dYdX: Analyzing Token Prospects Amid 21Shares' ETP and Declining Revenue

An analysis of the dYdX token’s prospects following the ETP launch by 21Shares. A breakdown of the exchange’s financial metrics, an analysis of the token’s chart and volumes, and an assessment of the effectiveness of the Buyback program and other dYdX initiatives. A discussion of the token’s potential and risks.

Table of content

The recent partnership between the Swiss company 21Shares and the decentralized exchange dYdX has attracted significant interest. 21Shares launched the world’s first ETP (Exchange Traded Product) on the dYdX token to provide large institutional investors with access to the DeFi market through a regulated and familiar instrument. This is an important step for Mass Adoption and demonstrates the growing legitimacy of dYdX in the eyes of traditional finance.

dYdX: A Leader Among DEXes Facing a Downturn

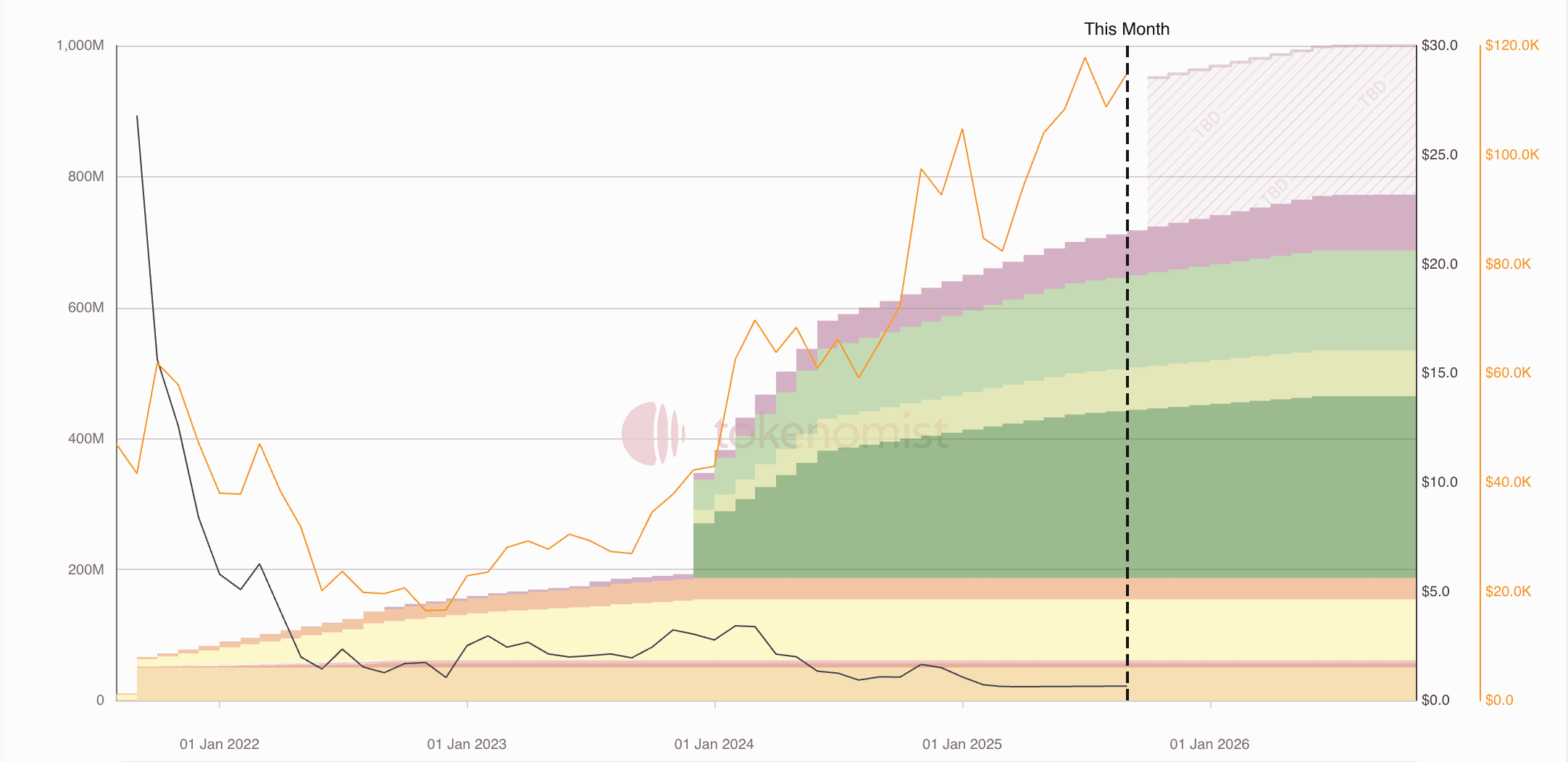

dYdX is one of the largest decentralized derivatives exchanges, with over 200 futures contracts and enormous trading volumes. Founded in 2018, the exchange has achieved significant success. However, according to recent data, its revenue from fees is declining significantly. While it was $20 million in Q2 2024, it fell to $3.2 million in Q2 2025. This raises concerns, especially considering the upcoming token unlock, which will create additional supply in the market.

dYdX’s Steps to Stabilize the Situation

dYdX management understands the need to increase revenue and improve the platform. The exchange has recently launched several important updates:

- Order Gateway: Infrastructure that reduces latency and enhances “fair access,” expected to improve the trading experience and user retention.

- Partner Revenue Share: A program that rewards partners for driving Order Flow, aimed at increasing trading volumes and profitability.

- Buyback Program: Since late March 2025, 25% of the revenue from fees has been allocated to buying back the dYdX token from the market. This is a key mechanism for reducing supply and supporting the price.

Analysis of the dYdX Token’s Chart and Volumes

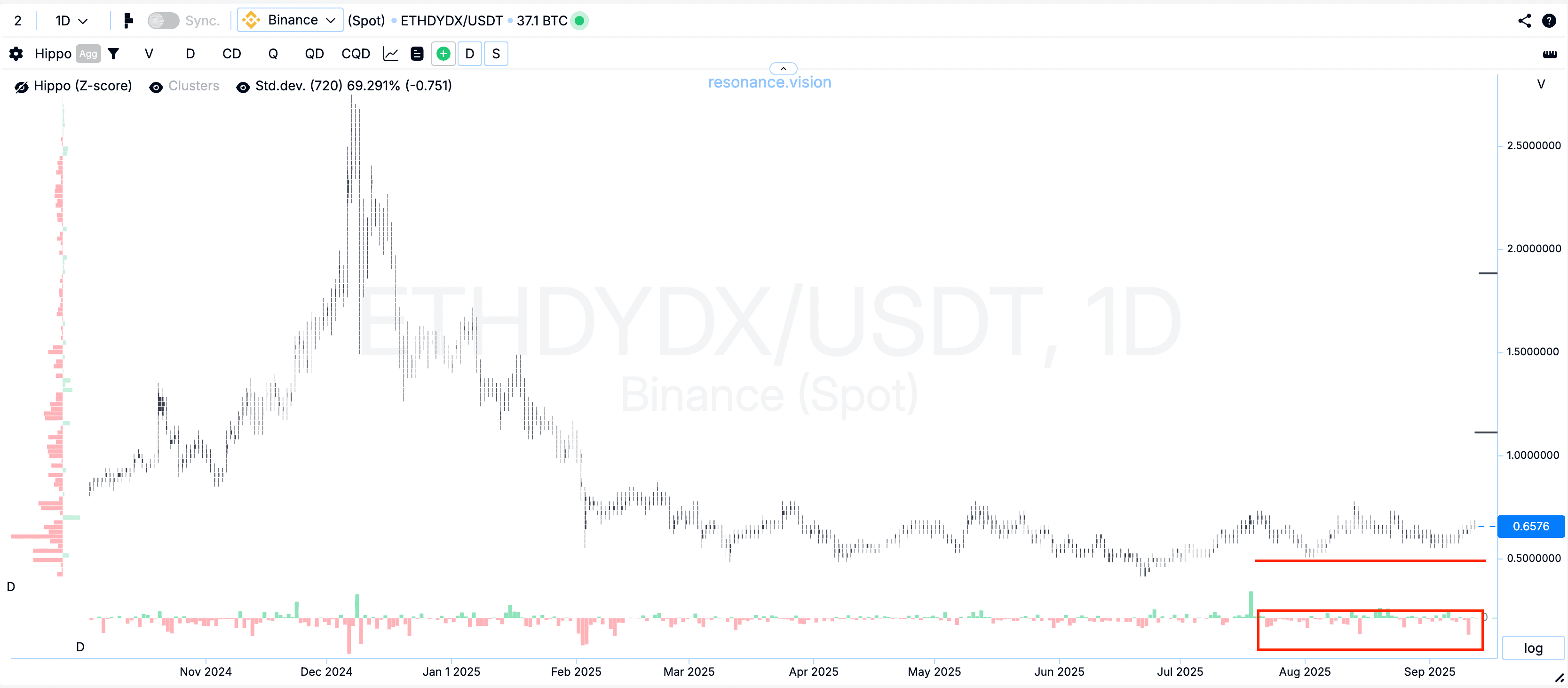

An analysis of the dYdX chart shows that after a prolonged downtrend that began at the end of last year, signs of scarcity have appeared in the market. Large sales volumes do not lead to a price decline, which indicates strong demand and the absorption of supply. This is a classic signal of accumulation.

However, unlike other assets such as Solana or AVAX, which recently broke out of their range and hit new highs, dYdX remains within its trading range. This may indicate a lack of sufficient fundamental drivers for an impulsive rally. While the idea of buying based on signs of scarcity is attractive, it should be implemented with caution.

Conclusion

The launch of the ETP by 21Shares is positive news for dYdX as it opens the door to large institutional capital. The Buyback Program also supports the token’s price, offsetting the decline in fee revenue and the upcoming unlock. The chart shows signs of scarcity, indicating the presence of demand.

However, given the declining profitability and lack of impulsive growth, dYdX is less attractive for aggressive positions compared to other assets. The best strategy for investors who believe in the project may be to use Grid bots to trade within the existing range, allowing them to profit from volatility without the high risks associated with directional positions. Always remember to practice risk management!

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.