Avalanche (AVAX): Analyzing Network Growth and Token Potential

Analysis of Avalanche’s (AVAX) 66% network growth, breaking down key drivers (DeFi, games, NFTs) and the project’s inclusion in a U.S. Department of Commerce pilot program. Technical analysis of the price chart and signs of a potential impulsive rally.

Table of content

Recent news about Avalanche (AVAX) has attracted significant attention from the crypto community: the number of transactions on the network has grown by 66%, reaching 11 million, with 181 thousand active wallets. This figure is particularly impressive as it surpassed the number on Solana, where activity decreased during the same period. This indicates stable development and growing interest in the Avalanche ecosystem.

Growth Drivers and Key Activity Factors

The growth of activity on the AVAX network is driven by several key factors:

- DeFi Platforms: Decentralized finance services continue to be the main engine, attracting users who seek fast and cheap transactions.

- Games and NFTs: The GameFi and non-fungible token industries are a significant catalyst. Projects built on Avalanche attract new players and collectors, increasing the demand for AVAX as “gas.”

- Integration with Government Entities: An interesting precedent was the news about Avalanche’s inclusion in a pilot project by the U.S. Department of Commerce to publish GDP data on the blockchain. While the practical value of this step is currently debatable, it adds weight and legitimacy to the project in the eyes of traditional financial institutions.

Analysis: Price Movements and Signs of Scarcity

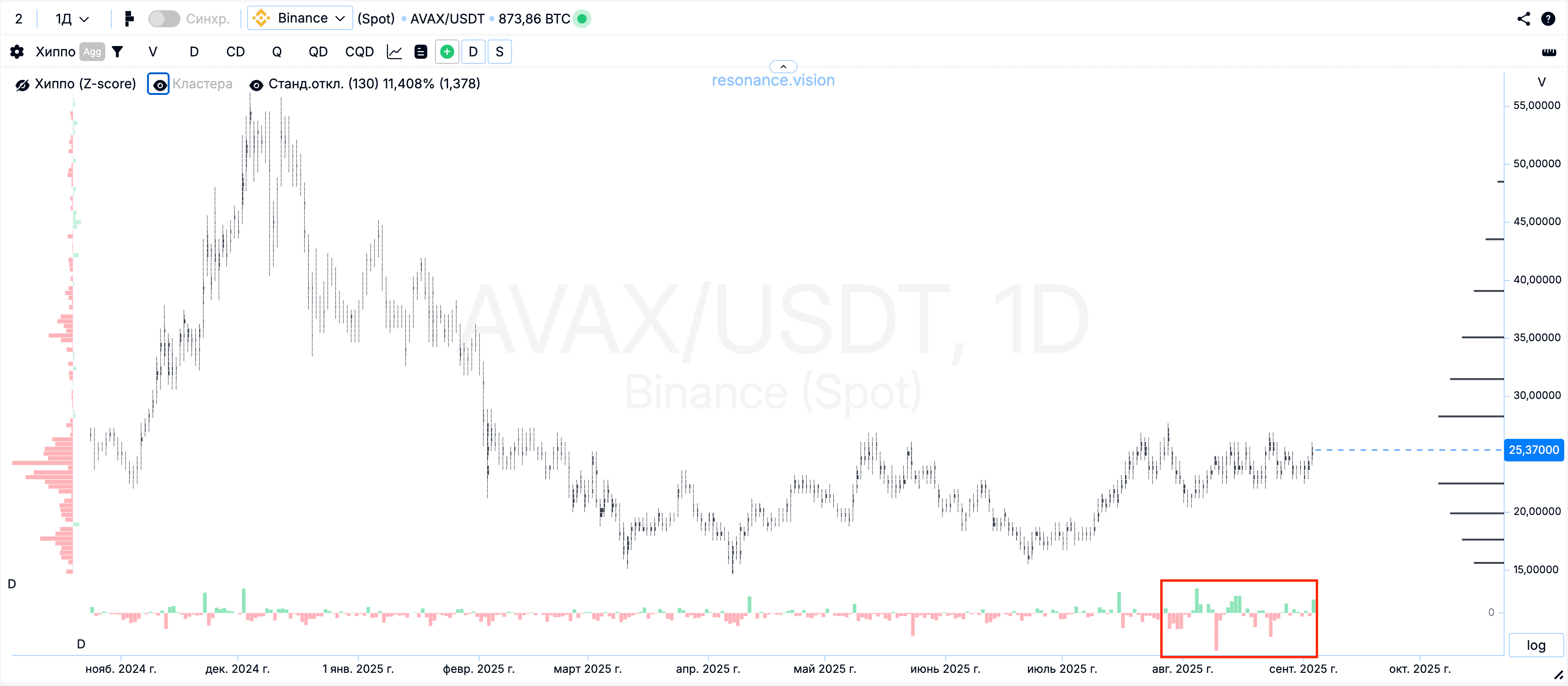

The analysis of the AVAX price chart reveals interesting trends. Although Grid bots were previously recommended for trading AVAX, the current situation indicates a change in market dynamics. There is a gradual increase in price, suggesting an upward trend. This movement is accompanied by large sales volumes that, however, do not push the price down. At the same time, large purchases do not lead to sharp spikes. This may indicate that market participants are preparing “something interesting.”

This behavior is often a sign of supply scarcity. When large volumes of supply are absorbed by buyers, and the price does not fall, it can signal the accumulation of the asset before a potential impulsive rally. Given that the AVAX price is smoothly moving upward, there are signs of buyer activity who are actively “cleaning out” the supply from the market. While this is not a trading recommendation, experience shows that similar market configurations often precede significant upward movements.

Conclusion

The growth in the number of transactions and integration with large organizations confirm that Avalanche is a powerful project with a promising future. While trading on Grid bots remains a relevant strategy, the current analysis points to increased attention to AVAX from major players. Signs of scarcity and increased buyer activity signal the potential for further growth. As always, before making any investment decisions, it is important to follow risk management rules.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.