INJ ETF: Long-Term Outlook

Will Injective Become the New Favorite Among Investors?

The article explores the launch of a new ETF by Canary Capital and analyzes the prospects of the Injective (INJ) blockchain project. You’ll learn how INJ works, why it attracts interest from funds, and how to profit from it under current market conditions.

Table of content

Hi! Today we’ll explore another piece of news about a new ETF launched by Canary Capital, and also take a detailed look at the long-term potential of the blockchain project Injective (INJ). This material is based on recent trends, market analysis, and our experience, to help you better understand what’s happening with INJ and how this asset can be used in your investment strategy.

Contents

- Canary Capital and Their New INJ-Based ETF

- What is Injective (INJ)?

- INJ Token Distribution and Market Analysis

- How to Profit from INJ: Staking and Trading

- Technical Analysis: INJ Price Trends

- Current Market Conditions and Outlook

- Conclusion

Canary Capital and Their New INJ-Based ETF

Canary Capital is a Delaware-registered fund known for the advantage of zero tax obligations when there’s no profit. This company actively submits applications to launch new ETFs, and it seems they operate on a “coin flip” model: today, they launch an ETF based on a specific token — and the idea gets executed quite rapidly, sometimes even without deep analytics.

The main goal of Canary Capital is to attract as much capital as possible to their fund, earning fees from asset management. That’s why they continue to launch ETFs based on different cryptocurrencies, including INJ. It’s important to understand that most funds don’t survive on profits from assets but rather on steady management fees. So their interest lies in maximum investor inflow from around the world.

What is Injective (INJ)?

Injective is a finance-oriented layer-1 blockchain specialized in applications for decentralized finance (DeFi), artificial intelligence, exchange operations, derivatives, and real-world asset tokenization (RWA).

This blockchain features a high transaction processing speed — up to 25,000 transactions per second — along with fast block formation. Injective is compatible with networks such as Ethereum, Solana, Cosmos and around 20 others, allowing bridge solutions for asset transfers across ecosystems.

Helix, a decentralized exchange based on Injective, has significant trading volume and offers futures trading. The exchange earns revenue from transaction fees, and funds circulating through the network come from external sources — making the project attractive from an infrastructure standpoint.

INJ Token Distribution and Market Analysis

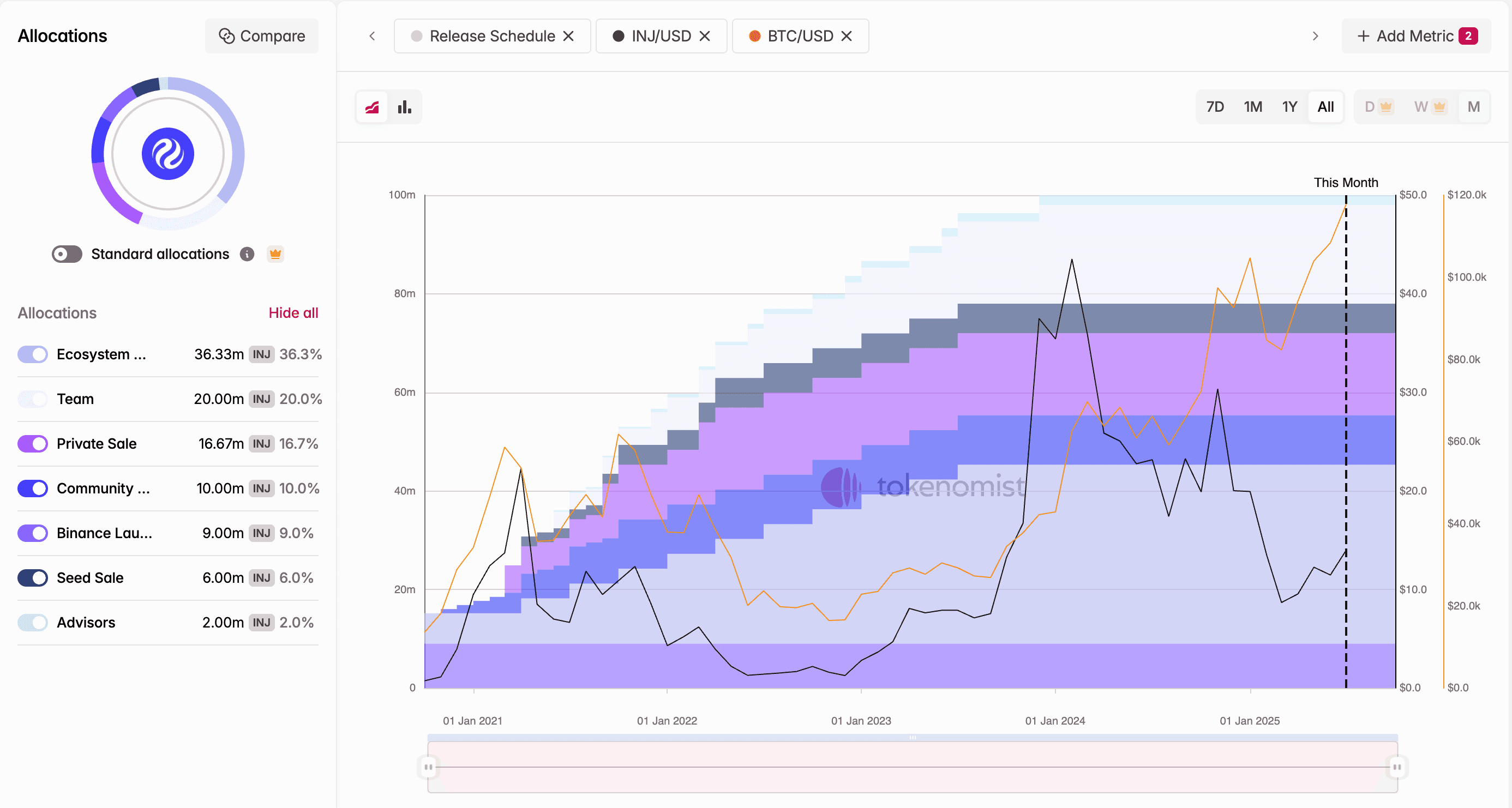

Looking at INJ token allocation, most tokens have already been unlocked and have been circulating in the market since February of last year. This means there are no expectations of major upcoming unlocks that could negatively impact price.

Injective is a promising blockchain on which projects with real revenue are being built. Therefore, it makes sense to consider INJ as a long-term asset.

How to Profit from INJ: Staking and Trading

One of the easiest ways to generate income from INJ is through staking. On Binance, one of the most popular platforms, you can earn up to 69% APY on 120-day staking — a rather attractive figure for those viewing INJ as a long-term investment.

If you’re planning long-term investing through a DCA (Dollar Cost Averaging) strategy, buying INJ on the spot market followed by staking looks like a logical step. Given that there are no major upcoming unlocks, this adds an extra layer of stability.

Regarding trading, INJ is listed on many exchanges, but we emphasize Binance due to its popularity and high daily trading volume.

INJ Price Trends

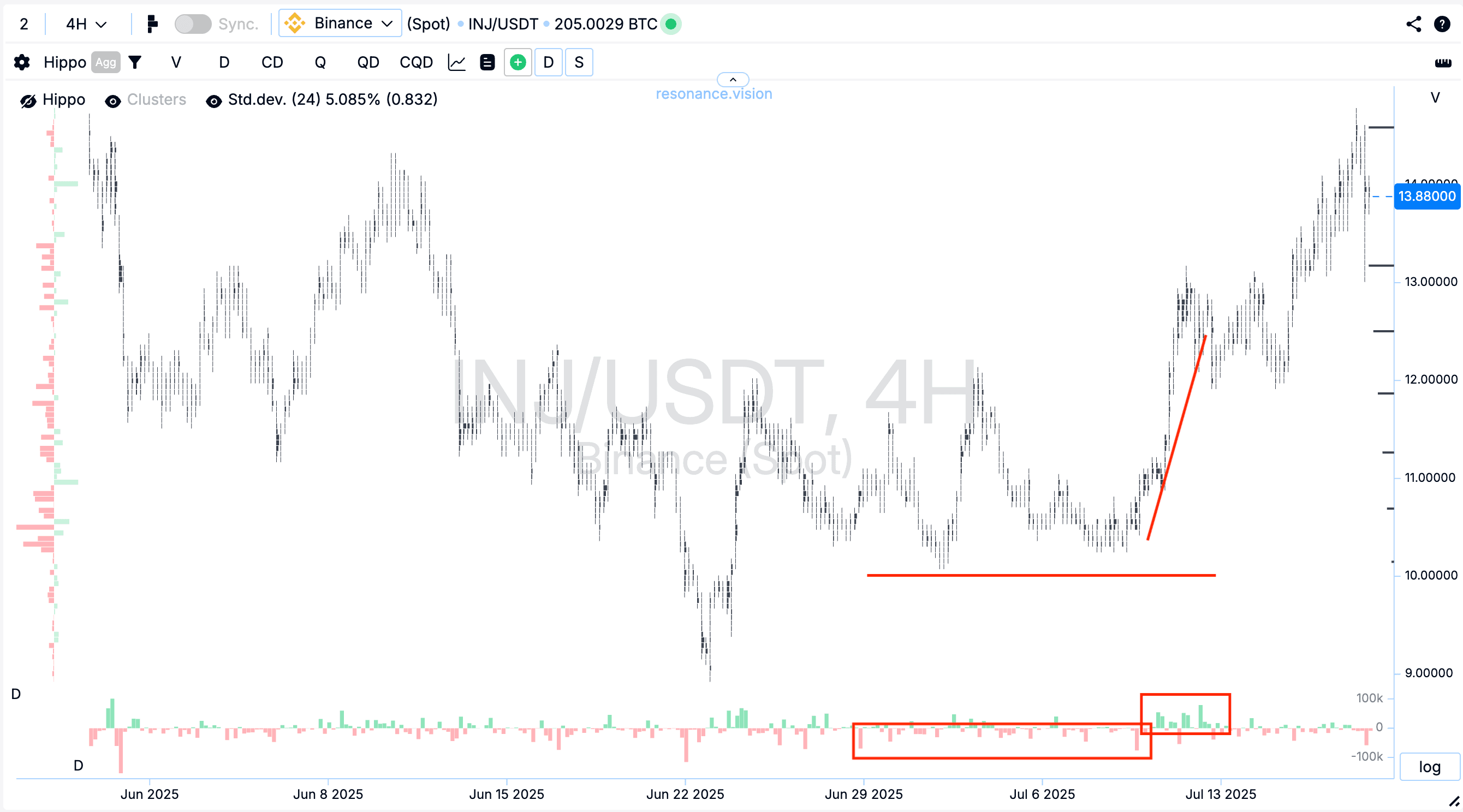

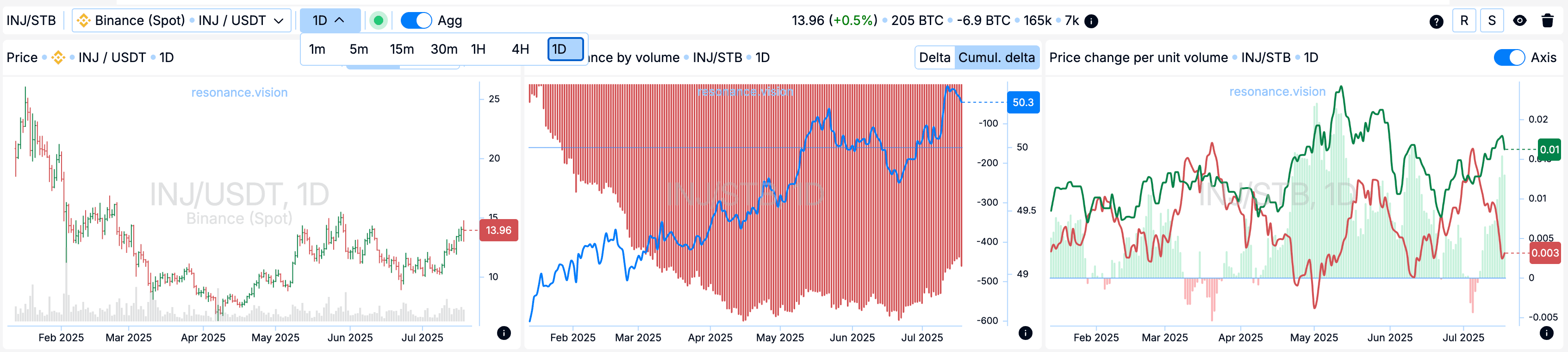

Previously, INJ was priced around $50 per token, but then experienced a sharp drop. After this, market participants began actively investing to create a supply shortage, supporting the price and even triggering short-term rallies.

Currently, we see a long-term consolidation and formation of an uptrend. Despite local pullbacks, the price isn’t making new lows, which indicates a trend reversal in a positive direction.

It’s important to understand that no one can give accurate predictions on how long the price will rise or what levels it might reach — such claims should be considered speculation or even fraud.

Investment and Trading Strategies

- DCA (Medium-to-Long-Term Investing): gradually accumulating the asset at various price levels

- Grid Trading: using grid bots to trade within a wide horizontal price range

- Staking: holding tokens for passive income

Given that INJ is an infrastructure project unlikely to experience rapid pumps, it’s best viewed as a stable asset with gradual growth potential.

Current Market Conditions and Outlook

On lower timeframes, we observe signs of steady growth and supply shortage — both of which support the positive trend. Selling volumes are not resulting in new lows, which indicates persistent demand.

Although we don’t expect sharp pumps, the uptrend remains intact, making INJ attractive for medium- and long-term investors and traders.

Conclusion

INJ is a promising blockchain project with high-speed infrastructure and working applications that generate revenue. Canary Capital is attempting to leverage this asset by launching a new ETF — a sign of institutional interest.

For investors, INJ may represent a solid long-term position with opportunities to earn through staking and gradual accumulation. Preliminary analysis shows the formation of an uptrend, supporting an optimistic outlook for the project.

That said, it’s important to remember the risks and avoid investing more than you can afford to lose. We recommend keeping a close eye on the market and monitoring the situation regularly.

Follow new insights in our telegram channel.

No need to invent complex schemes and look for the "grail". Use the Resonance platform tools.

Register via the link — get a bonus and start earning:

OKX | BingX | KuCoin.

Promo code TOPBLOG gives you a 10% discount on any Resonance tariff plan.