BlackRock's buying and Bitcoin's forward-looking: what does this mean for the cryptocurrency market?

The article explores how BlackRock, the world’s largest investment fund, is increasing its Bitcoin holdings, now owning over 741,000 BTC. It examines the reasons behind this strategy, its impact on the crypto market, and the factors that could push Bitcoin’s price to $1 million within the next 5–10 years.

Table of content

Introduction

The world of investments continues to evolve under the influence of global players. One of the most influential is BlackRock — the largest investment fund in the world, managing assets worth approximately $10 trillion. One of the many assets that the fund focuses on is Bitcoin. Over the past few months, BlackRock has been actively increasing its positions in Bitcoin, causing significant resonance in the market.

In this material, we will examine the volumes of BTC currently held in BlackRock’s portfolio, when and how much they have bought or sold, what this could mean for the crypto market, and whether we should expect Bitcoin’s price to reach $1 million in the long term.

BlackRock Buys Bitcoin: What Is Known

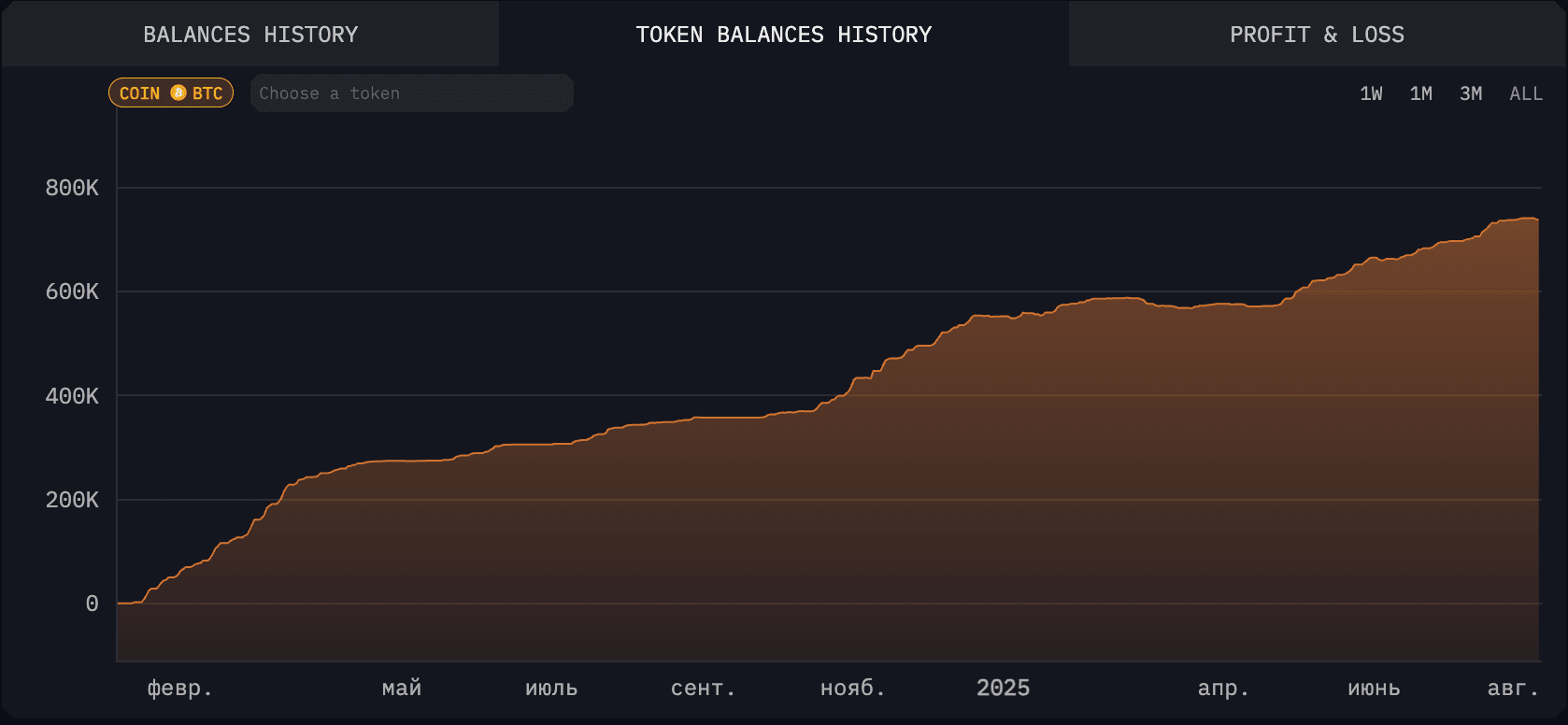

As of today, BlackRock’s portfolio holds approximately 741 thousand BTC. Based on charts and analytics, it is evident that at the beginning of 2024, the fund actively accumulated Bitcoin, reaching its first peak of 587 thousand BTC in February. After a slight reduction in volumes from February to April (selling off 15–17 thousand BTC), a new accumulation phase began, and by July, the total volumes reached 741 thousand BTC.

BlackRock, as an American company, mostly conducts its transactions through Coinbase, the largest U.S. cryptocurrency exchange. This is a logical choice due to compliance with legal standards, transparency, and the platform’s reliability.

Rebalancing or Strategic Accumulation?

Although the fund periodically sells portions of Bitcoin, this is most likely part of a portfolio rebalancing strategy. In other words, BlackRock is not trying to “catch the bottom” or “sell at the top,” but rather maintains an optimal share of BTC in its asset structure. As of today, Bitcoin accounts for only 1% of the fund’s total portfolio, equating to about $97 billion in digital assets out of a $10 trillion total.

This fact is crucial. If Bitcoin constitutes just 1% of the portfolio, and BlackRock already holds $97 billion in BTC, the potential for further investments in case of a strategic weight adjustment is enormous.

Why This Is Important for the Crypto Market

BlackRock is not just an investor. It is a flagship of global capital that shapes trends and serves as a signal for thousands of other funds, banks, and private investors. Their actions are often interpreted as confirmation of an asset’s legitimacy and long-term potential.

If the world’s largest fund includes Bitcoin in its long-term strategy, it opens the door to billions in new investments. This also confirms that Bitcoin is not a “bubble” or “speculative game,” but a real financial instrument being integrated into the traditional financial system.

Forecast: $1 Million for Bitcoin?

Bitcoin could reach a price of $1 million in a 5–10 year perspective. There are several reasons for this:

- Deflationary model of BTC: The total number of coins is limited.

- Institutional recognition: ETFs, stablecoins, blockchain integration into the real sector (Visa, Western Union, Ripple, etc.).

- Market volume growth: The capitalization of stablecoins has risen from $10 billion in 2020 to over $200 billion in 2025.

- Possible interest rate reduction in the U.S.: If monetary policy softens, investors will direct more funds into risky assets, including crypto.

- Legislative regulation: The GENIUS Act — a 2025 law that establishes regulatory frameworks for stablecoins in the U.S.

Thus, the long-term bullish trend remains in place, even if short-term corrections and pullbacks are possible.

Market Analysis: Current Trends

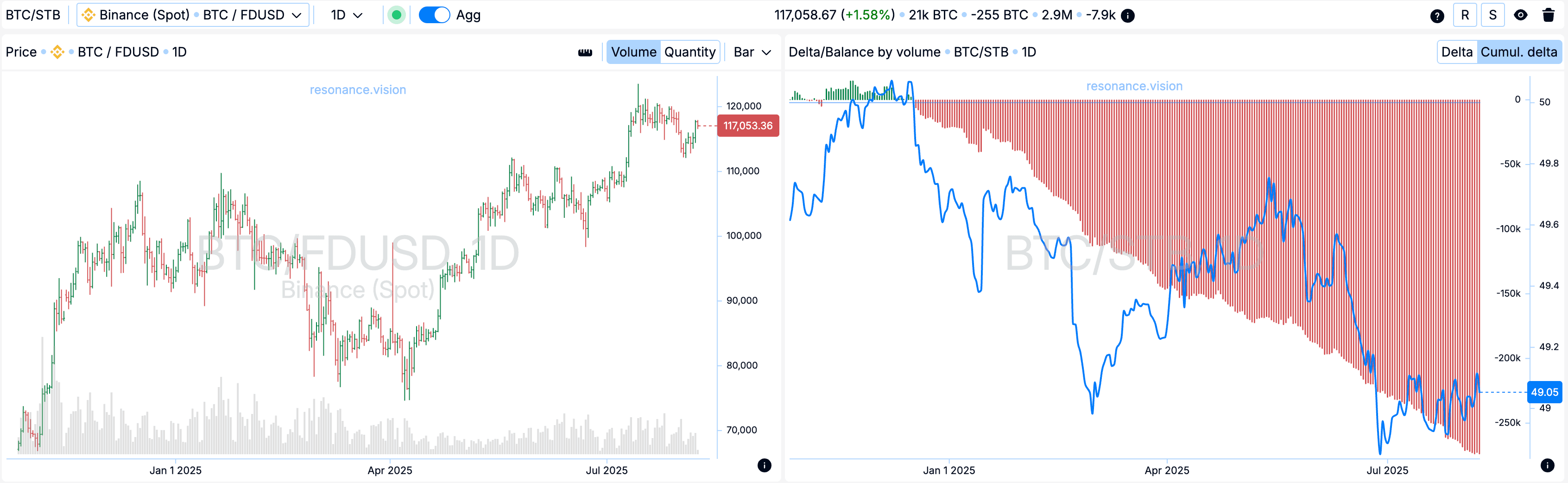

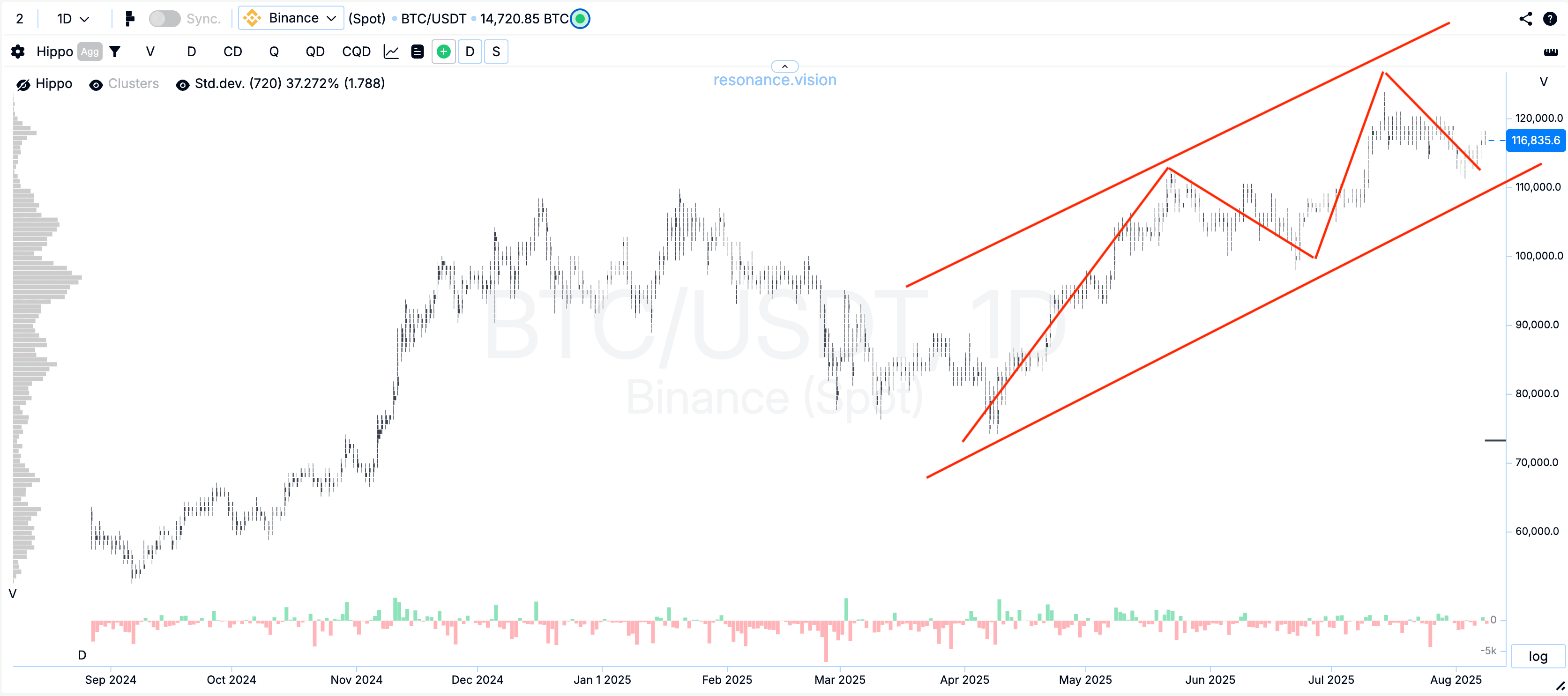

Based on exchange data analysis, there is steady pressure from sellers.

This indicates the possibility of a short-term correction or consolidation.

However, the global trend, according to Dow Theory, remains upward: each new high exceeds the previous one, and lows are not being updated.

Why BTC Is Not Always the Best Tool for Trading

Although Bitcoin is considered a reliable asset for long-term investment, it is not always the most effective in short-term trading (trading). Altcoins often exhibit higher volatility and growth dynamics. Therefore, while Bitcoin is an ideal option for accumulation using a DCA strategy, active speculative trading may be more effective with altcoins.

Conclusion

BlackRock’s activity confirms that Bitcoin has become part of the global financial landscape. Including BTC in the portfolio of a fund of this caliber is a signal to the market: cryptocurrencies can no longer be ignored.

Although short-term volatility may raise doubts, the long-term trend points to growing interest and trust in Bitcoin. If institutional investors continue to accumulate and regulatory conditions improve, Bitcoin could indeed reach new historical highs — and even $1 million in the next 10 years.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.