BGB and Morph: Analyzing the New Phase of Bitget Token's Development and its Integration with the L2 Network

A detailed analysis of the Bitget (BGB) token following its integration with the high-performance Layer 2 network Morph. Breakdown of its tokenomics, functionality, and price movements, as well as the potential of BGB as a “gas” and governance token in the new ecosystem.

Table of content

The crypto community was recently surprised by an important announcement signaling a new phase in the life of the Bitget token — BGB. The Bitget exchange has announced the transfer of 440 million BGB tokens to the Morph Foundation. This move is strategic, as it not only demonstrates a significant share of BGB owned by the exchange itself but also defines a new role for the token in the ecosystem. Of this amount, 220 million BGB will be immediately burned, and the remaining 220 million will be locked. The unlock will occur gradually, at 2% per month, to stimulate liquidity, ecosystem development, and educational programs.

BGB: From a Utility Token to a Full-Fledged Network Asset

Traditionally, BGB has functioned as a utility token for the Bitget crypto exchange and its decentralized wallet, Bitget Wallet. Its primary functions included:

- Paying trading fees with discounts.

- Participating in Launchpads — early access to new projects.

- Granting VIP privileges.

- The ability to earn passive income.

However, with its integration into the Morph ecosystem, BGB is transforming into a full-fledged network asset. It will become the “gas token” and governance token for the Morph Chain, which means its value and demand will be directly correlated with the usage of this new network.

Morph: A High-Performance L2 Network

What exactly is Morph? It’s a high-performance Layer 2 network built on Ethereum. Its main goal is the mass adoption of Web3 payments and financial services. Morph positions itself as an infrastructure that provides fast, reliable transactions with low fees and easy integration with global payment systems.

Morph has two key products that generate fees and create demand for BGB:

- Morph Pay — a client application for Web3 payments.

- Morph Rails — a decentralized alternative to payment gateways like Stripe, supporting not only crypto payments but also Forex operations.

Analysis of BGB Tokenomics and Price Movements

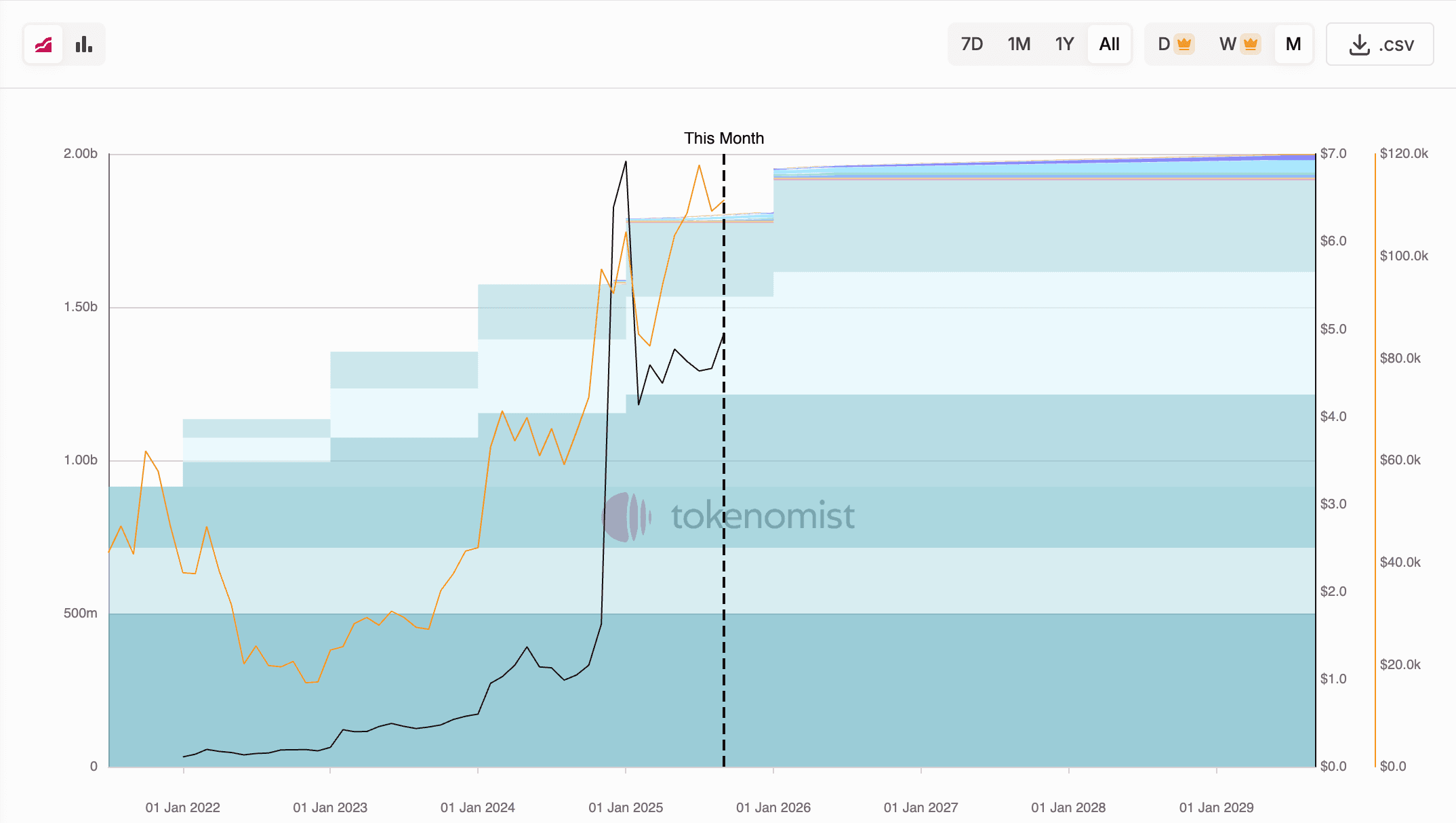

Founded in 2018, the Bitget exchange initially issued 2 billion BGB, then burned 800 million, leaving a total emission of 1.3 billion tokens. This makes BGB a deflationary asset, as the exchange regularly buys back and burns tokens every quarter.

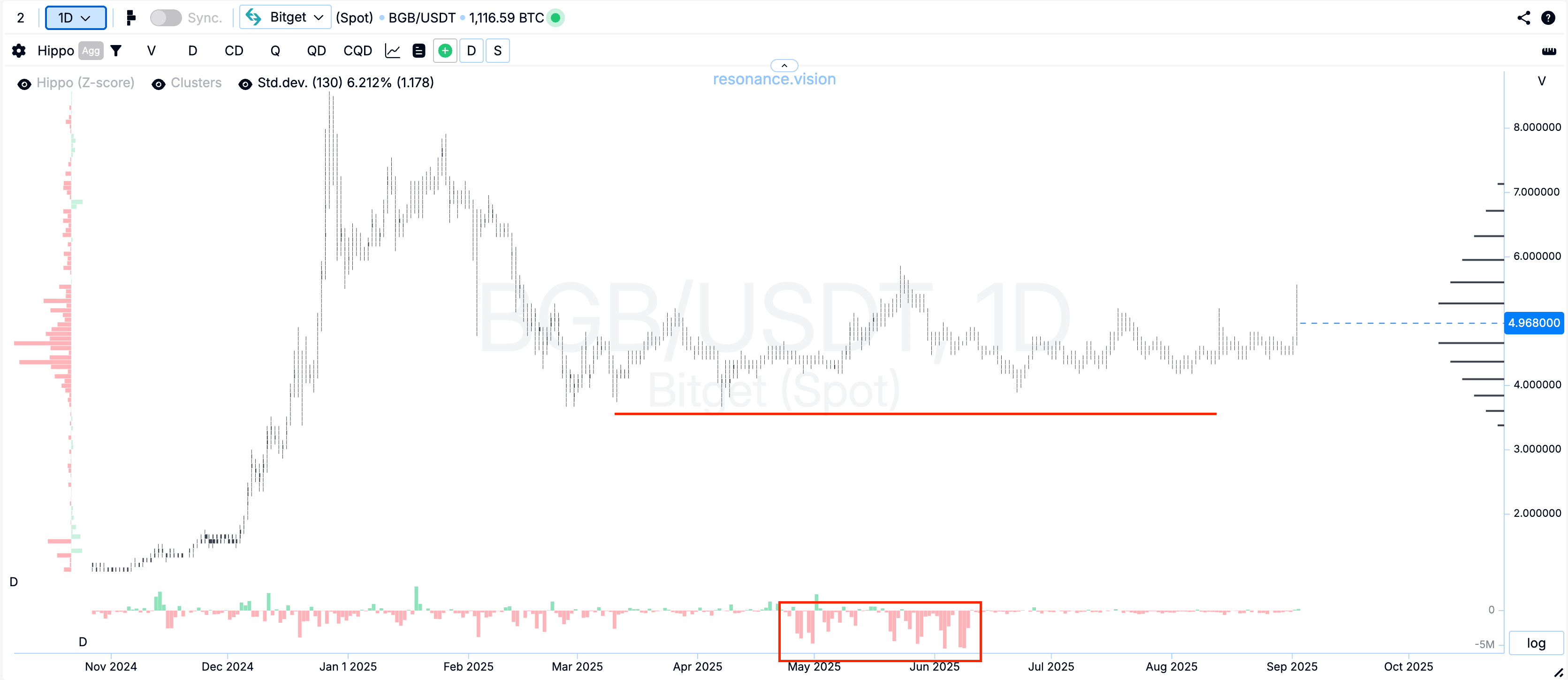

The BGB price chart shows significant growth after its release at 6 cents, reaching a peak of over 700% growth. Recently, the price has entered a consolidation phase, but with high volatility. Large sales volumes are being absorbed by buyers, indicating strong interest in the asset. Despite short-term uncertainty, the absence of new lows and active buying suggest potential for further growth. This situation could be a precursor to an impulsive move, possibly related to the news about Morph.

Conclusion

The integration of BGB with the Morph Chain is a strategically important step that expands its functionality and directly ties its value to the success of the Morph payment infrastructure. This transforms BGB from a simple exchange token into a full-fledged network asset. Given the stable revenue of the Bitget exchange (estimated at up to $585 million per year) and the growing demand for Web3 payments, BGB has the potential for further growth. While current volatility calls for caution, the long-term prospects look promising, especially if Morph succeeds in the adoption of its payment solutions.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.