Crypto and Politics: Why Trump’s Statement Affected the Digital Asset Market

Following Donald Trump’s statements about imposing 100% tariffs on Chinese goods, panic ensued, and positions worth tens of billions of dollars were liquidated. In this article, we explore why a single political statement triggered a market crash, how fundamental economic factors impact the cryptocurrency market, and how to anticipate a collapse in advance through supply and demand analysis.

Table of content

- 01Trigger: News and Politics

- 02Impact of 100% Tariffs on Chinese Goods

- 03Impact on Manufacturing and Technology

- 04Pressure on the Consumer Sector

- 05Macroeconomic and Logistical Consequences

- 06Global Consequences for the World Economy

- 07Could the Crash Have Been Predicted?

- 08What Should Investors Do?

- 09Conclusion

Trigger: News and Politics

On 10 October 2025, the cryptocurrency market crashed. Positions worth tens of billions of dollars were liquidated, leaving traders and investors in a state of panic. The situation raised an important question: what affects the cryptocurrency market, and why can political statements trigger such rapid reactions? How does Trump influence cryptocurrency prices? Why? What happened to the crypto market? What affects cryptocurrency prices?

Let’s dive in.

The trigger for the market’s decline was President Trump’s statement about the potential introduction of 100% tariffs on Chinese goods. His tweets further amplified the market’s reaction, spreading rapidly across news outlets and social media.

Markets reacted immediately:

- The stock market saw an instant decline—investors perceived the initiative as a potential threat to global trade, rising costs, and inflation.

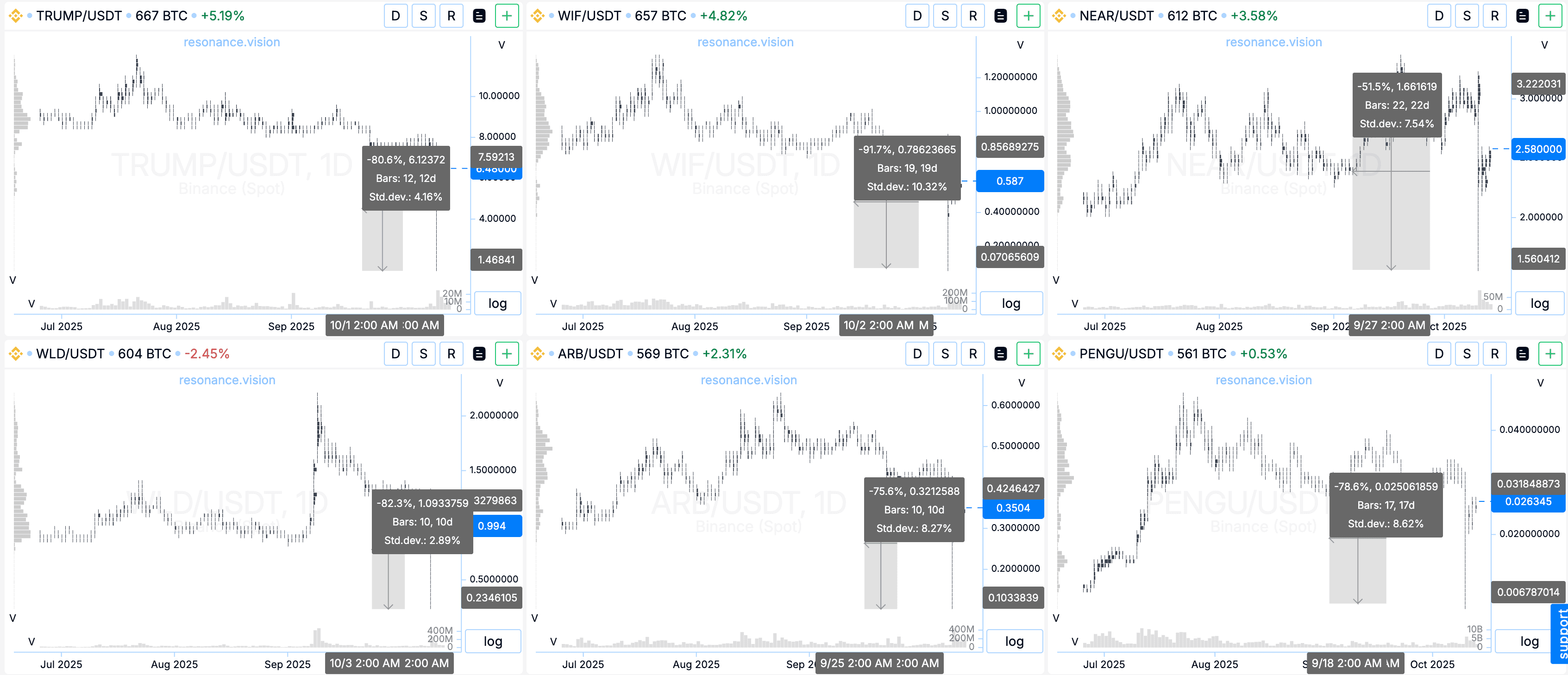

- Cryptocurrencies reacted even more strongly: amid this news, mass sell-offs and liquidations of positions worth tens of billions of dollars began, with Bitcoin falling by approximately 17% and some altcoins dropping by 60–99%.

This was one of the most striking examples of news affecting cryptocurrency, showing how political events can instantly move digital asset markets. In today’s digital environment, even a few tweets from political figures like President Trump can shake investor confidence and move crypto prices dramatically.

Impact of 100% Tariffs on Chinese Goods

Recent global economic news confirms that U.S. trade decisions have an immediate impact on the crypto market. If 100% tariffs on Chinese goods are implemented, they will cause a significant shock, instantly affecting supply chains, the consumer market, and politics. For the global economy, this situation could be a test of resilience. Macroeconomic factors form the foundation of long-term trends, influencing both the rise and fall of cryptocurrencies.

Impact on Manufacturing and Technology

These sectors will face sharp increases in production costs and supply chain disruptions. For example, electronics and IT equipment—smartphones, computers, tablets, and semiconductors—will be affected.

This could result in a sharp rise in prices for finished products in the U.S., potential shortages of key components, and reduced profit margins for American companies involved in assembly.

This will also affect industrial raw materials and components: aluminium, steel, plastic, rubber, and more. This threatens to increase costs for all U.S. manufacturing. Companies will be forced to seek alternative, often more expensive, suppliers outside of China.

Pressure on the Consumer Sector

The introduction of tariffs is a direct tax on imports, immediately borne by American consumers, leading to rising inflation.

Clothing, footwear, accessories, furniture, and household appliances will increase in price by 15–20% or more.

Rising prices for such goods increase the cost of living, prompting people to delay purchases of expensive, durable goods.

Macroeconomic and Logistical Consequences

Tariffs are a powerful inflationary factor, as they raise the cost of imports. Among the main factors are political instability, shifting trade policies, and investor sentiment — each playing a critical role in shaping crypto trends.

Companies in the U.S. and Europe will be forced to rapidly relocate production from China to Vietnam, India, Mexico, or back to the U.S.

However, this process is costly and time-consuming, leading to increased expenses and supply chain disruptions.

Global Consequences for the World Economy

Let’s take a broader view and highlight a few positive and negative aspects.

The introduction of 100% tariffs is a measure with significant impact. Like any major economic policy, it has both intended positive outcomes and inevitable negative consequences.

Negative Impacts:

- Rising Prices: Tariffs increase the cost of Chinese imports and goods from substitute countries like Vietnam and India, where demand surges. This creates shortages and fuels a new wave of inflation. Economics and politics often go hand in hand.

- Decline in Quality and Innovation Pace: Companies are forced to find new suppliers, often of lower quality, and reallocate funds, diverting them from research and development (R&D).

- Slowdown in Global Trade: Reduced trade between the world’s largest economies—the U.S. and China—inevitably affects the overall volume of global trade and GDP growth.

- Increased Geopolitical Tension: Retaliatory measures from China are possible, which could exacerbate international conflicts.

Potentially Positive Consequences:

On the positive side, substitute countries such as Vietnam, India, Indonesia, and Thailand will benefit from the relocation of manufacturing.

This will lead to increased investments, job creation, higher incomes, and improved quality of life for local residents.

Additionally, it will reduce market monopolisation and dependence on China, strengthening global economic resilience and reducing geopolitical risks.

Could the Crash Have Been Predicted?

To answer this, we first need to understand what affects crypto price and what fundamental factors drive the market’s direction.

The market operates according to the Law of Supply and Demand.

If visualised on a graph, with price on the X-axis and quantity on the Y-axis, it becomes clear: at low prices, participants want to buy more; at high prices, they buy less.

Conversely, sellers are more active when prices rise.

When prices are low, supply is minimal, but demand is high.

Buyers absorb the available supply and, over time, become sellers themselves, aiming to lock in profits at higher prices.

This forms the waves of market cycles.

Four Phases of the Market Cycle:

- Scarcity Phase: A lack of supply forms—prices do not fall despite sales.

- Realisation of Scarcity: Active buying drives prices upward.

- Consolidation: Participants lock in profits, and parts of the market lose clarity.

- Surplus Phase: Supply exceeds demand, purchases no longer push prices up, and a downward trend begins.

After this, the cycle repeats—the market seeks balance again and forms a new scarcity phase.

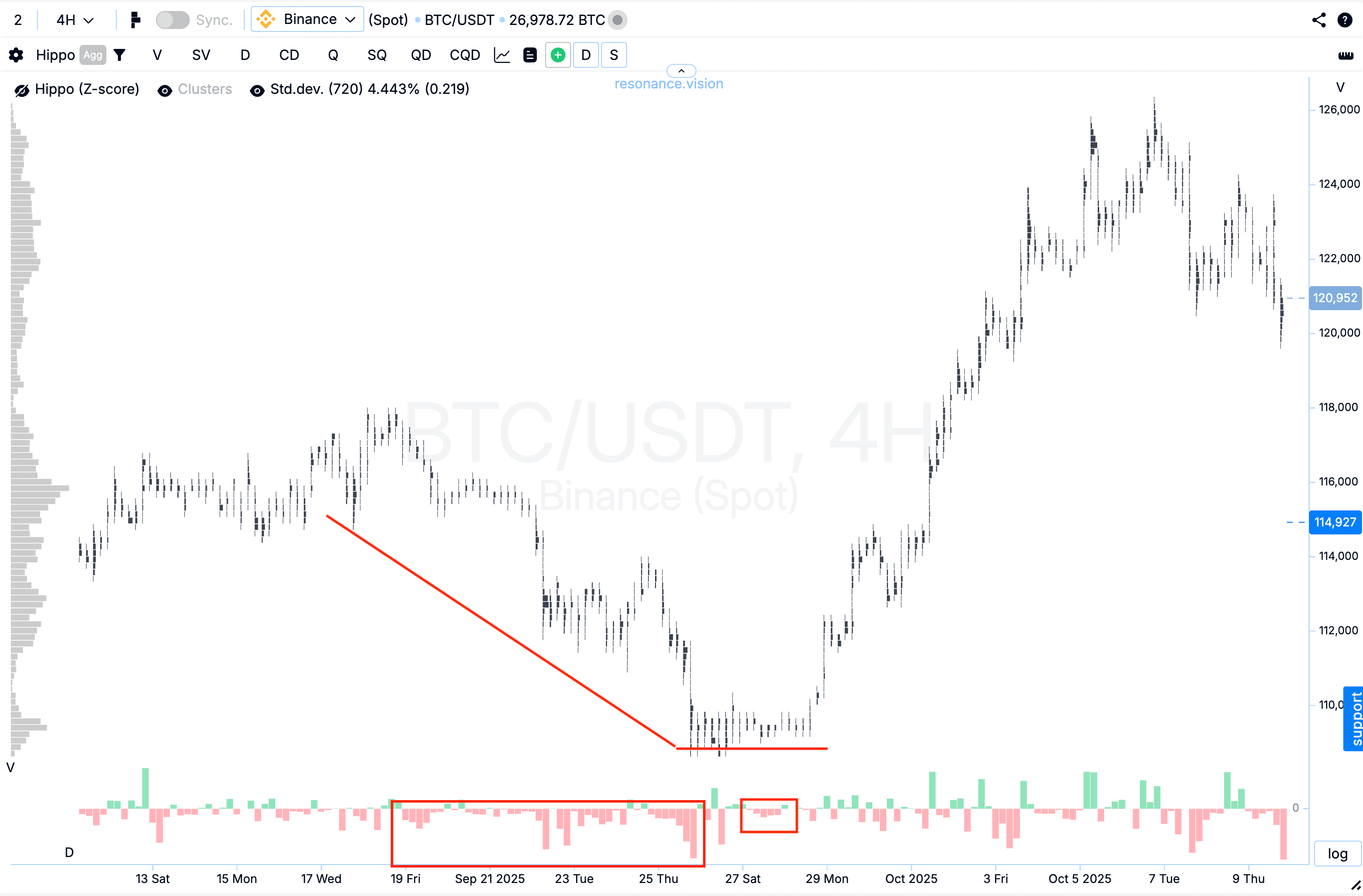

On Bitcoin’s chart, these phases are clearly visible: a decline due to effective sales, followed by a low-volatility zone where sales do not lower the price, and small purchases begin to push it up. This signals the formation of scarcity.

Later, signs of surplus emerge—purchases no longer set new highs, and sales start breaking through lows.

In such a phase, holding long positions is inefficient because price growth is impossible with excess supply.

The crypto market’s dynamics are influenced by both fundamental and psychological factors, so sharp price fluctuations often result from not only economic processes but also investor sentiment.

What Should Investors Do?

The crash could have been anticipated, especially after the strong growth of Bitcoin, Ethereum, Solana, BNB, and other coins. Experienced traders rely not on news but on cluster charts as a key part of market analysis.

Many of these charts showed signs of surplus.

Therefore, it’s crucial to follow risk management and diversification strategies.

This political situation has prompted many to reassess their investment and trading strategies.

Portfolio Allocation Principles:

- 60/40—Agressive Portfolio: 60% low-risk investments, 40% high-risk.

- 70/30—Balanced Portfolio: 70% low-risk assets.

- 80/20—Conservative Portfolio: 80% low-risk instruments.

Of the high-risk asset portion, only 5% should be used for active futures trading. The rest should be allocated to hedging and diversified strategies.

To understand market logic, it’s recommended to take a mini-course by Aires on the Resonance platform.

Its six steps explain how to analyse supply and demand, interpret market signals, and avoid liquidations.

Use the Resonance analytical platform—it will help you analyse the market objectively.

Conclusion

Crashes and declines in the crypto market are inevitable—they are a natural part of the cycle.

This situation demonstrated how sensitive the crypto market is to political decisions. The key is not to try to predict everything but to work with facts: analyse the balance of supply and demand, maintain diversification, and protect capital. Political headlines, tweets, and breaking news continue to influence the crypto market — but understanding supply, demand, and price dynamics remains the foundation for stable decision-making. Even in unstable situations, it’s vital to stay calm and disciplined. Only then can you weather any crisis without significant losses. Focus not on news or political signals but on volumes (or rather, their impact on price)—they often serve as the first signs of a trend change.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.