Grayscale Bets on Hedera (HBAR): What Investors Need to Know

Grayscale files an application to launch an ETF based on the Hedera (HBAR) token, giving investors from traditional financial markets access to the innovative Hashgraph technology. The material provides a detailed breakdown of opportunities, partnerships, growth prospects, and risks for investors in 2025.

Table of content

Grayscale, one of the largest digital asset management companies in the world, has filed an application in Delaware to launch an ETF based on the Hedera (HBAR) token. This news has already sparked investor interest, as it combines two important themes – legal access to cryptocurrencies and the innovative Hashgraph technology.

What is Grayscale and Why It Matters

Grayscale is a leading investment company founded in 2017, specializing in creating financial products for cryptocurrency investment. Its most famous products are the Grayscale Bitcoin Trust and the Grayscale Ethereum Trust.

The principle is simple: the company buys cryptocurrency, for example, Bitcoin, and issues stock market shares backed by these assets. This gives US investors legal access to crypto through familiar exchange tools, without the need to buy digital assets directly.

Advantages of this approach:

- Regulation by the US Securities and Exchange Commission (SEC)

- The ability to buy cryptocurrency through a brokerage account or even a 401K pension plan

- Transparent structure and clear terms

Grayscale earns a 2% management fee, which, with billions in assets, translates into significant revenue.

What is Hedera and the Hashgraph Technology

Hedera is an alternative to traditional blockchains, using Hashgraph technology.

Its advantages:

- Up to 10,000 transactions per second

- Instant transaction confirmation (≈5 seconds)

- Tiny commission ($0.0001 per transaction)

- Support for smart contracts and staking

The project was launched via ICO in 2018. The founders are experienced tech entrepreneurs, including a former research fellow at the US Cyber Planning Academy.

Hedera Economics and Revenue Sources

Hedera has issued 50 billion HBAR tokens.

Main revenue sources:

- Selling tokens from its reserves

- Collecting transaction fees

- Licensing Hashgraph technology for commercial use

Partners include IBM, Shinhan Bank, Mandallas, and other companies testing or implementing its solutions.

ETF on Hedera: What Will Change

An ETF (Exchange-Traded Fund) is an exchange-traded instrument that allows investors to buy a token via stock markets.

Advantages of an HBAR ETF:

- Inflow of new investors from the traditional financial sector

- Increased token liquidity

- Greater trust in the project thanks to regulation

Already in Europe, ETPs on HBAR are traded on Euronext Amsterdam and Euronext Paris, and a similar product is available in Frankfurt.

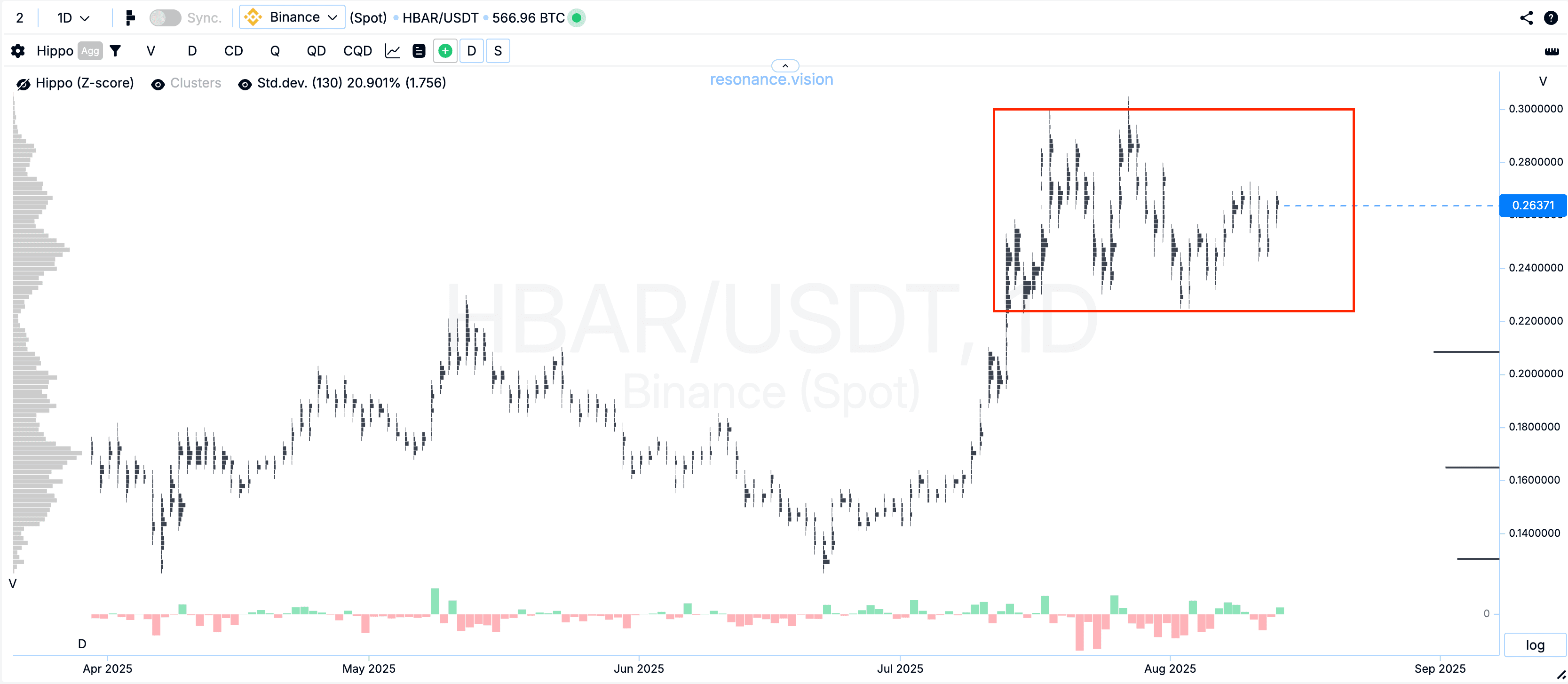

HBAR Price and Market Analysis

Price history shows HBAR has significant volatility:

- November 2019: launched at $0.02

- Growth peaks – up to +1200%

- Declines coincided with general market corrections

Currently, there is high volatility and substantial selling volume that does not push the price below key levels. This may indicate accumulation before potential growth, especially with the anticipated ETF approval.

Should You Invest Now?

For long-term investors, HBAR is attractive due to:

- Potential ETF launch in 2025

- Innovative Hashgraph technology

- Presence of large partners and real integrations

For short-term traders, it is important to consider high volatility and wait for reduced market turbulence before entering positions.

Conclusion

The launch of an ETF on Hedera by Grayscale could be a powerful growth catalyst for HBAR and the entire Hashgraph ecosystem. Investors should watch the news and prepare for possible market changes in the second half of 2025.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.