Avalanche (AVAX): Do News Drive the Market, or Do They Just Follow It?

An analysis of the AVAX token’s growth amidst news about a new treasury fund and a partnership in Korea. We explore whether the news is the cause of the rally or just a justification for an existing move prepared by large players. A discussion on the importance of analyzing volumes and price dynamics.

Table of content

The recent significant surge of the Avalanche (AVAX) token has triggered a wave of news trying to explain its causes. Two key events have been put forward as the main drivers of growth: the signing of a memorandum between Avalabs and the Korean company Vblock to develop tokenization, and the announcement by the Avalanche Foundation to create a $1 billion treasury fund. These news items are undoubtedly positive, but did they truly cause the market move?

News as a Catalyst vs. News as a Justification

The first news piece concerns the expansion of Avalanche’s influence in the tokenization market, particularly in South Korea. This highlights AVAX’s status as a leader in this field with $3 billion in tokenized products. The second piece of news—about the creation of a $1 billion fund—indicates the project’s significant institutional ambitions, and negotiations with players like BlackRock and Visa add weight to its position in the traditional finance sector.

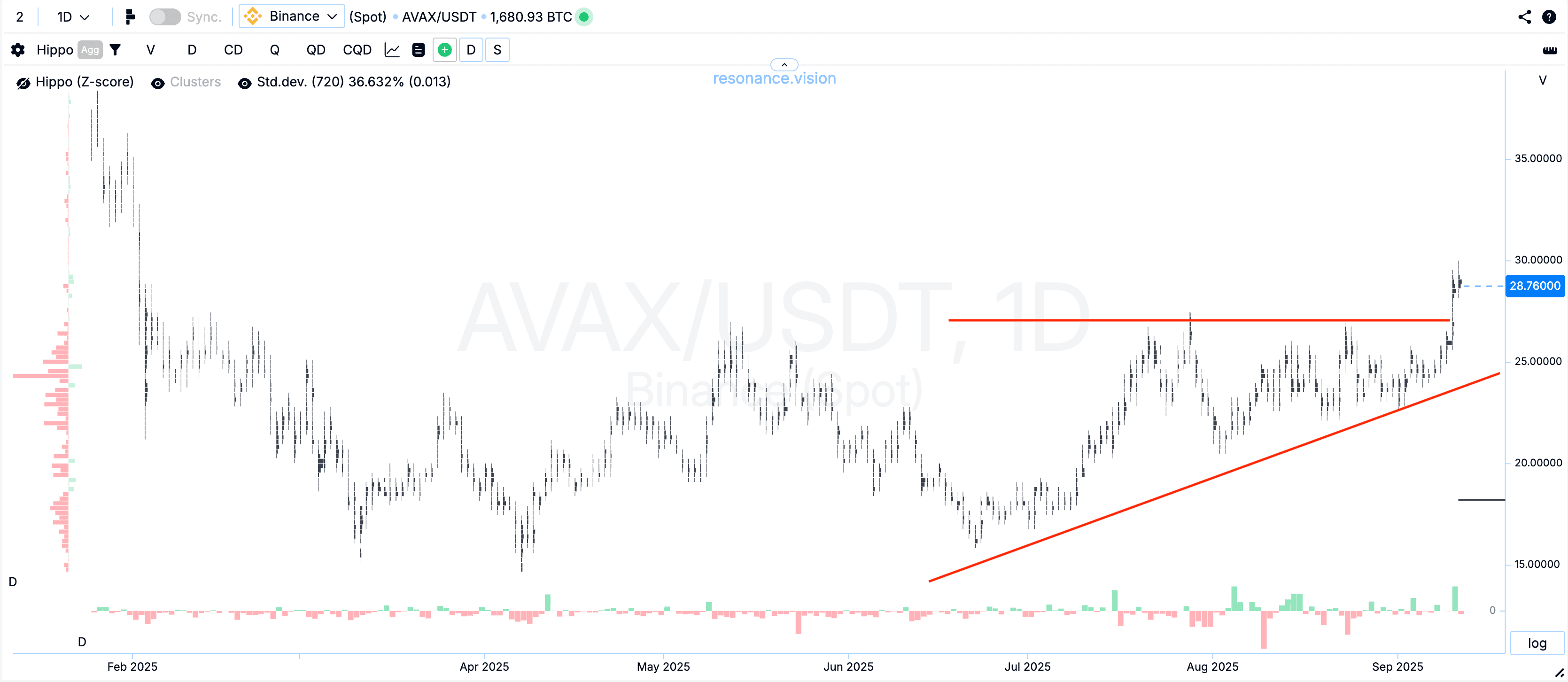

However, if news is the cause of growth, a question arises: why was chart activity visible long before these announcements? For almost two months, the AVAX chart showed signs of an active accumulation phase. There was a steady rise in minimums, despite large sales volumes. These sales were ineffective as they didn’t lead to a break of local lows. This indicates that buyers were systematically absorbing the supply, preparing for an impulsive move.

Chart and Volume Analysis: Experience vs. Noise

Based on the analysis of volumes and price movements, it can be concluded that large players were accumulating positions long before the news was published. They used a strategy of gradual accumulation to avoid causing a sharp price increase and to buy as much of the asset as possible. When the news came out, it likely served as a catalyst for the already accumulated energy. This led to an explosive move that became visible to everyone.

This situation raises an important question for investors: what should be the focus? The noise created by the news, or the real behavior of market participants, which can be seen on the chart? While news provides an understanding of a project’s fundamental prospects, it rarely provides timely information for making trading decisions. Analyzing volumes, price dynamics, and the effectiveness of movements allows one to see the market’s “intentions” in advance.

Conclusion

The surge of Avalanche (AVAX) is a great example of how the market often precedes the news. While the memorandum with the Korean company and the creation of a $1 billion fund are positive events, they were likely used to justify an existing move prepared by large players. For effective investment decisions, it’s important not only to read the news but also to understand how the market behaves by analyzing the chart and volumes.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.