PEPE doesn’t attempt to build any infrastructure. It’s just a meme.

Is there any sense in long-term investment in PEPE?

From our perspective — no.

- Speculative trading — yes

- Grid bot usage — possibly, due to high volatility

- But holding it long term — risky and illogical

The fact that Hayes got rid of PEPE isn’t surprising. What’s surprising is that he didn’t do it earlier.

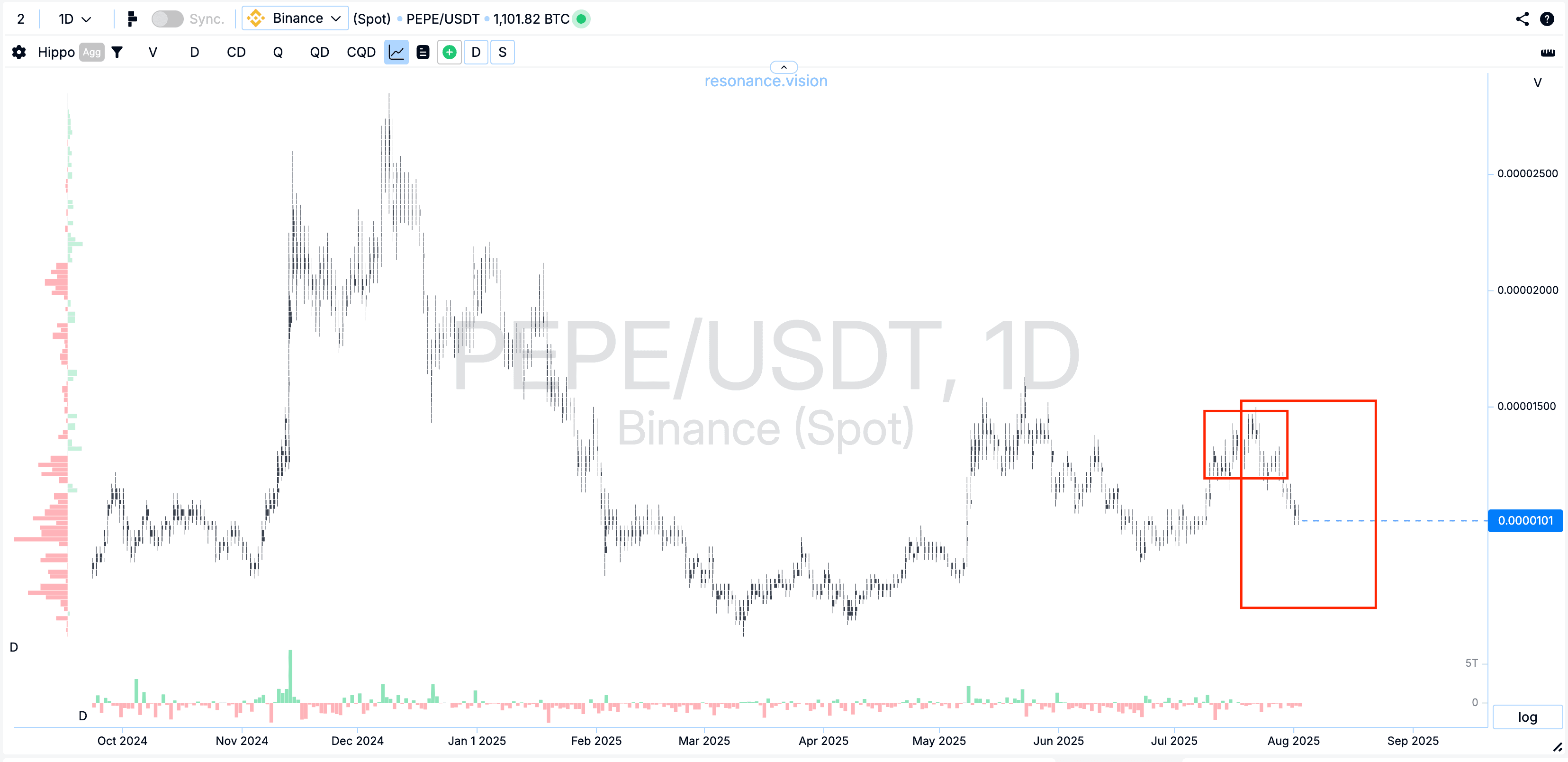

Currently, we see that PEPE is in a balance-searching phase:

ENA (Ethena): does it have potential?

Next up is a token that looks very different.

Ethena (ENA) is not just another altcoin, but an infrastructure project that may become part of the future digital financial system.

We have previously published a detailed breakdown of this token — we recommend checking out the full analysis in a separate article.

Why is ENA worth attention?

One of the key factors is the Genius Act, a bill currently being promoted in the U.S. This act is made to create a regulatory framework for stablecoins, which:

- Increases the legitimacy of infrastructure projects like Ethena

- Stimulates institutional interest in such solutions

- Lays the foundation for their integration into traditional financial systems

If the stablecoin market receives clear legal regulation, projects like ENA could benefit the most.

Is there any sense in long-term investment in ENA?

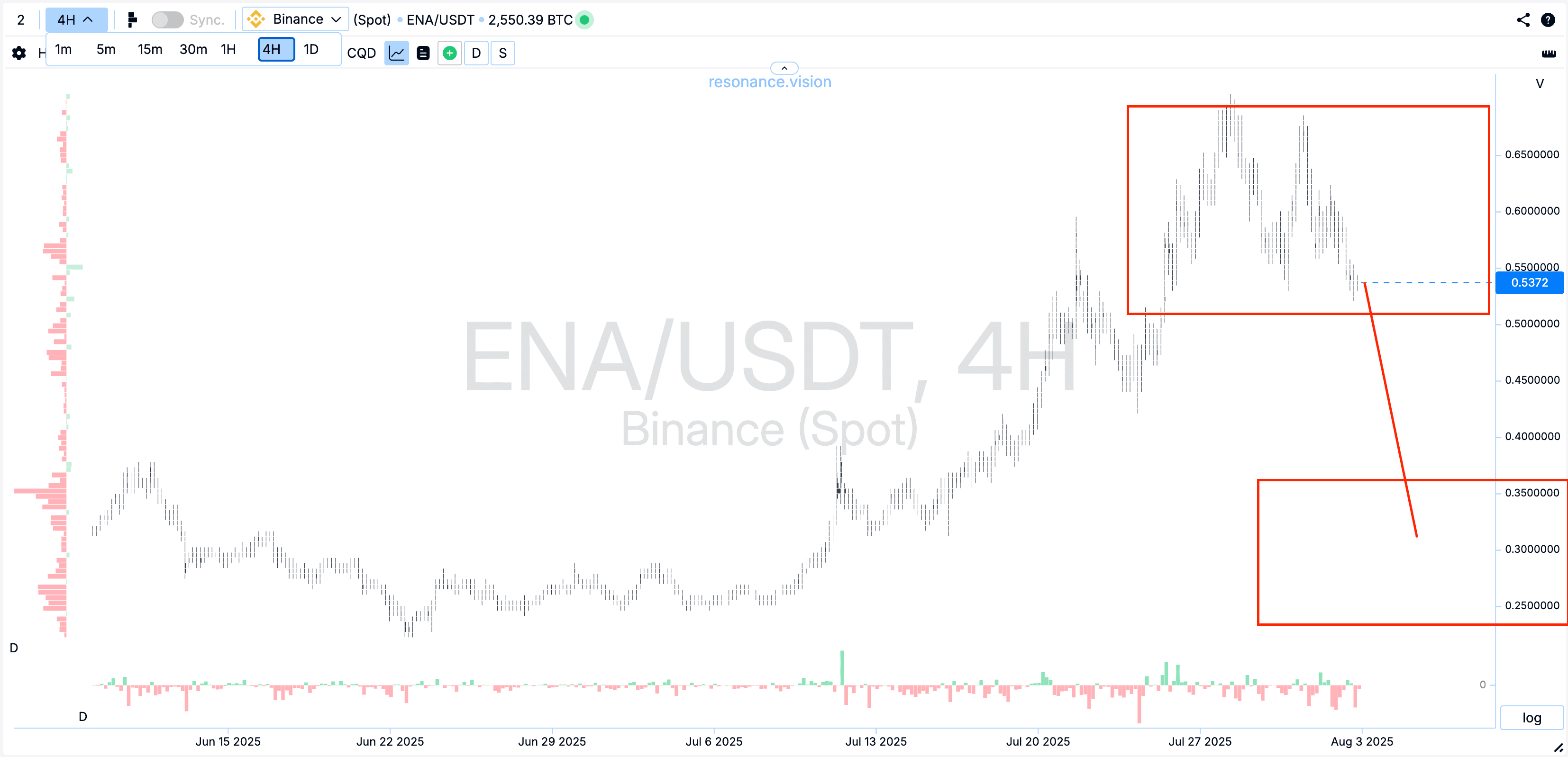

As an infrastructure project, ENA can be considered a long-term investment — especially with current low prices and growing expectations of a new altseason.

However, it’s important to understand that even such assets are currently highly volatile, so you should have a clear action plan and decide whether DCA (Dollar-Cost Averaging) is suitable for you right now.

Step-by-step action plan

Any analysis of major player behavior should be done through the lens of market phases and analytical tools. Regardless of the news, we have three stages to assess a market situation:

- Trigger

Abnormal volumes, news, limit activity spikes — anything that draws our attention to a crypto asset - Analysis

How do volumes affect price? Is the pressure from buyers/sellers effective? - Trade validation

We look for confirmation of supply deficit or surplus

Note: Volatility is extremely high right now. Many coins are declining in price.

It’s impossible to precisely predict where the market will find balance.

But we will definitely see signs of deficit on cluster charts, and that will be the moment to re-enter positions.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.