Dogecoin ETF from Grayscale: a playful memecoin or a new institutional investment?

We examine the launch of Grayscale Dogecoin ETF in the USA. You will learn what Dogecoin is, why it has become one of the most popular memecoins, how its mining works, what factors influence its price, and what risks exist for investors. We also analyze the long-term prospects of DOGE and the opportunities that the launch of the world’s first Dogecoin ETF may open

Table of content

- 01Introduction: how a meme turns into a serious asset

- 02What is Dogecoin and why is it important

- 03Grayscale Dogecoin ETF: what it means for the market

- 04Technical side of Dogecoin: how mining works

- 05Fundamental factors influencing DOGE price

- 06Market analysis: is it time to invest?

- 07Risks of investing in DOGE

- 08Conclusion: the future of Dogecoin is in institutional hands

Introduction: how a meme turns into a serious asset

The news that Grayscale has filed for the launch of a spot ETF on Dogecoin (GDOG) in the U.S. has caused much discussion in the crypto world. The idea seems almost unbelievable — just a few years ago, Dogecoin was perceived only as an internet joke, and today it claims the role of an institutional asset.

Can a memecoin, which began with an image of a Shiba Inu dog, become a full-fledged instrument for investors and funds? Let’s find out.

What is Dogecoin and why is it important

Dogecoin (DOGE) appeared in 2013 thanks to programmers Billy Markus and Jackson Palmer. They created a cryptocurrency based on the Litecoin code, but with a humorous undertone: the logo became the meme with a Shiba Inu dog. No one thought that this “joke” would turn into a multibillion-dollar asset.

Today Dogecoin has:

- a huge community supporting its development;

- numerous exchange listings — from Binance to Coinbase;

- real-life use — Tesla and other companies accept DOGE as payment;

- unlimited issuance: about 5 billion coins are created in the network every year, making the asset inflationary.

Thus, Dogecoin combines the status of a memecoin and a real payment instrument.

Grayscale Dogecoin ETF: what it means for the market

Filing with the SEC to create a spot ETF on DOGE means that the fund will directly buy and hold Dogecoin coins. Coinbase Custody will act as custodian, and the ETF will be traded under the ticker GDOG.

This opens several opportunities:

- Institutional investors will be able to access DOGE without buying it directly on exchanges.

- Demand for the coin may increase significantly, since the ETF will repurchase DOGE from the spot market.

- This creates a precedent — for the first time, a memecoin receives an institutional wrapper, which has not happened in crypto history.

For Grayscale, this is also a business model: the company earns on fees (about 2% per year), so it is interested in attracting billions of dollars into assets under management.

Technical side of Dogecoin: how mining works

To understand the future of DOGE, it is worth looking at its economics.

- Mining algorithm — Scrypt, the same as in Litecoin.

- Block reward — 10,000 DOGE every minute.

- Daily issuance — 14.4 million coins.

- Annual issuance — about 5 billion DOGE.

This means that Dogecoin is inflationary, but its value has historically increased due to popularity and high demand. Over the years, DOGE has risen by 41,000% from its initial price.

Fundamental factors influencing DOGE price

Community and celebrity support

Elon Musk has repeatedly called DOGE his favorite cryptocurrency. Each of his tweets pushed the price up.Business adoption

Companies like Tesla and online services have started to accept Dogecoin as payment. This adds practical value to the coin.

New developments

The MyDogWallet team announced the possibility of integrating anonymous transactions and new features into the DOGE ecosystem. This may strengthen the coin’s position among users who value privacy.ETF as a demand driver

If Grayscale Dogecoin ETF is approved, demand for DOGE may increase proportionally to institutional inflows.

Market analysis: is it time to invest?

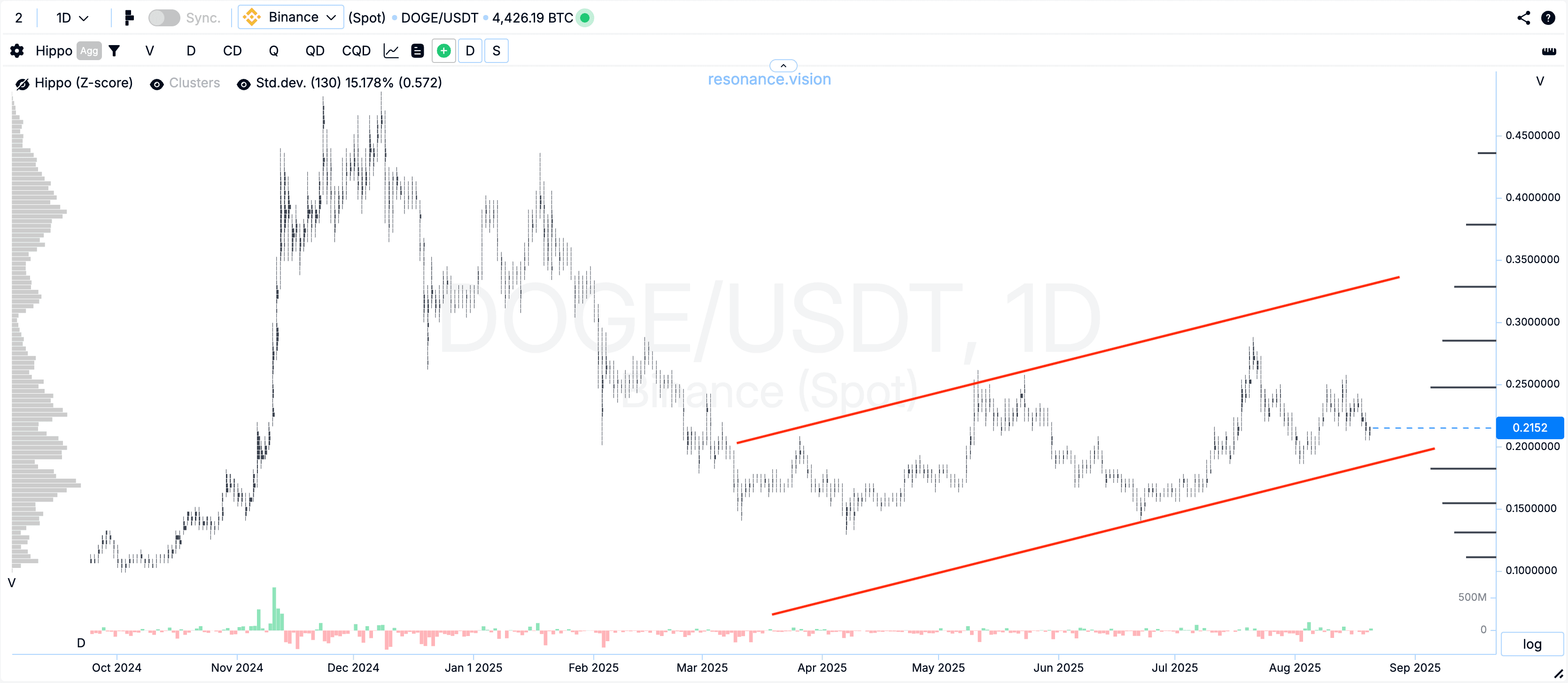

Today Dogecoin trades around $0.20. Analysis shows:

- A long-term upward trend is forming on the chart.

- After strong pullbacks, DOGE recovers, indicating buyer support.

- High volatility makes medium-term and intraday trades risky.

Traders should consider:

- For DCA strategies, DOGE may be interesting in combination with other assets.

- For short-term speculation, caution and in-depth analysis of supply and demand are needed.

- The ETF launch could be a catalyst for a new growth cycle.

Risks of investing in DOGE

Despite positive factors, investors should remember the risks:

- Inflationary model puts pressure on the long-term price.

- The coin depends on hype and public figure support.

- In competition with technologically advanced blockchains (Ethereum, Solana), DOGE looks weaker.

- Volatility can become a trap for unprepared traders.

Conclusion: the future of Dogecoin is in institutional hands

Dogecoin has gone through a unique path: from a memecoin to an asset attracting institutional capital. The launch of Grayscale Dogecoin ETF may become a historic event, showing that even a “joke” cryptocurrency can earn the trust of serious investors.

However, DOGE remains a high-risk asset. It may be an interesting part of a diversified portfolio, but it should not be its foundation.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.