DOGE and Zero Knowledge Proofs: how infrastructure updates can affect the price

A new infrastructure initiative for Dogecoin: the DogOS team proposes the implementation of Zero Knowledge Proofs. We analyze how this could affect the value of DOGE, whether it will open the door to DeFi, and what earning opportunities are emerging right now.

Table of content

- 01What is DogOS proposing and why is it needed?

- 02Technical implementation and timeline

- 03DOGE market structure analysis: is there growth potential?

- 04Should you invest?

- 05How can we profit from this?

- 061. Monitor for signs of supply deficit

- 072. Range trading

- 083. Locking in profits before the next impulse

- 094. Speculative trading on the news

- 105. Long-term position under infrastructure upgrade

- 11Conclusion

Dogecoin (DOGE) is once again in the spotlight thanks to an important infrastructure initiative. The DogOS team, the creators of MyDC Wallet — a popular wallet with over 500,000 users — has proposed integrating Zero Knowledge Proofs (ZKP) into the DOGE blockchain. This solution could significantly impact both the internal architecture of Dogecoin and its prospects in the decentralized finance (DeFi) market.

What is DogOS proposing and why is it needed?

DogOS is not just a wallet — it’s a full-fledged application layer: SDKs, APIs, integrations, and developer tools built on the DOGE infrastructure. Their new proposal is to add switchable anonymity, similar to Zcash or Tornado Cash, based on Zero Knowledge Proofs.

The user will be able to choose the mode: public or anonymous. This would allow:

- hiding transaction amounts and addresses

- maintaining transaction validation at the blockchain level

- creating a foundation for anonymous DeFi products — from DEX integrations to anonymous lending

Such an update is a step toward turning a meme coin into a real infrastructure asset.

Technical implementation and timeline

It’s important to understand: this is still a proposal, not a finalized release. Developing and integrating such solutions is a complex and lengthy process:

- a security audit must be conducted;

- legal risks related to anonymity may arise;

- community support is required.

Even with strong support from users and validators, such an upgrade may take months.

DOGE market structure analysis: is there growth potential?

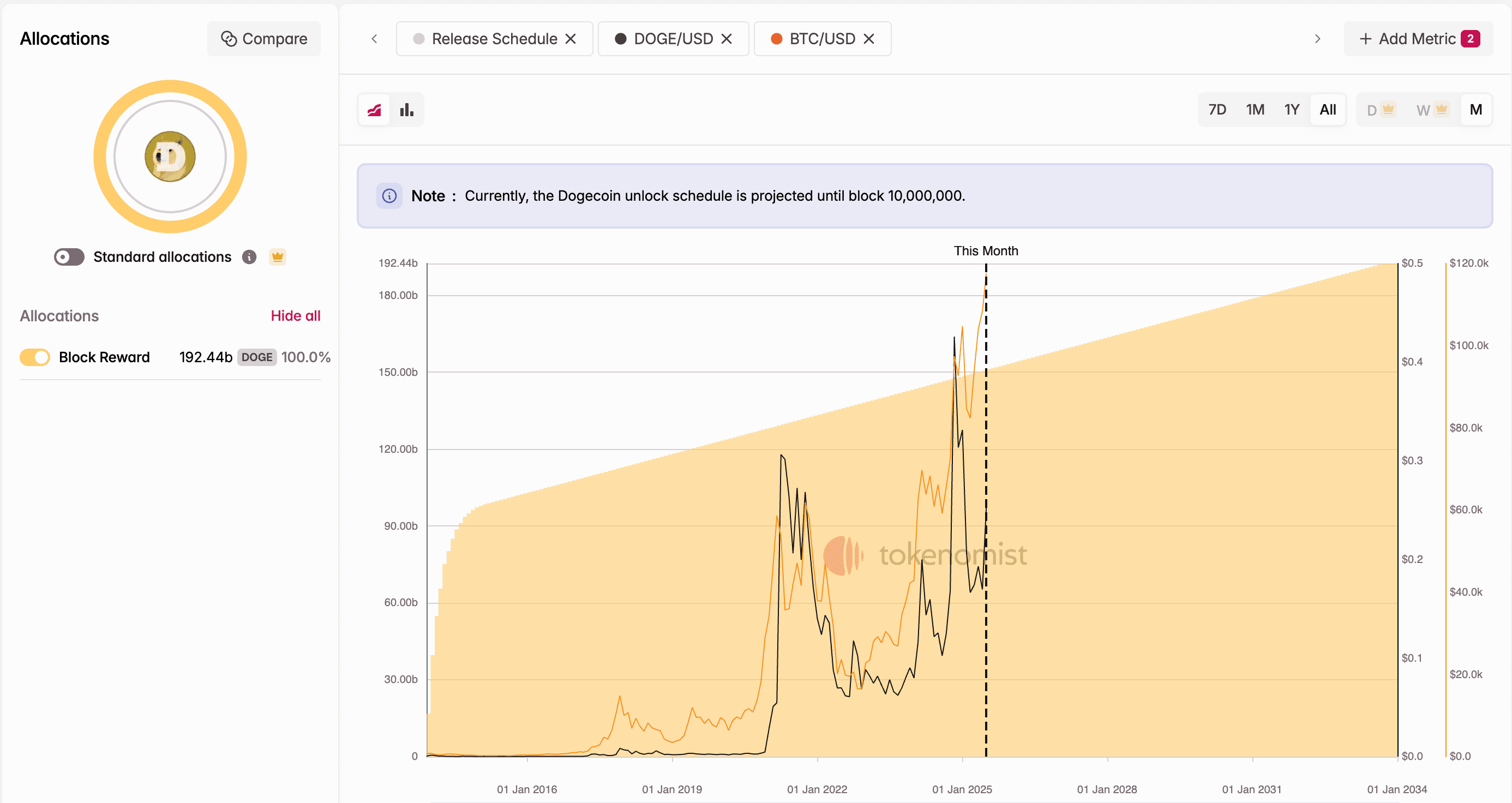

From a fundamental perspective, Dogecoin is in an interesting phase:

- 80% of DOGE’s total supply is already in circulation — a positive signal, since the pressure from new emissions is minimal.

- In recent months, DOGE has shown growth of over 100%, followed by consolidation.

- Signs of supply deficit (limited supply against rising demand) are still present.

However:

- Volatility remains high;

- Market participants have already spent significant capital on price growth;

- Most crypto assets are currently in a consolidation phase following the altcoin season.

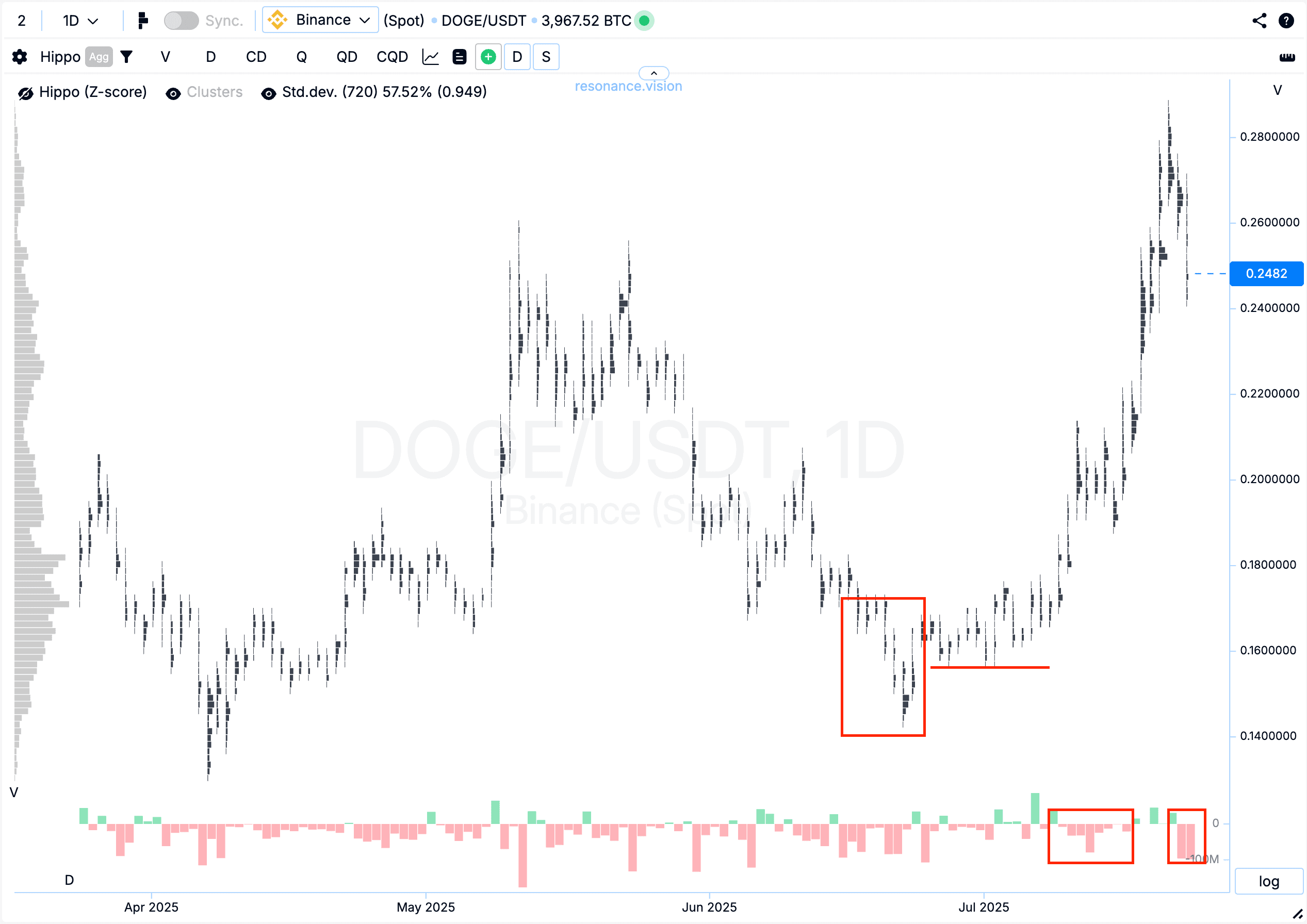

Cluster chart: volume confirms that participants have started locking in profits, and now the most likely scenarios are a pause in growth, a pullback, or a broad sideways consolidation.

Should you invest?

The infrastructure proposal from DogOS could become a long-term growth driver for DOGE. If ZKP technology is integrated, Dogecoin would gain:

- functionality comparable to that of DeFi coins;

- access to new markets and tools;

- increased interest from developers and investors.

But in the short term, the growth has already been priced in.

How can we profit from this?

The integration of Zero Knowledge Proofs in Dogecoin is still just a proposal, not a realized upgrade. Nevertheless, the very emergence of such an initiative could influence market participants’ behavior. Here are several scenarios for leveraging the situation:

1. Monitor for signs of supply deficit

DOGE charts have already shown zones of supply deficit — participants actively bought the coin, forming demand. This often precedes price growth. If new signs of deficit appear, especially after consolidation, it could present a good entry point.

2. Range trading

After a 100% price increase, Dogecoin is likely to enter a consolidation phase — a volatile sideways movement. This type of market is ideal for short-term trading between support and resistance zones.

3. Locking in profits before the next impulse

Many participants have already locked in profits. The result — a pullback. Along with it come opportunities to enter at a better price. If the market gives clear signals of supply deficit formation, this would confirm a phase of accumulation.

4. Speculative trading on the news

Even the discussion of ZKP implementation may cause a surge of interest. This is a short-term, but potentially profitable scenario: buy on rumors — sell on news. Watch the market’s reaction to official announcements and sentiment in social media. Remember: news is only a trigger. It’s important to analyze cluster volume data to validate any trade setup.

5. Long-term position under infrastructure upgrade

If you believe that Dogecoin will be able to implement anonymity and break into the DeFi segment, then it makes sense to consider buying during the accumulation phase, with an execution horizon of several months.

Conclusion

The infrastructure initiative by DogOS could become a key turning point for Dogecoin. The implementation of Zero Knowledge Proofs may transform DOGE from a meme coin into an asset with true DeFi capabilities — from anonymous transactions to lending. However, for now, it remains only a proposal, and the market has already partially reacted to the news impulse. It’s crucial to watch for consolidation, signs of supply deficit, and the community’s reaction. For traders and investors, this is an opportunity to assess potential early and prepare for the next breakout.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.