Binance launches a promotion with DOLO (Dolomite): should you pay attention to this new DeFi project?

Learn about the new DeFi platform Dolomite (DOLO) on Binance: features, price dynamics, and opportunities for trading and investing.

Table of content

Recently, Binance has been increasingly running trading promotions for its users. At first glance, it’s the usual challenge: trade a certain volume — receive rewards in tokens. But this time, the focus is on Dolomite (DOLO), and it’s worth a closer look.

What is Dolomite?

Dolomite positions itself as a next-generation DeFi platform. Its key features for users:

- Borrow funds while keeping assets as collateral;

- Stake, vote, and earn rewards simultaneously;

- Trade and earn yield without locking assets for long periods.

A key tool is Dynamic Collateral, which allows users to use assets as collateral while retaining their utility: coins in positions still generate staking rewards or voting rights.

Other notable features:

- Smart Debt and Smart Collateral — flexible position management;

- Strategies Hub — ready-to-use investment strategies, suitable even for beginners.

The platform shows millions of dollars in locked liquidity and decent yields, indicating a certain level of user trust.

DOLO price dynamics after listing

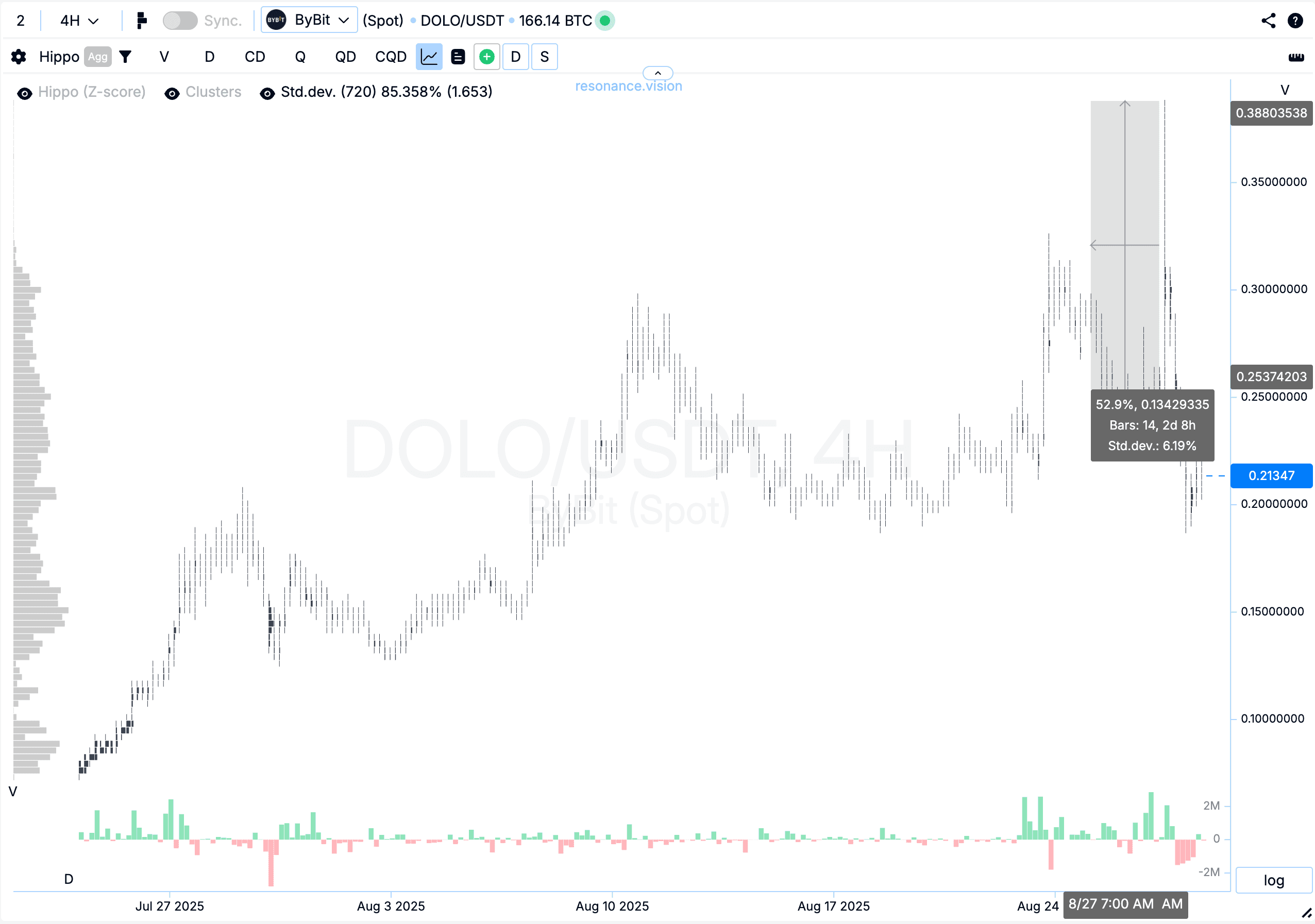

On Bybit, DOLO started around $0.06, dropped to $0.03, and then grew over 500% to $0.38. Typical for new assets:

- Initial high volatility;

- Attempt to find balance;

- Several pumps and corrections.

Recently, there was a sharp impulse — about +50% in a short time. These jumps look impressive, but usually the market calms down afterward and volatility decreases. Despite large purchases, the price did not hold, showing that buyers aren’t strong enough yet to push it higher.

What to expect from DOLO now?

Current situation:

- The market remains highly volatile, short-term speculative trades possible;

- Lacking stability for medium- or long-term positions;

- Signs of supply deficit (price not making new lows after sales), which could lead to local gains.

It’s too early for a stable trend. The next phase is likely volatility reduction until the market decides the direction.

Conclusion

Dolomite is an interesting DeFi project offering innovative solutions for collateral and asset management. Functionalities look promising, but the market remains unstable.

- Intraday speculators may still find opportunities;

- For medium-term investments, it’s better to wait for the market to clarify direction.

What do you think about DOLO? Are you more into short-term trading, staking, or long-term DeFi strategies? Share in comments!

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.