Coinbase Ventures invests in TON: what it means for the market and investors

The investment by Coinbase Ventures in TON could become a key driver for the development of the Telegram ecosystem and the growth of the token’s value. The piece explores the reasons behind the interest of a major venture player, parallels with Facebook’s success, earning opportunities through staking, grid bots, and speculative trading, as well as market analysis across major exchanges.

Table of content

Coinbase Ventures has taken an important step toward TON, an ecosystem closely connected to Telegram. Although the amount of the deal has not been disclosed, it is clear that this is a long-term investment with potentially favorable conditions. This event may affect not only the price of TON, but also the overall perception of the project among institutional investors.

Why Coinbase Ventures is interested in TON

Coinbase Ventures — the venture arm of one of the largest crypto exchanges in the world — operates under strict regulatory conditions, especially in the United States. This means that any investments they make are done with maximum caution, selecting projects with strong prospects.

TON is not just a cryptocurrency, but a key element of Telegram’s infrastructure. The token is used for paying for premium subscriptions, purchasing advertising in channels, and other platform services. Thus, TON has real utility value and the potential for scaling.

Comparison with the Facebook case

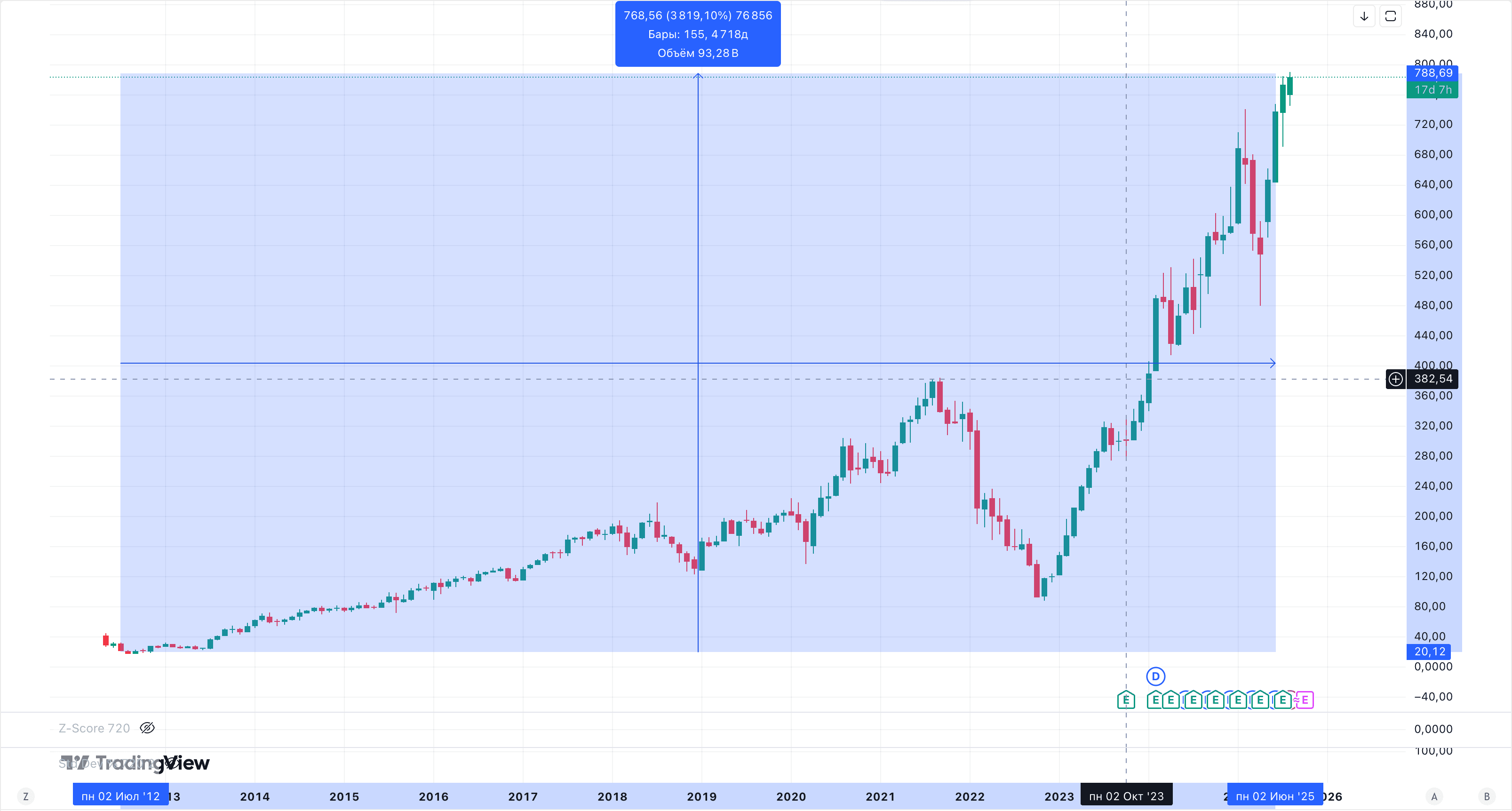

The development story of TON partly resembles that of Facebook. In 2012, the social network launched advertising, which became the trigger for its capitalization growth by 700%.

Similarly, Telegram is already monetizing through advertising and paid features, and this can become a strong driver for TON price growth in the future.

Investment opportunities with TON

There are several ways to earn on TON:

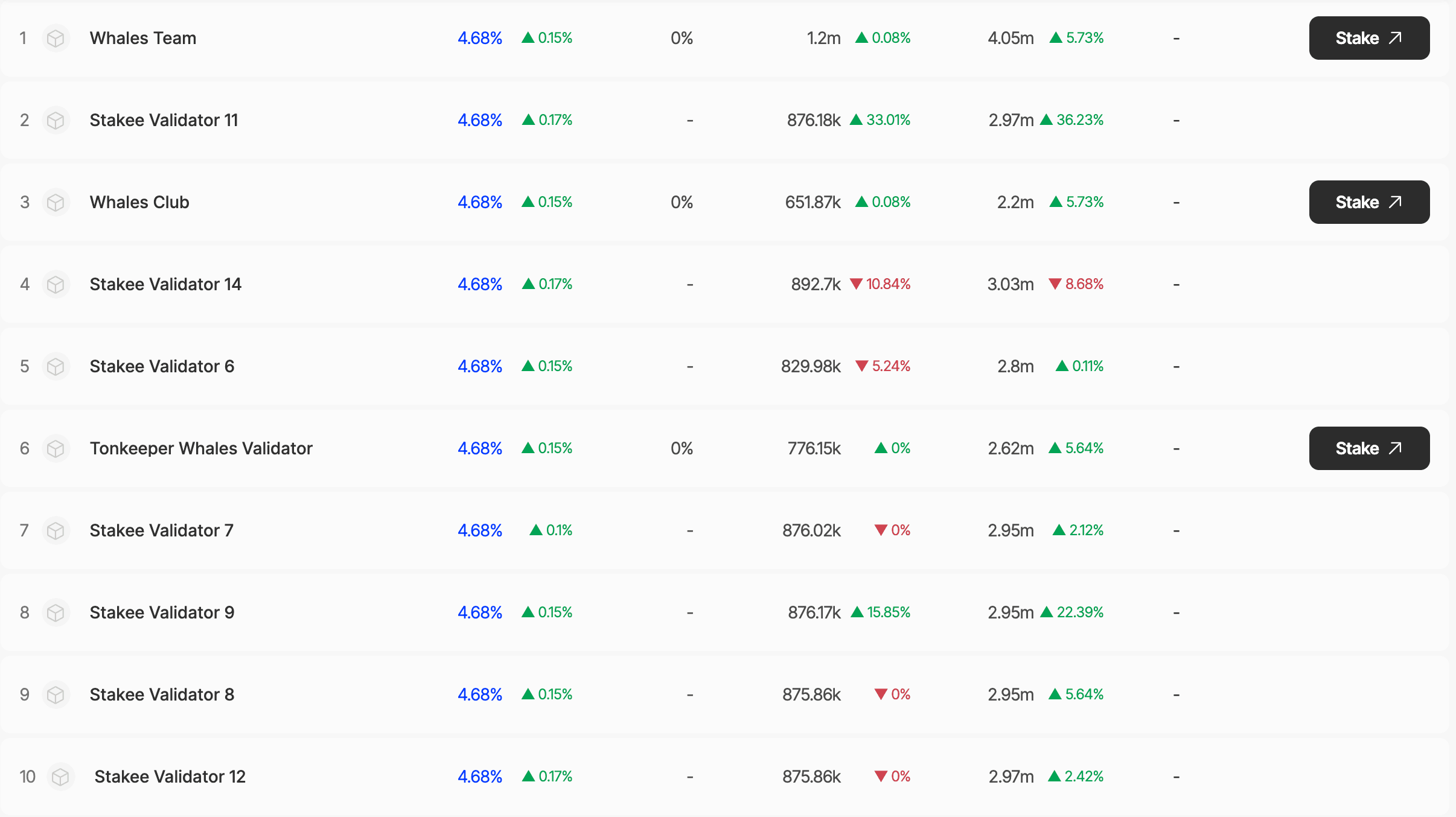

- Staking – according to Staking Rewards, yields can reach 4.6% annually. Using the DCA (Dollar-Cost Averaging) strategy allows you to accumulate tokens gradually, reducing volatility risks.

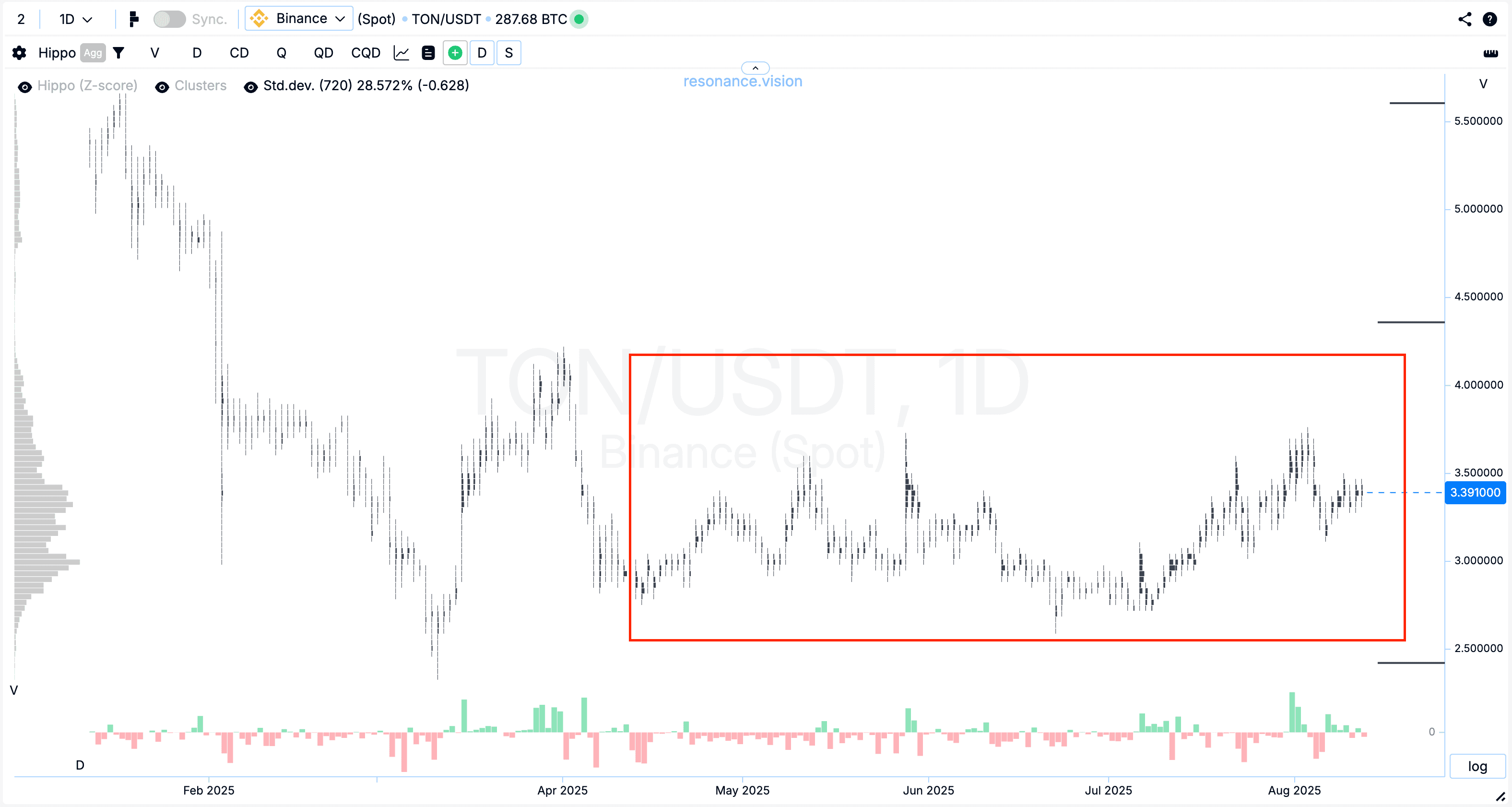

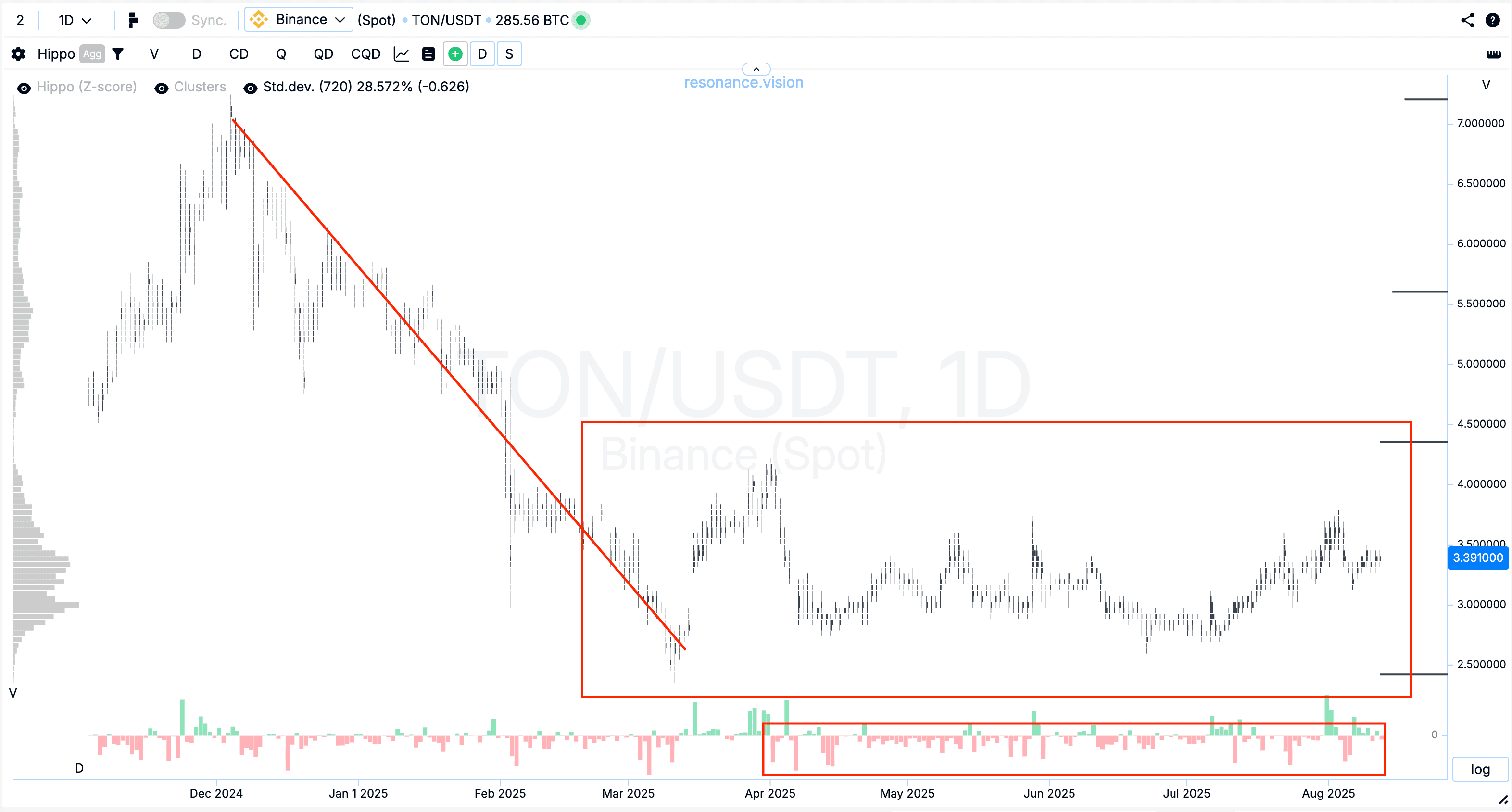

- Grid bot – for active trading in a sideways market. Under current conditions, you can set up a long grid with moderate leverage (no more than 5x).

- Speculative trades – using short-term price fluctuations within a set range.

TON market analysis on exchanges

- Binance: sideways movement with occasional volume spikes on buys. But the coin is not falling much on sales. This indicates a possible supply deficit.

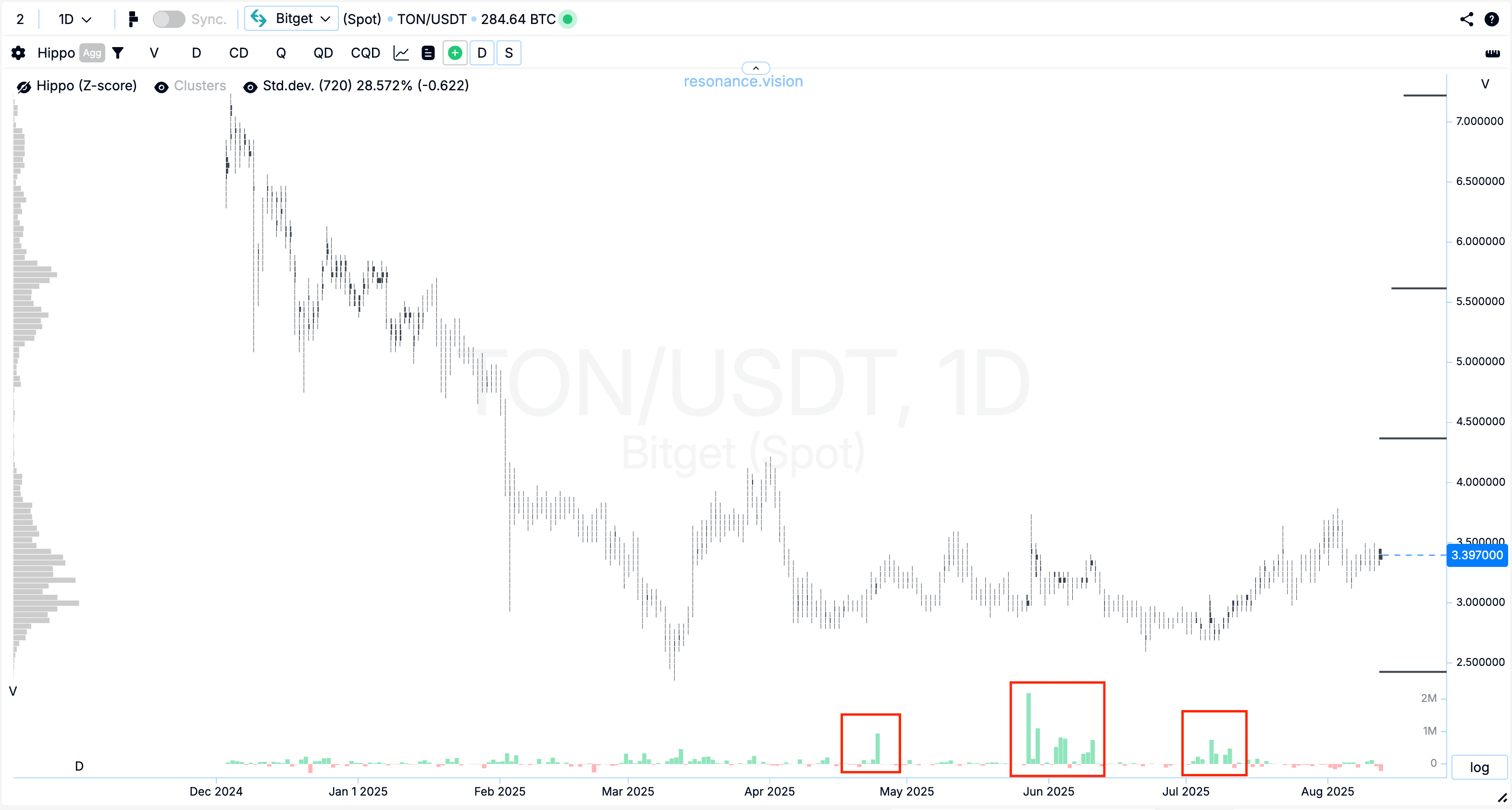

- Bitget: active buying with subsequent short-term growth is observed.

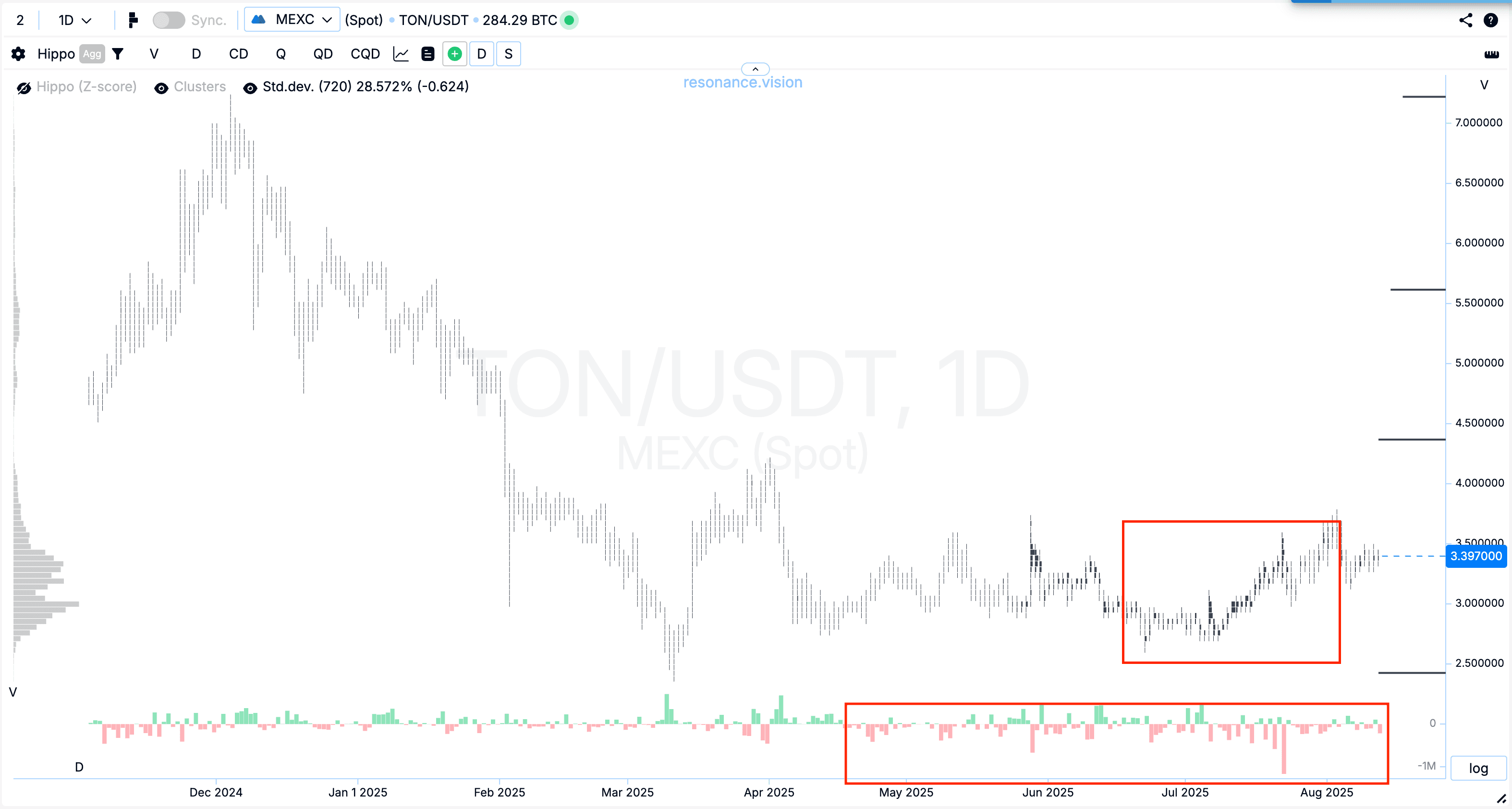

- MEXC: significant selling, but without a major price drop.

The absence of TON trading on Coinbase Pro only emphasizes the strategic nature of Coinbase Ventures’ investment — perhaps the token will appear there in the future.

Development prospects

If Telegram continues to expand its functionality and implement new services based on TON, the token has every chance to repeat the success of the largest technology companies. In the long term, the token could show multiple growth.

Conclusion: the investment by Coinbase Ventures in TON is a signal to the market about the serious potential of the project. For investors, both conservative earning options through staking and riskier ones through speculative trading are now available. The main thing is to follow risk management and monitor the development of the Telegram ecosystem.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.